EUR/USD Looks Tempting to Sell, As Investor Sentiment Deteriorates

EUR/USD reversed at 1.1280s in July after making three doji candlesticks at the top on the daily chart, signaling a reversal after the previ

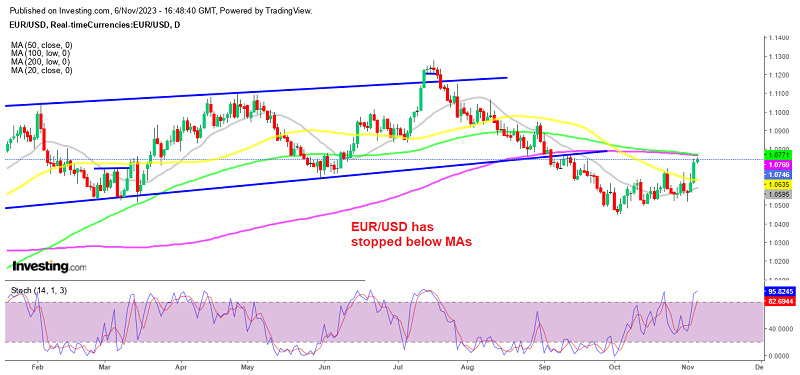

EUR/USD reversed at 1.1280s in July after making three doji candlesticks at the top on the daily chart, signaling a reversal after the previous bullish trend. Moving averages have contributed to this downward movement, providing resistance during pullbacks and it seems like the climb has stalled at MAs again.

European stock indices turned bearish today, while US futures remain on a lack of new triggers. Crude oil made some gains following Friday’s pressure but the climb has stopped and it seems like it is reversing lower, as the sentiment from continuing geopolitics and a slew of optimistic factors are wearing off. The DXY is trading below 105 points, while risk currencies such as the Euro and the NZD are limited. Bonds yields have almost recuperated Friday’s post-US data gains, with 10-year rates firming at around 5.65%.

On the daily chart, the 20 SMA (gray) and 50 SMA (yellow) were pushing the highs lower, indicating that selling pressure was strong. The rise in US Treasury rates, along with solid US economic data, has kept the USD in demand, adding to the fact that the Eurozone economy looks to be worsening.

However, we have seen some bad figures from the US in the previous two weeks which have sent this pair higher. But the 100 SM A(green) and the 200 SMA (purple) are providing resistance and the climb has stopped there. After today’s investor confidence numbers from the Eurozone, the sentiment is turning negative again so this looks like a good opportunity to sell EUR/USD .

Eurozone Sentix Investor Confidence for November

- EU Sentix Investor Confidence Actual -18.6 points

- Forecast was for a -22.2 point reading

- October Sentix Investor Confidence was -21.9 points

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account