US Consumer Continues to Show Resilience Helping the US Economy and the USD Along

On Friday we had some positive reports from the US, with the NFP figures showing that the employment sector remains in decent shape.

On Friday we had some positive reports from the US, with the NFP figures showing that the employment sector remains in decent shape, while consumer confidence remains strong. This sent the dollar up again which made new highs on a few fronts, with Gold dipping below $2,000, although it closed the week above that round level.

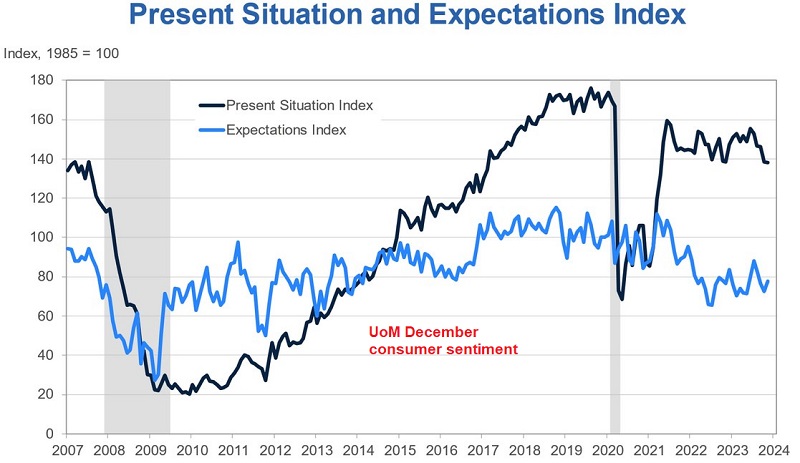

The University of Michigan consumer sentiment indicator showed a jump to 69.4 points this month, which indicates that the US consumer is feeling confident again. The robust headline wasn’t although, as both short and long-term inflation indicators fell, adding to the disinflationary storyline, which further points to a soft landing. So, the Buck started the week on a negative note, but ended it up, and we might see a continuation of the upward momentum early next week.

US December UMich Consumer Sentiment

- December UMich consumer sentiment 69.4 points vs 62.0 points expected

- November UMich consumer sentiment was 61.3 points

- Prior was 74.0 points vs 68.5 points expected

- Current conditions 74.0 points vs 68.5 points expected

- Expectations 66.4 points vs 57.0 points expected

- One -year inflation 3.1% vs 4.5% prior

- Five-year inflation 2.8% vs 3.2% prior

Gold XAU Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account