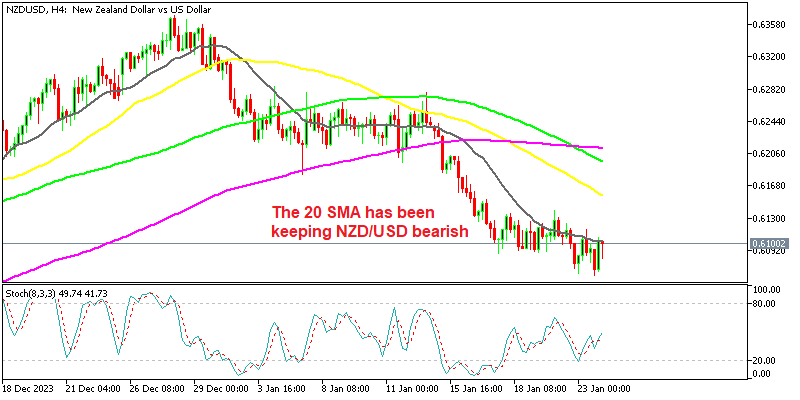

NZD/USD Returns to the 20 SMA Again Despite Softer NZ Data

Late yesterday we received the CPI (Consumer Price Index) inflation report from Australia, which was expected to show a sizeable decline...

Late yesterday we received the CPI (Consumer Price Index) inflation report from Australia, which was expected to show a sizeable decline in Q4, down to 0.5% from 1.9% in Q3. The NZD has been bearish since late December, with MAs acting as resistance and pushing it lower, and yesterday’s soft CPI reading didn’t help, although the details of the report were more mixed than the headline.

NZD/USD H4 Chart – The 20 SMA Pushing the Highs Lower

The RBNZ is pleased with the headline inflation figure for the fourth quarter of 2023. The ‘Non-tradeable’ CPI YoY, which the Reserve Bank of New Zealand can address, has risen to 5.9% and +1.1% q/q, exceeding the predicted 0.8%. High non-tradeable inflation calls for ongoing monetary tightening.

New Zealand Q4 CPI Inflation Report

- New Zealand Q4 CPI 0.5% vs 0.5% expected

- Q3 CPI QoQ was 1.9%

- New Zealand CPI YoY 4.7% vs 4.7% expected

- ‘Non-tradeable’ inflation YoY increased to 5.9%

- ‘Non-tradeable’ inflation QoQ increased to +1.1% vs 0.8% expected

Yesterday the Chinese stock markets rose, following claims of stimulus and financial backing by Chinese authorities. It also supported commodities and commodity currencies, although only somewhat. NZD/USD climbed to 0.6138 early yesterday but fell all the way to 0.60.62 in the US session due to USD strength and a sour mood in equities, but it eventually found a footing late in the day and today this forex pair managed to move above 0.61 again.

Given the China backdrop yesterday, it highlights the market’s skepticism that Beijing is truly prepared to move. However today the market mood is feeling better after the Chinese central bank announced the first RRR cut of the year. Meanwwhile the New Zealand Performance of Services Index yesterday was poor as well, with the BNZ – BusinessNZ Performance of Services Index (PSI) slipping back into contraction last month, down to 48.8 pointfrom 51.2 points in November.

NZD/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account