DAX Surges to 17,500: ECB Rate Cut Speculation & Consumer Confidence Boost

The DAX index extended its upward trend and surged to new heights on Tuesday, reaching a record high of 17,501.50. This remarkable performan

The DAX index extended its upward trend and surged to new heights on Tuesday, reaching a record high of 17,501.50. This remarkable performance was driven by a combination of factors that buoyed investor sentiment.

German consumer confidence figures for March provided a positive outlook, indicating a slight recovery despite ongoing economic uncertainties. Additionally, robust corporate earnings contributed to investor optimism, highlighting resilience in the German economy.

Furthermore, the anticipation of a rate cut by the European Central Bank (ECB) further fueled market sentiment, with investors betting on monetary stimulus to support economic growth. Consequently, the upbeat economic indicators and corporate performance propelled the DAX to unprecedented levels, signaling a bullish trend in the stock market.

In contrast to this, ongoing uncertainties surrounding monetary policy decisions, economic outlooks, and geopolitical risks could cap further gains in the DAX index.

ECB Stance and German Consumer Confidence Impact DAX Momentum

On the Euro front, the European Central Bank’s (ECB) approach to interest rates and the release of German consumer confidence data significantly impact the direction of the DAX index. Investors closely monitor speculation regarding potential ECB rate cuts, which have surged to exceptional levels, indicating expectations for supportive monetary policy actions. This heightened interest reflects the crucial role of central bank policies in shaping market dynamics.

Besides this, US economic data, including consumer confidence and durable goods orders, serve as barometers of economic health, shaping investor expectations. Any surprises or deviations from forecasts in US economic data may lead to shifts in market sentiment, impacting the DAX’s performance.

Therefore, the DAX index reacts sensitively to ECB rate decisions and German consumer sentiment as speculation on rate cuts and consumer confidence trends influence investor sentiment, directly impacting the DAX’s trajectory.

Therefore, the DAX index reacts sensitively to ECB rate decisions and German consumer sentiment as speculation on rate cuts and consumer confidence trends influence investor sentiment, directly impacting the DAX’s trajectory.

Federal Reserve Interest Rate Cut Stance and US Economic Data Influence DAX Performance

On the US front, the Federal Reserve’s stance on interest rates and US economic data exert significant influence on the DAX index. However, the latest meeting minutes and statements by Federal Reserve officials, suggesting a cautious approach to reducing interest rates.

Kansas City Fed President Jeffrey Schmid has emphasized the importance of ensuring inflation is under control before considering rate adjustments. While the consensus among analysts suggests that there won’t be a rate cut in March, there is a 60% likelihood of one in June.

Consequently, the current downward pressure on the US dollar is influencing the trajectory of the DAX index. Therefore, the speculation on Fed rate adjustments and surprises in economic indicators prompt market volatility, influencing investor sentiment and the DAX’s performance.

Geopolitical Issues and Their Impact on the DAX Index

On the geopolitical front, the ongoing conflict between Israel and Gaza, can cap further gains in the DAX index. However, the heightened geopolitical risks lead to market volatility as investors assess potential geopolitical implications on global economic stability.

Escalating conflicts or geopolitical uncertainties may trigger risk aversion among investors, prompting sell-offs and impacting stock market performance, including the DAX.

DAX Price Analysis: Technical Outlook

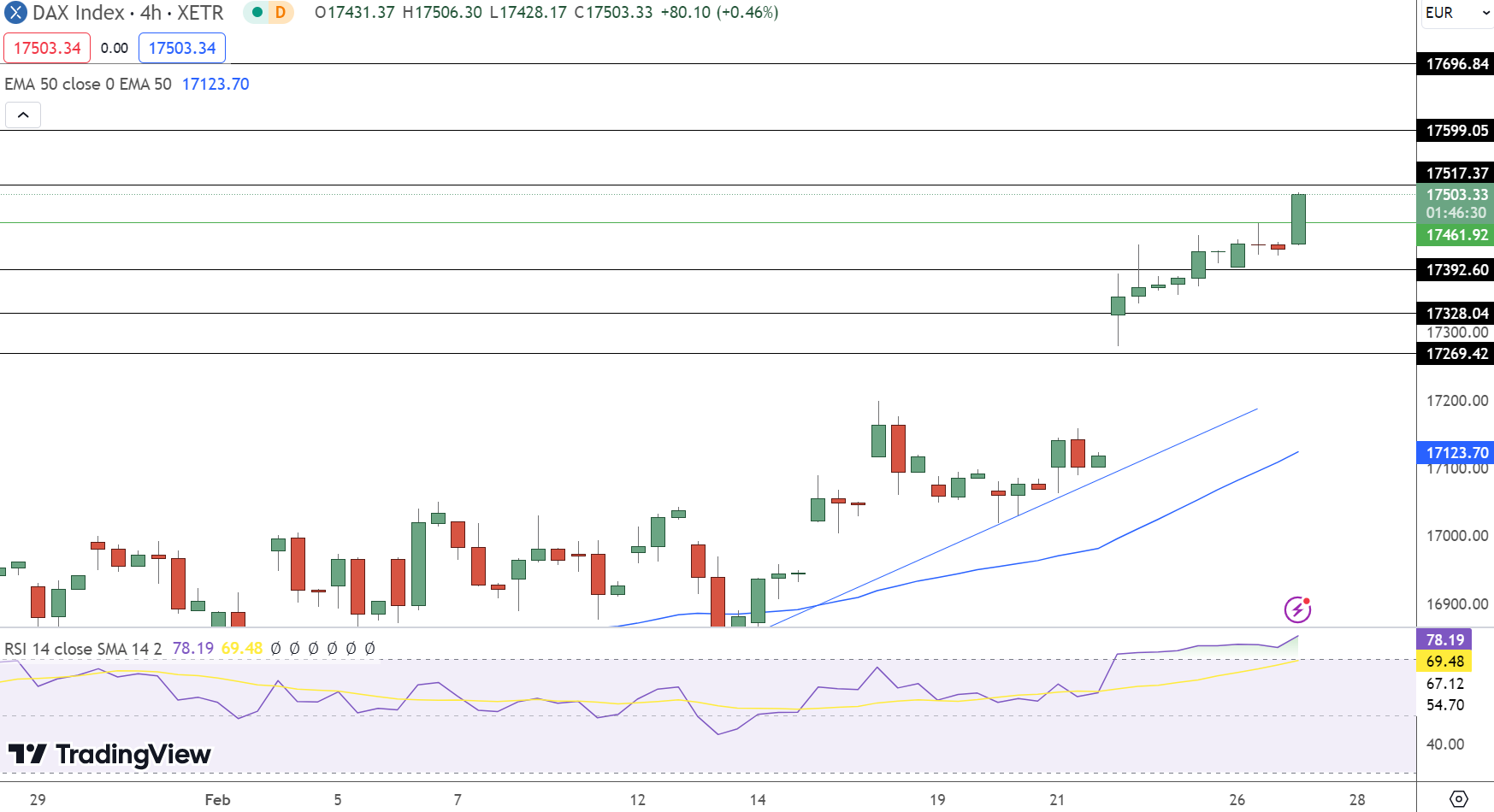

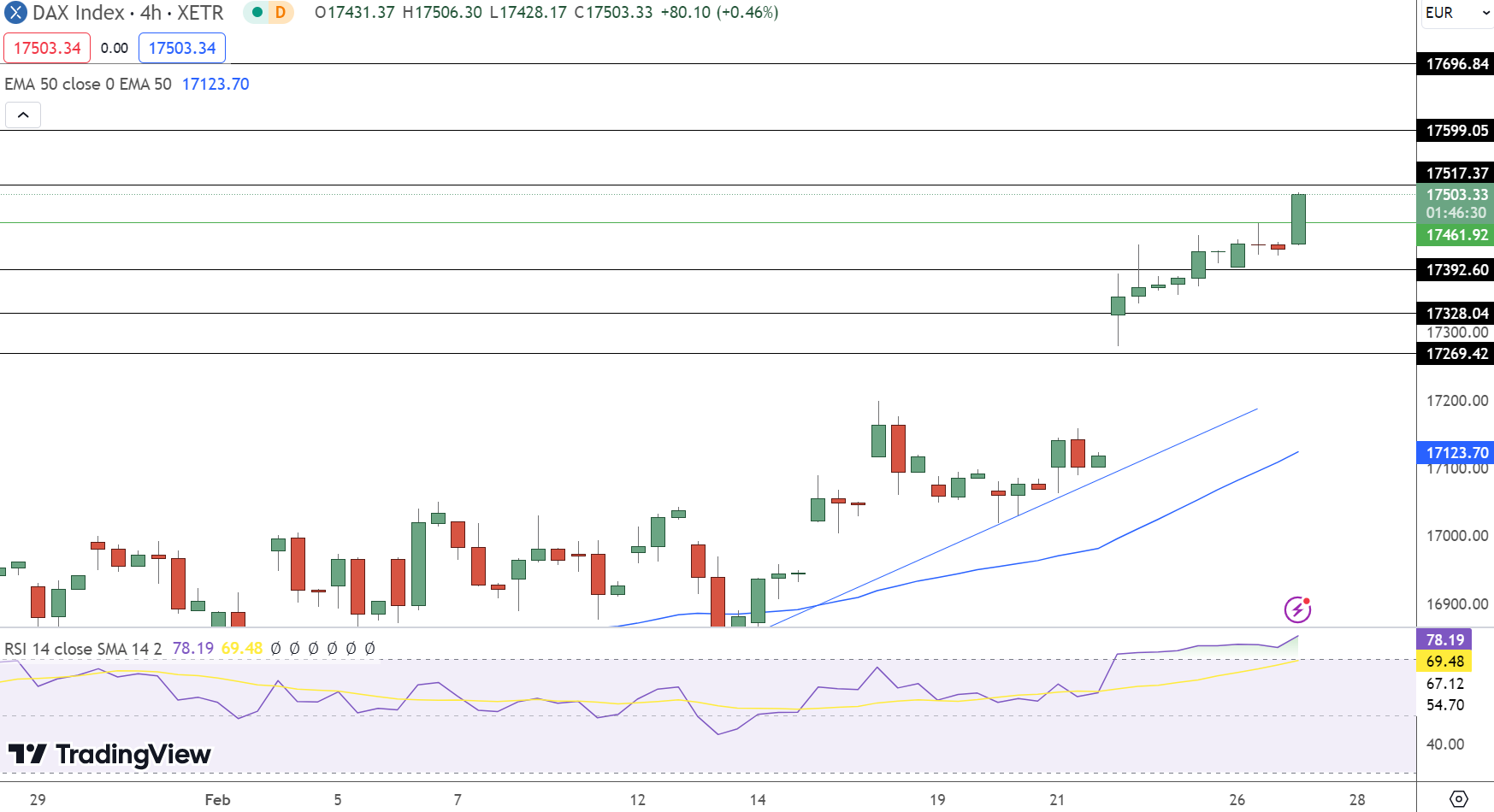

In today’s analysis of the DAX, the index showed a positive trajectory, closing at 17,503.33, marking an increase of 0.47%. This movement places the pivot point at 17,461.92, suggesting a cautiously optimistic outlook for traders.

Resistance levels are identified at 17,517.37, 17,599.05, and 17,696.84, delineating potential hurdles for upward momentum.

On the downside, support levels are established at 17,392.60, 17,328.04, and 17,269.42, providing areas where buyers might regain strength.

The RSI indicator signals at 78, indicating an overbought condition that warrants attention for potential pullbacks. Meanwhile, the 50-day Exponential Moving Average (EMA) stands at 17,123.00, reinforcing the current bullish sentiment above the pivot.

However, traders should exercise caution, as the market is susceptible to shifts, particularly given the current overbought conditions.

Overall, the DAX presents a bullish trend above 17,461.92, suggesting an upward trajectory in the short term, contingent on market dynamics and investor sentiment.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account