USD Down After FED Rate Decision, FOMC Statement

The FED interest rates were left unchanged just a while ago, while the FOMC statement wasn't as hawkish as markets were fearing beforehand.

The FED interest rates were left unchanged just a while ago, while the FOMC statement wasn’t as hawkish as markets were fearing beforehand, which has left the USD weaker as an initial reaction. However, we are waiting for the FED chairman Jerome Powell to hold the press conference, which might change the situation dramatically.

Following the FOMC rate decision, the initial market response shows a slight decrease in the value of the dollar, accompanied by marginal gains in stocks and a dip in yields. Further developments are awaited. EUR/USD reached a new session high and surpassed the 200 SMA on the H1 chart which stands at 1.0690.

However, it remains below its 100-hour moving average of 1.0725. As mentioned earlier, surpassing both moving averages is necessary to strengthen the bullish sentiment, which has not yet occurred. The USD/JPY pair is lower but still above the outlined swing area at 157.23. The 100-hour moving average at 156.994 also serves as a level to watch, as breaking below it would increase the bearish sentiment.

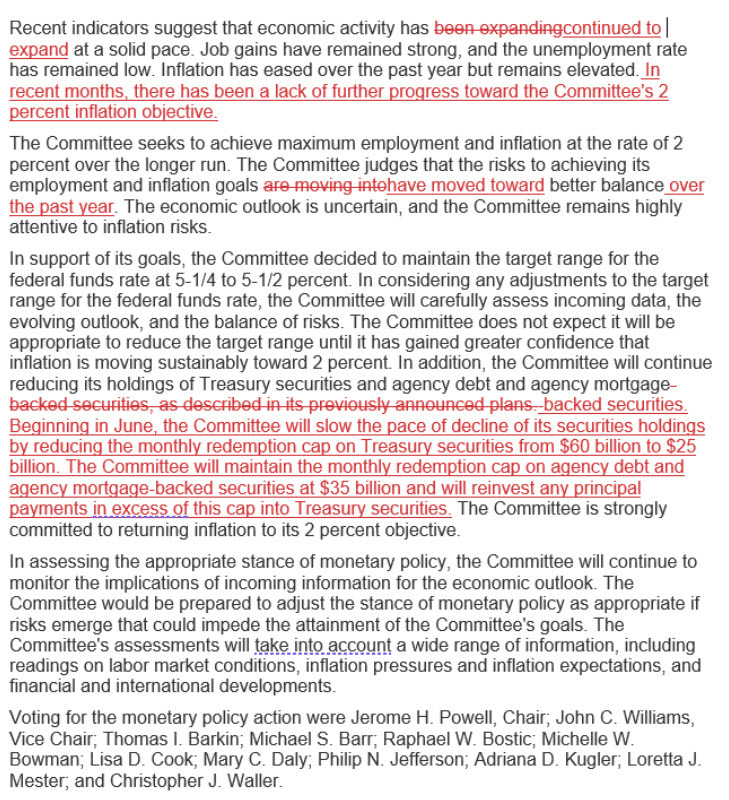

Highlights of the FOMC statement on May 1, 2024

- FED leaves interest rates unchanged at 5.25%-5.50%, cites lack of further progress on inflation

- Prior rate was 5.25-5.50%

- QT pace $25 billion vs $60 billion ($30 billion was expected)

- Economic activity described as ‘continued to expand at a solid pace’ vs ‘expanding at a solid pace’ prior

- Jobs gains described as ‘have remained strong’ vs ‘have remained strong’ prior

- Inflation described as ‘remains elevated’ vs ‘remains elevated’ prior

- Adds line to say ‘In recent months, there has been a lack of further progress toward the Committee’s 2 percent inflation objective.’

- The Committee judges that the risks to achieving its employment and inflation goals have moved toward better balance over the past year

Changes in the FOMC Statement from Zerohedge:

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account