Japanese Data Can’t Stop the Bullish Momentum in USDJPY

The trend in the USD to JPY rate remains pretty bullish, as buyers keep buying the dips in USD/JPY, undermining the BoJ intervention

The trend in the USD to JPY rate remains pretty bullish, as buyers keep buying the dips in USD/JPY, undermining the Bank of Japan intervention, which was backed by the Japanese Ministry of Finance. We have seen dips in this pair whenever there have been weak economic data releases from the US.

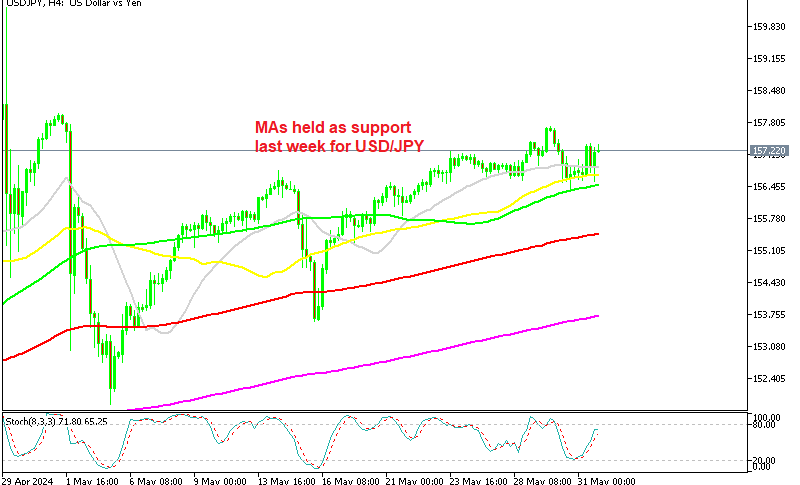

USD/JPY Chart H4 – MAs Held As Support Last Week

The USD has indeed demonstrated considerable bullish strength against the Japanese yen, propelling the USD/JPY pair above 157.70 early last week. Despite a subsequent 140-pip retracement from this peak, key moving averages on the H4 chart provided support, prompting buyers to re-enter the market and drive the price back above 157 by the week’s end.

One of the drivers behind the USD’s strength was the release of robust US consumer confidence data released last week, which was quite strong and triggered a notable increase in US bond yields. This data underscored the resilience of the US labor market, a positive signal for economic growth, which abated some recession fears after several weak economic indicators from the US last month.

Given the Federal Reserve’s stance of maintaining a tight policy for an extended period and prevailing bullish sentiment in the markets which keeps safe havens such as the JPY soft, the USD is expected to remain supported against the JPY. Both of these factors typically weigh on the yen. However, this dynamic could shift if the US starts to experience recessionary conditions, prompting the market to anticipate a more aggressive rate-cutting trajectory. Until then, the bullish momentum of the USD against the JPY is likely to persist.

Japan Final Manufacturing PMI for May

USD/JPY Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account