This Might Turn Out to Be A Great Week for Bitcoin

The crypto market went into a meltdown several days ago, with Bitcoin diving below 50K, but the situation is looking increasingly better.

The crypto market went into a meltdown several days ago, with Bitcoin diving below 50K, but the situation is looking increasingly better. The decline has reversed and yesterday we saw a decent bounce as risk sentiment improved considerably, and the weekly chart is pointing to BTC resuming the larger trend.

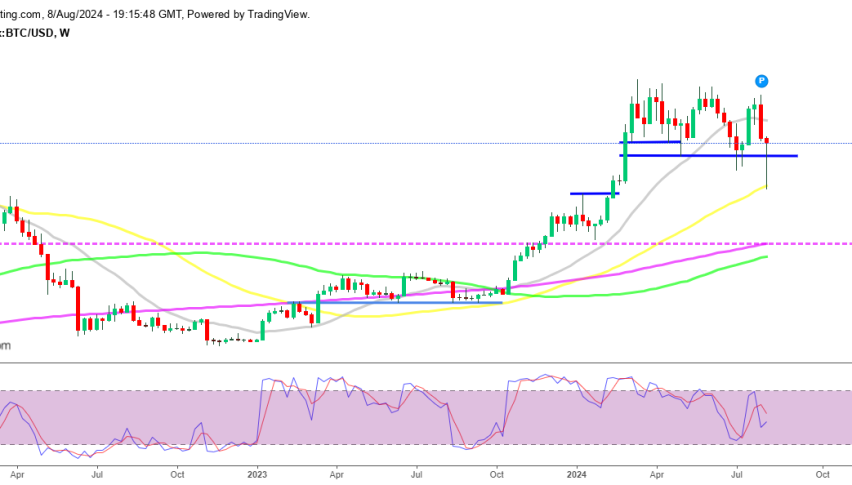

Bitcoin Chart Weekly – The 50 SMA Held As Support

Cryptocurrency Market Collapse and Initial Rebound

Over the past two weeks, the cryptocurrency market has faced a dramatic collapse, with Bitcoin dropping by around $20,000, or 20%, as risk sentiment swiftly deteriorated. This steep decline rattled the industry, leading to over $1 billion in liquidations. The downturn was triggered by a sharp fall in the Nikkei, which sent shockwaves across financial markets.

BITCOIN fell below $50,000, and other cryptocurrencies, such as ETHEREUM (ETH) and Binance Coin (BNB), also saw significant losses, with declines of 25% and 20%, respectively. The market panic led many long investors to sell off a portion of their holdings, especially those with substantial investments exceeding $1 billion.

Signs of Recovery and Whale Accumulation

Despite the recent turmoil, the 50 SMA (yellow) on the weekly chart held as support, and Bitcoin is now bouncing off this moving average. The weekly candlestick is shaping up like a pin, potentially closing as a bullish hammer, which could signal further gains. On-chain data is supporting this recovery, showing a trend of whale accumulation that suggests a possible Bitcoin supply shock on the horizon. Wallets holding between 10 and 1,000 BTC have seen a surge in buying, indicating that large investors took advantage of the dip.

Since the market’s lowest point on Monday morning, the overall cryptocurrency market has risen by 9%, reaching $2.15 trillion by Thursday. During this upswing, Bitcoin’s value has increased by about 20%, now trading above $59,800. Ethereum has also climbed above $2,500 per coin, while Bitcoin’s market capitalization now dominates 57% of the entire cryptocurrency market.

Bitcoin Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account