XRP Stuck: Will $0.55 Hold Amid Massive Coin Outflow From Exchanges?

XRP is uneventful at press time and has barely moved over the past few trading days. If anything, the coin is choppy and confirmed within a larger bull bar, which is bullish, at least for now. From the daily chart, the local support is at around $0.55, a critical level. However, though buyers are confident of what lies ahead, there must be a conclusive close above the current consolidation. Ideally, a rally forcing the coin above $0.62 will be ideal.

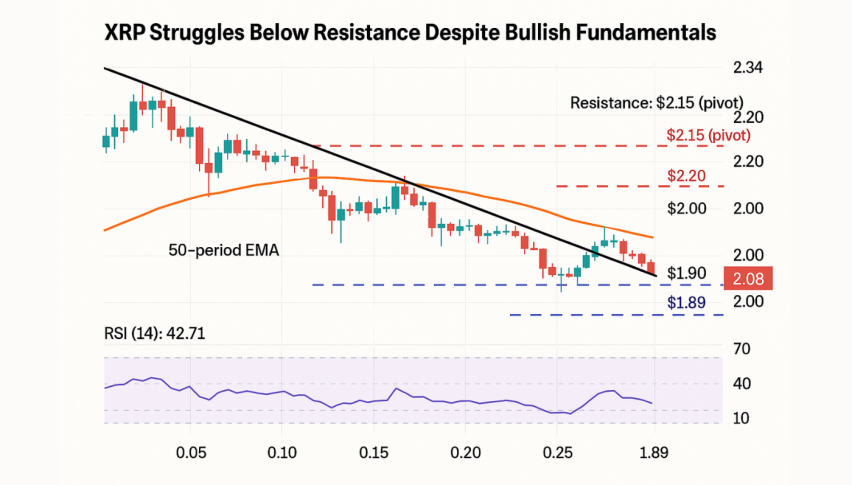

The state of price action in the daily chart shows how the coin has been performing. As it grapples with USDC for the sixth spot, it is flat in the last day and week. At the same time, trading volume has rapidly contracted from those seen in the first week of August. It is now at around $830 million.

Ripple and XRP traders are watching the following news events:

- Amid the consolidation, more holders are pulling their coins from exchanges. Usually, whenever there is outflow from Binance or Coinbase, it is a net positive for bulls.

- The confidence after the Ripple-SEC case resolution is yet to be seen on the daily chart. Though lower, the penalty of $125 million and the regulator’s lack of a plan forward is impacting sentiment and, thus, prices.

XRP Price Analysis

XRP/USD is moving sideways, looking at price action.

Even though the uptrend remains and prices are inside the August 7 and 8 bar, the absence of a follow-through is a concern.

Aggressive traders may consider loading the dips above the multi-week support at $0.55. In this case, it will confirm buyers of August 7 and 8, setting the base for gains above $0.66.

Conservative, risk-on traders, on the other hand, may wait for a clean close above $0.66, preferably with rising volume, as they target $0.74.

Losses below $0.55 may slow down the uptrend, forcing XRP towards $0.50—or lower.