Oil Prices Eye $62 as U.S.-China Tariff Talks Boost Sentiment

Oil prices are finding support as traders weigh recent trade deals and geopolitical tensions. WTI is testing key resistance...

Quick overview

- Oil prices are supported by recent trade deals and geopolitical tensions, with WTI testing key resistance levels.

- US-China trade hopes and a breakthrough US-UK trade deal have contributed to rising oil prices.

- Escalating tensions between India and Pakistan pose risks to oil demand, potentially leading to increased fuel consumption for military operations.

- Short-term traders are advised to consider a buy setup if WTI breaks above $60.87, with specific targets and stop-loss levels outlined.

Oil prices are finding support as traders weigh recent trade deals and geopolitical tensions. WTI is testing key resistance levels and the next move will depend on fresh diplomatic breakthroughs.

Trade Deals Boost Oil

Oil prices rose on Friday, adding to Thursday’s 3% gain, as US-China trade hopes lifted sentiment. US Treasury Secretary Scott Bessent is meeting China’s Vice Premier He Lifeng in Switzerland on May 10 to cool tensions that have weighed on global demand. A reduction in tariffs could add $2-$3 per barrel, according to Vandana Hari, founder of Vanda Insights.

China’s Trade Data: China’s customs data showed a faster-than-expected rise in exports for April, providing a tailwind for oil prices as the world’s largest crude importer sees signs of recovery.

US-UK Deal: Meanwhile, the US and UK announced a “breakthrough” trade deal, cutting British tariffs on US imports to 1.8% from 5.1%, though the US kept a 10% duty on most other goods.

OPEC+ Production: OPEC and its allies have also been a factor, with production cuts from Libya, Venezuela and Iraq slightly offsetting planned increases, supporting prices.

Geopolitical Risks Rise

In South Asia, tensions between India and Pakistan are escalating and oil demand is at risk. Pakistan’s military launched multiple attacks along the western border, while India, consuming around 5.4 million barrels per day (mb/d), is way ahead of Pakistan’s 0.25 mb/d, according to Rystad Energy. This gap means a big demand spike if conflict intensifies.

Military Mobilization: Increased fuel demand for military operations could lift diesel prices, while airline fuel consumption might suffer due to flight disruptions.

Sanctions: US sanctions on two small Chinese refiners for importing Iranian oil have also tightened supply, adding to the upward pressure.

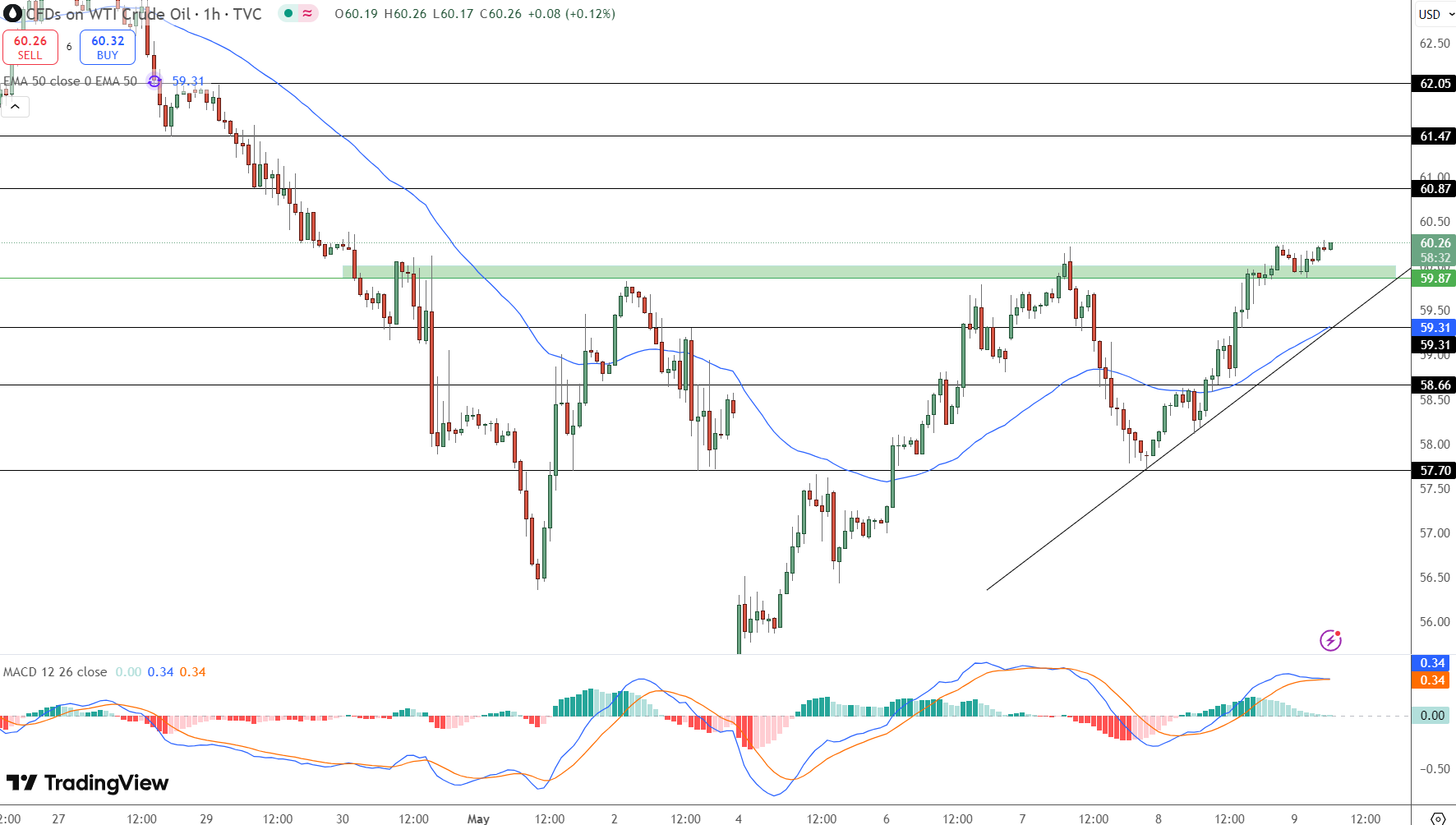

WTI Trade Setup

For short-term traders, the current WTI setup is a breakout opportunity:

Buy Setup: Longs can be taken if WTI breaks above $60.87, targeting $61.47 and $62.05 next.

Stop: $59.31

Signal: MACD cross

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account