Gold Slips After 3-Day Rally as Traders Eye Flood of US Data

The bullion faltered after three days of gains, as traders awaited hints from a deluge of economic data following the US government's return from its longest-ever shutdown

Quick overview

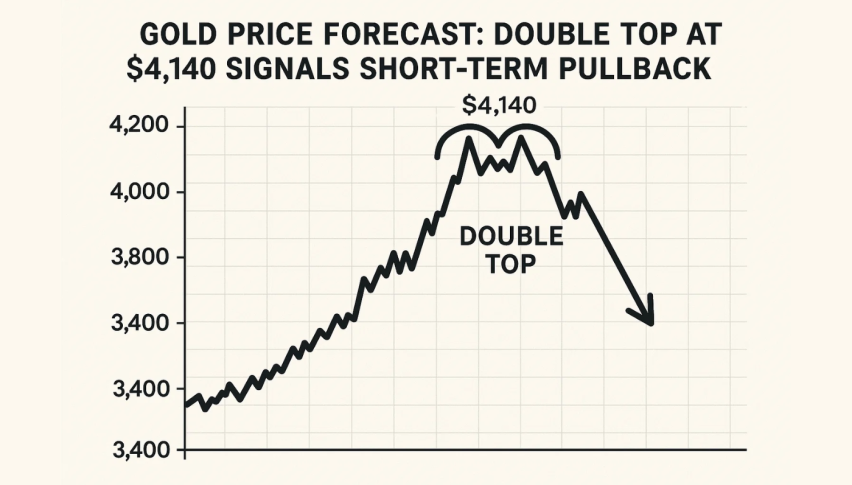

- Bullion prices fell after three days of gains, trading just above $4,100 per ounce.

- Weakness in the US labor market has increased the likelihood of further interest rate cuts by the Federal Reserve.

- Investors remain cautious as the government shutdown nears its end, pending approval of a temporary spending plan.

- Despite recent profit-taking, gold is on track for its best yearly performance since 1979, driven by strong central-bank purchases.

The bullion faltered after three days of gains, as traders awaited hints from a deluge of economic data following the US government’s return from its longest-ever shutdown.

Bullion was trading just above $4,100 per ounce. Recent data on private employment showed weakness in the US labor market, raising the likelihood that the Federal Reserve will cut interest rates further.

However, as the more than 40-day government shutdown nears its likely end, investors remain cautious.

The reopening now depends on the Republican-controlled House, which is scheduled to return to Washington on Wednesday to review a temporary spending plan approved by the Senate with support from eight centrist Democrats.

The precious metal has pulled back from last month’s record high above $4,380 as investors took profits from a rally many believed had gone too far, too quickly.

According to Bloomberg data, gold-backed exchange-traded funds recorded three straight weeks of net outflows in a dramatic shift. Nonetheless, gold, which has gained more than 55% this year, remains on track for its best yearly performance since 1979, supported by factors such as increased central-bank purchases.

Hebe Chan, an analyst at Vantage Markets in Melbourne, said the recent surge above $4,100 revealed underlying unease amid the optimistic outlook on the government reopening. Despite the overall risk-on attitude, “the lingering ripple effects of the longest US government shutdown in history have probably left a lasting impression, keeping safe-haven demand for gold alive,” she stated. Growing expectations of Fed rate cuts could be justified as new economic data begins to emerge, creating a win-win situation.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account