10 Best Forex Chart Websites

The 10 Best Forex Chart Websites revealed. We have explored several forex charting websites to identify the 10 best.

In this in-depth guide, you’ll learn:

- What is the Importance of Forex Charts in Trading?

- What are the 10 Best Forex Chart Websites?

- The Criteria for Selecting the Best Forex Chart Websites.

- How to Use Forex Chart Websites for Effective Trading.

- Are free forex charting websites reliable?

- Popular FAQs about the 10 Best Forex Chart Websites.

And lots more…

So, if you’re ready to go “all in” with the 10 Best Forex Chart Websites…

Let’s dive right in…

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA | USD 100 | Visit Broker >> |

| 🥈 |  | Read Review | FMA, FSA | USD 50 | Visit Broker >> |

| 🥉 |  | Read Review | FSCA, CySEC, DFSA, FSA, CMA | USD 0 | Visit Broker >> |

| 4 |  | Read Review | SFSA, FSCA, CySec* | USD 5 | Visit Broker >> |

| 5 |  | Read Review | FCA, CySEC, FSCA, SCB | USD 100 | Visit Broker >> |

| 6 |  | Read Review | FCA, FINMA, FSA, ASIC | USD 0 | Visit Broker >> |

| 7 |  | Read Review | CySEC, FCA, FSA, FSCA, Labuan FSA | USD 100 | Visit Broker >> |

| 8 |  | Read Review | Not Regulated | 0.001 BTC | Visit Broker >> |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker >> |

| 10 |  | Read Review | CySEC,MISA, FSCA | USD 20 | Visit Broker >> |

What is the Importance of Forex Charts in Trading?

Forex charts are essential for studying currency markets, visually representing exchange rate fluctuations over time. They also offer historical data and trend lines for predicting future market trends.

Additionally, sophisticated forex charting websites offer analytical tools like Fibonacci retracements, moving averages, and oscillators, allowing traders to analyze market sentiments, assess volatility levels, and identify optimal entry and exit points.

10 Best Forex Chart Websites (2024*)

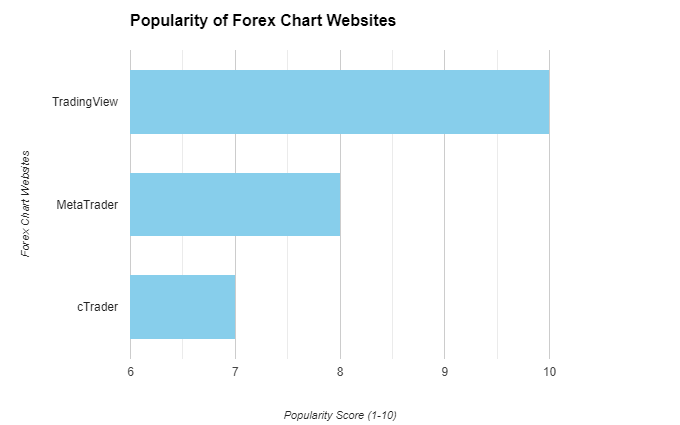

- ✔️TradingView – Overall Best Forex Chart Website

- ✔️NetDania – Offers Superior and Accurate Real-time Data

- ✔️Forex Factory – Offers Real-time Data and Advanced Charting Tools

- ✔️TC2000 – Known for its Advanced Charting Features

- ✔️StockCharts.com – Caters to Amateur and Seasoned Traders

- ✔️Barchart – Provides up-to-date Data and Advanced Charting Solutions

- ✔️Myfxbook – Offers Currency Market Analytics Tools

- ✔️DailyFX – Offers Live Currency Rates

- ✔️Bloomberg – Widely Utilized Platform

- ✔️FxStreet – Offers a Wide Range of Charting Tools

1. TradingView

Real-Time Data and Charting Tools

TradingView is a popular platform for novice and experienced traders due to its real-time data and advanced charting tools.

In addition to providing timely price updates across various markets, including Forex, it also offers a suite of graph-related functionalities with various technical instruments and drawing capabilities for thorough market analysis.

Variety of Chart Types

The software offers a wide range of chart styles, including basic line and bar charts. In addition, it provides more intricate options like Heikin Ashi and Renko charts. This flexibility enables traders to assess market data through multiple lenses, ultimately improving their trend identification and pattern recognition abilities.

User Interface and Usability

The TradingView platform offers a user-friendly, uncomplicated, and versatile interface. In other words, its design enables individuals with varying levels of competence to navigate its functionalities effortlessly, consequently rendering it an appealing choice amongst the forex community.

Customization and Advanced Analysis Tools

In addition to offering extensive configuration, TradingView’s platform boasts advanced analysis capabilities. This empowers traders to customize dashboards, create unique technical indicator combinations, and develop strategies using the Pine programming language.

Integration with Trading Platforms

Moreover, TradingView provides a professional platform for trading, featuring advanced charting tools and social networking capabilities.

It seamlessly integrates with selected brokerage accounts, allowing direct trading. This integration boosts transaction efficiency and encourages improved performance for traders.

2. NetDania

Real-Time Data and Charting Tools

Overall, NetDania is widely recognized for its superior and accurate real-time data on currency and financial markets, its robust charting capabilities, and live quotes on diverse financial instruments.

This site is pivotal in assisting traders requiring swift information access to make informed decisions.

Variety of Chart Types

This platform provides various chart types encompassing candlestick, line, and area charts.

This level of adaptability empowers traders to effectively analyze market movements in a manner that is tailored towards their unique trading strategy to achieve greater levels of information acquisition and strategic benefit.

User Interface and Usability

The interface presented by NetDania is both lucid and uncomplicated, thus facilitating the monitoring of markets, analysis of charts, and execution of trades.

Further to this effect is their mobile application that sets a high benchmark for usability standards, allowing traders easy access even while on the go.

Customization and Advanced Analysis Tools

NetDania allows its users to customize charts and workspaces according to their preferences. Additionally, it provides advanced analysis tools, including algorithmic trading indicators, strategy testers, and new integrations.

Additionally, these functionalities empower traders with extensive research capabilities that facilitate the creation of meticulously informed trading strategies.

Integration with Trading Platforms

NetDania seamlessly facilitates connectivity with diverse trading platforms, thereby allowing users access to real-time data feeds and the ability to execute transactions directly via the application.

This integration not only enhances the trading experience but also consolidates an expansive suite of tools and information onto one platform.

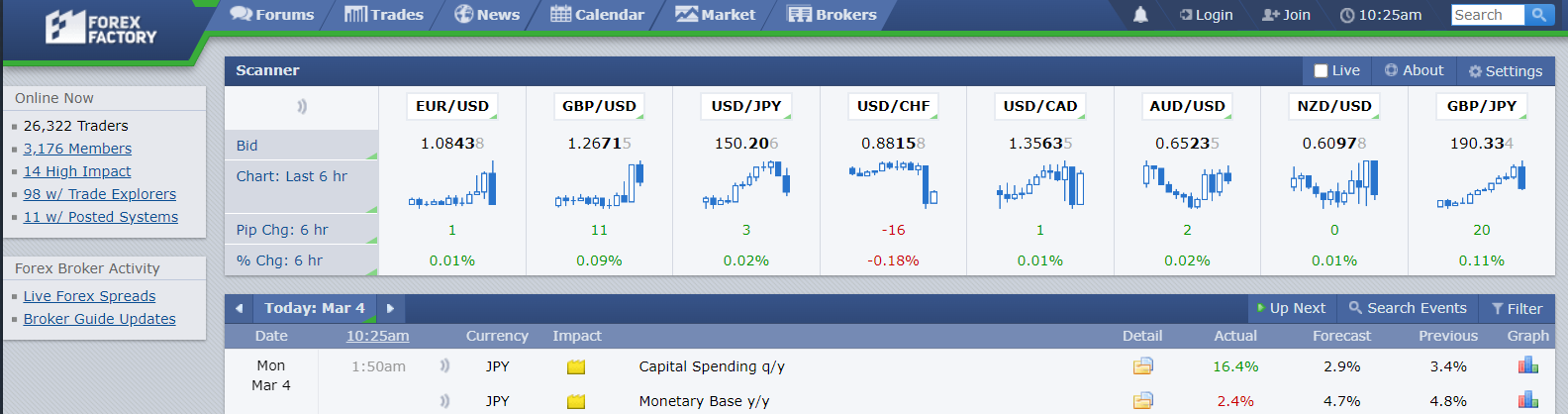

3. Forex Factory

Real-Time Data and Charting Tools

Overall, Forex Factory is a valuable resource for traders, offering real-time data and advanced charting tools. Additionally, its calendar component is popular for timely market news and economic updates impacting currency values.

While its proprietary software provides basic functionality, specialized platforms may offer more sophisticated capabilities.

Variety of Chart Types

Forex Factory’s chart options are comparatively limited, prioritizing simplicity and practicality. Discerning traders seeking more complex graphical representations may adopt Forex Factory with specialized charting utilities.

User Interface and Usability

The website is designed for traders to easily access currency pairs, market statistics, and forums, with a user interface that is straightforward to navigate, making it an ideal platform for quick information access.

Customization and Advanced Analysis Tools

Forex Factory offers limited customization options for charting and analytical instruments, but its economic calendar and forum discussions facilitate trader exchange of ideas and strategies rather than comprehensive technical analyses.

Integration with Trading Platforms

Forex Factory fosters knowledge sharing and community participation amongst traders while collaborating with specialized trading tools and platforms without directly interacting with the latter.

4. TC2000

Real-Time Data and Charting Tools

The TC2000 platform is renowned for its real-time data and advanced charting features, catering to stock and options traders and forex research. It offers various technical indicators and graphical tools for thorough market analysis.

Variety of Chart Types

The platform presents a diverse selection of chart types, featuring distinctive customized options that can be tailored to satisfy the specific analytical criteria of any trader. This adaptability affords in-depth exploration into market data, facilitating technical and fundamental analysis methods.

User Interface and Usability

The platform features a notably intuitive and adaptable interface, rendering it accessible to traders of every aptitude level. It manages to strike an appropriate equilibrium between complexity and user-friendliness, thus guaranteeing that its ease of use does not impede potency or utility.

Customization and Advanced Analysis Tools

TC2000 is a highly customizable platform that allows users to personalize their charting experience by creating bespoke indicators and implementing conditional alerts based on market conditions.

This powerful analytical instrument effectively adapts to individual trader’s unique requirements, making it an effective tool for analysis.

Integration with Trading Platforms

TC2000’s integration with trading platforms, particularly through brokerage amenities, allows traders to conduct market analysis, create strategies, and execute trades seamlessly within a unified ecosystem to optimize trading activities and improve decision-making efficacy.

5. StockCharts.com

Real-Time Data and Charting Tools

StockCharts.com is a popular platform known for its real-time data and charting tools, catering to amateur and seasoned traders. It offers detailed forex charts, indicators, and overlays for thorough market analysis, constantly updated.

Variety of Chart Types

StockCharts.com provides a broad range of chart types, such as candlestick, point and figure, and Renko charts that facilitate viewing market data from different perspectives.

This multiplicity assists users in detecting patterns and trends that may remain concealed when employing conventional chart types.

User Interface and Usability

The user interface of StockCharts.com has been thoughtfully crafted to address its users’ diverse skill levels and requirements, even those with intricate data needs.

It boasts a simplistic layout and an array of tools that facilitate effortless customization and unobstructed views for comprehensive analyses.

Customization and Advanced Analysis Tools

StockCharts.com provides sophisticated analytical tools and customization features to its clientele, enabling them to devise charts that align with their distinctive requirements.

The platform delivers access to diverse technical indicators and exclusive proprietary strategies for unmatched market insights.

Integration with Trading Platforms

StockCharts.com is a prominent platform that offers charting and analysis services commonly preferred by traders. The website presents advanced analytical capabilities, enabling users to execute transactions through their respective brokerage accounts easily.

Furthermore, it is an instrumental tool for developing strategic trading plans among its user base.

6. Barchart

Real-Time Data and Charting Tools

Barchart is a renowned platform that provides up-to-date data and advanced charting solutions for multiple markets, including foreign exchange. It offers reliable market information and an extensive array of technical indicators suitable for fundamental and technical analysts.

Variety of Chart Types

The platform offers a comprehensive range of chart types, encompassing fundamental bar and line charts and intricate candlestick and point-and-figure charts.

Such an extensive variety enables traders to scrutinize market trends and patterns in the most compatible format with their trading strategies.

User Interface and Usability

Barchart’s interface is simple yet functional, offering traders easy access to market data and analytical tools. Despite its lack of aesthetic appeal, it remains a valuable resource for those seeking practicality and efficiency in market trading activities.

Customization and Advanced Analysis Tools

The platform provides ample opportunities for customization and is equipped with advanced analytical tools that facilitate the personalized compilation of watchlists and employment of singular indicators.

Furthermore, in-depth market analysis reports are accessible to the users. These attributes empower traders to tailor their trading experience to individual needs and strategies.

Integration with Trading Platforms

The primary focus of Barchart does not lie in offering direct integration with trading platforms. Rather, the site serves as an exhaustive data and analysis resource. Therefore, traders must consider using separate platforms for executing trades.

Barchart stands out by providing valuable intelligence that aids in making informed decisions while venturing into forex transactions.

7. Myfxbook

Real-Time Data and Charting Tools

Myfxbook is a forex trading platform that offers real-time data and currency market analytics tools. It provides live feeds, charts, and account management features for monitoring and assessing trading performance.

Furthermore, it represents a significant resource for foreign exchange investors seeking to improve their investment outcomes through reliable information-gathering techniques.

Variety of Chart Types

Although Myfxbook may not provide an extensive range of charts commonly available on platforms such as TradingView, it does furnish essential chart types specifically designed for forex trading.

Its noteworthy attribute is its capacity to present forex data in an understandable and simple format, facilitating effective trade analysis.

User Interface and Usability

The platform has been developed to facilitate community engagement and performance monitoring.

It features a user-friendly interface, coupled with an array of analytical tools and social networking functionalities, making it highly sought after by traders who place high value on comprehensive insights derived from the trading community and technical analysis capabilities.

Customization and Advanced Analysis Tools

Myfxbook offers advanced analytical tools for forex traders, including automated trade analysis and performance metrics.

Although customization options are limited, Myfxbook’s existing repertoire is particularly effective for foreign exchange-oriented data analytics, making it a valuable choice for traders.

Integration with Trading Platforms

Myfxbook integrates with a trader’s Forex brokerage account, enabling real-time trade tracking and performance analytics. This tool aids in monitoring and improving trading strategies based on empirical data and market analysis.

The seamless connection between trading activities and analytical insights improves strategic decision-making, allowing traders to refine their approaches based on performance metrics.

8. DailyFX

Real-Time Data and Charting Tools

DailyFX, a platform powered by FXCM, provides real-time statistics and charting tools for forex and CFD traders.

It offers live currency rates, analysis, and predictions to provide traders with precise insights into current market situations for informed decision-making in their trading operations.

Variety of Chart Types

The platform avails a targeted collection of chart types, notably the extensively utilized candlestick, line and bar charts.

These essential chart varieties support technical analysis in the forex market by enabling traders to analyze trends, patterns, and potential market fluctuations with utmost effectiveness.

User Interface and Usability

DailyFX offers a user-friendly interface that is focused on accessibility and usability.

The platform has been designed to offer traders rapid access to market analysis, news updates, and educational resources, which are fundamental in ensuring the trader remains informed and makes astute trading decisions.

Customization and Advanced Analysis Tools

DailyFX offers essential analytical tools and resources for the foreign exchange market, including market updates, technical analysis, and educational materials.

This helps traders formulate comprehensive trading strategies despite not offering the same level of personalization as specific charting platforms.

Integration with Trading Platforms

Additionally, DailyFX, part of the FXCM Group, provides valuable market insights and analysis that can be used with FXCM-supported trading platforms. This ensures traders can access high-quality data and insights to inform their trading activities on other platforms.

9. Bloomberg

Real-Time Data and Charting Tools

Bloomberg is a widely utilized platform for real-time data and charting tools in financial markets, specifically focusing on forex.

It enables users to access market data conveniently, news updates, and analytics; hence providing an appealing option among seasoned traders and esteemed financial institutions alike.

Variety of Chart Types

Bloomberg provides an extensive range of chart variants to fulfil the discerning demands of seasoned traders.

These charts encompass conventional options such as candlestick and line charts and various intricate analytical instruments that can be tailored to meet specific analysis necessities.

User Interface and Usability

Despite its advanced capabilities, the Bloomberg Terminal presents a challenging learning curve for professionals. However, mastery offers a wide range of market analysis features and critical data accessibility, making it an essential resource for forex trading.

Customization and Advanced Analysis Tools

Overall, Bloomberg offers various customization options and sophisticated analytical instruments, allowing end users to create bespoke indicators, perform historical data analyses, and access current news updates.

This makes it a top choice for finance specialists, influencing the forex market with its exceptional analysis and personalization capabilities.

Integration with Trading Platforms

The Bloomberg Terminal is a comprehensive tool for charting and analysis. In addition, it integrates with trading platforms for direct trade execution. This seamless workflow allows for efficient analysis to trade implementation, making it a valuable tool for professional traders and financial institutions.

10. FxStreet

Real-Time Data and Charting Tools

FxStreet is a leading platform for forex news and analysis. In addition, it offers a wide range of charting tools and data tailored to currency traders’ needs. Furthermore, its fast delivery system incorporates technical analysis, projections, and trade signalling mechanisms.

Overall, FxStreet’s proprietary charting software suite provides intuitive visualization, enabling traders to make informed decisions based on market trends and identify patterns effectively.

Variety of Chart Types

FxStreet offers a selection of chart types specifically catered to the requirements of foreign exchange traders, encompassing candlestick, bar, and line charts.

Various technical indicators and analysis tools reinforce these fundamental chart formats that facilitate in-depth forex market examination.

User Interface and Usability

The FxStreet platform provides traders with a user-friendly interface for convenient access to specialized information and tools.

Because its layout enhances efficiency and efficacy in trading, traders are enabled to promptly utilize market insights, analysis, and news toward informed decision-making.

Customization and Advanced Analysis Tools

Although FxStreet may not provide the same customization as certain specialized charting platforms, it offers advantageous analysis tools and resources.

Additionally, the platform prioritizes delivering top-notch market insights, technical analysis, and educational materials to assist traders in devising effective forex trading strategies.

Integration with Trading Platforms

The direct integration with trading platforms is not a primary focal point of FxStreet.

Rather, the platform functions as an indispensable resource for market information and analysis, assisting traders in arriving at informed decisions that they may subsequently implement on their preferred trading platforms.

The Criteria for Selecting the Best Forex Chart Websites

Choosing the best forex chart websites entails weighing numerous important elements to ensure that they fulfil the demands of both beginner and experienced traders.

➡️Firstly, real-time data accuracy is critical since even little delays may result in lost chances or incorrect judgments in the fast-paced forex market.

➡️A diverse set of chart types and technical indicators is required, allowing traders to use multiple analytical methodologies and strategies.

➡️A website’s user interface and usability considerably impact the efficiency and efficacy of trading operations; a user-friendly and intuitive interface may dramatically improve the trading experience.

➡️Customization options enable traders to adjust the platform to their unique requirements, resulting in a more personalized analytical method.

➡️Connectivity with trading platforms is useful, allowing for smooth transitions from analysis to trade execution.

These requirements guarantee that a Forex chart website has the tools and resources for efficient market research and trading.

How to Use Forex Chart Websites for Effective Trading

Effective trading on forex chart websites requires a strategic strategy that combines technical analysis, knowledge of chart patterns and indicators, and fundamental analysis.

Understanding Chart Patterns and Indicators

While mastering chart patterns and indicators is crucial for predicting market trends, it’s important to remember it’s not a foolproof method. Chart patterns, like head and shoulders, triangles, and flags, can indicate potential market reversals or continuations, offering valuable insights for traders.

Moreover, technical indicators like moving averages, RSI, and MACD provide insight into market patterns and momentum. Traders must be able to spot these patterns and understand their implications.

Applying Technical Analysis to Predict Market Movements

Overall, technical analysis is a method traders use to forecast future price movements by analyzing historical market data.

Additionally, it helps make informed decisions on entry and exit points, stop-loss orders, and potential trading opportunities. The continuous study and implementation of technical analysis techniques enhance a trader’s forex market proficiency.

Incorporating Fundamental Analysis

Technical analysis focuses on charts and patterns, while fundamental analysis deepens market comprehension by assessing economic statistics, central bank policies, and political events.

Traders can predict market responses to global events by following economic calendars and news releases on currency chart websites. This method provides a holistic perspective, enabling strategic trading choices.

Conclusion

Overall the best forex chart websites combine real-time accuracy, various analytical tools, and user-friendly interfaces to meet traders’ different demands. These systems offer a full market perspective, allowing for technical and fundamental research.

However, the learning curve may be high for novices, and the amount of knowledge available can be intimidating. In our experience, while connection with trading platforms improves the trading process, relying on external tools for execution could sometimes interrupt productivity.

Frequently Asked Questions

What is the difference between candlestick, line, and bar charts?

Candlestick charts provide a visual advantage by displaying more price information than line or bar charts. Line charts depict closing prices, while bar charts provide open, high, low, and close values.

Do I need a separate charting website if I have a forex trading platform?

Not necessarily. Many forex brokers include charting tools in their trading interfaces. However, a specialist charting website may provide more extensive tools and a broader selection of indications.

Are free forex charting websites reliable?

Yes, many free Forex charting services provide extensive features and data. However, commercial systems might provide a wider range of tools, more in-depth research, and specialized customer support.

What are some popular technical indicators for forex trading?

Moving averages (MA, SMA, EMA), the Relative Strength Index (RSI), Bollinger Bands, and the Moving Average Convergence Divergence (MACD) are some of the most often used technical indicators. These assist in discerning trends, support/resistance, and momentum.

Can I backtest trading strategies on forex charting websites?

Yes, many sophisticated charting tools support backtesting. This enables you to evaluate the success of trading methods against historical data.

What are the most important features of a good Forex charting website?

Top forex charting websites should have various technical indicators, drawing tools, real-time data, customizable timeframes, several chart formats, and an easy-to-use interface. Consider looking for venues that provide educational information and even a news feed.