A Crossover In The WTI Crude Oil – Inventories In Focus

Today, the crude oil is trending higher $44.15, staying below the major resistance level of $44.35. Despite yesterday's oversupply concerns, oil prices continued to recover ground as investors are still feeling hesitant to place their sells until and unless the crude oil completes its retracement.

As per the American Petroleum Institute (API) inventory figures, the crude oil showed a build of 0.85 million barrels following the 2.7 million barrel draw last week. Though the markets were anticipating a draw of about 2.6 million barrels for the week, the unexpected API build has weakened market sentiment.

So, can we expect EIA to release a less than expected draw in inventories? Time will tell. For now, we need to wait for the Energy Information Administration (due at 14:30 (GMT)), which reports the change in the number of barrels of crude oil held in inventory by commercial firms over the past week.

Forex Trading Signal

Investors are recommended to keep a close eye at $44.40, as below this level, crude oil is likely to stay in sell. On the other hand, we may see a bullish momentum above $44.40 until $45.25

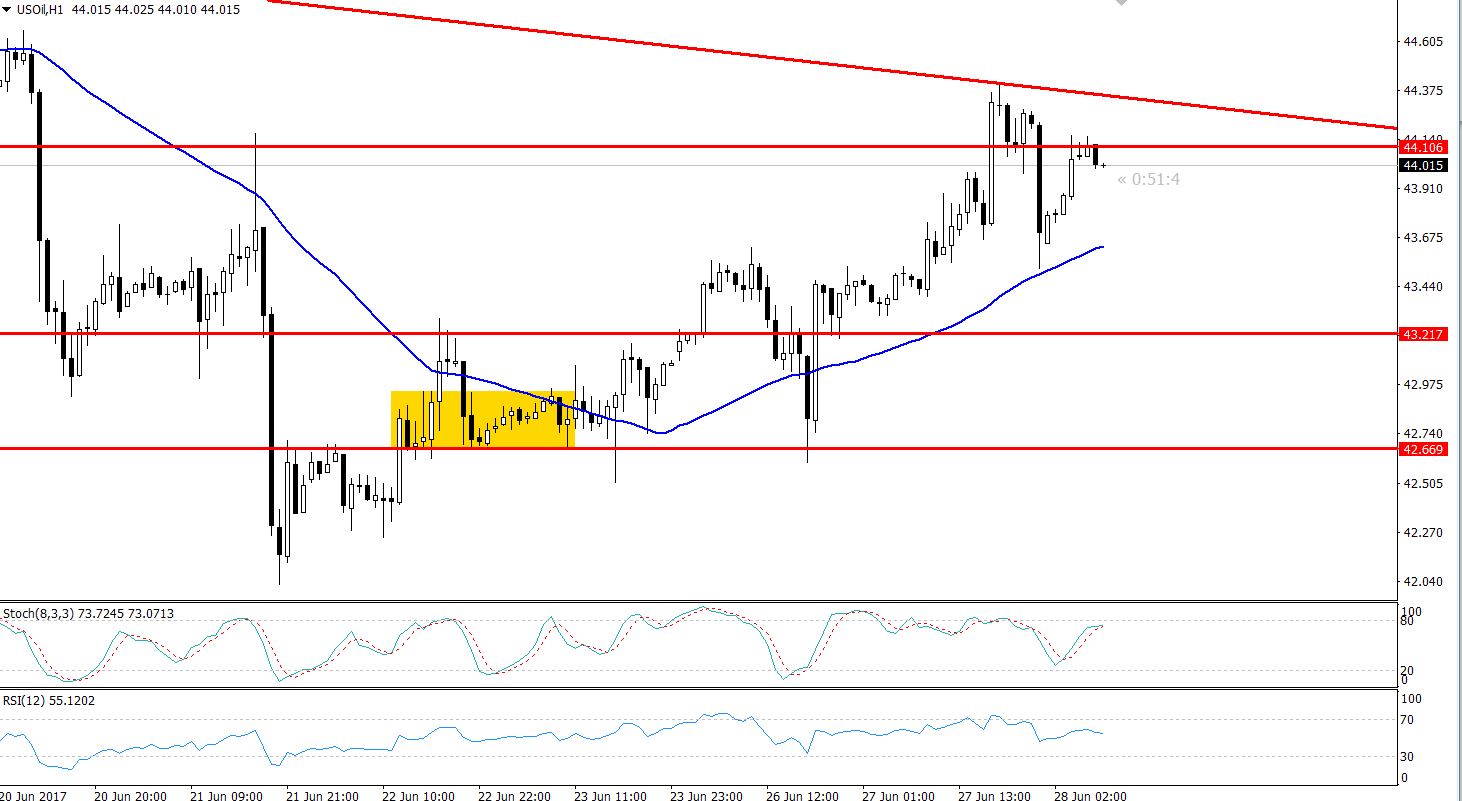

WTI Crude Oil Hourly Chart – EMA Crossover

WTI Crude Oil Hourly Chart – EMA Crossover

Technical Outlook – Intraday

The WTI Crude Oil has made a bold move when it broke out of the bearish channel at $43.40. This was expected as the energy instrument was trading in the oversold region.

We can see the crude oil has crossed above the 50-periods moving average on the 4-hour timeframe since May 25th, emphasizing investors' buying sentiment. Presently, the 50-periods moving average is extending a solid support at $43.65 and above this level, the black gold is likely to stay in buying. For a better understanding of moving average strategy, refer to the article here.

In the US session, the EIA inventory release will be under scrutiny and is likely to trigger volatility.