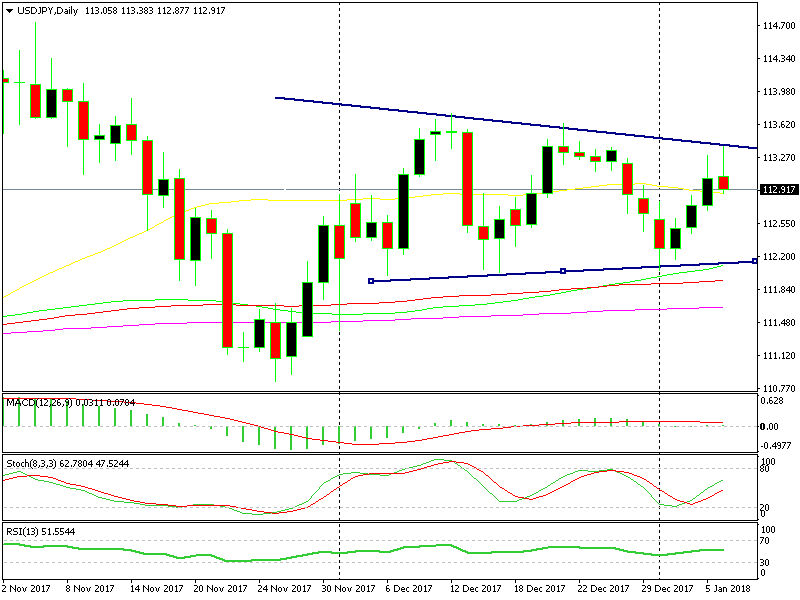

In the beginning of last month, the USD/JPY traded in a 180 pips range. At first, it looked as though this pair was going to trade on this range, but the range narrowed as the month progressed. It currently look like a wedge, rathen than a range.

A wedge is similar to a triangle, but seeing as the bottom and top lines are still far from each other, it isn’t likely that this chart pattern will evolve into one. We have a few trade strategies for wedges and triangles that would be great supports to you.

The range has evolved into a wedge of USD/JPY

Today, the price reversed right at the upper trend line of this wedge. The US Dollar has been finding some strong bids today, and yet it is still losing ground against the USD. This means that USD/JPY traders are aware of this wedge, and they’re closing their buy trades up there as a result. Hence, the reverse.

The Swissy is also feeling energetic today, which makes this more of a run for safety. Perhaps, though, this run for safety began after USD/JPY failed to break above the top line of the wedge. Think of the famous question of the chicken and the egg: what came first?

Whichever came first, the USD/JPY seems to have headed down, now. For this reason, I wouldn’t think it wise to make a long trade on the USD/JPY, which I highlighted previously on the US session brief. Perhaps I will scale down and try some scalping from down here- time will tell.

The stochastic indicator is not overbought yet, but it’s close. Tomorrow it may be overbought, which will be a good indicator for us to go short on this pair. If the daily candlestick closes as it is now, that would be yet another bearish sign, as the upside down hammer is a reversing signal. We may go short tomorrow on this forex pair, but until then, let’s just watch from the sidelines.