⚡Crypto Alert : Altcoins are up 28% in just last month! Unlock gains and start trading now - Click Here

BOE’s Bailey Seems A Bit More Optimistic Now Than in May

The Bank of England held its usual meting earlier today. They let cash rates unchanged at 0.10%, but increased the QE stimulus package by 100 billion. Last month, the BOE was expecting the economy to shrink by 27% in Q1 and Q2 combined, but now, the GDP contraction is seen lower at 20% for the first half of 2020. This is slightly more dovish than previously and Bailey thinks that the economic downturn has not been as and as previously thought.

- Trying to work out implications for UK and other countries’ experiences with negative rates

- Decision on negative rates is not in-any-sense imminent

- Evidence suggests economic downturn has not been as severe as in May scenario ‘but let’s not get carried away’

- Labour market is probably more relevant for judging inflation risks

- Now expecting 20% fall in GDP in Q1 and Q2 combined vs 27% in May forecast

- Slowing of QE pace reflects recent signs from economy and calming of markets since March

- We are slowing from warp speed QE to something which is still fast by historical standards

- Trajectory on inflation is for it to fall to very low levels

- Broadbent: It would be wrong to see slowing QE as a sign of tightening

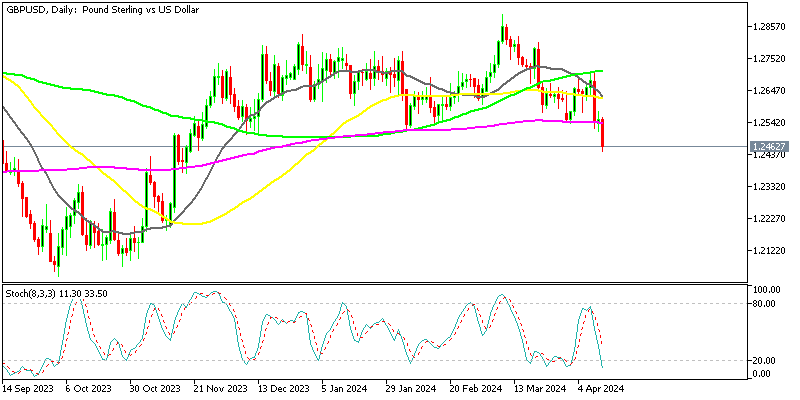

This fits with the earlier stance of being more-optimistic but the market is brushing it off and selling the pound hard. There was initially a pop on these headlines but only momentarily, but has resumed the decline again now and is around 150 pips lower on the day.

Check out our free forex signals

Follow the top economic events on FX Leaders economic calendar

Trade better, discover more Forex Trading Strategies

Related Articles

Comments

Subscribe

Login

0 Comments