We have seen quite a story in Crude Oil during the last several months, or better I say from the beginning of this year. We saw a climb initially this year in crude Oil, after the tensions between US and Iran in the beginning of January. But, the coronavirus came and panic set in in late February and US WTI crude Oil slipped from around $55 to below $20 in a couple of weeks.

OPEC+ tried to tackle the issue, cutting production by nearly 10 million barrels/day on the March meeting, which gave crude Oil a boost, sending it above $28. But, that was all the price action coming from the largest production cuts in history and US crude Oil resumed the bearish trend again.

There was no other way for crude Oil but to go down, since Saudis didn’t stick to the agreement to cut Oil production and exports. They flooded markets with cheap Oil. Some say they did that to bankrupt some Russian Oil companies, but that was aimed mainly at the US shale Oil producers, since they don’t make a profit when Oil is below $50/barrel. Oil producers ran out of containers to store Oil and as a result, US WTI crude fell to -$37/barrel.

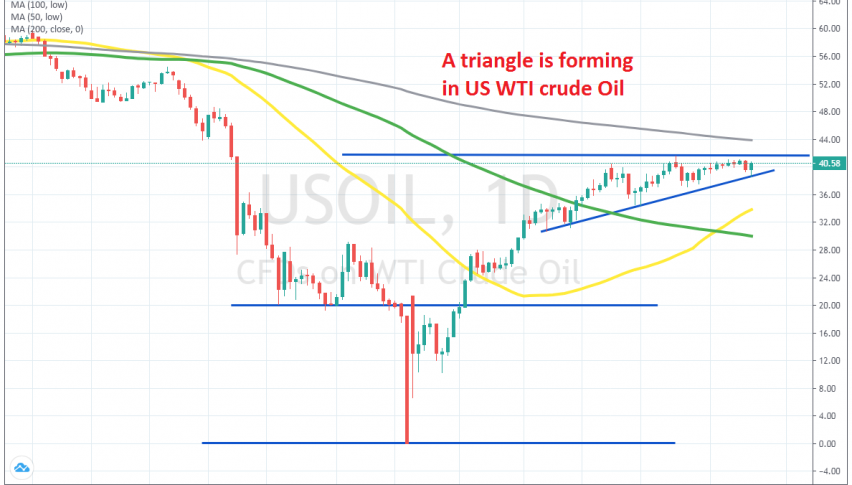

But the decline ended back then and we have seen a swift reversal in crude Oil since mid April. US WTI crude climbed from around -$40 to above $40 by the beginning of June. But, Oil buyers haven’t been able to make new highs since then. The top has been placed at $41.60, as Oil remained bullish for the last three months, which shows exhaustion by the buyers.

On the other hand, despite the failure to make new highs in the last several weeks, US WTI crude Oil has been making higher lows, forming a wedge on the daily chart. This chart setup points to a bullish breakout soon, since the range is getting narrower, as Oil heads to the tip of the triangle. But, do fundamentals also point to further gains?

- The world is reopening from the lock-downs and we are seeing some economic rebound. But, it is not as strong as it was hopped for.

- The sentiment among the consumers and the investors is still weak

- Uncertainty for the future remains high

- Coronavirus is still here, although less deadly than a few months ago

- The turmoil in the US is continuing

- Buyers are already exhausted from the $80 climb

- US shale producers didn’t bankrupt and they are coming back into the supply side, as Oil approaches $50

So, Oil has been climbing higher and it remains bullish, after the $2 climb on Friday evening before markets closed, which shows that buyers would rather end the week on the long side, rather than on the short side. They feel safer being long on Oil over the weekend. On the other hand, all the points above show that fundamentals don’t support the idea of much more upside. So, I think that we will likely see a decent pullback lower, to $30 or even $20 soon. We might open a sell forex signal here, but will follow the price action on Monday to see how it reacts when markets open.