Daily Brief, Sep 10: Economic Events Outlook – Risk Appetite Soars

On Tuesday, the greenback sailed lower as traders appetite for higher risk currencies gained support on sentiments of German stimulus plans. The diminishing prospects of a no-deal Brexit, expectations of a breakthrough in the Sino-US trade war have also driven a risk-on sentiment in the market.

During the early Asian session, China’s consumer price index (CPI) stood above trend in August, kindled by mounting food prices and weather-related stock deficiencies. Factory-gate prices, described by the producer price index (PPI), told an entirely different narrative. During the previous month, the PPI gauge dropped deeper into deflation, perhaps due to bitter trade war with the United States. However, the CPI Inflation figures remained steady. The National Bureau of Statistics reported that China’s CPI rose 0.7% in August, up from 0.4% in July.

Stronger economic figures from China are supporting the risk-off sentiment, driving bullish trends in the stock market, and bearish trends in gold.

Watchlist – Economic Events to Watch Today

French Final Private Payrolls q/q – 5:30 GMT

INSEE is due to release the figure during the European session. The final private payroll is forecast to show no change as it’s expected to stay at 0.3% vs. 0.3% in the past.

By the way, the figure shows a change in the number of employed people, excluding the farming industry and government.

French Industrial Production m/m – 6:45 GMT

INSEE is also due to release industrial production data for France. It’s a leading indicator of economic health – production reacts quickly to ups and downs in the business cycle and is correlated with consumer conditions such as employment levels and earnings.

Economists are expecting a growth of 0.5% in industrial production vs. -2.3% — positive numbers typically underpin the demand for Euro. If most of the economic data come out favorable, the ECB may think again before giving a dovish stance.

UK Labor Market Report – 8:30 GMT

Claimant Count Change

The Office for National Statistics is due to release Claimant Count Change at 8:30 GMT. The data is the first indication of the employment situation, released a month earlier than the Unemployment Rate. Source changed series calculation formula as of June 2015.

Moreover, it shows a change in the number of people claiming unemployment-related benefits during the previous month. Economists are expecting a slight negative change in jobless claims as figures are about to rise to 29.3K vs. 28.0K.

Unemployment Rate

Considering the prolonged uncertainty in the UK markets, it will be interesting to see the unemployment rate. Although, the economists are expecting the unemployment rate to remain stable at 3.9% vs. 3.9%. The Office for National Statistics is due to report this data at 8:30 GMT.

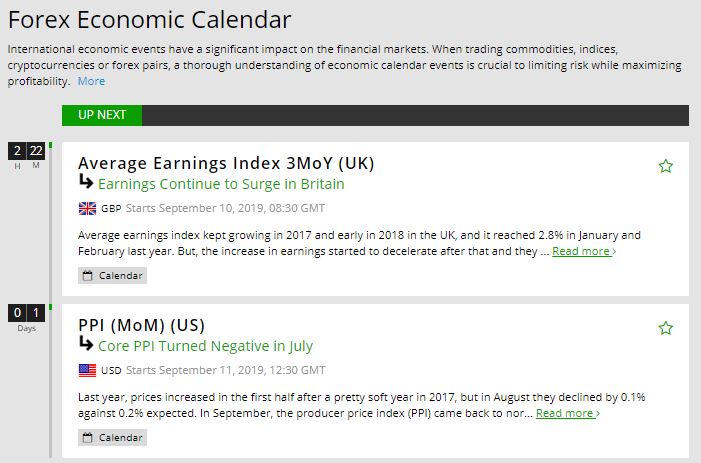

Average Earnings Index 3m/y

Well, one of the most critical data is the average earnings index as it reports a change in the number of people claiming unemployment-related benefits during the previous month.

Higher earnings levels result in a higher level of spending which ultimately lead to a higher level of Inflation. That’s exactly what investors want to see to invest in Sterling.

Economists are expecting a neutral figure of 3.7% vs. 3.7% during the last month. I will be looking for a deviation to capture a quick trade in Sterling pairs today.

Good luck for today, and stay tuned to FX Leaders Economic Calender for the live coverage of economic events.