EUR/CHF Sits Where No One Wants It

Good morning FXML followers! The day everyone has been waiting for is finally here. The infamous FED meeting is scheduled at 7 pm GMT today and forex traders are making some last day adjustments. Traders who have buy position are selling and the sellers are buying in order to square off before the meeting.

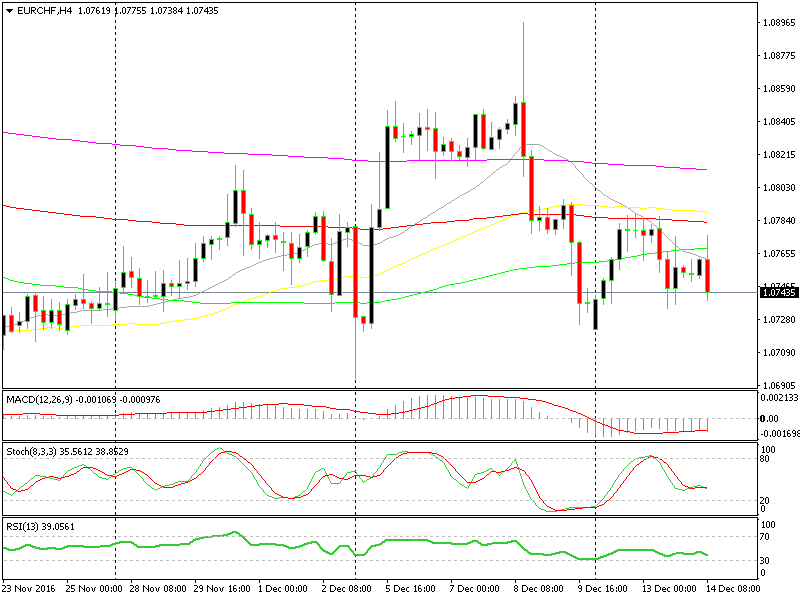

This has left some forex pairs in tight ranges and EUR/CHF is one of them. This pair has tried the bottom at 1.07 a few times last month and it tried the top several days ago. So, EUR/CHF sellers had a go at the bottom and failed, then the buyers had their turn at the top side and failed too. Perhaps they gave up for the time being until the FED meeting is over.

Now it looks like no one wants this pair anymore. We saw the same price action today but to a lesser degree when it crawled to 1.0775 overnight but fell to 1.0740 just an hour ago. This means that no one wants or has the guts to take this pair in any direction.

No one has the guts to break the range.

No one has the guts to break the range.

Both buyers and sellers don´t see much reward in either side, which means that this is the balance level, at least for now until the forex market gets over the FED. Trust me, if this wasn´t the balance point, which means that there would be potential to make some money here, then the forex traders would have seized the chance and taken this forex pair to another level where buyers and sellers would match each other.

However, since either party doesn´t want to push against the other side, then we can say that this is the level no one wants EUR/CHF. We have two open forex signals in this pair, but there´s nothing we can do about it. We have to wait until this is all over and then reevaluate after the price has calmed.