Forex Signals Brief August 8th – Quick Technical Setups to Trade

Today, we aren't expecting any high impact news from the fundamental side, placing the ball in the technical court. Here’s what I’ll be watching today…

So far, the month of August has given us good trade opportunities despite the lack of top tier fundamentals. Our forex trading signals secured four take profits in a row on the Nikkei, S&P 500, EUR/USD & NZD/USD helping us gain a good number of pips. Let's look at today's new trade plans.

Top Economic Events Today

US Dollar – USD

At 14:00 (GMT), the Bureau of Labor Statistics will be releasing JOLTS Job Openings with a positive forecast of 5.74M, higher than the previous month's figure of 5.67M. JOLTS Job Openings shows the number of job openings during the reported month, excluding the farming industry. Though it's released late, it can impact the market because job openings are a leading indicator of overall employment.

Australian Dollar – AUD

RBA Assistant Governor Kent is due to speak at the Bloomberg Address, in Sydney at 22:35 (GMT). He's responsible for advising Reserve Bank Board members, who decide on matters relating to economics. His public engagements are often used to drop subtle clues regarding future policy shifts. Check out our FX Leaders news trading strategy article to learn how to effectively trade based on news events such as this.

Top Trade Setups Today

EUR/USD – Breakout of Bullish Channel

The EUR/USD hasn't moved much due to the absence of major news on Monday, keeping the technical levels intact. In my earlier update Forex Signals Brief August 7th – 13th, I pointed out the breakout of the bullish channel after testing the top edge near $1.1900.

EUR/USD – 2-Hour Chart – 61.8% Retracement

EUR/USD – 2-Hour Chart – 61.8% Retracement

Like yesterday, the pair is consolidating below this channel, with an immediate resistance at $1.1840. The Stochastic is not in the oversold region anymore as the EUR/USD is heading towards 61.8% Fibonacci retracement at $1.1835. This could be a good level to place a sell somewhere around the $1.1840 trading level. You can find the intraday trading levels below.

EUR/USD – Key Trading Levels

Support Resistance

1.1769 1.1816

1.1745 1.1839

1.1722 1.1863

EUR/USD Trading Plan

The scenario has changed leaving us with two options.

First, stick with the same plan of entering a sell position below $1.1840 in order to target $1.1795 and $1.1735 with a stop loss above $1.1890.

Second, if today's market fails to break $1.1790, it will be a good sign to stay on the buying side.

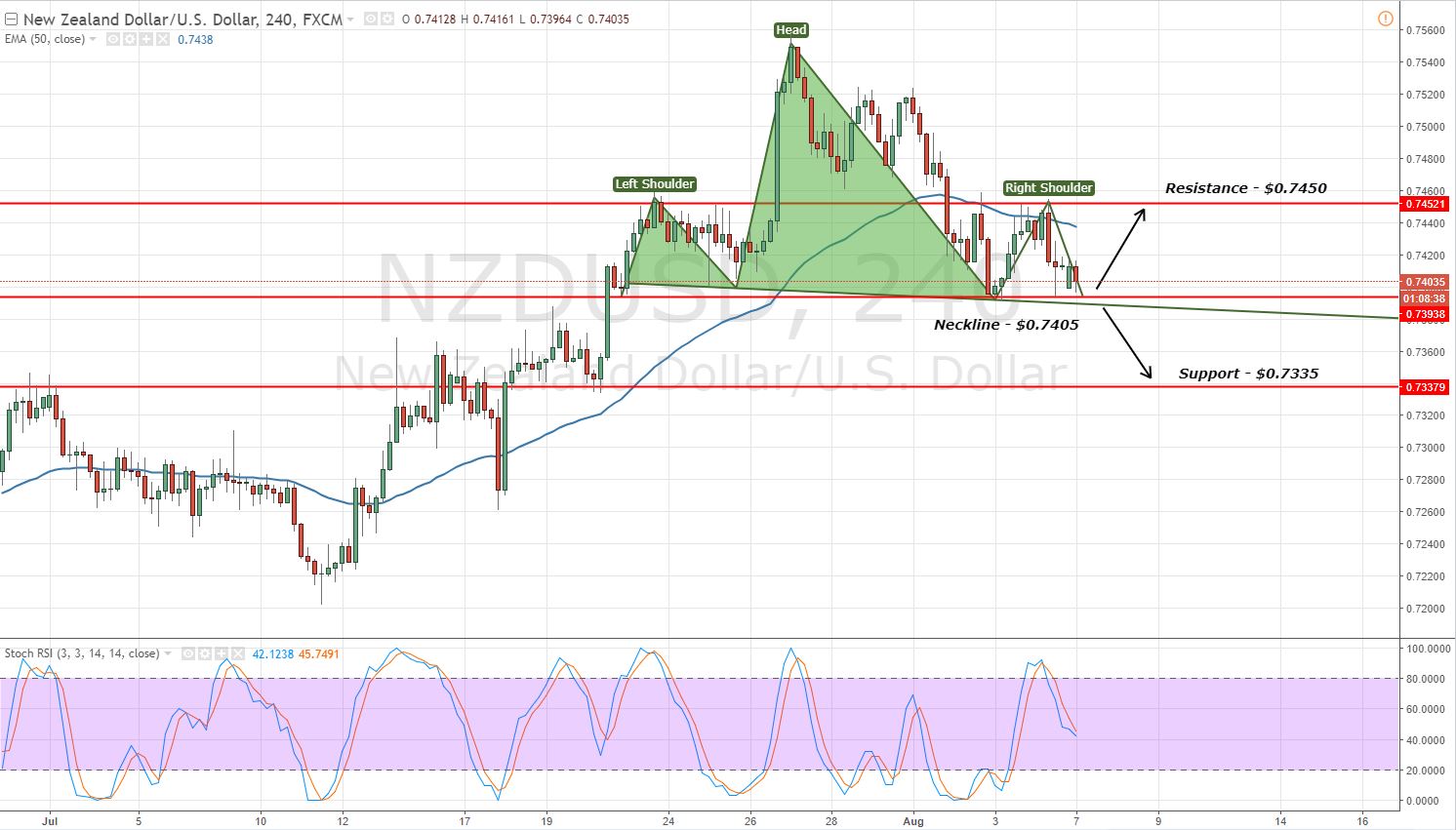

NZD/USD – Head & Shoulder In Play

Shorting NZD/USD was a good idea below $0.7400, especially on the breakage of neckline support. As mentioned in our previous analysis, the NZD/USD is progressively heading towards my earlier target of $0.7335. So far, it has dropped about 50 pips.

NZD/USD – Neckline Breakout – Monday

NZD/USD – Neckline Breakout – Monday

As of now, there is a slight change in the technical scenario. On the 4-hour chart, the Stochastics has entered the oversold region (below 20), signifying that the bears are exhausted and they may take profit before entering the market again. Let's wait for a slight correction before taking another sell trade.

NZDUSD – 2-Hour Chart – Heading Towards Target

NZDUSD – 2-Hour Chart – Heading Towards Target

NZD/USD- Key Trading Levels

Support Resistance

0.7334 0.7403

0.7306 0.7444

0.7265 0.7472

NZD/USD – Trading Plan

I'm looking to enter another sell below $0.7375 in order to target $0.7335 today. As we know, the market can exhibit thin volatility so make sure to target the nearest levels. Good luck & stay tuned for more updates!