Forex Signals Brief for June 16th – A Technically Supported Bearish Mode & The Gold!

Happy Friday, traders. It's been an amazing week so far, with plenty of phenomenal forex trading signals and live market updates. This week remained highly volatile due to the release of four monetary policy decisions, specifically the decision from the Federal Reserve. However, the market frequently traded as we expected and supported our trade ideas.

Forex Market Recap

- Today, in the early Asian session, we manually closed our forex trading signal on the WTI Crude Oil at $44.35 on the formation of reversal signs.

- US unemployment claims fell from 245K to 237K as opposed to the forecast 241K.

- US industrial production remained flat at 0% gain, instead of growing 0.2%.

- US capacity utilization rate was red at 76.6%, well below the forecasted 76.8%.

- Philly Fed index sank from 38.8 to 27.6 as opposed to the expected 25.5.

- BOE turned hawkish on MPC vote, where 3 members voted in favor of increasing the interest rates.

Daily Highlights

- BOJ held its benchmark interest rate at -0.1%, the same level where it has stood since the start of 2016.

- Eurozone Inflation figures at 9:00 (GMT) with a neutral forecast.

- U.S Building Permits at 12:30 (GMT) with a negative forecast.

- Prelim UoM Consumer Sentiment at 14:00 (GMT), ready to support the dollar with a positive forecast.

- Gold near $1251, ready to give us another trading signal.

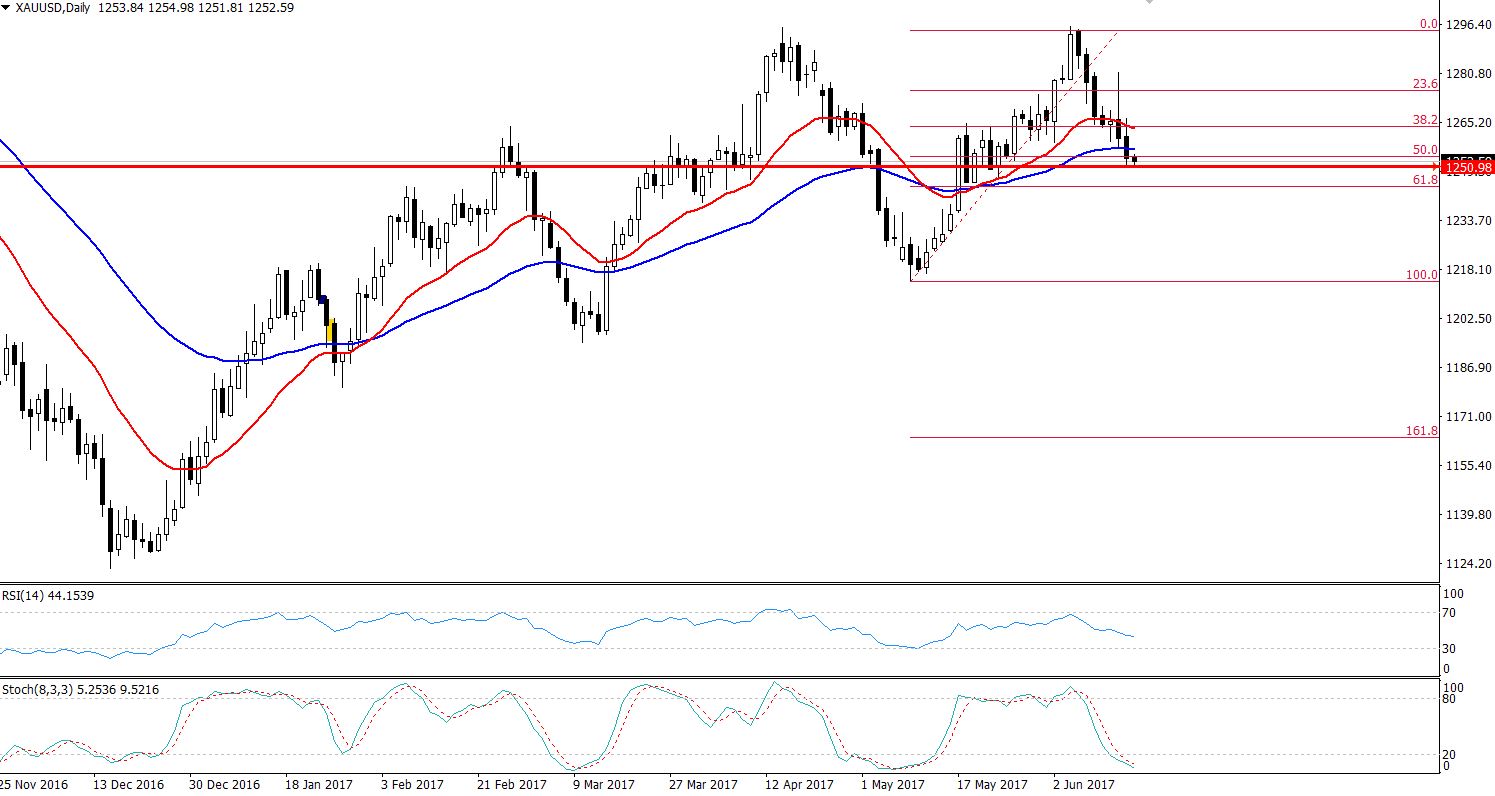

Gold – XAUUSD- Ready To Test 61.8% Fibonacci Retracement Level

In the Asian sessions, the precious metal gold is trading with an inadequate bullish tone, specifically due to weaker than expected economic events. Investors are looking to enter buying positions in the oversold metal in order trade the mixed economic events from the United States.

Overall, in the long term, the yellow metal trades with a bearish sentiment. Unsurprisingly, the bearish sentiment is gaining additional support due to the hawkish FOMC meeting this week.

The Federal Reserve interest rate decision matched market expectations with an additional 0.25% jump in interest rates to 1.00-1.25%, the 2nd rate hike of 2017.

In the European & US trading sessions, the gold is likely to show slight fluctuations upon the release of medium impact economic releases, but the fluctuations shouldn't be too strong to handle.

Forex Trading Signal – Idea

Investors are recommended to keep a close eye on $1250/51. It seems to be a good trading level for a buy position above, with a stop loss below $1249, and a take profit above $1254/55 On the other hand, traders can also have a sell position below $1250 with a take profit of $1246/44.

Gold – Daily Chart -50% Retracement

Gold – Daily Chart -50% Retracement

Technical Outlook – Intraday

At the moment, the bullion is trading at $1252. If we look at the daily chart, the gold has made its way towards 50% Fibonacci retracement level of $1254. Now, it's likely to head towards 61.8% Fibonacci retracement level of $1244.

But, $1251 is a minor hurdle along the way. It is the double bottom level, which we can see on the hourly chart. Gold has formed couple doji and spinning top right above this level, due to which $1251 trading level has gained attention. The 20 & 50 periods EMA's are suggesting a bearish trend, along with the momentum indicators. The RSI and Stochastic are trading in the sell zone.

Overall, gold is trending lower, that's why my preferred entry will be selling rather than buying.

Ending Remarks

Today, the focus is on the US macroeconomic events which are due to be released in the New York session. Personally, I'm not expecting a stronger price action, but perhaps there will be a slight adjustment in fundamental prices. Good luck and have a great weekend!

Gold – Daily Chart -50% Retracement

Gold – Daily Chart -50% Retracement