Forex Signals Brief for June 20th – Risk On Sentiment Ruling The Market, Speeches Ahead…

Yesterday, in the US trading Session, the greenback surged to place highs compared to the basket of peer currencies and resulting in significant drops in the bullion market, particularly, in the gold prices. It's highly speculative to keep our trading positions active while there is a major quantitative or qualitative fundamental release is expected. Therefore, we closed our gold trading signal manually in profit. Before we begin with the new day, let's have a quick look at the market recap:

Forex Market Recap:

- Gold edged lower by 0.92% to trade at $1244.85.

- WTI soared but later dropped to $44.33 due to the stronger US dollar.

- Forex Majors traded with stronger dollar sentiment. For example, EUR/USD dropped by 48 pips to $1.1149 and the GBP/USD by 44 pips to trade at $1.2735.

- Global stocks remained dramatically bullish over the "risk-on" sentiment after the release of Dudley's speech.

Key Points – US FOMC Official Dudley

- He is “very confident” that the US. economy can keep growing.

- US growth is well-distributed over the United States.

- US economy is close to full employment, while the growth in wages is also consistent with productivity.

Key Drivers To Watch Out For Today

- Australia Monetary Policy Meeting Minutes voted to leave interest rates at a record low of 1.5% just a few minutes back.

- BOE Gov Carney is due to speak at the Mansion House dinner, in London at 7:30 (GMT).

- SNB Chairman Jordan is due to deliver opening remarks at the Swiss International Finance Forum, in Bern at 8:45 (GMT).

- US FOMC member Fischer is expected to speak at the Riksbank macroprudential conference, in Amsterdam at 12:00 (GMT).

- The US will be releasing the Current Account figures at 12:30 (GMT) with a negative forecast.

- US FOMC member Kaplan is scheduled to speak about the economy and monetary policy at the Commonwealth Club, in San Francisco at 19:00 (GMT).

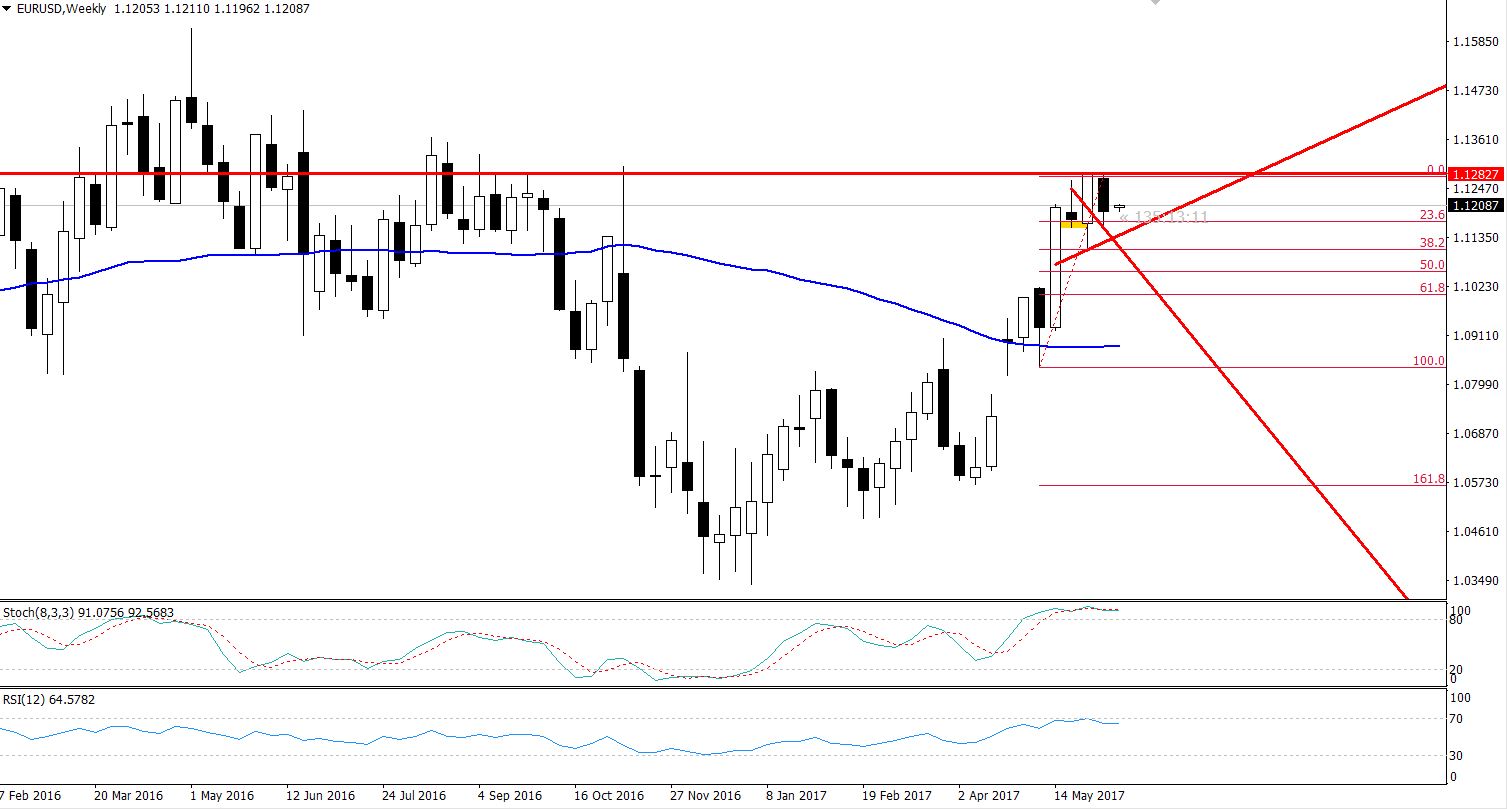

EUR/USD – Triple Bottom Support

As recommended in our Forex Signals Brief For June 19th – 25th, the EUR/USD dropped lower to trade at $1.1145. The slump in the pair was due to the hawkish comments from Federal Reserve member Dudley.

In addition, EU exit discussions among the United Kingdom and other 27 European Union member formally commenced on Monday. Despite that, there is still a high level of uncertainty surrounding the UK negotiating stance.

Forex Trading Signal – Idea

Our previous trade idea was a success. We had recommended staying on the selling side below $1.1207 with a target of $1.1160 (initial). For now, the crucial trading level is $1.1140. It is important to buy above and sell below it.

EUR/USD – Triple Bottom Pattern – Weekly Chart

Technical Outlook – Intraday

In the early Asian session, the major currency EUR/USD placed an intraday low of $1.1139 but failed to break below a significant support. On the 4-hour chart, there is a triple top pattern which is extending a solid support at $1.1139/40.

Now the pair has tested $1.1140 for the third time, making this level stronger. In the meantime, this has become our trade setup. At the moment, the immediate resistance is found at $1.1185. Whereas, below $1.1135, the market has the potential to target $1.1060.

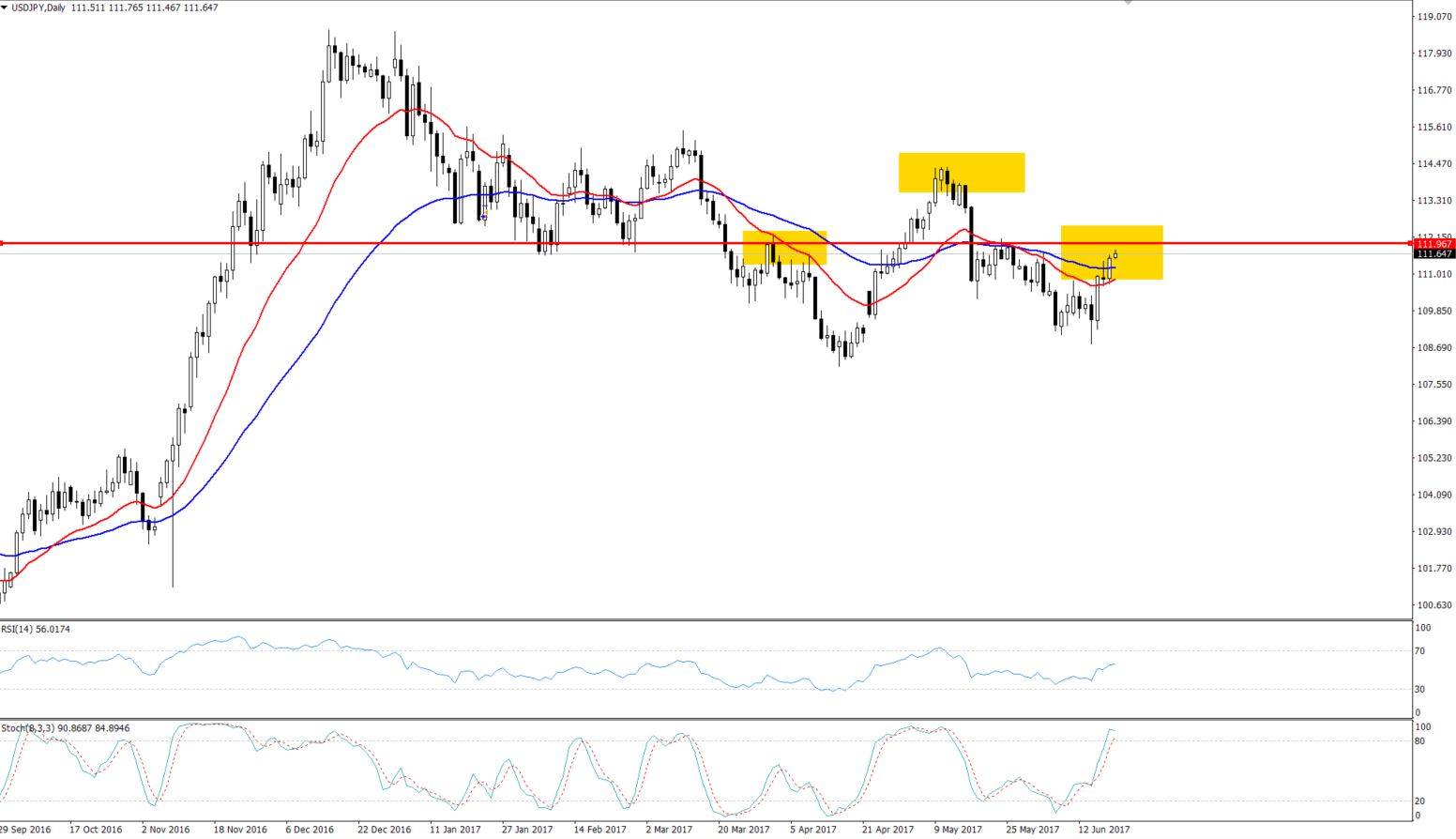

USD/JPY- The Head & Shoulder Pattern

The safe haven currency pair is slightly bullish because of the "risk-on" sentiment. Traders are focusing on riskier assets to invest in, particularly after the hawkish FOMC, Fed Rate Hike and recent remarks of FOMC official Dudely. He is quite optimistic about the US economy.

There is a need to monitor the speeches and current account figures from the United States, as the Japanese Economy has nothing to release today.

Forex Trading Signal – Idea

Investors are advised to keep $112 in focus in order to secure today's trade. The rough idea is to have a buying/ sell position below or above this level. Whereas, on the sell side, the target is likely to be $110.960.

USD/JPY Daily Chart – Head & Shoulder Pattern

USD/JPY Daily Chart – Head & Shoulder Pattern

Technical Outlook – Intraday

Technically, the USD/JPY is forming a head and shoulder pattern, which is signaling a potential reversal. Due to this pattern, the USD/JPY is facing a significant resistance at $112, and here I'm expecting a pullback. Refer to this article to gain more understanding about head & shoulder pattern.

Overall, the pair's trend is slightly bullish as we just had an RSI crossover in the daily timeframe. Both moving averages, 20 & 50 periods are showing a bullish momentum in the pair.

Ending Remarks

Today, investors are likely to trade with the dollar stronger sentiment the will come from Dudley's hawkish remarks. However, we need to wait for further clues from the other FOMC members regarding the next rate hike. Stay tuned for more live market updates!