Unexpected Dip In WTI Crude Oil – What’s Wrong?

We had some bad luck with the last Crude Oil Forex trading signal.We suggested to open a buy position in the WTI Crude Oil with 1:1 risk to reward ratio. Although the signal was purely based on technicals, the fundamentals intervened to appoint an excellent trading opportunity.

There is so much going on in the market, such as geopolitical tensions from the U.S, North Korean issues and now the OPEC meeting which has made the market highly uncertain.

That's why we are experiencing a 'random walk behavior' in the market. Therefore, trends are really short, and reversals are really uncertain. Anyways, we have well-protected trades with a proper stop loss, which always ensures our capital and help us stay on the green side.

What's Wrong With The WTI Crude Oil?

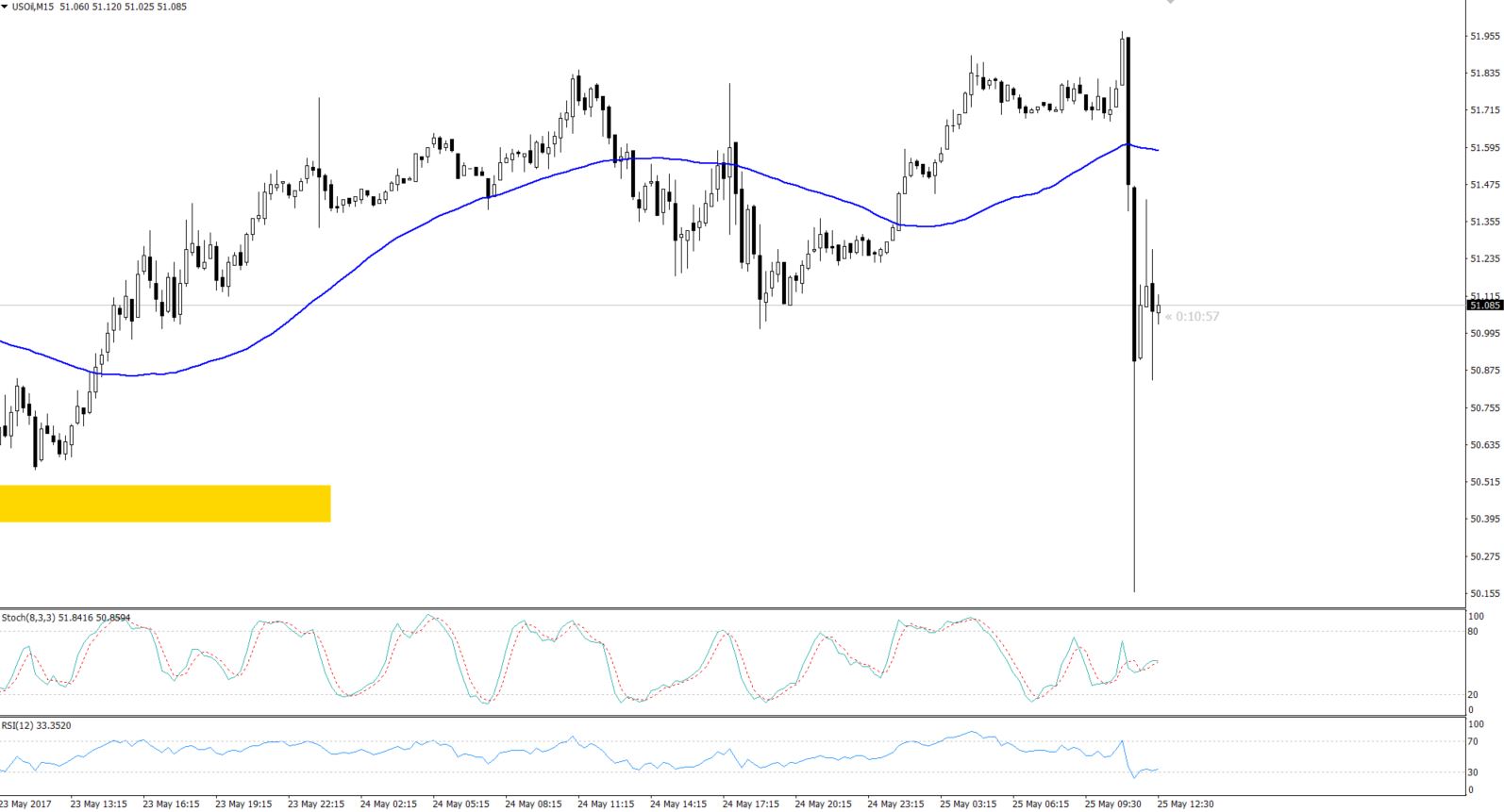

A few minutes ago, the oil prices sharply turned into the negative region, after trading bullish in the Asian sessions. The sudden reversal came right after Saudi Arabia's energy minister intimated that OPEC agrees to extend its current production cut deal for an additional 9 months.

If it's bullish news why did Oil fall by 180 pips?

The oil prices already "priced in" the output cut sentiment and these were likely to reversal on the actual output cut decisions.

However, this wasn't the only reasons. Massive drop initiated when the Saudi energy minister Khalid al-Falih remarked, the consensus is that the deeper cuts are not needed now.

Forex Trading Signal

Considering the massive volatility in the market, I'm waiting for the market to settle down before taking a fresh entry. As we often say, it's better to be safe than sorry!