USD/CAD Tightens Ahead Of Oil Inventories

For the second straight session, the USD/CAD is trading in an extremely tight range. Following the bull run of last week, the Loonie has consolidated near the 1.3100 level. The weekly crude oil inventories cycle is set to kick off in a matter of hours ― are we in for a USD/CAD breakout on the release?

Oil Inventories

It is Tuesday and another collection of supply numbers are due out from the oil industry. Builds in supply have been the norm as of late. Perhaps this trend will continue for both the API and EIA numbers in the coming 24 hours. Here is a look at what to expect from each release:

Event Previous Projected

API Crude Oil Stocks -2.1M NA

EIA Crude Oil Stocks 6.49M 3.55M

With WTI crude establishing a foothold below $70.00, growing supplies may bring more selling to crude and bids to the USD/CAD. We will see what happens as the stocks figures are released to the public.

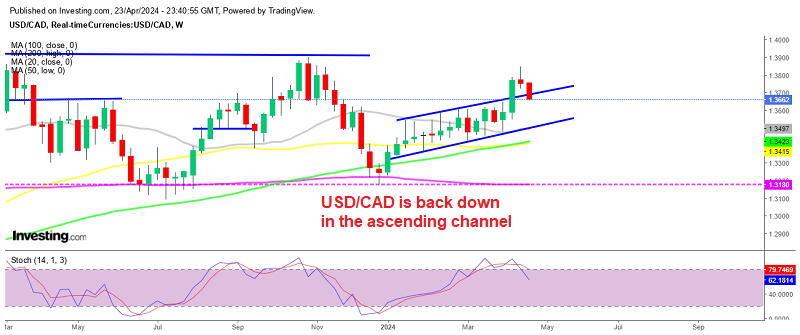

USD/CAD Technicals

The daily chart sums up the tight action in the Loonie. 1.3100 is acting as a strong two-way catalyst, effectively setting up a bullish pennant formation.

+2018_10_23.png)

Bottom Line: Action in WTI crude oil is always an integral part of USD/CAD valuations. The coming 24 hours will bring plenty of participation to WTI and the Loonie. As of now, it appears a breakout, either bullish or bearish, is imminent.

For the next two sessions, I will have buy orders queued up from just above the 38% Current Wave Retracement (1.3050). Longs from 1.3054 are good trade location to the bull. With an initial stop loss at 1.3024, this trade is good for 25 pips using a conservative sub-1:1 risk vs reward management plan.