Daily Brief, Mar 16: Everything You Need to Know to Trade Gold Today

Safe-haven-metal prices flashing green and rose to $1,544.2 mainly due to the US Federal Reserve declared a surprise rate cut to 0.25%...

During the Asian session, the safe haven metal prices were flashing green and rose to $1,544.2 mainly due to the US Federal Reserve declaring a surprise rate cut to 0.25%, as well as $700 billion worth of Quantitative Easing (QE) over the weekend.

At the time of writing, gold is currently trading at 1,543.90 and consolidates in the range between the 1,524.00 – 1,574.70.

Gold futures were up 1.81% to $1,544.2 by 11:01 PM ET (3:01 GMT) on Monday, up from a $1,516.7 close on Friday. The Fed’s announcement of an interest rate cut to 0%-0.25% and a US$700 billion bond buyback program came in addition to last Friday’s $1.75 trillion injections. The US central bank will buy back $500 billion worth of Treasuries and $200 billion of agency-backed mortgage securities, starting with a $40 billion purchase on Monday.

Many central banks had followed the Fed’s role with the Bank of Canada, the Bank of England, and the Bank of Japan, also delivering rate cuts in the same week.

A report came from Fed Chairman Jerome Powell who said that they would maintain the rate at this level until they’re sure that the economy has overcome recent events and is on the recovery track to achieve the best employment and price stability goals.

Despite the rate cuts, Coronavirus (COVID-19) is still weighing on the market’s trade sentiment of late, pushing investors away from trading/investment. The latest updates from Italy and France have been worrying while those from China keep moving back. The market’s risk-tone remains under pressure with the US equity futures and 10-year treasury yields down.

However, Japan’s NIKKEI seems to recover some early-day losses ahead of the BOJ. Moving ahead, traders will keep their eyes on central banks’ moves and announcements/surprises, which will be taken seriously for near-term trade direction. On the other hand, coronavirus headlines will also be key to watch.

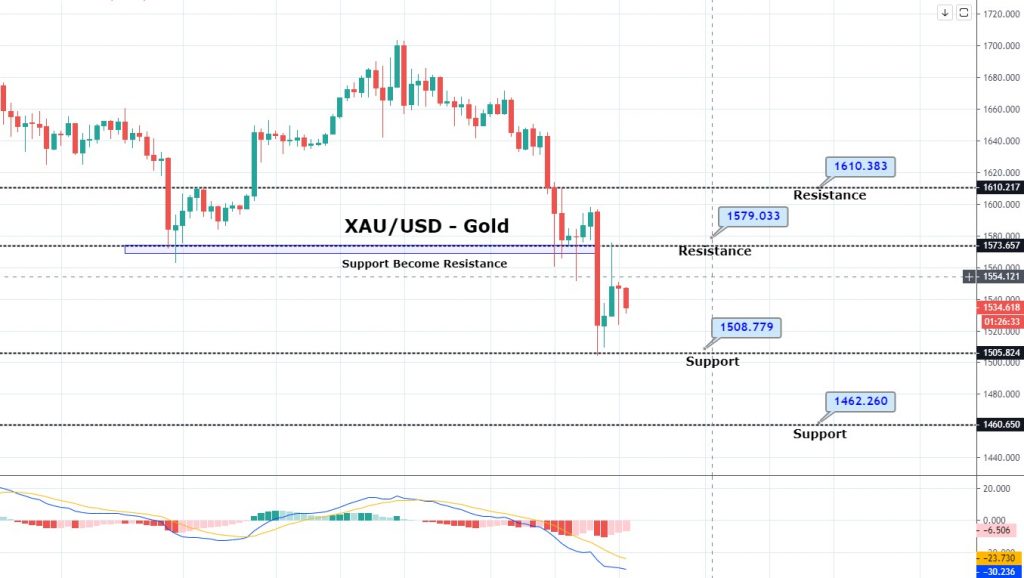

Daily Support and Resistance

S1 1424.55

S2 1509.41

S3 1542.86

Pivot Point 1594.26

R1 1627.71

R2 1679.12

R3 1763.97

The precious metal GOLD opened with a bullish gap to place a high around 1,578, but the bullish momentum reversed later as traders decided to fill the gap around 1,529 level. Gold’s trading range is pretty big due to massive volatility in the market. So far, immediate support prevails around 1,523 levels, and resistance stays around 1,565. We may see gold consolidating in the same trading range until we have further updates regarding coronavirus and its vaccinations.

Good luck!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account