- Home /

- Live Rates /

- GOLD

Last Updated: Jul 04, 2025 03:08:04 PM (GMT)

GOLD: The current market price is 3354.64, up 0.72% from the previous close.

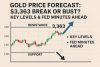

Support and Resistance Levels Support levels are at 3315.86, 3305.77, and 3295.54, while resistance levels are at 3365.57, 3364.70, and 3363.45. The pivot point is at 3338.00.

Indicators The RSI is at 44.39, indicating neutral momentum. The ADX is strong at 40.88, suggesting a strong trend. The ATR is at 12.39, indicating volatility, while Parabolic SAR suggests upward momentum.

Market Sentiment The market is bullish as the price is above the pivot point (3338.00) and indicators support a buying trend.

GOLD Signals & Technical Analysis

Market Sentiment

Trend Indicators

Oscillators

Moving Averages

Pivot

ABOUT THE GOLD (XAU/USD)

Gold is the world's oldest mode of exchange. With a bright and glossy appearance, gold is not only visually attractive but also has exceptional uses. Gold is regarded both as a long term investment and as a short term hedge in times of uncertainty or anxiety in the markets. Gold prices therefore usually display enhanced volatility during political or economic uncertainty as investors increase gold's demand due to its global acceptability.

In the forex world, the XAU/USD pair is the abbreviated term depicting gold and the US dollar, also named as the precious metal, yellow metal and bullion. It’s a spot commodity based on the price of gold and traded against the US dollar. Previously, gold was used as a standard for monetary exchange as well. This practice was stopped with the introduction of the fiat system in the US in 1971.

Breaking Down "XAU/USD"

COMEX Division Spot gold and futures offer an essential alternative to conventional means of investing in gold such as coins, bullion and mining assets. Gold futures contracts are valuable trading tools for institutional investors and independent forex traders.

For day traders, an electronically traded fund (ETF) based on several aspects of gold's valuation is excellent for engaging the marketplace on a short-term basis. Gold futures offer hedgers and speculators an ability to transfer the rights to various quantities of gold without having to worry about providing delivery. Therefore, the appetite of forex traders to settle the trade in cash ensures high levels of ongoing liquidity until the contract's expiration date.

Gold Correlations

Although gold is not a currency by definition, it is often viewed as and traded in the same way as currencies, especially in the modern electronic trading environment.

US Dollar - Gold has a primary correlation with the US dollar and it is typically used as an alternative hedging tool when the dollar is showing signs of weakness.

Swiss Franc - The Swiss Franc is highly correlated with gold; hence, the USD/CHF and XAU/USD (Gold/United States dollar) have a remarkable one-year inverse correlation of -0.82). When the USD/CHF pair moves higher, gold tends to move lower.

Aussie - One essential characteristic of gold prices is that it has a high positive correlation with AUD. The reason behind this is that Australia is the third biggest gold producer in the world. As a result, whenever the price of gold rises or falls, the Aussie goes along for the ride.

How to Trade Gold?

Trading a contract for difference (CFD) on gold is not complicated. By buying or selling a gold CFD in response to one of our gold trading signals, you participate in the price movement of this precious metal without actually owning it physically. It’s traded exactly like a currency pair.

The only difference is that you’re buying or selling gold against the US dollar. The symbol for the gold CFD is usually XAU/USD. XAU is the gold component and USD the US dollar component. When you believe the gold price will fall, you can sell this “pair”, and when you think the gold price will rise, you can buy it.

What Determines the XAU/USD Exchange Rate?

Many economic factors influence gold’s trading price which include interest rates, inflation, gold supply and demand, the value of the US dollar, and large gold transactions by central banks.

US FED Monetary Policies: The Federal Reserve controls the supply of money in the market, to keep the economy on track. A dovish policy, which is also known as expansionary policy, weakens the currency. In contrast, a hawkish monetary policy (contractionary policy) strengthens the currency, USD.

Economic Events: Any movement in the US economic events determines the exchange rates. Top of the line economic events include GDP, Employment Change, Industrial Production, and Consumer Price Index. Better than forecast data hikes the demand for and impacts the value of the US Dollar, causing a drop in the XAU/USD exchange rate and vice versa.

Gold & Dollar: Since gold is mostly priced in US dollars, it is, to a great extent, inversely correlated with the dollar. When there is a broad weakening of the dollar against other currencies, these currencies automatically have more gold purchasing power (directly since gold is priced in dollars). The effect is that the demand for gold increases, which in turn raises the gold price up to the point where it reaches a temporary state of equilibrium, so to speak.

Political announcements & natural disasters – Besides scheduled economic events, political elections, new systems, wars, terror incidents, and natural calamities, etc., can all cause severe variations within XAU/USD.

XAU/USD Specifications

The XAU/USD is traded in amounts denominated in the US Dollar. Standard lot Size: 100 Ounces. One pip in decimals 0.01 Pip Value: $1

Formula

Profit/Loss = (Bid Price – Ask Price) X Contract Size X Number of Lots

Gold's historically reliable price stability makes it a desirable asset to hold during periods of inflation. This has made the XAU/USD pair an increasingly popular option amongst Forex traders, which provides an attractive opportunity to incorporate gold into their trading strategies.

Gold prices rebounded significantly from seven-week lows of $1,819 on 17th Feb 2023. However, the prices are still exhibiting a lack of directional momentum at the moment. On the other hand, Investor sentiment is exhibiting caution due to the resurgence of geopolitical risks and the aftermath of releasing minutes from the US Federal Reserve meeting that was held in February.

It is important to note that the relationship between gold prices and recessions is not always consistent, as it is contingent on the particular dynamics of each recession. Recently, higher interest rates have had a detrimental effect on the US dollar index, which reached its long-term resistance in 2022 and is projected to depreciate further in 2023. Consequently, demand for gold is expected to increase over the course of 2023.

The trading price of gold is affected by a range of economic factors, including interest rates, inflation, the supply and demand of gold, the exchange rate of the US Dollar and significant transactions conducted by central banks.