JustMarkets Review

- Overview

- Safety and Security

- Worldwide Trading with JustMarkets

- Choose Your Live Account, Know Your Deposit

- Islamic, Swap-Free Trading Account

- Demo Account

- How to Open a JustMarkets Account

- Fees, Spreads, and Commissions

- How Does JustMarkets Stack Up?

- Trading Platforms and Tools

- Expansive Asset Selection

- Deposit and Withdrawal

- Introducing Broker Program

- Loyalty Programme - Climb, Earn, Celebrate

- Educational Resources and Tools

- Customer Support

- Insights from Real Traders

- JustMarkets vs HFM vs XM - a Comparison

- Pros and Cons

- In Conclusion

JustMarkets is a top-tier, highly regulated Forex broker with a stellar trust score of 90/99. It offers traders access to a wide range of financial instruments and ultra-competitive trading conditions, making it a standout choice in 2025.

🛡️Regulated and trusted by FSA, CySEC, FSCA, FSC

🛡️2106 new traders chose this broker in the last 90 days.

🛡️Available for global Traders.

★★★★★ | Minimum Deposit: $10 Regulated by: FSA, CySEC, FSCA, FSC Crypto: Yes |

Overview

JustMarkets is a globally trusted and highly professional broker, offering competitive trading conditions and access to multiple markets. With millions of clients in 160+ countries, it stands out for its transparency, security, and client-first approach.

Frequently Asked Questions

Is JustMarkets a safe broker for beginners?

Yes, JustMarkets is ideal for beginners. It’s heavily regulated (FSA, CySEC, FSCA, FSC), offers a $1 minimum deposit, and provides negative balance protection, which ensures new traders can learn in a safe environment.

What trading platforms does JustMarkets offer?

JustMarkets offers MetaTrader 4 and MetaTrader 5, two of the industry’s most trusted platforms. These platforms provide advanced charting tools, expert advisor support, and smooth mobile trading options for users of all experience levels.

Our Insights

JustMarkets excels in trust, global reach, and client protection. Backed by multiple regulations and strong trading conditions, it’s a reliable broker for traders at any level seeking transparency and long-term trading success.

★★★★★ | Minimum Deposit: $10 Regulated by: FSA, CySEC, FSCA, FSC Crypto: Yes |

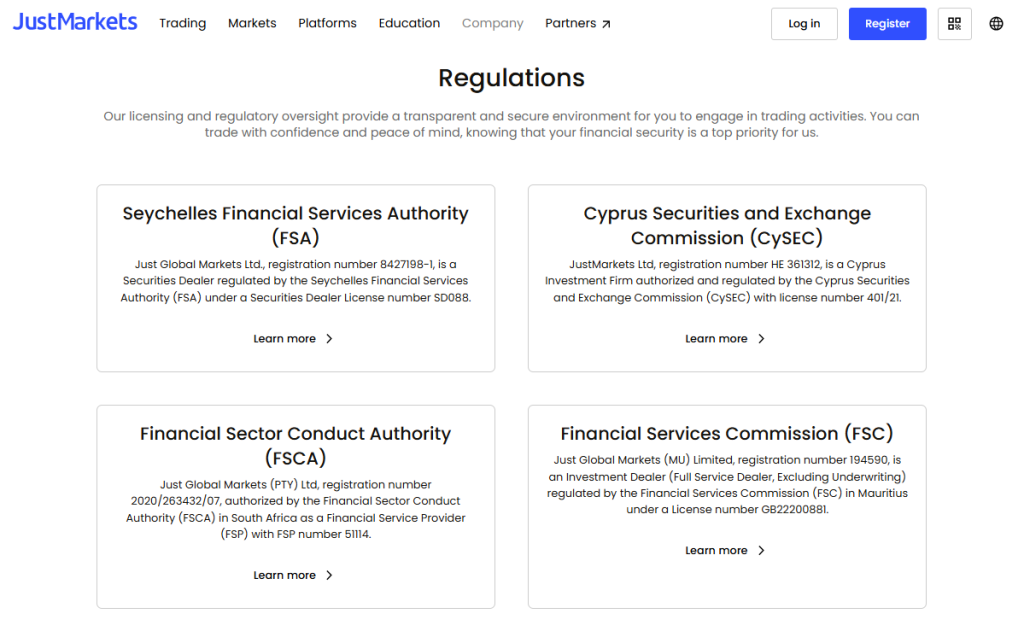

Safety and Security

JustMarkets operates under four globally recognized regulatory bodies, ensuring maximum transparency, fund protection, and operational integrity. With licenses across multiple jurisdictions, traders enjoy a secure environment built on compliance, oversight, and financial peace of mind.

| Authority | Country | Company Name | License No. |

| 🇸🇨 FSA | 🇸🇨 Seychelles | Just Global Markets Ltd. | SD088 |

| 🇨🇾 CySEC | 🇨🇾 Cyprus | JustMarkets Ltd. | 401/21 |

| 🇿🇦 FSCA | 🇿🇦 South Africa | Just Global Markets (PTY) Ltd | FSP 51114 |

| 🇲🇺 FSC | 🇲🇺 Mauritius | Just Global Markets (MU) Limited | GB22200881 |

| Negative Balance Protection | 🌍 Global | All Clients | Enabled |

| Fund Safety and Segregation | 🌍 Global | Segregated Bank Accounts | Yes |

| Data Encryption and Cybersecurity | 🌍 Global | Bank-grade SSL Encryption | Active |

Frequently Asked Questions

Is JustMarkets regulated?

Yes, JustMarkets is licensed by four respected financial regulators: FSA (Seychelles), CySEC (Cyprus), FSCA (South Africa), and FSC (Mauritius). These licenses ensure strict compliance with international laws and trader protection standards.

What is the difference between a regulated and an unregulated broker?

A regulated broker like JustMarkets must meet strict legal, operational, and financial standards enforced by authorities. Unregulated brokers operate with minimal oversight, putting client funds and personal data at significantly higher risk.

Our Insights

With multi-jurisdictional regulation, negative balance protection, and encrypted transactions, JustMarkets provides the kind of safety serious traders demand. Its commitment to regulatory compliance makes it one of the most secure brokers globally.

★★★★★ | Minimum Deposit: $10 Regulated by: FSA, CySEC, FSCA, FSC Crypto: Yes |

Worldwide Trading with JustMarkets

JustMarkets offers access to clients in over 160 countries, backed by localized regulatory presence and tailored service. With licenses across Africa, Europe, and Asia, it delivers regulated trading to a broad global audience.

| Region | Availability | Local Regulator | Entity Name |

| Africa | Available | 🇿🇦 FSCA South Africa | Just Global Markets (PTY) Ltd |

| Europe | Available | 🇨🇾 CySEC Cyprus | JustMarkets Ltd |

| Asia | Available | 🇸🇨 FSA Seychelles 🇲🇺 FSC Mauritius | Just Global Markets Ltd / MU Ltd |

| Latin America | Available | Offshore licensing supported | Global Coverage |

| Middle East | Available | International access Global | Regulatory-compliant onboarding |

| North America | Not Available | Regulatory restrictions apply | N/A |

| Australia | Available | International service coverage 🇦🇺 Australia | Global onboarding supported |

Frequently Asked Questions

In which countries is JustMarkets regulated?

JustMarkets holds licenses in Cyprus (EU), Seychelles, South Africa, and Mauritius. This gives it regulatory presence across key regions, including Europe, Africa, and Asia, allowing it to legally operate in most global markets.

Can traders from my region use JustMarkets?

If you’re outside of North America, chances are you can! JustMarkets supports clients in over 160 countries, offering localized service and compliance with regional financial laws for safer and smoother trading experiences.

Our Insights

AvaTrade is a top-tier broker that combines global regulation, user-friendly platforms, and trader protection tools. It’s well-suited for beginners and experienced traders alike, thanks to its strong educational resources and innovative features like AvaProtect.

★★★★★ | Minimum Deposit: $10 Regulated by: FSA, CySEC, FSCA, FSC Crypto: Yes |

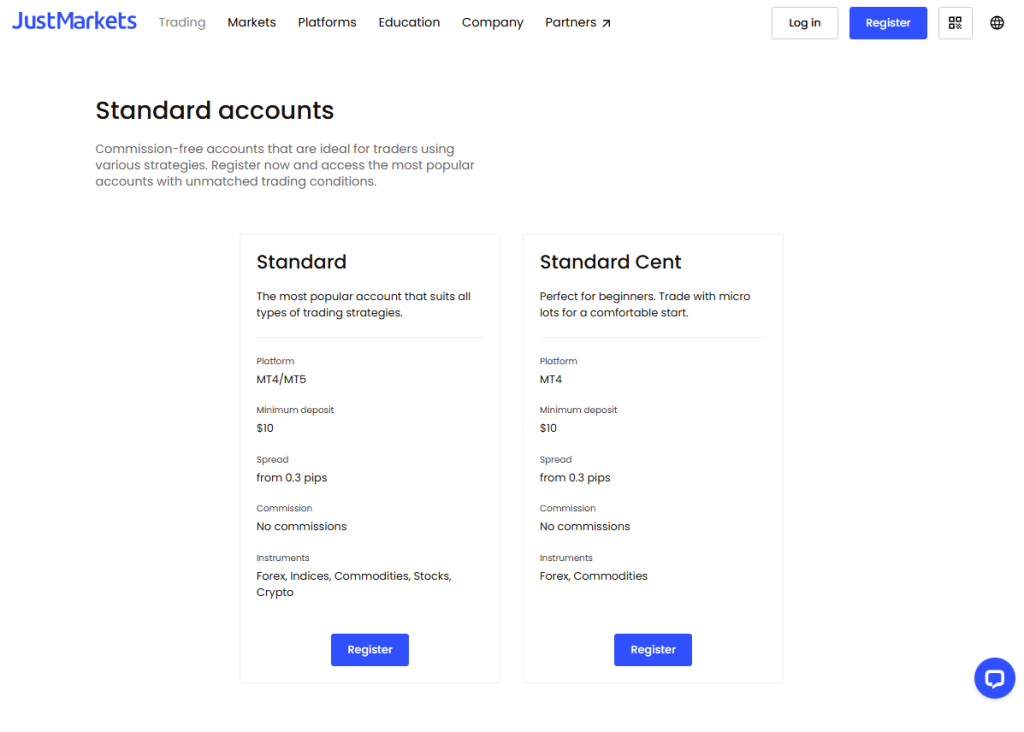

Choose Your Live Account, Know Your Deposit

JustMarkets offers four flexible account types, from micro-lot Cent accounts to high-volume Pro options. With low deposits starting at just $10, traders at any level can find a tailored fit to match their strategy, risk, and experience.

Standard and Cent Accounts

JustMarkets offers commission-free Standard accounts that cater to both beginners and seasoned traders. With competitive spreads, low entry costs, and broad instrument access, these accounts provide a balanced blend of accessibility, flexibility, and powerful features.

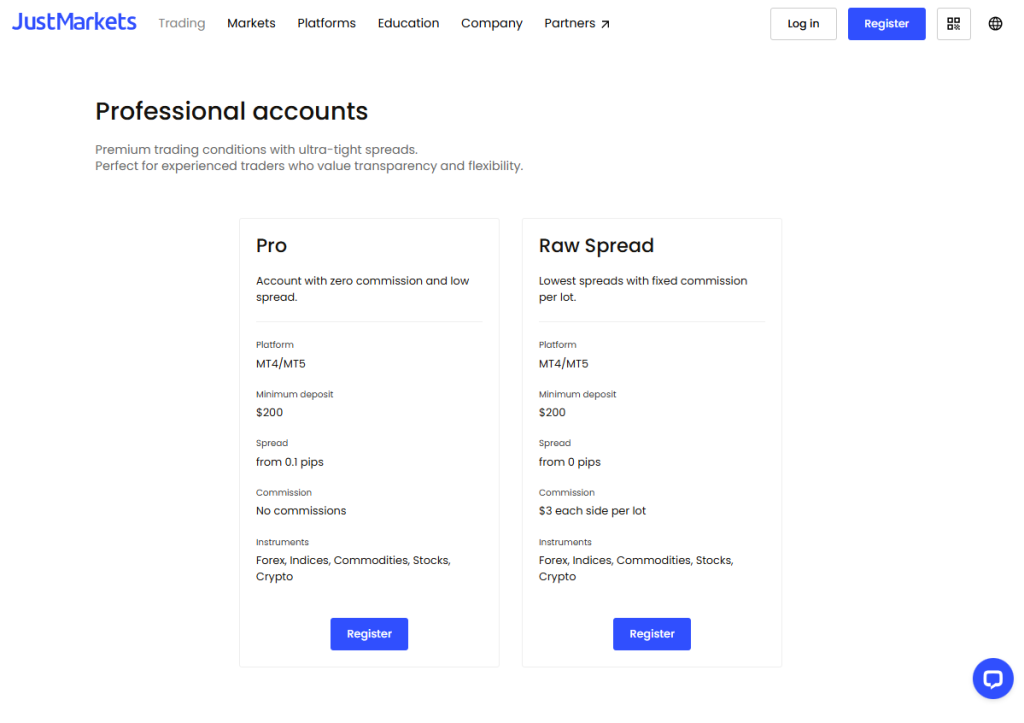

Professional Accounts

JustMarkets’ professional accounts are tailor-made for advanced traders seeking razor-sharp spreads, market execution, and transparency. With low fees and flexible platforms, Pro and Raw Spread accounts deliver premium trading power for serious market participants.

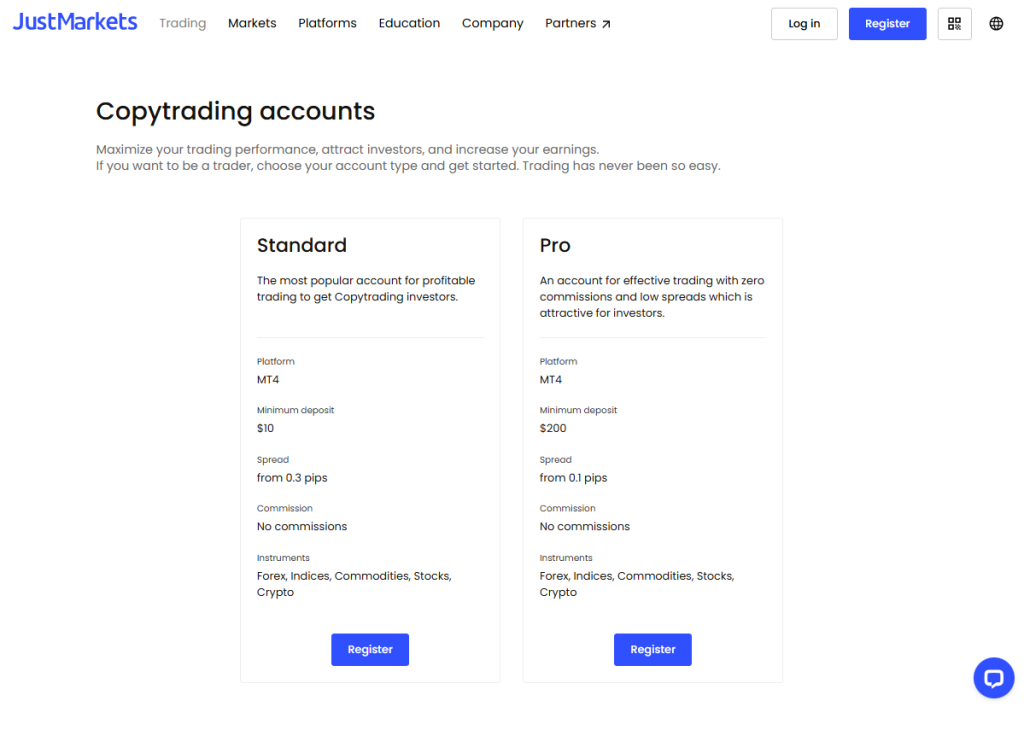

Copytrading Accounts

Whether you’re a beginner looking to follow top-performing traders or a pro aiming to attract investors, JustMarkets Copytrading accounts offer flexible platforms, tight spreads, and zero commissions, making copy-based trading accessible, rewarding, and scalable for all.

Frequently Asked Questions

What’s the minimum deposit to open a JustMarkets account?

You can start trading with as little as $10 on Standard and Cent accounts. Pro and Raw Spread accounts require a $200 minimum, ideal for traders seeking tighter spreads and enhanced trading conditions.

Which JustMarkets account type is best for beginners?

The Standard Cent account is perfect for beginners. It allows micro-lot trading and lower exposure, making it easier to practice trading strategies with minimal financial risk while benefiting from real market conditions.

Our Insights

Whether you’re just beginning or trading professionally, JustMarkets provides an account structure that supports your journey—from Cent and Standard to Pro and Raw Spread. All options offer competitive leverage and user-friendly conditions.

★★★★★ | Minimum Deposit: $10 Regulated by: FSA, CySEC, FSCA, FSC Crypto: Yes |

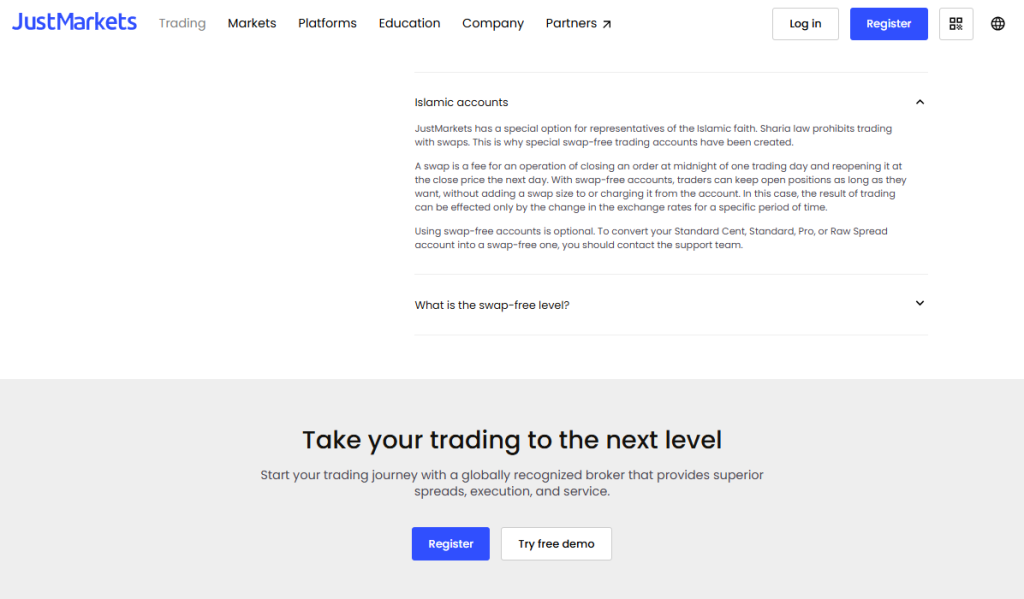

Islamic, Swap-Free Trading Account

For traders who follow Islamic principles, JustMarkets offers swap-free accounts compliant with Sharia law. These accounts eliminate overnight interest charges, allowing positions to stay open indefinitely – ideal for long-term strategies without compromising faith or market opportunity.

Frequently Asked Questions

What makes JustMarkets’ Islamic accounts Sharia-compliant?

JustMarkets Islamic accounts are swap-free, meaning they exclude overnight interest fees. This aligns with Sharia law, which prohibits earning or paying interest. Traders can hold positions overnight or long term without paying swaps.

Can any account type become Islamic at JustMarkets?

Yes, clients can request swap-free status for their Standard Cent, Standard, Pro, or Raw Spread accounts. This must be done through the support team, which will review eligibility and apply the conversion.

Our Insights

JustMarkets’ Islamic accounts offer a practical and faith-compliant way to trade, preserving full trading functionality across all major account types, without swaps. A perfect balance of ethical trading and modern market access.

★★★★★ | Minimum Deposit: $10 Regulated by: FSA, CySEC, FSCA, FSC Crypto: Yes |

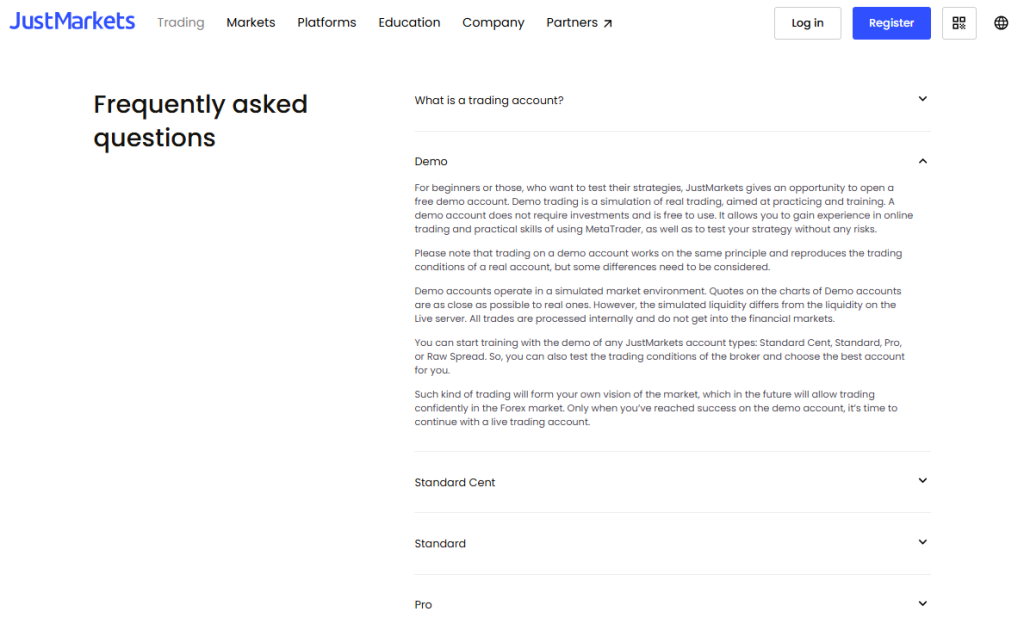

Demo Account

JustMarkets provides free demo accounts for beginners and strategy testers alike. These accounts simulate real trading conditions on MetaTrader platforms, letting users gain experience and confidence without risking capital or committing to a live environment.

Frequently Asked Questions

What can I do with a JustMarkets demo account?

A demo account lets you practice trading, explore MetaTrader tools, and test strategies risk-free. It mimics real trading conditions, providing a valuable hands-on experience before moving to live markets.

Is the JustMarkets demo account truly realistic?

Yes, demo accounts replicate real trading environments closely. While quotes are nearly identical to live accounts, trades execute in a simulated liquidity environment, meaning execution speed and depth may differ slightly.

Our Insights

JustMarkets demo accounts are a smart, safe way to sharpen trading skills, explore different account types, and gain confidence. Ideal for beginners and seasoned traders testing strategies, all without risking a cent.

★★★★★ | Minimum Deposit: $10 Regulated by: FSA, CySEC, FSCA, FSC Crypto: Yes |

How to Open a JustMarkets Account

Go to www.justmarkets.com and click on the “Open Account” or “Sign Up” button at the top of the homepage to begin the registration process.

Step 1: Complete the Registration Form

Enter your full name, email address, password, and country of residence. Accept the terms and conditions, then submit the form to create your client area account.

Step 2: Verify Your Email

Check your inbox for a confirmation email from JustMarkets. Click the verification link provided to activate your client portal.

Step 3: Fill in Personal Details

Log in to your client area and complete your profile by providing your date of birth, address, phone number, and tax residence information.

Step 4: Upload Verification Documents

Submit a valid government-issued ID (passport, national ID, or driver’s license) and a recent proof of address document (such as a utility bill or bank statement dated within the last 3 months).

Step 5: Choose an Account Type

Select from Standard Cent, Standard, Pro, or Raw Spread accounts. You may also opt to open a demo account to practice without financial risk.

Step 6: Set Account Preferences

Pick your trading platform (MT4 or MT5), account currency (USD, EUR, etc.), and preferred leverage (up to 1:3000).

Step 7: Fund Your Account

Head to the “Deposit” section and select your preferred payment method. Deposit at least $10 for Standard and Cent accounts, or $200 for Pro and Raw Spread accounts.

Step 8: Download the Trading Platform

Install MetaTrader 4 or MetaTrader 5 on your device. Use your login details provided by JustMarkets to connect your trading account.

Once logged in, you’re ready to begin trading Forex, commodities, indices, stocks, or crypto based on the account type and platform you selected.

★★★★★ | Minimum Deposit: $10 Regulated by: FSA, CySEC, FSCA, FSC Crypto: Yes |

Fees, Spreads, and Commissions

JustMarkets keeps its fee structure transparent and competitive. With zero-commission options, tight spreads, and flexible swap-free settings, traders of all experience levels can choose account types tailored to their strategies, without worrying about hidden costs.

¹ Currencies supported: USD, EUR, GBP, JPY, MYR, IDR, THB, VND, KWD, CNY, ZAR, AED, NGN

² Swap-free is available for Muslim clients and those with an extended swap-free level.

³ Step size for Standard Cent is 0.01.

Frequently Asked Questions

Are there any hidden fees on JustMarkets accounts?

No hidden fees. All accounts clearly outline spreads and commission terms. Standard, Cent, and Pro accounts charge no commissions, while the Raw Spread account charges a fixed $3 per side per lot.

Which account offers the tightest spreads at JustMarkets?

The Raw Spread account provides spreads starting from 0.0 pips, making it ideal for high-frequency and professional traders who prioritize low entry costs and are comfortable with a fixed commission.

Our Insights

JustMarkets offers flexible fee models for all trader types—from beginners using Standard or Cent accounts with no commissions, to pros leveraging Raw Spread accounts for ultra-tight pricing. The clarity and choice in cost structures are definite strong points.

★★★★★ | Minimum Deposit: $10 Regulated by: FSA, CySEC, FSCA, FSC Crypto: Yes |

How Does JustMarkets Stack Up?

JustMarkets positions itself as a serious contender in the online trading space by offering ultra-low spreads, high leverage, and a flexible range of account types. Its appeal lies in affordability, platform versatility, and beginner-to-pro accessibility.

| Feature | JustMarkets | Industry Average |

| Minimum Deposit | $10 (Standard/Cent) $200 (Pro/Raw) | $100 – $250 |

| Spreads | From 0.0 pips (Raw) 0.3 pips (Std) | From 0.8 – 1.2 pips (average) |

| Leverage | Up to 1:3000 | Typically up to 1:500 |

| Commissions | $0 (Std/Pro), $3/lot/side (Raw) | $3.50 – $7 per lot (Raw accounts) |

| Platforms | MT4 MT5 | MT4 MT5 Proprietary |

| Swap-Free Option | Yes | Available on select brokers |

| Demo Account | Yes | Yes |

Frequently Asked Questions

How do JustMarkets’ trading conditions compare to top brokers?

JustMarkets offers spreads from 0.0 pips on Raw Spread accounts and leverage up to 1:3000, rivalling industry leaders. It also features commission-free options, swap-free accounts, and low minimum deposits, giving traders a highly flexible and affordable setup.

Is JustMarkets a good choice for beginner traders?

Yes. With a $10 minimum deposit, a free demo account, and simple account types like Standard Cent, JustMarkets makes it easy for beginners to start trading and test strategies before transitioning to live markets with higher volume.

Our Insights

JustMarkets stands out for its ultra-competitive trading conditions, especially for cost-conscious or high-leverage traders. While not as brand-heavy as some major brokers, its offering is solid and purposefully structured for trader growth.

★★★★★ | Minimum Deposit: $10 Regulated by: FSA, CySEC, FSCA, FSC Crypto: Yes |

Trading Platforms and Tools

JustMarkets offers a powerful suite of trading platforms, including MetaTrader 4, MetaTrader 5, and its mobile app. Each platform is optimized for different trading styles, desktop, web, or mobile, delivering real-time execution, advanced analysis tools, and global market access.

MetaTrader 5

MetaTrader 5 (MT5) stands out as one of the most advanced and comprehensive trading platforms for CFDs across forex, stocks, indices, and commodities. JustMarkets offers MT5 free to download on all major devices.

| Platform | MetaTrader 5 |

| Assets Available | Forex Commodities Indices Stocks |

| Tools | 80+ indicators 21 timeframes charting tools |

| Algorithmic Trading | Yes (Expert Advisors using MQL5) |

| Economic Calendar | Integrated with live news and events |

| Order Types | Market Pending Stop Trailing Stop |

| Market Depth | Available |

| Device Support | Windows Mac iOS Android |

| Execution Speed | Ultra-fast near-instant |

| Spreads | From 0.0 pips (Raw Spread accounts) |

| Withdrawals | Fast, multiple methods supported¹ |

¹ Withdrawal approval speed depends on the method and account status.

What makes MT5 different from MT4?

MetaTrader 5 builds on MT4 with 21 timeframes, 80+ indicators, algorithmic trading tools, and economic calendars. It’s ideal for traders seeking deeper analytics, more asset classes, and faster execution.

Can I trade on the go using MT5?

Yes, MT5 supports mobile trading for iOS and Android. It includes full access to interactive charts, indicators, and trade orders, so you can manage trades anywhere with real-time functionality.

MetaTrader 4

MetaTrader 4 (MT4) on JustMarkets combines robust trading technology with user-friendly features, ideal for beginners and pros alike. Traders benefit from advanced analysis tools, automated strategies, and reliable execution across forex, commodities, indices, and stocks.

| Platform | MetaTrader 4 |

| Operating Systems | Windows Mac |

| Asset Classes | Forex Commodities Stocks Indices |

| Popular Instruments | EURUSD XAUUSD AAPL S&P500 |

| Technical Indicators | 30+ built-in plus custom indicators |

| Automated Trading | Expert Advisors (EAs) supported |

| Charting Tools | Multiple chart types 9 timeframes |

| Security | 128-bit encryption for secure data exchange |

| Execution Speed | Instant order execution in fractions of a second |

| Spreads | Tight spreads from 0.0 pips |

| Withdrawals | Instant withdrawals with multiple payment options |

What makes MetaTrader 4 a popular platform for traders on JustMarkets?

MetaTrader 4 is known for its ease of use, advanced charting tools, and support for automated trading via Expert Advisors. On JustMarkets, it’s backed by fast execution, tight spreads, and secure data protection, enhancing trading efficiency.

Can I trade multiple asset classes using MT4 on JustMarkets?

Yes, MT4 on JustMarkets allows you to trade CFDs on forex, commodities, stocks, and indices. It supports over 100 currency pairs and a variety of global instruments, making it a versatile solution for portfolio diversification.

JustMarkets Mobile App

The JustMarkets Trading App delivers full-featured mobile trading with powerful tools, real-time order control, advanced charting, and secure account management. Stay connected to the markets, analyze data, and manage trades – right from your pocket.

| Platform | JustMarkets Trading Mobile App |

| Availability | iOS Android Android APK |

| Trading Tools | Create/manage orders in-app execution favorites folder |

| Charting | Advanced charting with 1,000+ indicators |

| Market Analysis | Economic calendar top news real-time insights |

| Account Management | Change settings deposit/withdraw funds live support |

| Multilingual Support | 24/7 in-app live chat |

| Execution Speed | Fast execution within fractions of a second |

| Spreads | Tight and stable spreads from 0.0 pips |

| Security | Secure access and transactions from mobile |

How does the JustMarkets mobile app enhance trading on the go?

The JustMarkets app gives traders access to in-app trading, advanced charting with 1,000+ indicators, and full order lifecycle management. It also includes economic news, a calendar, and account controls, all within a responsive mobile interface.

Can I manage my account directly through the JustMarkets app?

Yes, the app allows full account management. You can change account settings, make deposits and withdrawals via multiple payment methods, and get 24/7 multilingual support through live chat – all without leaving the app.

MT4 and MT5 Mobile Apps

JustMarkets empowers traders with the mobile versions of MT4 and MT5, offering unmatched flexibility, real-time alerts, and full trading functionality. Whether you’re analyzing charts or placing trades, these apps keep you connected to the market – anytime, anywhere.

| Feature | MT4 App | MT5 App |

| Markets Available | Forex CFDs Stocks Indices Commodities Digital assets | Forex CFDs Stocks Indices Commodities Digital assets |

| Time Frames | 9 | 21 |

| Order Types | Buy Limit Sell Limit Buy Stop Sell Stop | + Buy Stop Limit Sell Stop Limit (6 types total) |

| Chart Settings | 6 | 13 |

| History View | By positions | By positions orders, or trades |

| Platform Access | iOS, Android | iOS, Android |

| Push Notifications | Yes | Yes |

| Interface | Simple, intuitive | More advanced, detailed |

| Execution Speed | Fast (JustMarkets optimized) | Fast (JustMarkets optimized) |

| Spreads | From 0.0 pips | From 0.0 pips |

What makes the MT4 and MT5 mobile apps ideal for trading on the move?

Both MT4 and MT5 mobile apps offer full access to markets, fast order execution, and real-time notifications. Their portability, intuitive interface, and customizable charting make them reliable tools for traders who need to act quickly on the go.

Can I receive trading alerts through MT4 and MT5 mobile apps?

Yes, both apps support real-time push notifications. Traders can receive alerts for price levels, trade execution, or market events, helping them stay informed and ready to act without constantly monitoring their screens.

Frequently Asked Questions

What are the main differences between MT4 and MT5 on JustMarkets?

MetaTrader 5 offers more timeframes, technical indicators, and order types compared to MT4. It also includes an integrated economic calendar, deeper analytics, and faster execution—ideal for traders seeking broader asset coverage and more sophisticated strategies.

Is the JustMarkets mobile app as powerful as MT4 or MT5?

Yes. The JustMarkets app supports real-time trading, 1,000+ indicators, and complete account management. While MT4/MT5 focuses on deeper analytics, the JustMarkets app excels in convenience, live chat support, and mobile-first trading functionality.

Our Insights

JustMarkets gives traders flexible, powerful, and secure options across MT4, MT5, and its proprietary app. Whether on desktop or mobile, beginners and pros alike benefit from fast execution, advanced tools, and broad asset access tailored to their preferences.

★★★★★ | Minimum Deposit: $10 Regulated by: FSA, CySEC, FSCA, FSC Crypto: Yes |

Expansive Asset Selection

JustMarkets gives traders access to a broad range of markets, including forex, commodities, stocks, indices, ETFs, and cryptocurrencies. This diversity allows for robust portfolio building and strategic trading opportunities across both traditional and digital financial instruments.

| Asset Class | Examples |

| Forex | EUR/USD GBP/USD USD/TRY (Majors, Minors, Exotics) |

| Indices | S&P 500 NASDAQ 100 FTSE 100 |

| Stocks | Apple (AAPL) Amazon (AMZN) Tesla (TSLA) |

| Commodities | Gold (XAU/USD) Silver (XAG/USD) Crude Oil (WTI) Natural Gas (XNG/USD) |

| Cryptocurrencies | Bitcoin (BTC) Ethereum (ETH) Altcoins |

| ETFs | Sector- and index-based exchange-traded funds |

Frequently Asked Questions

What forex pairs can I trade on JustMarkets?

Traders can access major, minor, and exotic forex pairs, global stock indices, shares of leading companies, commodities like oil and gold, ETFs, and top cryptocurrencies. This wide selection supports portfolio diversification and market flexibility.

Does JustMarkets offer cryptocurrency trading?

Yes, JustMarkets enables crypto trading with popular assets like Bitcoin and Ethereum. The platform also supports a growing list of altcoins, offering traders opportunities to engage with both established and emerging digital currencies.

Our Insights

JustMarkets excels in offering a wide spectrum of trading markets, from forex and commodities to digital assets and ETFs. Its inclusive approach makes it ideal for traders who value both variety and strategic flexibility in asset selection.

★★★★★ | Minimum Deposit: $10 Regulated by: FSA, CySEC, FSCA, FSC Crypto: Yes |

Deposit and Withdrawal

JustMarkets streamlines your funding experience with instant, secure deposits and withdrawals. Featuring local and international payment options, zero internal fees, and robust safety protocols, it ensures both convenience and peace of mind for global traders.

| Feature | Details |

| Speed | Instant deposits and withdrawals from JustMarkets’ side¹ |

| Fees | Zero commissions by JustMarkets² |

| Security | PCI DSS certified, OTP for withdrawals, multiple protection layers |

| Account Safety | Segregated client accounts |

| Payment Methods | Local and global options available |

| Deposit Process | Register → Choose method → Click “Deposit” |

| Availability | 24/7 transaction access |

| Customer Protection | No use of third-party or relative payment accounts allowed |

¹ JustMarkets processes deposits and withdrawals instantly on their end (within 1 minute). However, delays may occur depending on the payment provider.

² Some third-party payment systems may charge fees independently of JustMarkets, which are outside the broker’s control.

Frequently Asked Questions

Are there any fees for deposits and withdrawals on JustMarkets?

JustMarkets charges no internal fees for deposits or withdrawals. However, certain external payment providers may apply their charges, which are beyond JustMarkets’ control and are disclosed when applicable.

How does JustMarkets secure financial transactions?

All transactions are protected by multi-layered security, including PCI DSS-certified systems, segregated client accounts, and OTP verification for withdrawals. This approach ensures your funds and personal data remain safe throughout every transfer process.

Our Insights

JustMarkets provides a reliable and user-friendly funding process with instant internal processing, strong security, and zero hidden charges. It’s an ideal choice for traders who prioritize both speed and trust in financial transactions.

★★★★★ | Minimum Deposit: $10 Regulated by: FSA, CySEC, FSCA, FSC Crypto: Yes |

Introducing Broker Program

JustMarkets’ Introducing Broker Program offers a high-potential earning model by sharing up to 40% of the broker’s revenue. With strong support, fast payouts, and real-time analytics, it’s a robust platform for long-term affiliate success.

| Feature | Details |

| Revenue Share | Earn up to 40% of broker revenue |

| Commission Model | Based on valid trades by referred clients |

| Payment Frequency | Daily payouts with instant withdrawal options |

| Support Tools | Promo materials, automated rebates, real-time statistics |

| Regulation and Trust | Licensed by FSA, CySEC, FSC, FSCA; operates in 190+ countries |

| Level Advancement | Fast-track level upgrades during the boost period |

| Client Incentives | Tight spreads, leverage up to 1:3000, swap-free accounts, 24/7 support |

| Platforms Available | JustMarkets Trading App, Copytrading App, Trader’s Personal Area |

Frequently Asked Questions

How do I earn as an Introducing Broker with JustMarkets?

You earn by referring clients who trade. Every valid trade made by a referred client contributes to your commission, with daily payouts and instant withdrawals available through various payment systems.

What support does JustMarkets offer its IB partners?

JustMarkets provides extensive promotional tools, detailed real-time statistics, automated rebate systems, and a unique boost period to level up faster—all designed to help partners attract and retain more clients efficiently.

Our Insights

JustMarkets’ IB program is a smart choice for partners seeking flexible, performance-based earnings with daily payouts and strong backend support. The variety of tools and real-time tracking make client management and growth scalable.

★★★★★ | Minimum Deposit: $10 Regulated by: FSA, CySEC, FSCA, FSC Crypto: Yes |

Loyalty Programme – Climb, Earn, Celebrate

The JustMarkets Partner Loyalty Program turns consistent growth into tangible rewards. With no limits on achievement, partners can earn luxurious prizes or cash alternatives by simply scaling their referral activity, all without extra steps.

| Feature | Details |

| Enrollment | Automatic upon becoming a partner |

| Reward Type | Luxury prizes or cash alternatives |

| Milestone Model | Unlimited milestone tiers, progress never stops |

| Tracking and Stats | Real-time updates in the Partner Area |

| Available Prizes | 11 unique luxury prizes to unlock |

| Partner Reach | 190+ countries participating globally |

| Prize Pool | Over $500,000 allocated per partner |

| Ease of Use | No extra setup - just refer and grow |

Frequently Asked Questions

How do I join the JustMarkets Partner Loyalty Program?

Simply register as a JustMarkets partner. You’re automatically enrolled in the loyalty program, where your referral activity and milestones are tracked to reward you with exclusive prizes or cash rewards.

What kind of rewards can I expect from the loyalty program?

As you grow your network and hit new milestones, you can unlock one of eleven luxury prizes or opt for cash equivalents. Rewards scale with performance, and there’s no cap to your growth.

Our Insights

The JustMarkets Partner Loyalty Program offers a simple, automated way to earn luxury rewards while scaling your client base. It’s ideal for growth-focused partners looking to boost performance with meaningful, milestone-based incentives.

★★★★★ | Minimum Deposit: $10 Regulated by: FSA, CySEC, FSCA, FSC Crypto: Yes |

Educational Resources and Tools

JustMarkets provides a well-rounded suite of educational tools for traders of all levels. With in-depth articles, glossaries, and advanced video tutorials, it combines theory and practice to help users strengthen their trading knowledge and confidence.

Frequently Asked Questions

What types of educational materials does JustMarkets provide?

JustMarkets delivers diverse educational content, including in-depth forex articles, a detailed trading glossary, and instructional videos on strategy and platform use. These resources support both beginners and seasoned traders in building knowledge and refining their trading techniques.

Are the educational resources on JustMarkets free to access?

Yes, all JustMarkets educational materials are available free of charge. This includes informative articles, comprehensive glossaries, and video tutorials, enabling traders at any level to enhance their knowledge and skills without incurring extra costs.

Our Insights

JustMarkets demonstrates a strong commitment to trader education by offering a wide range of free learning resources. These accessible tools help traders build confidence and competence, supporting their ongoing development and increasing their chances of long-term trading success.

★★★★★ | Minimum Deposit: $10 Regulated by: FSA, CySEC, FSCA, FSC Crypto: Yes |

Customer Support

JustMarkets offers round-the-clock customer support in multiple languages via email, phone, and popular messaging apps. Whether you’re a trader or a partner, their responsive support ensures seamless communication, quick issue resolution, and dependable assistance across global time zones.

| Support Type | Details |

| Availability | 24/7 global customer service |

| Email (Support) | [email protected] |

| Email (Partners) | [email protected] |

| Languages Supported | English Indonesian Malaysian Spanish Portuguese Vietnamese |

| Phone Numbers | +248 4632027 +230 52970330 (carrier charges may apply) |

| Callback Option | Request a callback via website |

| Live Chat | Available on the JustMarkets website |

Frequently Asked Questions

How can I contact JustMarkets for trading support?

You can reach JustMarkets support 24/7 via email, phone, live chat, and messengers like Telegram, WhatsApp, and Viber. They offer multilingual support to ensure effective communication with traders around the world.

Is support available for partners as well?

Yes, partners can directly contact JustMarkets at [email protected]. The team provides assistance on commissions, tools, and marketing strategies to help partners succeed and grow their referral network efficiently.

Our Insights

JustMarkets provides exceptional 24/7 multilingual support across various channels, making it easy for traders and partners to access help anytime. The platform’s responsive service reflects its commitment to global accessibility, client satisfaction, and long-term reliability.

★★★★★ | Minimum Deposit: $10 Regulated by: FSA, CySEC, FSCA, FSC Crypto: Yes |

Insights from Real Traders

⭐⭐⭐⭐

Quick and efficient service from the customer support team, with speedy deposits and, most importantly, rapid withdrawals. Appreciate it, JustMarkets.

Muhammad

⭐⭐⭐⭐⭐

The tight spreads and the 50% bonus on deposits are quite appealing, especially for those just starting. Additionally, the $30 no-deposit bonus provides a solid foundation for beginners.

Junaid

⭐⭐⭐⭐

Big thank you to Rose, who was incredibly quick in resolving my issue. Within minutes, my problem was sorted out without any hassle. It’s refreshing to have such responsive and efficient customer service in the trading industry!

Anon

Customer Reviews and Trust Scores

| Platform | Rating (5) | Highlights | Concerns |

| Trustpilot | 4.8 | High customer satisfaction, fast withdrawals, responsive support | Minor issues reported by a small percentage of users |

| Investing.com | 4.7 | Competitive spreads, user-friendly platform | Occasional delays in withdrawal processing |

| Forex Peace Army | 2.8 | Offers a range of trading instruments | Concerns about withdrawal processes and support responsiveness |

★★★★★ | Minimum Deposit: $10 Regulated by: FSA, CySEC, FSCA, FSC Crypto: Yes |

JustMarkets vs HFM vs XM – a Comparison

Pros and Cons

| Pros | Cons |

| MAM accounts | US clients not accepted |

| Excellent Education | High Spreads |

| Low Minimum Deposit | Limited Regulation |

| High Leverage | Limited Investor Protection Schemes |

In Conclusion

JustMarkets is a well-regulated broker licensed by CySEC, FSCA, and FSA. It ensures trader security through strict regulatory compliance, negative balance protection, and secure data handling, making it a trustworthy choice for safety-conscious investors.

You might also like:

Faq

JustMarkets may not be available in certain countries due to regional regulations. To avoid any issues, it’s recommended to check the broker’s availability in your country before attempting to register or open an account.

Yes, JustMarkets is regulated by CySEC, ensuring it complies with strict financial standards applicable to all brokers operating within the European Union. This regulation adds credibility and enhances trader protection across EU member countries.

JustMarkets does not charge any withdrawal fees itself, but your selected payment provider might apply a fee. Always review the specific terms and conditions of your payment method to understand any potential external charges before withdrawing funds.

JustMarkets provides strong technical safeguards to minimize risks like system failures. As with any online platform, traders should take personal measures, such as using strong passwords and enabling two-factor authentication, to ensure their account security remains protected.

- Overview

- Safety and Security

- Worldwide Trading with JustMarkets

- Choose Your Live Account, Know Your Deposit

- Islamic, Swap-Free Trading Account

- Demo Account

- How to Open a JustMarkets Account

- Fees, Spreads, and Commissions

- How Does JustMarkets Stack Up?

- Trading Platforms and Tools

- Expansive Asset Selection

- Deposit and Withdrawal

- Introducing Broker Program

- Loyalty Programme - Climb, Earn, Celebrate

- Educational Resources and Tools

- Customer Support

- Insights from Real Traders

- JustMarkets vs HFM vs XM - a Comparison

- Pros and Cons

- In Conclusion