- Home /

- Forex Brokers /

- FxPro

FxPro Review

- Overview

- What Makes FxPro Stand Out from Other Brokers?

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How To Open an Account

- Trading Platforms and Software

- Safety and Security

- Which Markets Can You Trade?

- Leverage and Margin

- Deposit and Withdrawal

- Educational Resources

- Customer Support

- FxPro vs AvaTrade vs HFM - A Comparison

- Insights from Real Traders

- Customer Reviews and Trust Scores

- Employee Insights

- Pros and Cons

- In Conclusion

FxPro is a trustworthy and highly regulated Forex Broker that is very well-known for its competitive spreads and innovative trading tools. The Broker offers access to a beginner-friendly Demo Account and has a trust score of 94 out of 99.

★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, ASIC Crypto: Yes |

Overview

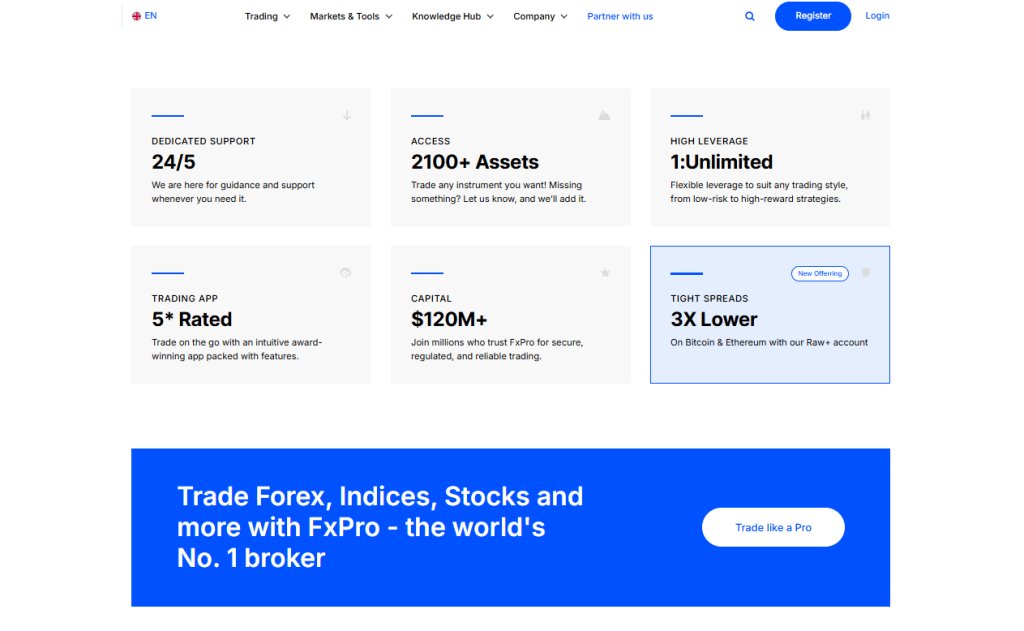

Viewed by many as a world-class brokerage, FxPro combines advanced technology with global accessibility. With 11 M+ client accounts in 173 countries, a $120 M+ capital base, and 125+ awards, it’s clear FxPro has built a solid reputation in the online trading industry since 1999.

Frequently Asked Questions

How many assets can I trade with FxPro?

FxPro gives traders access to over 2,100 assets, including Forex, shares, indices, metals, and more. Whether you’re trading major currency pairs or niche ETFs, the platform is designed to support a wide range of instruments across global markets.

Is FxPro a safe and regulated broker?

Yes. FxPro operates under five top-tier financial regulators, including the FCA in the UK. With $ 120 M+ in capital and 11 M+ client accounts since 1999, FxPro provides a secure and trustworthy environment for traders globally.

Our Insights

FxPro combines global credibility with an impressive range of assets and tight spreads. It’s an excellent choice for both novice and experienced traders seeking flexibility, security, and premium execution.

★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, ASIC Crypto: Yes |

What Makes FxPro Stand Out from Other Brokers?

FxPro distinguishes itself with a combination of robust regulation, a wide range of trading platforms, and over 2,100 assets to trade. With its customer-first approach, strong global presence, and advanced trading tools, it provides a comprehensive, secure trading environment for all types of traders.

| Feature | Details | Benefit | Rating |

| Platforms | MetaTrader 4 MetaTrader 5 cTrader | Multiple platforms for all trading styles | ⭐⭐⭐⭐⭐ |

| Leverage | Up to 1:500 | High leverage for flexible strategies | ⭐⭐⭐⭐⭐ |

| Regulation | 🇬🇧 FCA 🇨🇾 CySEC 🇧🇸 SCB 🇿🇦 FSCA 🇦🇪 DFSA | Trusted global regulation | ⭐⭐⭐⭐⭐ |

| Asset Range | 2,100+ instruments | Diverse market access | ⭐⭐⭐⭐⭐ |

Frequently Asked Questions

What platforms does FxPro offer for trading?

FxPro supports a variety of trading platforms, including MetaTrader 4, MetaTrader 5, and cTrader. Each platform is designed to cater to different trading preferences, with features such as advanced charting tools, real-time data, and efficient order execution.

Does FxPro offer flexible leverage options?

Yes, FxPro offers flexible leverage, with ratios ranging from 1:1 up to 1:500, allowing traders to choose leverage according to their risk tolerance and strategy. This flexibility suits both conservative and high-risk traders.

Our Insights

FxPro excels by offering multiple platforms, a wide asset range, and strong regulatory oversight. Its flexibility, transparency, and focus on customer service make it a standout choice for traders seeking reliability and support.

★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, ASIC Crypto: Yes |

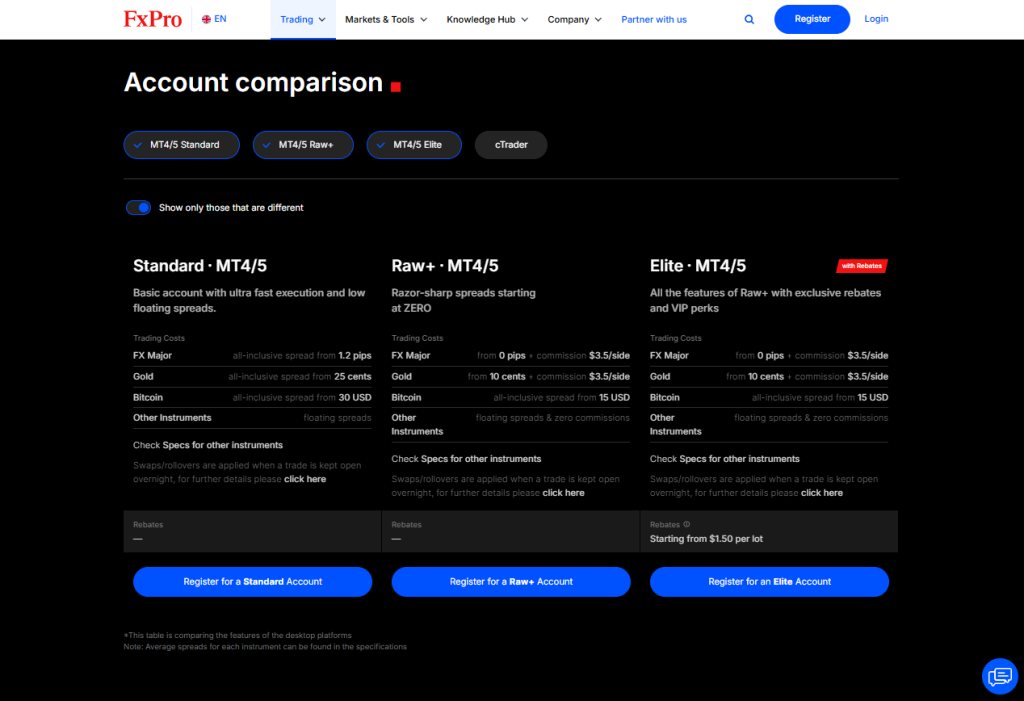

Fees, Spreads, and Commissions

FxPro offers traders a choice between all-inclusive spreads or raw pricing with commissions. From 0 pip spreads on Raw+ and Elite accounts to a 1.2 pip all-inclusive spread on the Standard account, trading costs vary based on your preference for pricing structure and execution style.

| Account Type | FX Majors | Gold | Bitcoin |

| Standard | 1.2 pips (all-in) | $0.25 (all-in) | $30 (all-in) |

| Raw+ | 0 pips + $3.5/side | $0.10 + $3.5/side | $15 (all-in) |

| Elite | 0 pips + $3.5/side | $0.10 + $3.5/side | $15 (all-in) |

Frequently Asked Questions

What’s the difference between all-inclusive spreads and raw spreads with commission?

All-inclusive spreads roll execution and broker fees into one price, like the Standard account. Raw spreads, like those on Raw+ or Elite, start from 0 pips but add a fixed commission – ideal for tighter cost control during high-volume trades.

Are there any hidden charges, such as swap or overnight fees?

FxPro applies standard swaps or rollover charges for positions held overnight. These are not hidden but are based on instrument type and position duration. Full details are transparently available within each instrument’s specification panel on the platform.

Our Insights

FxPro’s flexible fee model caters to both cost-conscious and traditional traders. With ultra-tight spreads from 0 pips and fair commission structures, it supports low-cost trading while maintaining execution quality.

★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, ASIC Crypto: Yes |

Minimum Deposit and Account Types

FxPro offers three main account types, Standard, Raw+, and Elite, each designed with different pricing structures and commission models. Traders can select based on preferred spread type, commission style, and trading volume.

| Account Type | Spread Type | Commission | Rebates |

| Standard | All-inclusive (from 1.2 pips) | None | n/a |

| Raw+ | Raw (from 0.0 pips) | $3.5 per side | n/a |

| Elite | Raw (from 0.0 pips) | $3.5 per side | From $1.50/lot |

Frequently Asked Questions

What’s the difference between FxPro’s Standard and Raw+ accounts?

The Standard account features all-inclusive spreads starting from 1.2 pips, making it ideal for simplicity. Raw+ offers ultra-low spreads starting from 0.0 pips with a $3.5 commission per side, better suited for active or algorithmic traders.

Who qualifies for the FxPro Elite account?

The Elite account is tailored for high-volume traders. It offers all the benefits of Raw+ along with rebates starting at $1.50 per lot, plus additional VIP features. It requires a higher trading volume to qualify.

Our Insights

FxPro’s tiered account structure gives traders real control over their cost preferences. From zero-spread models to rebate-rich VIP setups, there’s an account that aligns with every trading budget and goal.

★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, ASIC Crypto: Yes |

How To Open an Account

To register an account with FxPro, follow these steps:

1. Step 1: Start the Registration Process.

Begin the process by going to the FxPro website and browsing the registration page. After submitting the initial form, check your email for a confirmation PIN.

2. Step 2: Complete The Questionnaire.

You will next be prompted to complete a questionnaire about your financial knowledge and trading experience. Choose your favorite trading platform from the alternatives available.

3. Step 3: Meet regulatory requirements

To meet regulatory requirements, submit a clear copy of your government-issued ID or passport. You will get confirmation from FxPro after your papers have been successfully verified and your account approved.

Finally, after your account has been funded, you may begin trading by accessing FxPro’s wide variety of financial products via your preferred platform.

★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, ASIC Crypto: Yes |

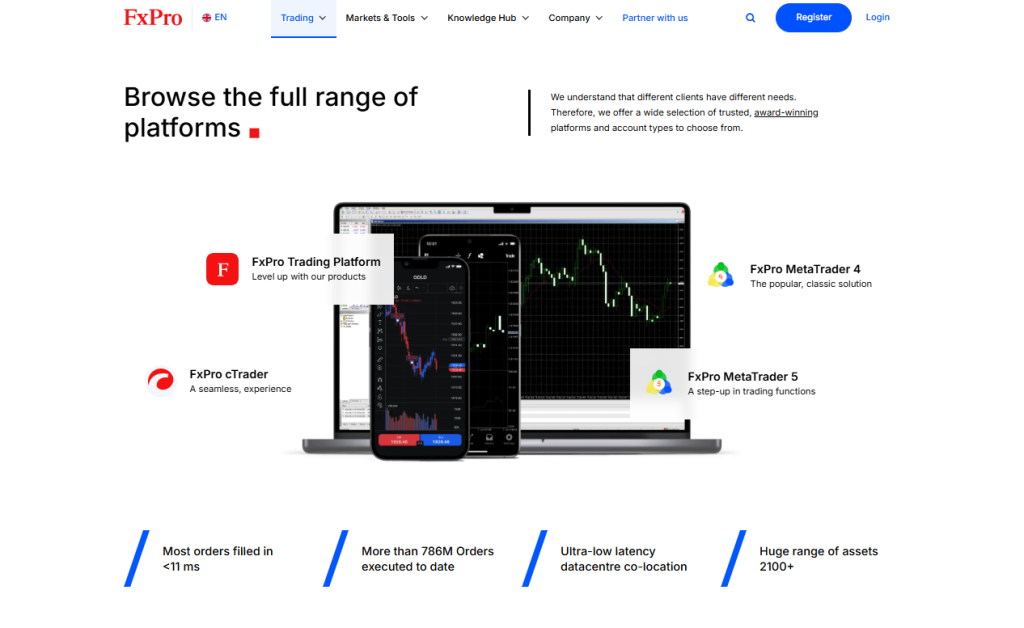

Trading Platforms and Software

FxPro offers four professional-grade platforms – MetaTrader 4, MetaTrader 5, cTrader, and the FxPro Trading Platform. Each platform comes with distinct features tailored to different experience levels, trading strategies, and automation preferences.

| Feature | MT4 | MT5 | cTrader | FxPro Platform |

| EA Trading | Yes | Yes | Yes | Yes |

| Chart Types | 3 | 3 | 4+ | 6+ |

| Indicators | 30+ | 35+ | 55+ | 50+ |

| Timeframes | 9 | 21 | 26+ | 15 |

| Trailing Stop | Yes | Yes | Advanced | N/A |

| Integrated Economic Calendar | Yes | Yes | Yes | Yes |

| Coding Language | MQL4 | MQL5 | C# | N/A |

| Trading Central Integration | Plug-in | Plug-in | Chart targets | None |

Frequently Asked Questions

Which FxPro platform is best for automated trading?

All platforms support automated trading, but MetaTrader 4 and 5 are ideal for Expert Advisors (EAs), while cTrader stands out with advanced coding options in C#. Choose based on your preferred scripting language and technical needs.

Does FxPro’s platform offer advanced charting tools?

Yes. Each platform includes a variety of chart types, indicators, and timeframes. cTrader leads with 55+ indicators and over 26 timeframes, including tick and range charts, making it a top choice for advanced chartists.

Our Insights

FxPro provides powerful and flexible platforms for traders at every level. Whether you value simplicity (MT4), advanced analysis (MT5), or professional execution tools (cTrader), there’s a tailored solution for your strategy and workflow.

★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, ASIC Crypto: Yes |

Safety and Security

FxPro operates under a multi-jurisdictional regulatory framework with licenses from respected authorities like the FCA, FSCA, SCB, and FSA. This layered oversight, combined with strong fund protection practices, ensures client assets remain safe, segregated, and governed by internationally recognized financial standards.

| Regulatory Body | Entity Name | License/Reg No. | Region |

| 🇬🇧 FCA | FxPro UK Limited | 509956 | United Kingdom |

| 🇿🇦 FSCA | FxPro Financial Services Limited | 45052 | South Africa |

| 🇧🇸 SCB | FxPro Global Markets Limited | SIA-F184 | The Bahamas |

| sc FSA | Invemonde Trading Ltd + FxPro GM | SD120 | Seychelles |

Frequently Asked Questions

How does FxPro protect client funds?

FxPro keeps client funds in top-tier banks such as Barclays and Julius Baer, fully segregated from company funds. It enforces strict internal controls, supports negative balance protection, and only operates in jurisdictions where client fund separation is legally protected.

Which regulatory bodies oversee FxPro’s operations?

FxPro is regulated by multiple authorities: the UK’s FCA, South Africa’s FSCA, the Bahamas’ SCB, and the Seychelles FSA. Each license enhances the broker’s credibility and enforces compliance with financial safety, transparency, and dispute resolution protocols.

Our Insights

FxPro offers one of the most comprehensive regulatory frameworks in the online trading industry. From multi-regional licensing to independent fund auditing and investor protection schemes, it delivers a high level of security and trust for both new and experienced traders.

★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, ASIC Crypto: Yes |

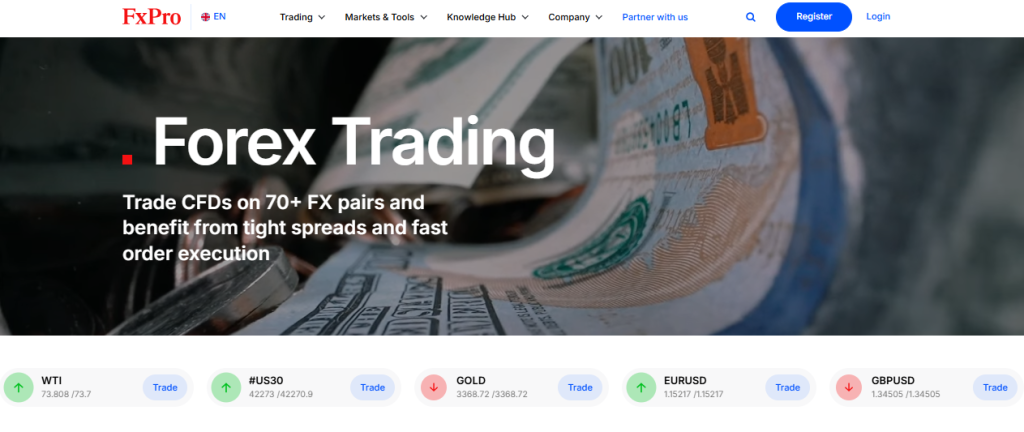

Which Markets Can You Trade?

FxPro gives traders access to an extensive and diverse portfolio of markets. From major forex pairs and global indices to stock CFDs, cryptocurrencies, metals, and energy, the broker supports over 2,000 trading instruments across multiple asset classes – all from one unified platform.

| Market Type | Number of Instruments | Includes | Notes |

| Forex | 70+ | Majors Minors Exotics | Available to all clients |

| Stocks (CFDs) | 2,000+ | Global companies sectors | MT5 required for full access |

| Futures | 24 | Various contracts | Includes indices and commodities |

| Spot Indices | 19 | US30 UK100 GER40 | High global market exposure |

| Precious Metals | 7 | Gold Silver Platinum | Spot and futures available |

| Spot Energy | 3 | Brent WTI Natural Gas | Volatility-based strategies supported |

| Cryptocurrencies | 18+ | BTC ETH XRP LTC | Not for FxPro UK Ltd retail clients |

Frequently Asked Questions

What types of markets can I trade on FxPro?

FxPro offers access to 70+ forex pairs, 24 futures, 19 global indices, 2,000+ stock CFDs, precious metals, energy commodities, and cryptocurrencies. This range supports broad trading strategies from currency speculation to equity and commodity investing.

Are cryptocurrencies available to all FxPro clients?

Cryptocurrency trading is available on FxPro, offering access to 18+ crypto instruments. However, this feature is not available to retail clients of FxPro UK Ltd due to regulatory restrictions. Professional clients may still access crypto assets based on their classification.

Our Insights

FxPro delivers exceptional market variety for retail and professional traders alike. Whether you prefer trading currencies, stocks, indices, or commodities, you’ll find a rich set of instruments available, with competitive conditions and a single account structure across all markets.

★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, ASIC Crypto: Yes |

Leverage and Margin

FxPro offers flexible leverage up to 1:200 for retail traders, enabling greater exposure with less upfront capital. Qualified professional clients may access even higher ratios. While leverage can magnify profits, it also increases risk, making margin management and risk awareness essential.

| Client Type | Max Leverage | Example Margin (EUR/USD, 1 lot) | Notes |

| Retail Trader | Up to 1:200 | $500 | Applies to major forex pairs |

| Professional Client | Higher on request | Varies by instrument | Eligibility criteria must be met |

| Commodities & Indices | Typically lower | Depends on asset | Leverage varies per asset class |

| Crypto (if eligible) | Variable | Higher margin requirements | Not available to all retail clients |

Frequently Asked Questions

What is the maximum leverage available at FxPro?

Retail clients at FxPro can access up to 1:200 leverage on major forex pairs. Higher leverage may be available for professional clients who meet regulatory criteria. Leverage levels vary by instrument and account classification.

How is margin calculated on leveraged trades?

Margin is calculated by dividing the trade size by the leverage ratio. For example, to open a 1 lot EUR/USD trade with 1:200 leverage, a trader needs $500 in margin if the exchange rate is approximately 1.13798.

Our Insights

FxPro’s leverage model offers traders powerful exposure with limited capital requirements. While the ability to magnify returns is attractive, the associated risks require strong risk management strategies, especially for retail traders using high leverage.

★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, ASIC Crypto: Yes |

Deposit and Withdrawal

FxPro supports a wide range of deposit and withdrawal methods, including bank wire transfers, credit/debit cards, and popular e-wallets. Designed for simplicity and speed, the platform ensures secure and timely transactions, with most deposits processed within one business day.

| Method | Type | Deposit Time | Withdrawal Time |

| Bank Transfer | Traditional | Within 1 business day | 1–3 business days |

| Credit/Debit Card | Instant | Instant or near-instant | 1–2 business days |

| E-Wallets | Digital | Instant or near-instant | Varies by provider |

| FxPro Direct | Account Portal | Centralized access | Manages all transactions |

Frequently Asked Questions

What deposit and withdrawal methods does FxPro support?

FxPro accepts bank wire transfers, credit/debit cards, and various e-wallets. All transactions are managed through the FxPro Direct portal, where users can follow step-by-step instructions for fast and secure fund transfers.

How long does it take to process deposits and withdrawals?

Deposits are typically processed within one working day. Withdrawals may vary depending on the payment method, but are designed to be flexible and efficient, returning funds to your original payment channel when possible.

Our Insights

FxPro offers a seamless deposit and withdrawal experience. With fast processing times, global payment options, and easy-to-follow procedures, managing your funds is simple and secure, whether you’re using a bank, card, or e-wallet.

★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, ASIC Crypto: Yes |

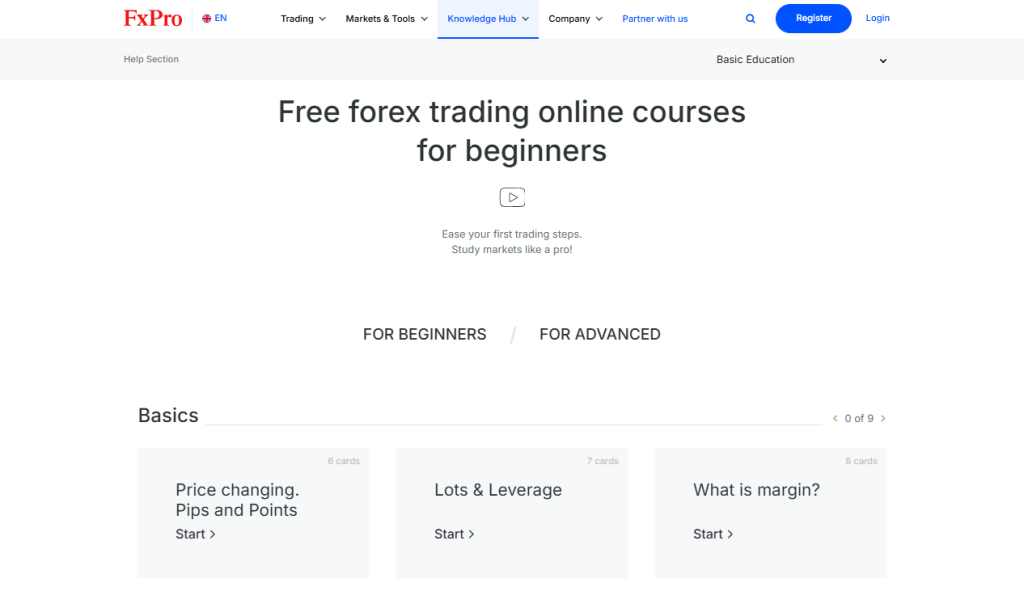

Educational Resources

FxPro supports trader development through a well-rounded educational offering. From foundational skills for beginners to advanced technical and psychological insights, the platform features structured courses that help users sharpen their strategies and make smarter, more informed trading decisions.

Frequently Asked Questions

What educational content is available for new traders?

FxPro offers nine interactive online courses tailored for beginners. These lessons help novice traders grasp essential concepts, understand how the markets work, and build confidence before diving into live trading environments.

Does FxPro offer content on trading psychology?

Yes. FxPro includes four dedicated courses on trading psychology. These cover key concepts like the sunk cost fallacy and escalation of commitment, helping traders recognize emotional triggers and avoid common mental pitfalls.

Our Insights

FxPro goes beyond basic trading education with a comprehensive curriculum. Covering fundamentals, technicals, and psychological discipline, the platform equips traders with the knowledge to make better, bias-aware decisions in dynamic market environments.

★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, ASIC Crypto: Yes |

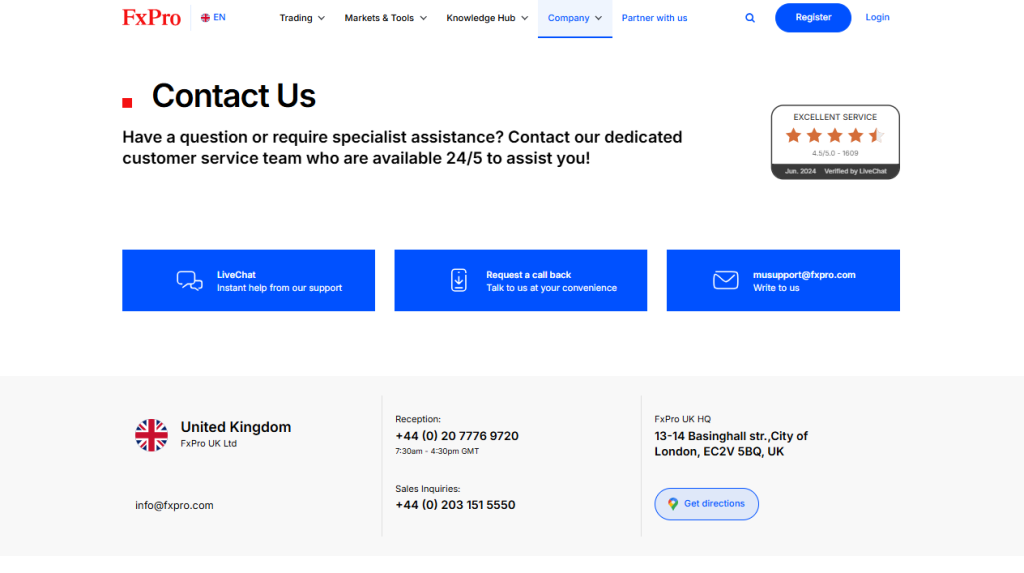

Customer Support

FxPro provides reliable, multilingual customer support 24/5 through live chat, email, and callback services. Whether you need platform help, account assistance, or region-specific guidance, their expert team is available to assist you from offices across the UK, Europe, the Middle East, and the Caribbean.

Frequently Asked Questions

How can I contact FxPro support?

You can reach FxPro via LiveChat for instant support, request a callback through their website, or email them directly. For general inquiries, use [email protected]; UK-based clients can also call the dedicated reception or sales lines.

Where are FxPro’s international offices located?

FxPro operates regional offices in the UK, Monaco, the Bahamas, and the UAE. Each office provides tailored client support and regional assistance, ensuring global accessibility across time zones and languages.

Our Insights

FxPro offers accessible, responsive customer service with multiple communication channels and international support offices. Whether you’re a new trader or a seasoned client, personalized help is never far – via chat, phone, or email, around the globe.

★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, ASIC Crypto: Yes |

FxPro vs AvaTrade vs HFM – A Comparison

★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, ASIC Crypto: Yes |

Insights from Real Traders

⭐⭐⭐⭐

I’ve been trading with FxPro for over a year now, and the order execution is super quick. MetaTrader 4 runs smoothly, and I’ve never had an issue with withdrawals. Highly recommend for forex traders!

Grace

⭐⭐⭐⭐⭐

The support team at FxPro is amazing, friendly, fast, and helpful. I had a few questions when setting up my account, and they walked me through everything. Top-notch service!

Michael

⭐⭐⭐⭐⭐

FxPro gives me access to all the markets I need: forex, indices, stocks, and crypto. I love being able to trade everything from one account. The platform tools are professional and reliable.

Peter

Customer Reviews and Trust Scores

FxPro is generally well-regarded for its trading platform quality, wide asset selection, transaction speed, and secure fund handling. Some users mention issues like delayed responses from support and a lack of clarity around certain fees.

| Source | Rating | Key Observations |

| Trustpilot | 4.0 | 52% 5★ 16% 1★ praised for platforms tools regulation segregated funds some complaints on inactivity fees |

| Sitejabber | 3.4 | 70.9% positive highlights demo platforms occasional withdrawal reliability issues |

| Independent sites | Mixed | Strengths: fast deposits/withdrawals platform variety Weaknesses: occasional lag during volatility, support delays, fee clarity |

Employee Insights

Employees report FxPro as a supportive and benefit-rich workplace with a professional and growth-oriented culture. Challenges include logistical inconveniences, management variations across departments, and pressure from rotating shifts or corporate changes.

| Platform | Overall Rating (5) | Pros | Cons |

| Glassdoor | 4.4 | Strong work-life balance, supportive colleagues, excellent benefits (13th salary, gym, lunches), high CEO approval | Office location may be inconvenient; occasional job cuts; mixed experiences with management |

| Glassdoor – Customer Support | 5 | Supportive training, collaborative teams, strong career growth, great cafeteria and gym perks | Limited parking and shift hours can be exhausting |

| Glassdoor – Software Engineering | Mixed | Competitive pay and benefits package | Some teams report poor leadership, high turnover, and occasional toxic work culture |

Pros and Cons

| ✓ Pros | ✕ Cons |

| MetaTrader 4 and 5 | Basic FXPro App |

| cTrader accounts | Commissions on cTrader accounts |

| Wide Range of Trading Instruments | Withdrawal Processing Times |

| Diverse Educational Resources | Limited Advanced Content |

| Multiple Platform Options | Spread Variability |

| Flexible Leverage | Potential for Higher Risk with Leverage |

| No Deposit or Withdrawal Fees | Complexity for New Traders |

You might also like:

References:

In Conclusion

FxPro caters to a wide range of traders, providing diverse trading opportunities thanks to its extensive selection of financial products. FxPro offers local offices and regional customer support in several countries, ensuring a strong global presence and accessible assistance for traders worldwide.

- 🇬🇧 United Kingdom

- 🇨🇾 Cyprus

- 🇲🇨 Monaco

- 🇧🇸 Bahamas

- 🇦🇪 United Arab Emirates

This global footprint not only reinforces FxPro’s credibility but also ensures clients receive timely, localised support, no matter where they trade from.

Faq

At FxPro, withdrawal requests are handled in a single business day; however, the withdrawal method may affect how long it takes for funds to post to your account.

Spreads are competitive, particularly on cTrader accounts, where raw spreads begin at 0 pip. On the other hand, these accounts may have greater commission costs than those of certain rivals.

With a $100 minimum deposit required to begin trading, FxPro provides most traders with an affordable starting point.

Yes, FxPro provides a free trial account with virtual funds to practice trading and become acquainted with their platforms before depositing real money.

No, FxPro does not accept Mobile Money as a payment method. The broker offers various deposit and withdrawal options, including credit/debit cards, PayPal, Skrill, and Neteller.

- Overview

- What Makes FxPro Stand Out from Other Brokers?

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How To Open an Account

- Trading Platforms and Software

- Safety and Security

- Which Markets Can You Trade?

- Leverage and Margin

- Deposit and Withdrawal

- Educational Resources

- Customer Support

- FxPro vs AvaTrade vs HFM - A Comparison

- Insights from Real Traders

- Customer Reviews and Trust Scores

- Employee Insights

- Pros and Cons

- In Conclusion