10 Best Islamic (Swap-Free) Forex Accounts

Last Update: June 26th, 2024

The 10 Best Islamic (Swap-Free) Forex Accounts revealed. Forex trading has seen the development of Muslim Forex accounts, also known as Swap-Free accounts, to promote inclusivity and respect for diverse religious beliefs.

In this in-depth guide, you’ll learn:

- What are Islamic Forex Accounts?

- The 10 Top Islamic (Swap-Free) Currency Market Accounts.

- Importance of Swap-Free Accounts for Muslim Forex Traders.

- Conclusion on The 10 Best Islamic (Swap-Free) Forex Accounts.

- FAQs about The 10 Best Muslim (Swap-Free) Forex Accounts.

And lots more…

So, if you’re ready to go “all in” with The 10 Best Islamic (Swap-Free) Forex Accounts…

Let’s dive right in…

🏆 10 Best Forex Brokers

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA | USD 100 | Visit Broker >> |

| 🥈 |  | Read Review | FMA, FSA | USD 50 | Visit Broker >> |

| 🥉 |  | Read Review | FSCA, CySEC, DFSA, FSA, CMA | USD 0 | Visit Broker >> |

| 4 |  | Read Review | ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB | USD 200 | Visit Broker >> |

| 5 |  | Read Review | FCA, CySEC, FSCA, SCB | USD 100 | Visit Broker >> |

| 6 |  | Read Review | CySEC, MISA, FSCA | USD 25 | Visit Broker >> |

| 7 |  | Read Review | CySEC, FCA, FSA, FSCA, Labuan FSA | USD 100 | Visit Broker >> |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker >> |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker >> |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker >> |

10 Best Islamic (Swap-Free) Forex Accounts (2024*)

- ☑️ HFM – Top, reliable, and accessible choice.

- ☑️ XTB – Free from interest-based charges.

- ☑️ Exness – compliant with Islamic finance principles.

- ☑️ Octa – Sharia-compliant, allowing halal trading.

- ☑️ eToro – No interest-based overnight fees.

- ☑️ Tickmill – Muslim trading on 2 trading account levels.

- ☑️ AvaTrade – Muslim clients can enjoy Islamic accounts.

- ☑️ XM– Micro-, Standard-, Ultra Low- and Shares accounts.

- ☑️ Admirals – halal trading, swap-free accounts.

- ☑️ FxPro – swap-free accounts for religious purposes.

What Are Islamic Forex Accounts?

Islamic Forex accounts offer a unique blend of financial innovation and adherence to religious principles, catering to the ethical trading needs of the Muslim community.

These accounts bridge the gap between modern financial practices and religious beliefs by eliminating interest (Riba) and adhering to Sharia law’s ethical standards.

They promote transparency and fairness in transactions, reflecting the Forex market’s shift towards inclusivity while preserving its dynamic and competitive nature on a global scale.

The 10 Best Islamic (Swap-Free) Forex Accounts

| 👥 Platform | 👉 Open Account | ☪️ Islamic Account | 💻Account Types Eligible for Islamic | 💵 Minimum Commission per Trade |

| HFM | 👉 https://www.fxleaders.com/hfm | ✔️Yes | Premium, Zero, Pro, Pro Plus | From $6 per round turn on Forex |

| XTB | 👉 Open Account | ✔️Yes | Swap-Free | None on Forex, Stocks, ETFs, Crypto |

| Exness | 👉 Open Account | ✔️Yes | Swap-Free | From $0.1 per side, per lot |

| Octa | 👉 Open Account | ✔️Yes | All | None |

| eToro | 👉 Open Account | ✔️Yes | Live Trading Account | None on Forex, Stocks, ETFs, Crypto |

| Tickmill | 👉 Open Account | ✔️Yes | All | $1 per side, per standard lot traded |

| AvaTrade | 👉 Open Account | ✔️Yes | Retail Account, Professional Account | None; only the spread is charged |

| XM | 👉 Open Account | ✔️Yes | All | From $1 per share |

| Admirals | 👉 Open Account | ✔️Yes | Trade.MT5 | $0.02 |

| FxPro | 👉 Open Account | ✔️Yes | All | $7 Round turn on Forex |

HFM

Overview and Compliance with Sharia Law

HFM provides an Islamic Forex account tailored to the interests of Muslim traders by complying with Sharia Law, which bans the accrual of interest.

This account is swap-free, which means it does not produce or collect interest on transactions that remain open overnight, per Islamic financial standards.

The Islamic Account at HFM is part of their commitment to cater to customers of all origins and beliefs, guaranteeing that their trading activities do not violate religious constraints. HFM’s Islamic Account is ideal for traders who want to trade Forex while adhering to Sharia Law.

Islamic Account and General Features

The HFM Islamic Account is designed to omit the element of interest (Riba) required for conformity with Islamic rules. It replaces traditional swap fees with a commission-based structure, enabling traders to participate in markets without earning or paying interest on overnight trades.

This account has attractive spreads beginning at 0.0 pips and a minimal fee per transaction of $3 to $4, depending on the real account converted. The Islamic Account provides a wide range of tradable assets, including Forex, precious metals, energy, and others, guaranteeing Muslim traders access to a diverse market without jeopardizing their religious beliefs.

Regulation and Security

HFM has built a reputation as a dependable and safe Forex broker. It is regulated by several bodies, including the FSCA, CySEC, DFSA, FSA, FCA, and CMA, demonstrating a dedication to maintaining the highest levels of regulatory compliance. This multi-tier regulation guarantees that traders utilizing the Islamic Account have access to a secure trading environment.

HFM’s adherence to these regulatory frameworks demonstrates its commitment to providing safe, transparent, and ethical trading circumstances that meet the standards of Islamic traders and the larger trading community.

Unique Features

| 🔎 Feature | 👁️🗨️ Information |

| 🏛️ Regulation | FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA |

| 💻 Demo Account | Yes |

| 🖥️Non-expiring Demo | Yes |

| 📱 Demo Duration | Unlimited |

| 🛍️ Retail Investor Accounts | 5 |

| ⬆️ Starting spread on NASDAQ | 1.3 pips |

| 📉 Maximum Leverage on NASDAQ | 1:200 |

| 🏴 NASDAQ Long (Buy) Swap | -4.83 pips |

| 📊 NASDAQ Short (Sell) Swap | 1.2 pips |

| 📲 Social Media Platforms | Facebook Telegram YouTube |

| 💵 Minimum Commission per Trade | None on Forex, Stocks, ETFs, Crypto |

| 💻Retail Investor Accounts | Standard, Swap-Free |

| 📊 Trading Platforms | MetaTrader 4 and MetaTrader 5 |

| 💰 Minimum Deposit | 0 USD |

| 📉 Trading Assets | Forex, Precious Metals, Energies, Indices, Shares, Commodities, Cryptocurrencies, Bonds, Stocks DMA, ETFs |

| ➕ Bonuses for traders? | ✔️ Yes |

| 📈Starting spread | From 0.0 pips |

| ☪️ Islamic Account | ✔️ Yes |

| 👉 Open Account | 👉 Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| HFM offers five flexible account types to traders of all experience levels | Islamic Accounts might have lower liquidity |

| HFM’s spreads start from 0.0 pips on the Zero Account | Islamic Accounts do not have access to the full range of instruments |

| HFM is compliant with Sharia law | The Cent Account cannot be converted into an Islamic Account |

| There are additional features that Islamic account holders can benefit from |

XTB

Overview and Compliance with Sharia Law

XTB offers a swap-free account option suited for traders who want to follow Islamic financial principles, notably Sharia Law, which forbids the accumulation of interest or Riba on transactions.

This swap-free account is intended to reduce swap costs on overnight positions, meeting the needs of Muslim traders who want to participate in the Forex market without sacrificing their religious views.

The product illustrates XTB’s commitment to diversity and ethical trading methods by meeting the different demands of its worldwide clientele.

By making its swap-free accounts as transparent as possible, XTB provides the Islamic trading community with a product that adheres to the essential principles of Islamic finance while still offering access to the dynamic world of CFD trading.

Islamic Account and General Features

XTB offers an Islamic account for Muslim traders, offering swap-free trading conditions during certain periods.

The account includes free account setup and maintenance, low-cost deposits and withdrawals, a $1 minimum deposit requirement, and platform availability on mobile, desktop, and tablet devices.

Traders also benefit from a 0% fee on CFD trading, leverage of up to 1:500, reasonable spreads, and a minimum order size of 0.01 lot, catering to a wide range of trading tastes and demands.

Regulation and Security

XTB, a broker with over 18 years of experience and a customer base of over 935,000 investors, is regulated by the UK Financial Conduct Authority (FCA) under FRN 522157 and several other regulations.

With a regulatory compliance and security commitment, XTB ensures a safe trading environment for all traders, including those needing Islamic accounts, through its regulatory monitoring.

Unique features

| 🔎 Feature | 👁️🗨️ Information |

| 🏛️ Regulation | FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA |

| 💻 Demo Account | Yes |

| 🖥️Non-expiring Demo | Yes |

| 📱 Demo Duration | Unlimited |

| 🛍️ Retail Investor Accounts | 5 |

| ⬆️ Starting spread on NASDAQ | 1.3 pips |

| 📉 Maximum Leverage on NASDAQ | 1:200 |

| 🏴 NASDAQ Long (Buy) Swap | -4.83 pips |

| 📊 NASDAQ Short (Sell) Swap | 1.2 pips |

| 📲 Social Media Platforms | Facebook Telegram YouTube |

| 💵 Minimum Commission per Trade | None on Forex, Stocks, ETFs, Crypto |

| 💻Retail Investor Accounts | Standard, Swap-Free |

| 📊 Trading Platforms | MetaTrader 4 and MetaTrader 5 |

| 💰 Minimum Deposit | 0 USD |

| 📉 Trading Assets | Forex, Precious Metals, Energies, Indices, Shares, Commodities, Cryptocurrencies, Bonds, Stocks DMA, ETFs |

| ➕ Bonuses for traders? | ✔️ Yes |

| 📈Starting spread | From 0.0 pips |

| ☪️ Islamic Account | ✔️ Yes |

| 👉 Open Account | 👉 Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| XTB offers a native Swap-Free Account | XTB only offers two retail accounts |

| Islamic Accounts have access to several halal financial instruments | There is a limited selection of instruments available on the Islamic Account |

| XTB offers commission-free trading | Commission fees apply to certain instruments on the Islamic Account |

| There is no set minimum deposit requirement on the Islamic Account |

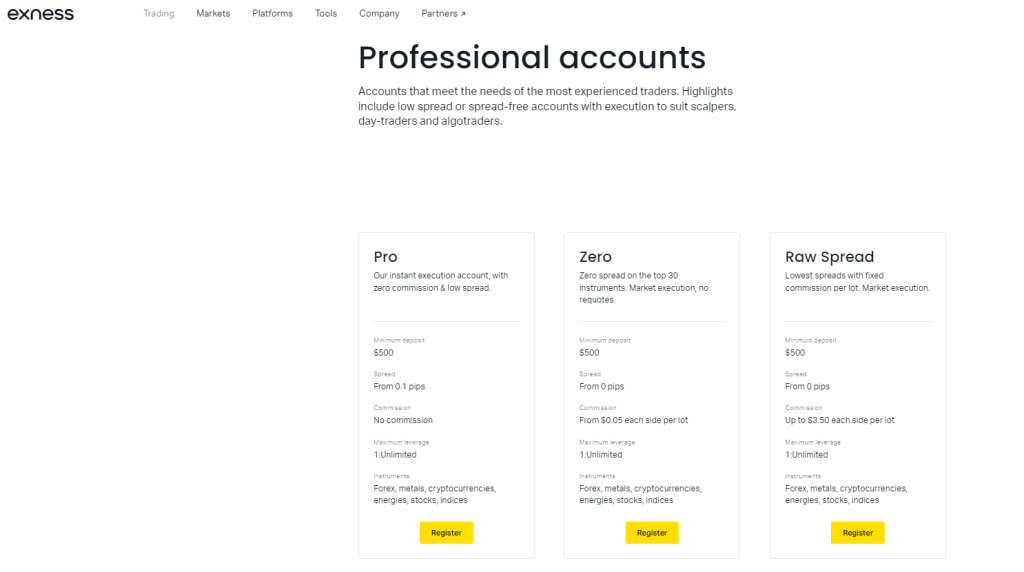

Exness

Overview and Compliance with Sharia Law

Exness offers Islamic forex accounts, or swap-free accounts, to cater to Muslim traders’ needs while adhering to Sharia law. These accounts prevent interest payments, which are forbidden in Islam. Exness automatically provides swap-free accounts to traders from Islamic countries, and traders outside these zones can use a conditional swap-free program.

This strategy demonstrates its commitment to supporting its diverse clientele’s religious views by creating an inclusive trading environment.

Islamic Account and General Features

Exness provides Islamic Forex accounts that align with Islamic financial principles, offering swap-free trading options. They offer both standard and extended swap-free accounts, showcasing greater flexibility.

These accounts grant access to a diverse range of financial products such as Forex, commodities, indices, and cryptocurrencies while adhering to Islamic law’s ethical and religious norms.

This enables Muslim traders to participate in global financial markets without encountering the ethical quandary of interest accumulation.

Regulation and Security

They are a well-respected broker known for following strict regulations and prioritizing safety in trading.

Exness is overseen by trusted financial agencies, ensuring fairness and security. Exness provides a reliable platform for traders worldwide and offers Islamic Forex accounts, assuring Muslim traders about the validity and ethical standards. With strong security measures, Exness protects all traders’ interests, fostering user confidence.

Unique Features

| Feature | Information |

| 🏛️ Regulation | FCA, BaFin CySEC, FINMA, DFSA, FSCA, MAS, JFSA, ASIC, FMA, CFTC, NFA, BMA |

| ☪️ Islamic Account | ✔️ Yes (Dubai customers only) |

| 💻Account Types Eligible for Islamic | Standard Swap-Free, Extended Swap-Free |

| 📲 Social Media Platforms | LinkedIn YouTube |

| 💵 Minimum Commission per Trade | From $0.1 per side, per lot |

| 💻Retail Investor Accounts | Standard, Standard Cent, Raw Spread, Zero, Pro |

| 💻 Trading Accounts | IG Trading Account Limited Risk Account Islamic Account (Dubai traders only) Demo Account |

| 📊 Trading Platforms | MetaTrader 4 IG Platform ProRealTime (PRT) L2 Dealer FIX API |

| 💰 Minimum Deposit | $250 |

| 📉 Trading Assets | Forex Indices Shares Commodities Cryptocurrencies Futures Options |

| 💲 USD-based Account? | ✔️ Yes |

| 💲 USD Deposits Allowed? | ✔️ Yes |

| ➕ Bonuses for traders? | ❌ No |

| 📈 Minimum spread | From 0.0 pips |

| 💻 Demo Account | ✔️ Yes |

| 👉 Open Account | 👉 Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Exness offers two native swap-free accounts to Muslim traders | Exness has a limited product offering |

| Exness’ swap-free accounts have competitive trading conditions | There are strict terms and conditions on the Exness Islamic Accounts |

| Traders can expect low and competitive commission fees | |

| Exness is well-regulated and Sharia-compliant |

Octa

Overview and Compliance with Sharia Law

Octa offers an Islamic forex account for Muslim traders, adhering to Sharia law by preventing interest accumulation and prohibiting Riba.

This account is free from interest rate fees, appealing to traders who align their financial activities with their religious beliefs. Octa’s commitment to offering a Sharia-compliant trading environment demonstrates its understanding of the diverse needs of its global clientele.

Islamic Account and General Features

OctaFX offers an Islamic account that aligns with Islamic principles, ensuring all accounts comply with Islamic standards. The broker prioritizes prohibiting interest rate accumulation, collection, or payment, allowing Muslim traders to engage in forex trading while adhering to their religious beliefs. The account offers a wide range of financial instruments without interest fees, catering to the needs of Muslim traders.

Regulation and Security

Octa offers a secure and transparent trading environment for Muslim traders. The broker ensures high regulatory compliance and security measures, monitoring its Islamic accounts to ensure compliance with financial regulations and Islamic principles.

This provides a secure platform for traders to participate in forex trading without worrying about legitimacy or ethics.

Unique Features

| 🔎 Feature | 👁️🗨️ Information |

| 🏛️ Regulation | Financial Services Authority in Saint Vincent and the Grenadines (SVG FSA), and Cyprus Securities and Exchange Commission (CySEC) |

| ☪️ Islamic Account | ✔️ Yes |

| 💻Account Types Eligible for Islamic | All |

| 📲 Social Media Platforms | LinkedIn You Tube Telegram |

| 💵 Minimum Commission per Trade | None |

| 💻Retail Investor Accounts | OctaTrader Account, MT4 Account, MT5 Account |

| 💻 Trading Accounts | MetaTrader 4 Habitual Trader Account, MetaTrader 5 Smart Trader Account |

| 📊 Trading Platforms | MetaTrader 4, MetaTrader 5, cTrader |

| 💰 Minimum Deposit | $5 |

| 📉 Trading Assets | Forex Currency Pairs, Index ECNs, Commodities, Cryptocurrencies |

| 💲 USD-based Account? | ✔️ Yes |

| 💲 USD Deposits Allowed? | ✔️ Yes |

| ➕ Bonuses for traders? | ✔️ Yes |

| 📈 Minimum spread | From 0.0 pips |

| 💻 Demo Account | ✔️ Yes |

| 👉 Open Account | 👉 Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Octa does not charge any commission fees on trades | Octa does not charge any commission fees on trades |

| The Islamic Account is available on all live trading accounts | The Islamic Account is available on all live trading accounts |

| There is a low minimum deposit requirement |

eToro

Overview and Compliance with Sharia Law

eToro provides special forex accounts for Muslim traders that follow Islamic rules. These accounts do not include interest charges or fees for keeping a position open overnight, which is important because Islamic law forbids earning interest. By doing this, eToro shows its commitment to offering a trading platform that is both inclusive and follows ethical financial principles, ensuring it respects the requirements of Islamic law.

Islamic Account and General Features

One live trading account for retail investors allows live trading with an Islamic account. Initial spreads begin at 0.6 pips, with no required commission per trade. Nevertheless, an Islamic account necessitates a minimum deposit of 1,000 USD. eToro’s commitment to regulatory standards and offering Islamic account options meet the requirements of Muslim traders, providing a safe and ethical trading atmosphere.

Regulation and Security

eToro is a reputable platform for traders, particularly those using Islamic accounts. Its strong regulatory standards and commitment to security make it a reliable choice for global traders.

The platform operates under the supervision of multiple financial authorities, ensuring transparency and fairness. This ensures that investments are handled securely and ethically, creating a safe and welcoming trading environment for all users.

Unique Features

| 🔎 Feature | 👁️🗨️ Information |

| 🏛️ Regulation | CySEC, FCA |

| ☪️ Islamic Account | ✔️ Yes |

| 💻Account Types Eligible for Islamic | Live Trading Account |

| 📲 Social Media Platforms | Facebook Youtube Telegram |

| 💵 Minimum Commission per Trade | None on Forex, Stocks, ETFs, Crypto |

| 💻Retail Investor Accounts | Single Live Trading Account |

| 💻 Trading Accounts | Personal Account Professional Account Corporate Account Islamic Account |

| 📊 Trading Platforms | eToro proprietary platform |

| 💰 Minimum Deposit | $50 |

| 📉 Trading Assets | Stocks. Indices. ETFs. Currencies. Commodities. Crypto assets. |

| 💲 USD-based Account? | ✔️ Yes |

| 💲 USD Deposits Allowed? | ✔️ Yes |

| ➕ Bonuses for traders? | ✔️ Yes |

| 📈 Minimum spread | From 0.9 pips |

| 💻 Demo Account | ✔️ Yes |

| 👉 Open Account | 👉 Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| eToro offers powerful trading platforms on its Islamic Accounts | eToro only has one retail account |

| Traders do not pay commission fees on trades with eToro | There is an expensive minimum deposit required to open an Islamic Account |

| eToro is well-regulated by several agencies worldwide |

Tickmill

Overview and Compliance with Sharia Law

As a broker, they offer a Swap-Free Account designed to adhere to the principles of Sharia law. This account type removes the swap or rollover interest on overnight positions, aligning with Islamic beliefs. Tickmill’s dedication to offering a trading environment that accommodates the religious beliefs of its clients is clear through the availability of these swap-free accounts.

They allow Muslim traders to participate in forex trading while adhering to their religious beliefs by ensuring no interest is involved in these accounts.

Islamic Account and General Features

They offer Islamic account options for all account types – Pro, Classic, and VIP – to meet the needs of retail investors. Tickmill offers competitive trading conditions with starting spreads from 0.0 pips and a minimum commission per trade of $1 per side per standard lot traded. With a minimum deposit of 100 USD, traders at different levels can easily access the platform.

Regulation and Security

Tickmill is a regulated broker that adheres to strict standards to ensure a secure and transparent trading environment for all clients, including those using Islamic accounts.

The broker’s commitment to security and integrity ensures its Islamic forex accounts’ legitimacy and ethical standing, allowing Muslim traders to trade confidently and protect their interests.

Unique Features

| 🔎 Feature | 👁️🗨️ Information |

| 🏛️ Regulation | Seychelles FSA, FCA, CySEC, Labuan FSA, FSCA |

| ☪️ Islamic Account | ✔️ Yes |

| 💻Account Types Eligible for Islamic | All |

| 📲 Social Media Platforms | Facebook Telegram YouTube |

| 💵 Minimum Commission per Trade | $1 per side, per standard lot traded |

| 💻Retail Investor Accounts | Single Live Trading Account |

| 💻 Trading Accounts | Pro Account, Classic Account, VIP Account |

| 📊 Trading Platforms | MetaTrader 4 and MetaTrader 5 |

| 💰 Minimum Deposit in RUB | RUB 465.28 or $5 |

| 📉 Trading Assets | Forex, Stock Indices, Energies, Precious Metals, Bonds, Cryptocurrencies |

| ➕ Bonuses for traders? | ✔️ Yes |

| 📈 Minimum spread | From 0.0 pips |

| 💻 Demo Account | ✔️ Yes |

| 👉 Open Account | 👉 Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Tickmill’s spreads start from 0.0 pips on major currencies like EUR/USD | Tickmill restricts the financial instruments that Islamic Accounts can trade |

| Muslim traders can convert three retail accounts into an Islamic Account | |

| The commission fees charged are low and competitive |

AvaTrade

Overview and Compliance with Sharia Law

AvaTrade offers an Islamic trading account that aligns with Sharia law, ensuring no interest is charged on overnight positions.

Managed by the broker, this account promotes ethical and fair trading, enabling Muslim traders to participate in financial markets while staying true to their faith.

Islamic Account and General Features

At AvaTrade, Retail and Professional Accounts can access Islamic options, catering to various investors.

Starting spreads for EUR/USD pairs at AvaTrade are as low as 0.9 pips, providing competitive pricing. There is no minimum commission per trade; only the spread is charged, ensuring transparent and straightforward pricing.

Regulation and Security

AvaTrade maintains rigorous standards to ensure trading transparency, security, and fairness. Its dedication to regulation and security creates a dependable and safe trading environment for all clients, including users of Islamic accounts.

Unique Features

| 🔎 Feature | 👁️🗨️ Information |

| 🏛️ Regulation | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA |

| ☪️ Islamic Account | ✔️ Yes (Dubai) |

| 💻Account Types Eligible for Islamic | Retail Account, Professional Account |

| 📲 Social Media Platforms | Instagram You Tube |

| 💵 Minimum Commission per Trade | None; only the spread is charged |

| 💻Retail Investor Accounts | Retail Account |

| 💻 Trading Accounts | Retail Account, Professional Account |

| 📊 Trading Platforms | AvaTradeGO AvaOptions AvaSocial MetaTrader 4 MetaTrader 5 DupliTrade ZuluTrade |

| 💰 Minimum Deposit | $100 |

| 📉 Trading Assets | Forex Stocks Commodities Cryptocurrencies Treasuries Bonds Indices Exchange-Traded Funds (ETFs) Options Contracts for Difference (CFDs) Precious Metals |

| 💲 USD-based Account? | ✔️ Yes |

| 💲 USD Deposits Allowed? | ✔️ Yes |

| ➕ Bonuses for traders? | ✔️ Yes |

| 📈 Minimum spread | From 0.0 pips |

| 💻 Demo Account | ✔️ Yes |

| 👉 Open Account | 👉 Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| AvaTrade caters specifically for Muslim traders by offering halal instruments across markets | There is only one retail account |

| Islamic Account holders can expect commission-free trades | The spreads charged can be extremely wide |

| AvaTrade offers powerful trading platforms |

XM

Overview and Compliance with Sharia Law

XM provides Islamic forex accounts that comply with Sharia law by eliminating swap or rollover interest on overnight positions.

This makes it suitable for Muslim traders who want to trade forex while adhering to religious principles. XM’s commitment to offering Islamic accounts caters to diverse customer needs.

Islamic Account and General Features

They offer a variety of account options for retail investors, such as Micro, Standard, XM Ultra-Low, and Shares accounts. XM offers Islamic options for all account types, providing inclusivity for Muslim traders.

XM provides competitive pricing with starting spreads of 0.7 pips and minimum commissions at $1 per share. In addition, the minimum deposit needed is impressively low at only 5 USD, ensuring that trading is within reach for investors at any level.

Regulation and Security

XM is a well-respected broker known for following strict regulations and ensuring a safe trading environment. It is overseen by various financial authorities, which means it operates transparently, fairly, and securely.

This regulatory oversight strengthens XM’s reputation as a trustworthy platform for traders worldwide, including Muslim traders. They can feel confident in the authenticity and ethical standards of XM’s Islamic forex accounts.

Unique Features

| 🔎 Feature | 👁️🗨️ Information |

| 🏛️ Regulation | FSCA, IFSC, ASIC, CySEC, DFSA |

| ☪️ Islamic Account | ✔️ Yes |

| 💻Account Types Eligible for Islamic | All |

| 📲 Social Media Platforms | LinkedIn YouTube |

| 💵 Minimum Commission per Trade | From $1 per share |

| 💻Retail Investor Accounts | Micro, Standard, XM Ultra-Low, Shares |

| 💻 Trading Accounts | Micro Account, Standard Account, XM Ultra-Low Account, Shares Account |

| 📊 Trading Platforms | MetaTrader 4, MetaTrader 5, XM Mobile App |

| 💰 Minimum Deposit | $5 |

| 📉 Trading Assets | Forex, Cryptocurrencies, Stock CFDs, Commodities, Equity Indices, Precious Metals, Energies, Shares, |

| 💲 USD-based Account? | ✔️ Yes |

| 💲 USD Deposits Allowed? | ✔️ Yes |

| ➕ Bonuses for traders? | ✔️ Yes |

| 📈 Minimum spread | From 0.0 pips |

| 💻 Demo Account | ✔️ Yes |

| 👉 Open Account | 👉 Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| XM is a trusted broker that offers halal trading conditions to Muslim traders | XM’s spreads are not the tightest compared to other brokers |

| There are four flexible account types that can be converted into Islamic Accounts | |

| Traders can expect competitive spreads on major currency pairs | |

| There is a low minimum deposit requirement |

Admirals

Overview and Compliance with Sharia Law

Admirals provides an Islamic forex account compliant with Islamic Sharia law, where interest accumulation is prohibited. This swap-free account enables Muslim traders to engage in Forex and CFD trading while staying true to their religious convictions.

Admirals’ dedication to inclusivity and respect for diverse religious beliefs is evident in their provision of a trading environment devoid of swap or rollover interest on overnight positions.

Islamic Account and General Features

Admirals offers a variety of account options for retail investors, such as Trade.MT4, Zero.MT4, Trade.MT5, Invest.MT5, and Zero.MT5 accounts.

Those interested in Islamic-compliant trading can use the Trade.MT5 account. Admirals provide competitive pricing with starting spreads as low as 0.0 pips and a variable spread structure.

Regulation and Security

Admirals is known for its robust regulatory framework and stringent security measures, including Islamic forex account options. Its regulatory oversight ensures transparency, fairness, and integrity. This ensures that Muslim traders using the Islamic account can operate in a secure, ethically compliant environment. Admirals’ dedication to regulation and security reflects its commitment to providing a reliable trading experience for all clients, including those of the Muslim faith.

Unique Features

| 🔎 Feature | 👁️🗨️ Information |

| 🏛️ Regulation | FCA, ASIC, CySEC, JSC, FSCA, FSA, CMA |

| ☪️ Islamic Account | ✔️ Yes |

| 💻Account Types Eligible for Islamic | Trade.MT5 |

| 💻 Demo Account | Yes |

| 💵 Minimum Commission per Trade | $0.02 |

| 💻Retail Investor Accounts | Trade.MT4, Zero.MT4, Trade.MT5, Invest.MT5, Zero.MT5 |

| 📊 Starting Spread | 0.0 pips, Variable |

| 💸 Minimum Deposit | 1 USD |

| 💰 Deposit Currencies | All |

| 💳 Account Base Currency | AUD, USD, ZAR, EUR, GBP, CHF, BGN, CZK, HRK, HUF, PLN, RON, JOD, AED |

| 💻 Trading Platforms | MetaTrader 4 MetaTrader 5 Admirals Mobile App |

| 👉 Open Account | 👉 Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Admirals is a trusted name in the forex industry | Only the Trade.MT5 account can be converted to an Islamic Account |

| Muslim traders can convert their Trade.MT5 account into an Islamic Account | |

| Admirals ensures fair and halal trading conditions |

FxPro

Overview and Compliance with Sharia Law

FxPro provides Islamic forex accounts, or swap-free accounts, to traders adhering to Sharia law. These accounts remove swap or rollover interest on overnight positions, which is not allowed in Islam. This aligns trading with Islamic financial principles, demonstrating FxPro’s commitment to inclusivity and understanding the diverse needs of its global client base.

Islamic Account and General Features

FxPro provides Islamic account options for all account types – Standard, Pro, Raw+, and ECN – to meet the needs of retail investors. Starting spreads are as tight as 0.0 pips at FxPro, ensuring competitive pricing.

When it comes to Forex trades, there is a minimum commission of $7 per trade round turn, ensuring clear fee structures. Starting with a minimum deposit of 100 USD allows accessibility to a wide range of investors.

Regulation and Security

FxPro is well-known for its strict adherence to regulatory standards and strong security measures, including its Islamic forex account options. The broker is overseen by multiple financial authorities, ensuring that trading is transparent, fair, and conducted with integrity.

This means Muslim traders using the Islamic account can trade confidently in a secure and ethically compliant environment. FxPro’s commitment to regulation and security reflects its dedication to providing a reliable trading experience for all clients.

Unique Features

| 🔎 Feature | 👁️🗨️ Information |

| 🏛️ Regulation | FCA, CySEC, SCB, FSCA, FSC |

| ☪️ Islamic Account | ✔️ Yes |

| 💻Account Types Eligible for Islamic | All |

| 📲 Social Media Platforms | LinkedIn You Tube |

| 💵 Minimum Commission per Trade | $7 Round turn on Forex |

| 💻Retail Investor Accounts | Standard, Pro, Raw+, ECN |

| 💻 Trading Accounts | Standard Account, Pro Account, Raw+ Account, and ECN Account |

| 📊 Trading Platforms | MetaTrader 4 MetaTrader 5 cTrader FxPro App |

| 💰 Minimum Deposit | $100 |

| 📉 Trading Assets | Forex Indices Shares Metals Cryptocurrency CFDs Energies Futures |

| 💲 USD-based Account? | ✔️ Yes |

| 💲 USD Deposits Allowed? | ✔️ Yes |

| ➕ Bonuses for traders? | ✔️ Yes |

| 📈 Minimum spread | N/A |

| 💻 Demo Account | ✔️ Yes |

| 👉 Open Account | 👉 Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| With FxPro, traders can convert all four retail accounts into Islamic options | There might be restrictions on the instruments available to Muslim traders when they use the Islamic Account |

| FxPro charges zero-pip spreads on major forex pairs and other popular instruments | |

| FxPro is Sharia-compliant and offers a range of halal instruments |

What is the Importance of Swap-Free Accounts for Muslim Forex Traders?

Islamic Forex accounts, known as Swap-Free accounts, are crucial for Muslim traders in the global financial markets. These specialized accounts are designed to comply with Islamic Sharia law, which strictly prohibits any form of Riba (interest).

Regarding Forex trading, the traditional swap or rollover interest that traders pay or receive for holding positions overnight contradicts this principle. Islamic Forex accounts remove this barrier, allowing Muslim traders to participate in the Forex market while adhering to their religious principles.

These accounts hold importance beyond just religious observance. They connect the ethical principles of Islam and the ever-changing realm of Forex trading, making global financial markets accessible to a large group of Muslim investors.

This inclusivity promotes a diverse trading atmosphere and creates new opportunities for financial growth and participation previously limited by religious constraints. Furthermore, Swap-Free accounts prioritize transparency and fairness in trading practices. These accounts typically provide a more transparent breakdown of transaction costs, mainly through commissions or wider spreads instead of interest-based charges.

Emphasizing transparency reflects Islamic values and aligns with ethical trading principles, attracting a wider audience seeking fair and clear trading conditions.

Conclusion

When assessing the top Islamic (Swap-Free) Islamic Forex Accounts, we have noticed brokers making a significant effort to align financial trading with Islamic principles, expanding market accessibility. In our experience, these accounts are notable for their ethical approach, eliminating interest-related fees and advocating inclusivity. Nevertheless, the fluctuations in spreads and commission structures as substitutes for swap fees indicate that traders should carefully examine account terms.

Providing a pathway for Muslim traders to access Forex markets while staying true to their religious principles, it is crucial to compare and comprehend the various financial ramifications carefully. Overall, we can conclude that introducing these accounts marks a significant step towards accommodating various financial practices and beliefs in the trading industry.

These accounts adhere to Sharia law by removing interest-based fees on overnight positions.

One can maintain positions without facing swap charges, enhancing profit potential.

No, conditions and fees may differ. Some brokers might provide access to different markets and have specific trading conditions for Islamic Accounts. Furthermore, some brokers charge administrative fees for open positions.

Regulation, minimum deposit, trading platform, commissions, and customer service are all crucial elements to consider.

Yes, Certain brokers will impose different fees or restrictions on various tradable assets.

Certain brokers might require a distinct Islamic account application, whereas some provide it as a choice for current accounts.