CMTrading Review

- Analysis of Brokers' Main Features

- Overview

- Detailed Summary

- Safety and Security

- Account Types

- How To Open an Account

- Trading Platforms and Software

- CMTrading Fees, Spreads, and Commissions

- Which Markets can You trade with CMTrading?

- Leverage and Margin

- Deposit and Withdrawal

- Educational Resources

- Pros and Cons

- Conclusion

Overall, CMTrading can be summarised as a trustworthy and highly regulated Forex Broker that is very competitive regarding its trading fees with access to various tools suitable for novice and advanced traders. The Broker has a trust score of 91 out of 99.

| 🔎 Broker | 🥇 CMTrading |

| 💴 Minimum Deposit | 100 USD |

| 💵 Inactivity Fee | ✅ Yes, $15 after 60 days of inactivity |

| 🥰 Website Languages | English, Spanish, Arabic |

| 💶 Fees and Commissions | Spreads from 0.9 pips, commission-free |

| 🤝 Affiliate Program | ✅Yes |

| 📈 Scalping | ✅Yes |

| 📉 Hedging | ✅Yes |

| 📊 Trading Instruments | Forex, Commodities, Indices, Stocks, Crypto CFDs |

| ⏰ Support Hours | 24/5 |

| 🚀 Open an Account | 👉 Click Here |

Analysis of Brokers’ Main Features

- ☑️ Overview

- ☑️ Detailed Summary

- ☑️ Safety and Security

- ☑️ Account Types

- ☑️ How To Open a CMTrading Account

- ☑️ Trading Platforms and Software

- ☑️ Fees, Spreads, and Commissions

- ☑️ Which Markets can You trade with CMTrading?

- ☑️ Leverage and Margin

- ☑️ Deposit and Withdrawal

- ☑️ Educational Resources

- ☑️ Pros and Cons

- ☑️ Conclusion

- ☑️ Frequently Asked Questions

Overview

Firstly, CMTrading is a leading trading platform for forex, bitcoin, and other financial products. Additionally, the platform is known for its user-friendliness as it has various tools suitable for novice and advanced traders.

Moreover, among the main features of CMTrading is the commitment to providing a full learning package. This includes comprehensive webinars, e-books, and daily market analyses designed to enhance users’ trading intellects and capabilities.

Furthermore, regarding trading conditions, CMTrading is known for its competitive spreads, which are important for traders wanting to save expenses. Lastly, the site also provides a range of account kinds, each targeted to particular trading styles and skill levels.

Detailed Summary

| 🔎 Broker | 🥇 CMTrading |

| 📈 Established Year | 2012 |

| 📉 Regulation and Licenses | FSA, FSCA |

| 5️⃣ Ease of Use Rating | 4/5 |

| 🎁 Bonuses | ✅ Yes, a referral program |

| ⏰ Support Hours | 24/5 |

| 🖱️ Trading Platforms | MetaTrader 4, CMTrading Web, CopyKat |

| 📌 Account Types | Bronze, Silver, Gold, Premium |

| 💴 Base Currencies | USD, EUR, GBP, ZAR |

| 📊 Spreads | From 0.9 pips |

| 💹 Leverage | 1:200 |

| 💵 Currency Pairs | 50; Minor, Major, Exotic |

| 💶 Minimum Deposit | 100 USD |

| 💷 Inactivity Fee | ✅ Yes, $15 after 60 days of inactivity |

| 🥰 Website Languages | English, Spanish, Arabic |

| 💳 Fees and Commissions | Spreads from 0.9 pips, commission-free |

| 🤝 Affiliate Program | ✅Yes |

| ❌ Banned Countries | The United States, Hong Kong, Israel, EU regions |

| 🅰️ Scalping | ✅Yes |

| 🅱️ Hedging | ✅Yes |

| 📐 Trading Instruments | Forex, Commodities, Indices, Stocks, Crypto CFDs |

| 🚀 Open an Account | 👉 Click Here |

How does CMTrading ensure the safety of its traders’ funds and personal information?

They employ cutting-edge encryption technology and strict security protocols to protect traders’ assets and personal information.

What is its approach towards customer support?

CMTrading provides 24-hour customer support, ensuring that traders may get help anytime.

Safety and Security

Traders can choose their leverage level when setting up their trading platform with CMTrading. In addition, It prioritizes the security of its customers’ money and data via various established safeguards.

Moreover, they are overseen by the Financial Sector Conduct Authority (FSCA) in South Africa and the FSA in the Seychelles, guaranteeing that they follow high financial rules and ethical procedures.

Furthermore, client funds are segregated in separate bank accounts from the broker’s operational funds as part of their safety policy, providing extra protection against broker bankruptcy.

In addition, to safeguard the transfer of sensitive information over the internet, CMTrading uses SSL encryption on its website and trading platforms. This helps to protect personal and financial information from unauthorized access.

Is CMTrading regulated, and by which authorities?

The Financial Services Authority of Seychelles (FSA) and South Africa’s Financial Sector Conduct Authority (FSCA) regulate CMTrading.

What kind of risk management tools are offered?

It provides risk management features like stop-loss orders and protects customers from negative balances, guaranteeing they do not lose more than their deposited cash.

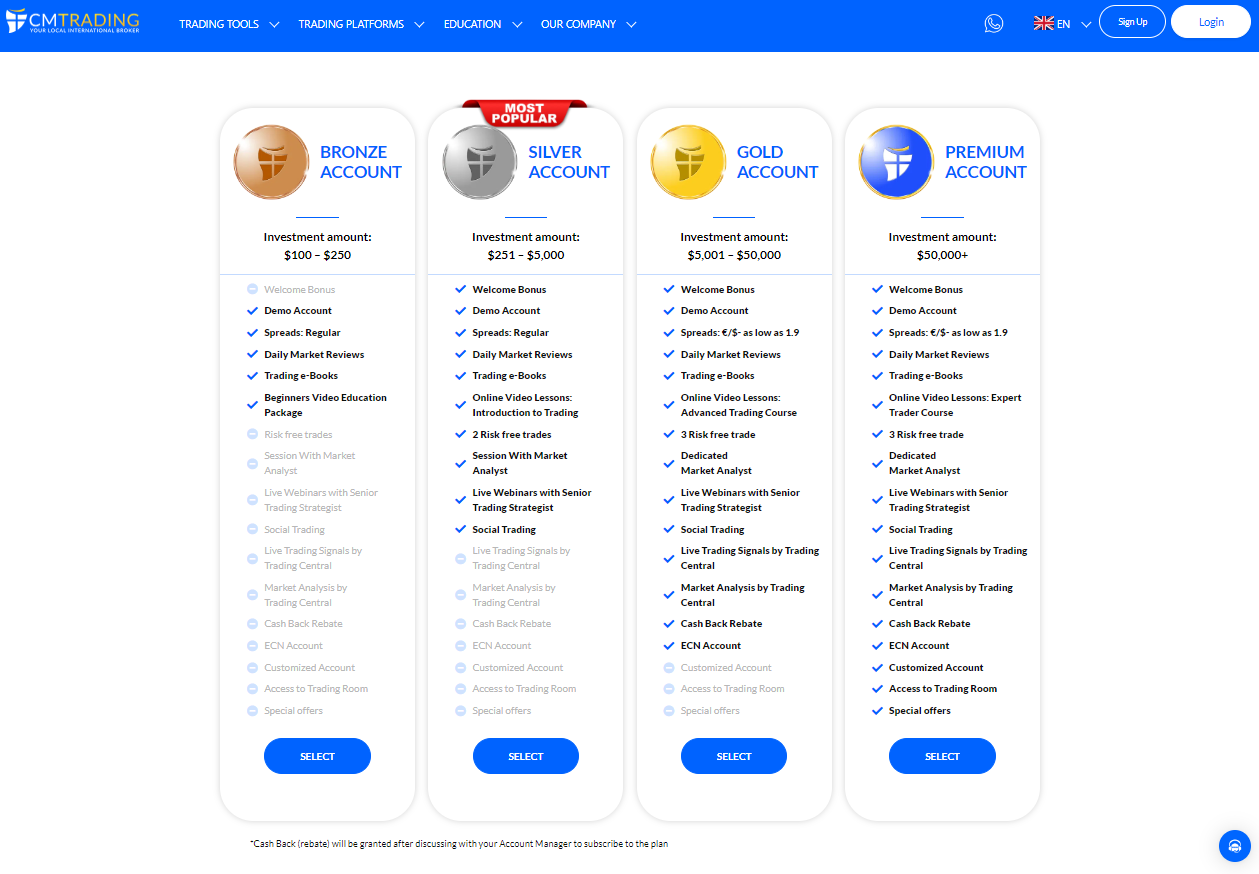

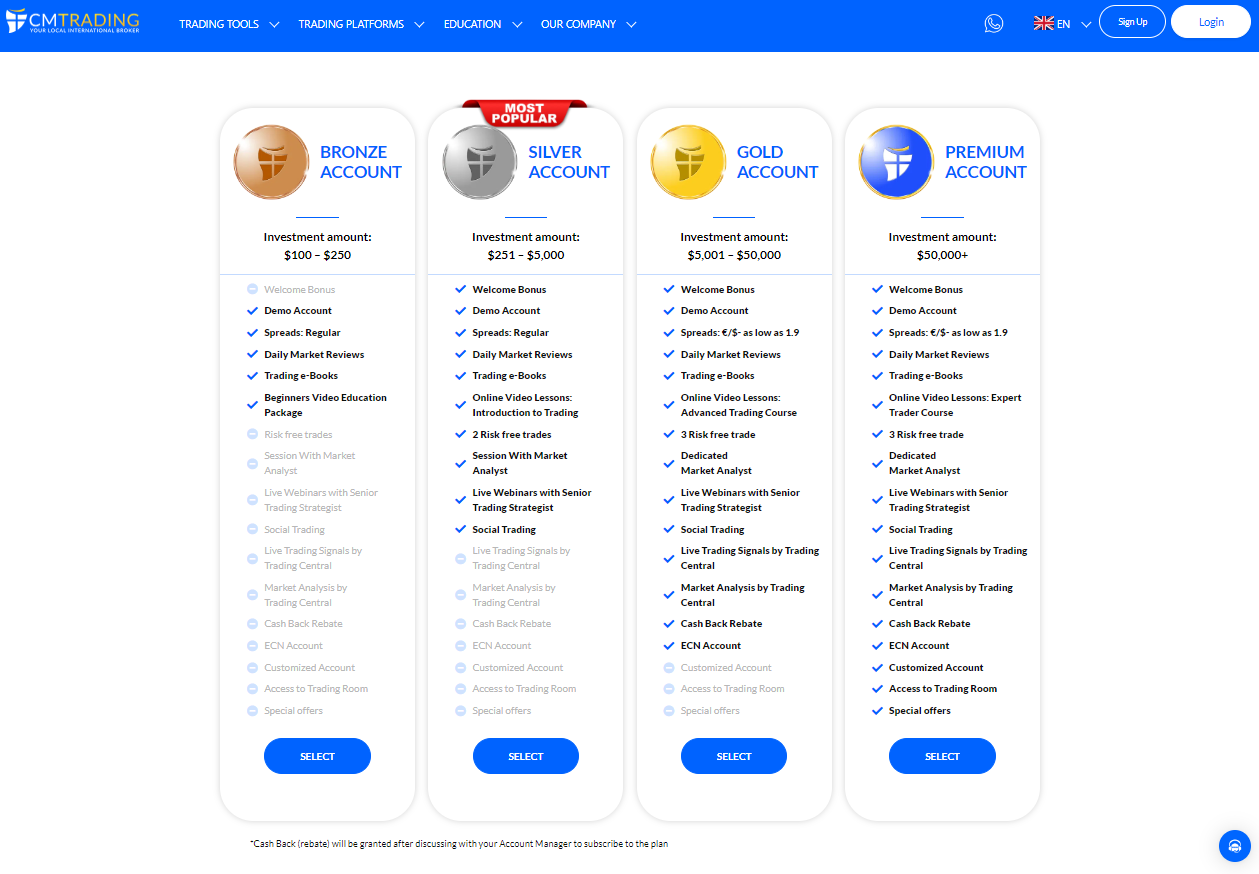

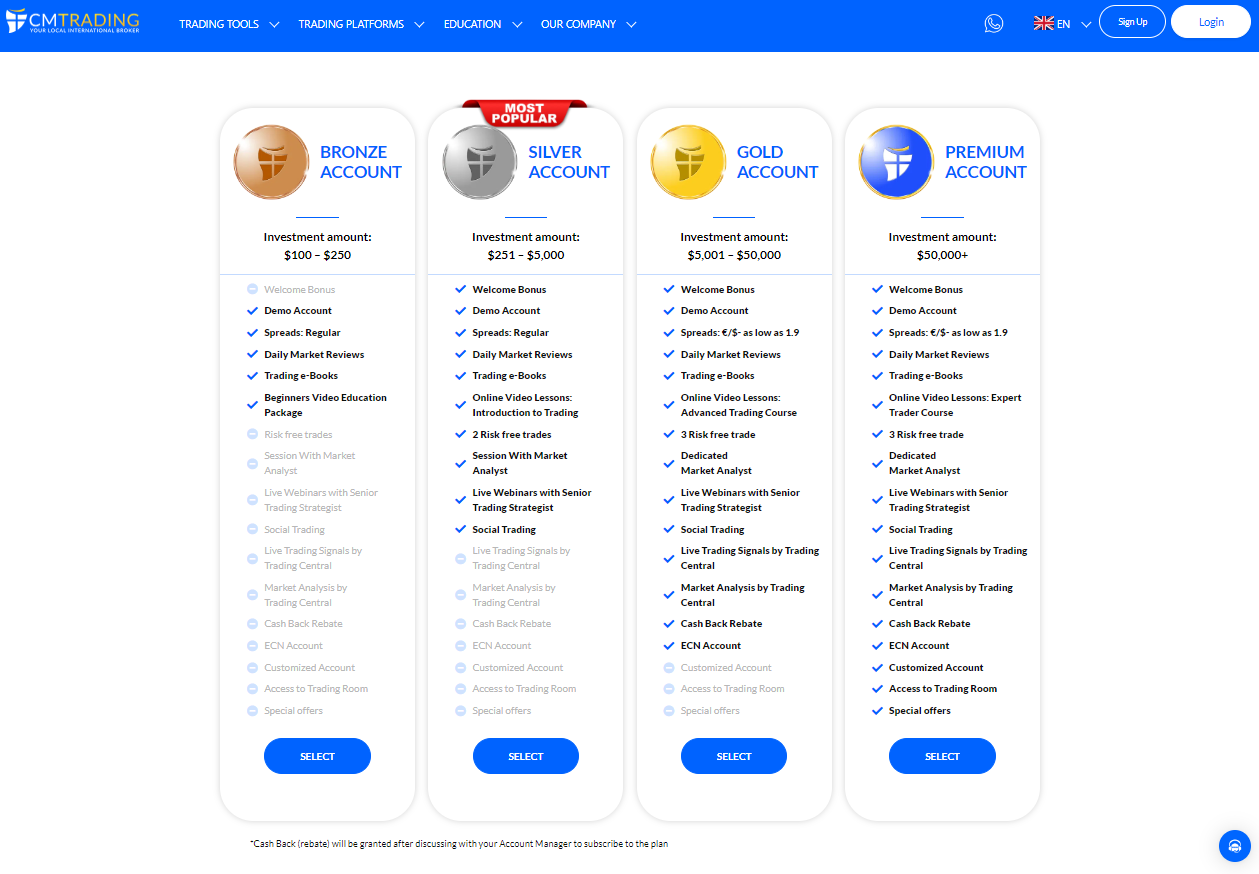

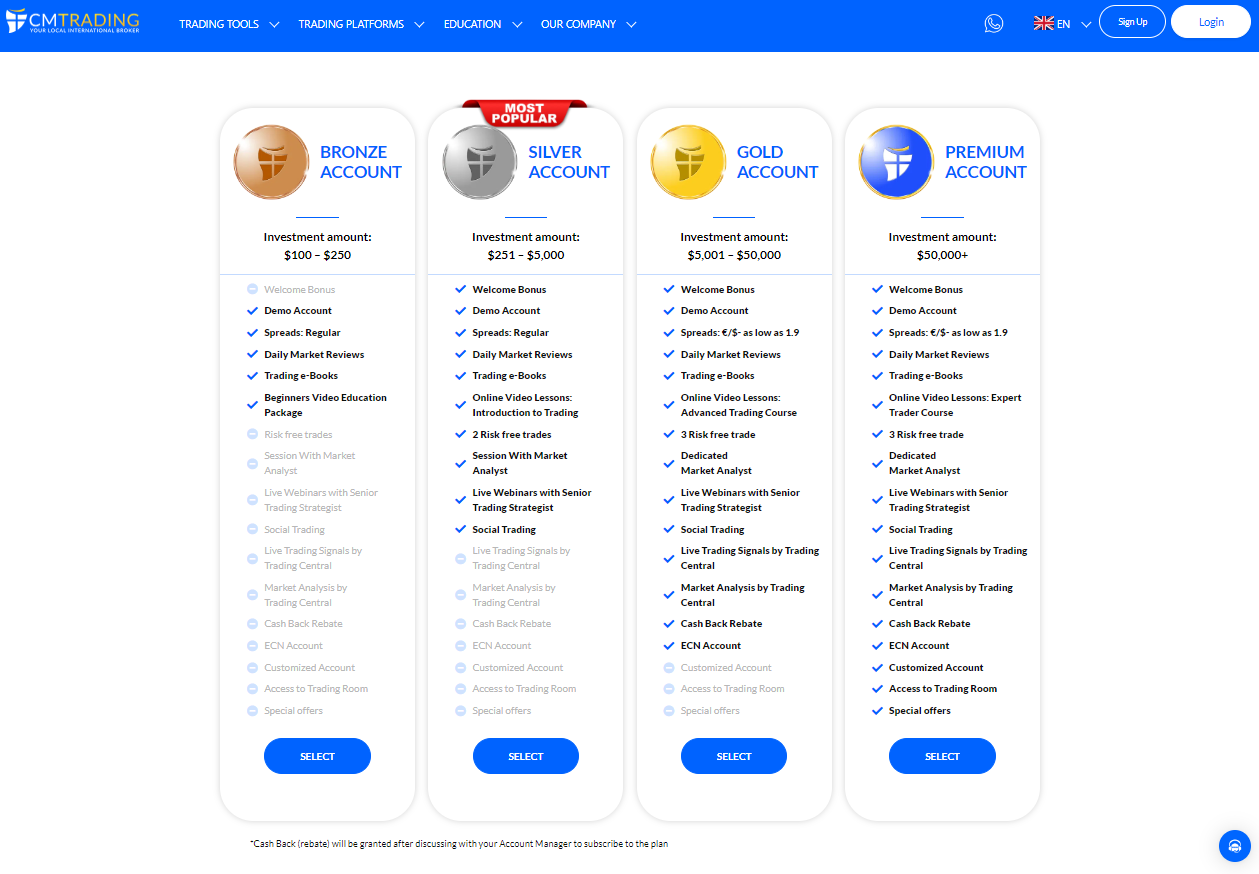

Account Types

| 🔎 Broker | 🥇 Bronze | 🥈 Silver | 🥉 Gold | 🏅 Premium |

| 📈 Availability | All traders | All traders | All traders | All traders |

| 📉 Markets | All | All | All | All |

| 📊 Commissions | None; only the spread is charged | None; only the spread is charged | None; only the spread is charged | None; only the spread is charged |

| 💹 Platforms | All | All | All | All |

| 📌 Trade Size | From 0.01 lots | From 0.01 lots | From 0.01 lots | From 0.01 lots |

| 📍 Leverage | 1:200 | 1:200 | 1:200 | 1:200 |

| 💷 Minimum Deposit | 100 USD | 251 USD | 5,0001 USD | 50,000 USD |

| 🚀 Open an Account | 👉 Click Here | 👉 Click Here | 👉 Click Here | 👉 Click Here |

Bronze Account

Ideal for new forex traders. It contains key tools, access to the CMTrading platform, and customer support.

Additionally, traders can benefit from advantages such as a minimum deposit of 100 USD, a maximum deposit of 250 USD, demo account availability, instructional resources (trading eBooks and webinars), market reviews, and spreads beginning at 1.7 pips.

Silver Account

Silver accounts provide benefits above Bronze accounts. Moreover, Silver account members get market reviews, Trading Central Live Trading Signals, personal support, and cheaper spreads (beginning at 1.2 pips for EUR/USD).

Furthermore, it has a minimum deposit of 251 USD, a maximum deposit of 5,000 USD, a demo account, instructional resources, one risk-free trade, and more.

Gold Account

Gold Account

For experienced traders, this account provides enhanced spreads (from 1.9 pips), quicker trade execution, cashback rebates, 5,001 USD, and a maximum amount of 50,000 USD. Furthermore, traders get three risk-free trades, a personal assistant, and access to ECN.

Premium Account

CM Trading’s Premium account caters to professional and institutional traders. In addition, it provides personalized trading conditions, bespoke services, cashback rebates, access to ECN, market news and analysis, special offers, a dedicated trading room, and financial guidance. Furthermore, the minimum deposit is 50,000 USD, and no maximum is given.

Demo Account

Furthermore, CMTrading’s Demo Account provides a complete and risk-free environment for novice and experienced traders to get acquainted with trading dynamics. It tries to make the move from practice to real trading more efficient by requiring the establishment of a genuine account first.

Moreover, with a pre-funded balance of USD 10,000, traders may learn the intricacies of the MT4 and MT5 platforms while experiencing real-time market conditions with no financial risk.

In addition, additional virtual funds are available upon request, allowing traders to properly analyze and adjust to the volatility of the currency market.

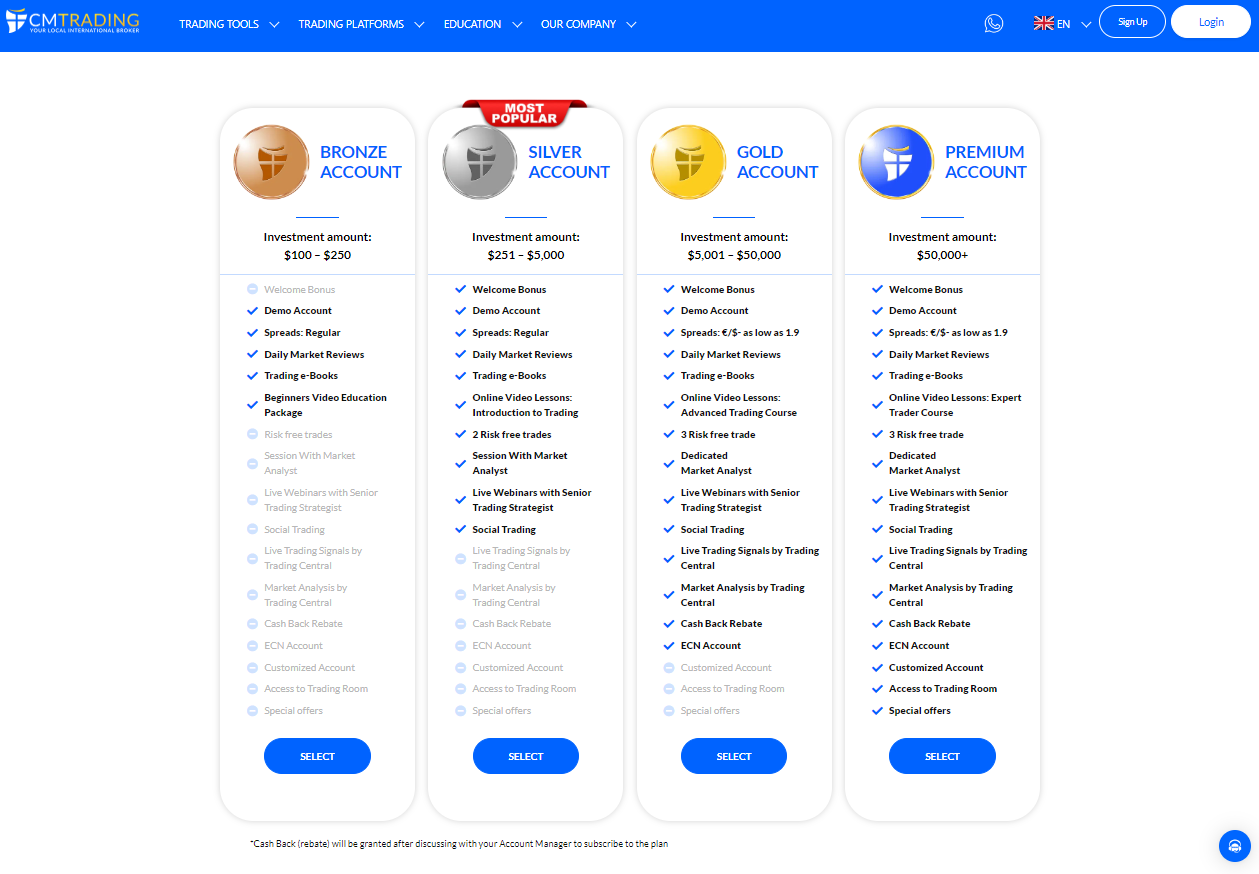

Islamic Account

Islamic Account

The CMTrading Islamic Account is particularly created for Muslim traders and adheres to Shariah law standards. This swap-free account adheres to Islamic banking by eliminating overnight interest costs, which aligns with religious views against usury.

The account includes various trading products, such as exotic currency pairings, cryptocurrencies, and stocks, increasing portfolio diversification potential while adhering to Islamic standards.

To access this account, traders may be asked to present proof of their religious allegiance, ensuring the account’s integrity and exclusivity for individuals following Islam.

Can beginners trade comfortably with CMTrading, and which account is recommended for them?

Yes, beginners may trade easily with CMTrading, and the Bronze account is suitable for beginning forex traders, with tools and assistance geared to their needs.

What benefits do I get with a Gold Account?

More experienced traders may benefit from a Gold Account, which includes improved spreads, faster trade execution, cashback rebates, and a personal assistant.

How To Open an Account

Go to the CMTrading website, select Open Account, and choose an account type. Fill up your personal information. Set up your trading platform and leverage. Complete the verification procedure. Fund your account and begin trading.

Are there any specific documents required to verify an account?

Indeed, they demand evidence of identification and residence, such as a passport, ID card, utility bill, or bank statement, to verify accounts.

How can I choose the right for my trading style?

CMTrading’s website provides thorough information on each account type, allowing traders to pick depending on their trading style and experience level.

Trading Platforms and Software

The following trading platforms and software:

- Web

- MetaTrader 4

- CopyKat Trading

Web

CMTrading Web is a web-based software application for online trading that does not require installation or download on the trader’s computer. It is an ideal platform for traders who need quick access to the markets from various devices.

It is easy to use but has advanced charting tools, live quotes, and a range of technical indicators. CMTrading Web is a convenient web interface that integrates with the trader’s account, allowing swift trade management, access to reside data, and analytical tools directly through your browser.

MetaTrader 4

MetaTrader 4 (MT4) is considered one of the most popular trading platforms that provides many analytical capabilities and other services. It is friendly to traders of all skill levels and offers detailed technical analysis, customized trading strategies, and algorithmic trading.

Algorithmic trading solutions are the strength of MT4, where traders can automate their strategies using EAs.

The trading software, MT4, has a customizable interface and offers a wide range of functionality. It provides a trade environment with many charts, technical indicators, and graphical elements to enable decision-making.

CopyKat Trading

CopyKat Trading

Additionally, CopyKat Trading is CMTrading’s social trading service that lets users mimic the positions of professional traders. This platform is especially useful for newbies since it allows them to learn from the techniques of experienced traders.

Moreover, CopyKat allows traders to read the profiles of skilled traders, see their techniques, and instantly duplicate their trades. This may drastically reduce the learning curve for beginners while also providing opportunities for diversification for more experienced traders.

Can I trade from my browser without downloading the software?

Yes, CMTrading Web enables you to trade straight from your browser without downloading any program.

What is CopyKat Trading at CMTrading, and who is it suitable for?

CopyKat Trading is CMTrading’s social trading platform that enables users to replicate expert traders’ positions, making it perfect for newbies to learn from experienced traders’ tactics.

CMTrading Fees, Spreads, and Commissions

Spreads

Furthermore, CMTrading’s spreads fluctuate daily depending on market circumstances and investor account type. Additionally, traders should anticipate varying average spreads for different instruments. For instance, EUR/USD may have spread as low as 0.00001 pips, while BTC/USD could start at 0.01 pips.

These spreads are crucial in determining trading costs and may differ among assets.

Commissions

CMTrading offers a commission-free approach, eliminating the need for traders to pay separate transaction fees. Instead, broker fees are included in the spreads.

This strategy simplifies cost computation for traders by allowing them to concentrate on spreads without worrying about extra commission costs.

Overnight Fees

To avoid CMTrading overnight fees, traders should carefully manage their holdings. These costs are determined using position size, duration, and the individual financial item exchanged.

For example, EUR/USD may have a swap rate of -14.56 points for long holdings and -2 points for short ones. Understanding and minimizing overnight fees is critical for cost-effective trading.

Deposit and Withdrawal Fees

CMTrading charges fees for deposit and withdrawal methods. Deposits made by bank wire may entail costs of up to 4% of the market rate, while withdrawals may result in a 4% deduction.

A 2.5% fee over the market rate may be charged for cryptocurrency deposits. Withdrawals made using cryptocurrency or credit/debit cards are subject to a 4% charge below the market rate.

Inactivity Fees

CMTrading charges a monthly fee of $15 (or €15) for inactive accounts to cover administrative expenses once an account has been dormant for 2 months.

Traders with several inactive accounts will be charged individually, with the cost imposed if the account balance exceeds $15 (or €15). This cost emphasizes the significance of continuing account activity to prevent extra fees.

Currency Conversion Fees

Currency conversion costs apply for trading in currencies other than the account’s base currency. CMTrading sets the exchange rate for such conversions. Traders should be informed that CMTrading is not responsible for currency rate changes throughout the conversion procedure.

Currency conversion fees vary, with deposits in various currencies costing up to 4% more than the market rate and withdrawals costing 4% less. Withdrawals may be handled at the original deposit rate less a 4% charge, at the discretion of CMTrading.

Are commission fees charged?

CMTrading provides commission-free trading, with expenses included in the spreads rather than separate transaction fees.

How competitive are CMTrading’s spreads in the market?

CMTrading is recognized for offering competitive spreads beginning at 0.1 pips, which is vital for traders who want to save on expenses.

Which Markets can You trade with CMTrading?

CMTrading offers the following tradable instruments:

- 50 currency pairings

- 16 commodities

- 17 global indices

- 109 stock CFDs

CMTrading caters to the digital currency movement by offering the possibility to trade 21 different cryptocurrencies with a leverage option of 1:2, recognizing the significant volatility associated with this asset class.

What types of financial products can I trade with CMTrading?

They provide various financial instruments, including forex, commodities, indices, stocks, and cryptocurrency CFDs.

How many currency pairs does CMTrading offer for forex trading?

CMTrading provides 50 currency pairings for trading, which include Minor, Major, and Exotic pairs.

Leverage and Margin

CMTrading provides traders with leverage, which is effectively a loan from the broker to assist them in building greater positions than their real capital would allow. Moreover, this considerably enhances possible earnings and raises the chance of large losses, so it should be used prudence.

The degree of leverage will vary depending on the item being traded, with currency pairings providing up to 1:200, commodities and indices up to 1:50, and stocks up to 1:10, reflecting their respective market volatilities.

Margin is the amount of equity required to make a transaction and is closely tied to leverage. For certain trades, the initial margin requirement at CMTrading is as little as 2% of the contract amount.

With such a large margin, traders must apply risk management techniques to preserve their wealth.

What is the margin requirement for CMTrading?

Depending on the traded instrument, CMTrading’s margin requirement is as little as 2% of the contract value.

Can I adjust the leverage on my CMTrading account?

Traders can choose their leverage level when setting up their trading platform with CMTrading.

Deposit and Withdrawal

| 🔎 Payment Method | 🌎 Country | 💰 Currencies Accepted | ⏰ Processing Time |

| 💴 MasterCard | All | USD, EUR, GBP, ZAR | Instant (deposit and withdrawal) |

| 💵 Visa | All | USD, EUR, GBP, ZAR | Instant (deposit and withdrawal) |

| 💶 Diners Card | All | USD | Instant (deposit and withdrawal) |

| 💷 Discover | All | USD | Instant (deposit and withdrawal) |

| 💴 Visa Electron | All | USD, EUR, GBP, ZAR | Instant (deposit and withdrawal) |

| 💵 Bank Transfers | All | USD, EUR, GBP, ZAR | 1 – 3 days on deposits and withdrawals |

| 💶 Cryptocurrency Payments | All | BTC, ETH, etc | Instant |

| 💷 Skrill | All | USD | Instant (deposit and withdrawal) |

| 💴 EFTPay | All | USD, EUR, GBP, ZAR | Instant (deposit and withdrawal) |

| 💵 Neteller | All | USD | Instant (deposit and withdrawal) |

| 💶 Perfect Money | All | USD | Instant (deposit and withdrawal) |

Here is an overview of how to deposit to CMTrading via the most popular Deposit Options:

Bank Wire

- Log in to your CMTrading account and navigate to the “Deposit” area.

- Select the “Bank Wire” option as your deposit method.

- Provide evidence of payment to CMTrading if needed.

Credit or Debit Card

- Login to your CMTrading account and go to the “Deposits” section.

- Select “Credit or Debit Card” from the list of payment options.

- Enter your card information and deposit amount.

- Additionally, you may need to send front and back copies of your card for verification, with critical information concealed. Next, Submit the deposit, and it should be reflected in your account instantly.

Cryptocurrency Wallets

- Access your CMTrading account and choose the “Deposit” option.

- Next, select Cryptocurrency.

- Traders will be given an address to which to transfer the cryptocurrency.

- Next, go to your cryptocurrency wallet and make a transfer to the specified address

- Confirm the transaction in the wallet and confirm that all information is valid. The funds should be in your CMTrading account within an hour.

e-wallets or Payment Gateways

- Sign in to your CMTrading dashboard.

- Next, click the “Deposit” option and choose your chosen e-wallet or payment provider.

- You will be taken to the e-Wallet or gateway login page.

- Enter the amount you want to deposit, confirm payment information, and authorize the transfer. The deposit is normally completed and accessible in your CMTrading account within an hour

Here is an overview of how to make a Withdrawal from CMTrading via the most popular Withdrawal Options:

Bank Wire

- Log into your CMTrading account.

- Go to your account section and choose ‘Withdraw.’

- Select ‘Bank Wire Transfer‘ as your withdrawal option and fill out the relevant banking information.

- Allow extra time for your bank to process the incoming funds, which might take 1 to 3 business days.

Credit or Debit Card

- Access your account and navigate to the withdrawal section in your account area.

- Choose the credit/debit card option for withdrawal and enter the amount you want to withdraw.

- Confirm your withdrawal.

Cryptocurrency Wallets

- Navigate to the CMTrading website and input your login information.

- Look for the “Withdrawal” button on your account dashboard.

- Choose “Cryptocurrency” from the available withdrawal methods.

- Enter the public address of your cryptocurrency wallet where you wish to receive the payments.

- Double-check the correct address and enter the amount you’d like to withdraw from your CMTrading account.

- Ensure that it fulfills the crypto withdrawal minimum limit.

- Review your withdrawal request information, including the method, amount, and wallet address.

- Finally, click the “Submit Withdrawal” button.

E-wallets or Payment Gateways

- To start, sign in to your CMTrading account, and in the account section, choose ‘Withdraw.’

- Next, choose an e-wallet or payment gateway from the available choices.

- Enter the withdrawal amount.

- Submit a withdrawal request.

- The funds should be instantly processed by the financing department and sent to your e-wallet, which may take longer depending on the e-wallet’s regulations.

What are the processing times for deposits and withdrawals with CMTrading?

CMTrading processes most credit/debit card transactions instantly. Bank transfers and cryptocurrency payments may take 1-3 days.

Does CMTrading charge any fees for deposits or withdrawals?

CMTrading may impose fees according to the deposit or withdrawal method, with certain transactions costing up to 4% of the market rate.

Educational Resources

Educational resources on offer include:

- eBooks

- Training videos

- Webinars

- Live seminars

Additionally, How To Videos will walk traders through different activities, like creating an account and making a trade.

Does CMTrading provide any resources for novice traders?

Yes, CMTrading offers an extensive collection of materials, including eBooks and training videos, for traders of all skill levels, including novices.

Are live seminars available through CMTrading for learning about trading?

Yes, CMTrading holds live seminars that provide immersive learning experiences and opportunities to connect with trade gurus.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| CMTrading offers a diversified portfolio of trading instruments across markets | CMTrading charges inactivity fees |

| CMTrading offers commission-free trading, with only the spread charged | Deposit fees apply |

| CMTrading offers instant execution on ECN accounts | CMTrading charges wide spreads on some accounts |

Conclusion

CMTrading is recognized as a professional brokerage business, notably for its strong regulatory structure under the Financial Services Authority (FSA) and the Financial Sector Conduct Authority (FSCA) of South Africa.

Furthermore, CMTrading provides a noteworthy selection of trading instruments, catering to a diversified clientele interested in forex, commodities, equities, indices, and cryptocurrency.

Yes, CMTrading is a licensed and regulated broker registered with the Financial Services Authority of Seychelles (FSA).

Yes, CMTrading is a safe broker. The Financial Sector Conduct Authority (FSCA) of South Africa and the Financial Services Authority of the Seychelles regulate CMTrading and require strong financial regulations, such as isolating client money from business funds, to ensure its safety as a broker.

The minimum deposit varies by account type and ranges from 100 USD to 50,000 USD.

Yes, leverage choices range from 1:2 to 1:200, depending on the instrument and the laws. Remember that increased leverage means greater risk.

Withdrawals at CMTrading are handled instantly or within three business days, with extra time required for the cash to be reimbursed, depending on the withdrawal type and the client’s banking institution.

Yes, you can. CMTrading offers an unlimited demo account that can be used.

CMTrading offers MetaTrader 4, CMTrading Web, and CopyKat Trading.

🏆 7 Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |

CopyKat Trading

CopyKat Trading