Automated vs Manual Crypto Signals – Everything you need to know

In the world of crypto, it seems like there’s an abundance of opportunities waiting around every corner. But where do you find them?

Instead of spending hours scouring charts, some traders turn to signals. By letting experienced traders do the work in return for a fee, some find massive success by simply following their suggestions.

But what difference does it make if a computer or a human generates these signals? This article explores the differences between automated and manual signals to help you decide the best service to invest your money in.

What are crypto trading signals?

Trading signals are the financial equivalent of horse-racing tips: a third party, either a human or an algorithm, determines a potentially profitable play based on a set of conditions and recommends the best course of action. In practice, these signals are usually made up of four components:

- The financial instrument, like a forex pair or cryptocurrency.

- The entry price.

- The expected move/take profit target.

- A stop loss.

Dedicated providers typically issue signals, but it’s not uncommon to see trade recommendations from banks, trading publications, and brokers.

For new traders, crypto trading signals can be an excellent way to gain valuable insight into what experienced traders highlight as prime opportunities. One of the most challenging skills for a new trader to learn is to look at a chart and identify where exactly they should be trading; signals allow them to examine the logic of top traders and learn from them.

Some traders use signals exclusively, taking advantage of others’ knowledge to save time and energy scouting for trades. Others incorporate the suggestions into their strategy, using their own conditions to justify the trade. Either way, signals can benefit every trader by allowing them to gain a fresh perspective on markets, broadening their pool of profitable trading opportunities.

How do crypto trading signals work?

While forex and stock trading signals have existed for decades, crypto signals have exploded in popularity due to the profit potential of volatile cryptocurrencies. A quick Google search will generate thousands of listings for crypto signal services. But how do they work?

Firstly, crypto trading signals fall into two categories: free and paid.

Free signals will generally be lower-quality and less timely. They’re often promotions for a paid service and given after their paying customers have already received the signal. Finding valuable free signals is possible, but it’s wise to scrutinize them very carefully.

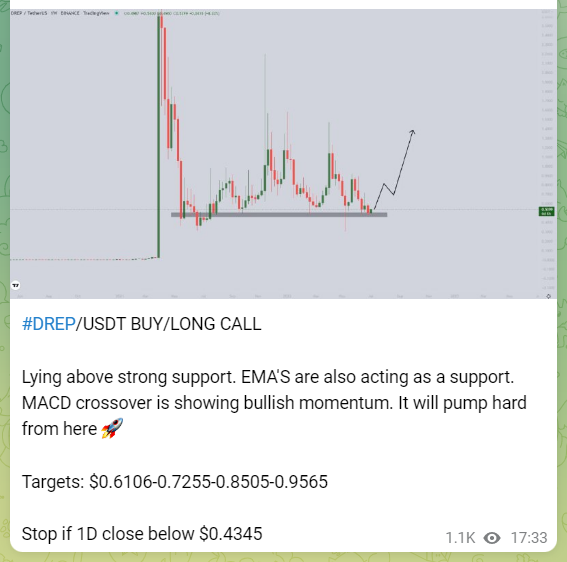

Paid signals are premium trade recommendations made by signal providers, paid for with a monthly subscription or a one-time fee. They’ll generally cost $30 to $150 per month, depending on the experience and profitability of the provider and the benefits offered (e.g., some may supply an in-depth explanation for the trade). Generally, crypto signals are distributed in premium groups. Groups are often found on messaging apps like Telegram, Discord, and Whatsapp. Providers take advantage of features like Telegram Channels or read-only Discord channels, where they can post streams of recommendations in an easily accessible format. There are also often adjacent discussion channels where subscribers can chat and interact with the provider and other traders.

There are platforms like Zignaly, 3Commas, and Cryptohopper that allow you to utilize signals given by others, but these are executed automatically and function as copy-trading platforms rather than being given suggestions for a trade.

This leads us to the main difference between crypto signals: automated and manual signals.

What are automated crypto signals?

Two emotions affect every trader, no matter how long they’ve been in the game: fear and greed. These demons seep into every unconscious decision and can be devastating if left unchecked. Thankfully, computers can help us make tough trading decisions without bringing emotion into the picture.

An automated crypto signal is generated by an algorithm that recommends trades based on mathematical formulas, analyzing technical indicator output and price action. When a specific set of conditions are met, an alert is automatically sent to the trader. For example, an algorithm might be trained to watch when BTCUSD has an RSI < 20 and closes three green candles in a row. Once this condition is met, the trader is alerted and can rush to the computer to make the trade.

While some use algorithms exclusively for their own trades, the same practice occurs with free and paid automated crypto signals. This happens on a more sophisticated scale, using complex conditions and entry requirements that trigger a message to be sent to subscribers. Some providers will even manually check the signal to confirm it’s valid before sharing it with their members.

Advantages of automated crypto signals

- Many traders struggle to stick to their plan after a few losing trades (or even after a few winners!) and lose sight of the consistency they need to maintain an edge. Automated signals remove as much of the human element as possible, so their recommendations will stay consistent even if the signal provider is having a bad day.

- When building an algorithm, the trader will observe how it performs on historical data, also known as backtesting. This backtest can easily prove these are profitable signals being automatically generated.

- Algorithms are optimizable, meaning providers can adjust them according to market conditions. While some manual signals may only perform well in a bull market, automated systems can be tweaked to handle both bull and bear markets.

- Automated trading software can track hundreds of instruments simultaneously, while most traders focus on maybe a dozen or so at a time. In a crypto market ripe with opportunity, automated signals can fill in the gaps with trades that many wouldn’t usually be aware of.

Disadvantages of automated crypto signals

- The past doesn’t always guarantee the future – and this is undoubtedly true in trading. While market conditions may have been favorable in the past, it doesn’t mean they will be in the future. Increased volatility, economic events, black swans, etc., can catch a poorly-maintained system off guard and generate false positives, leading to poor recommendations and losing streaks.

- ‘Curve fitting’ is a common issue among algorithmic traders. It occurs when traders adjust parameters to over-optimize their results over historical data when, in reality, it performs poorly given current market conditions. Any automated signal provider can fall victim to curve fitting, ruining your profitability in the long run.

- Crypto signals and automated trading systems must be constantly maintained and monitored to ensure they make the best recommendations. But what happens when someone unfamiliar else takes over, or the provider loses interest? You may begin receiving signals that lose money as the system pumps out unreliable recommendations based on a poorly-maintained or poorly-written algorithm.

- Automated trading signals rely on computer-generated entries and exits, which are often imprecise and based on math rather than logic. For example, a take profit might be set 1% away when price looks set for a big surge far exceeding 1%.

What are manual crypto signals?

Manual signals are generated based on the discretion of the provider. Using their own techniques built up over years of trading, providers will identify potential opportunities days or weeks in advance by scanning watchlists and charts, using technical indicators, chart patterns, and price action to form a hypothesis.

When the best opportunity to enter the trade arises, they’ll let their subscribers know, giving them the best entry price, take profit and stop loss levels to trade from. These signals tend to be less frequent than from an automated crypto signal provider, as trades are selected carefully, and the broader picture is taken into account.

Advantages of manual crypto signals

- One of the most significant advantages of manual signals is that they allow the signal provider to be more nuanced. While the vast majority of automated alerts work off technical output, manual providers can look at chart patterns, the fundamental picture, and price action to gauge the probability of a trade. This can lead to profitable trades being signaled that an automated system might miss.

- Manual providers are often made up of a small team to get different perspectives on trade and reduce the chance of human error. By having several pairs of eyes scrutinizing a trade recommendation and finding opportunities for you, your chances of receiving valuable, tradeable information increase dramatically.

- As humans generate these signals, they go through a discretionary filter that an automated system is unlikely to have. If something doesn’t look right, the provider can omit the signal. However, an automated system may only see its conditions being met while missing critical information that should prevent the trade from being taken.

- As previously mentioned, an explanation may be given for the trade. This is invaluable for new traders, as it shows the logic behind the trade and how a profitable trader thinks. It’s also insightful for experienced traders, as it offers a new perspective and way of thinking that they perhaps hadn’t considered.

Disadvantages of manual crypto signals

- With more nuance and discretion comes more opportunity to get things wrong. If the signal provider has a bad day or forgets to update a profit target, you lose out. While choosing a provider with a proven track record and a strong team should minimize the chances of human error influencing the trade, it’s always possible with manual signals.

- Even the most advanced manual signal providers must deal with their emotions when trading and making recommendations. If you’re on a losing streak right now, imagine how that would feel when you have hundreds, maybe even thousands, of subscribers following every trade, losing and blaming you. Pretty tough, right? This is what a manual provider goes through on a losing streak, and it’s easy to see how these emotions could negatively affect their decision-making abilities.

- Depending on the setup of the signal provider, an illness or emergency can mean days or weeks with no signals. While an automated service can likely keep going with minimal maintenance and input for a few days, if there’s no one to look at the charts, no manual signals will be generated.

Are automated or manual signals better for crypto?

There’s no one-size-fits-all answer to whether automated or manual signals are best for crypto. As we’ve seen, there are advantages and disadvantages to both approaches. New traders may prefer manual signals, as they’re often accompanied by explanations and updates on the crypto sphere. More experienced traders, however, may prefer automated services that produce more daily signals as they can pick and choose which trades they like.

The most important thing is to vet the provider to see if their signals are up to scratch. If you’re considering a signal provider, examine these three elements:

- Track record. Check if they’ve been around for a long time (six months, at the least) with a proven record of profitable trades.

- Team. You should be able to communicate with the team, or at the very least, receive support when you ask for it.

- Community. There should be a community of subscribers that are willing to share their ideas. This indicates the provider is fostering an active group, which is always a good sign that the service is genuine.

Crypto signals can be an excellent way to profit from cryptocurrency, and knowing the difference between automated and manual crypto signals can save you plenty of heartache (and money) in the future.

If you’d like to read more about crypto signals and how to use them, check out these articles: