IC Markets Review

- Overview

- Why IC Markets Global is a Top Choice for Serious Traders

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How To Open an IC Markets Account

- Safety and Security

- Trading Platforms and Software

- Markets Available for Trade

- Leverage and Margin

- Deposit and Withdrawal

- Educational Resources

- Customer Support

- Insights from Real Traders

- Customer Reviews and Trust Scores

- Trader Discussions and Forums

- Employee Feedback on IC Markets Global

- IC Markets vs AvaTrade vs Exness - A Comparison

- Pros and Cons

- In Conclusion

IC Markets is a trustworthy and highly regulated Forex Broker with very competitive trading fees. It offers access to an extensive range of financial instruments and has a trust score of 94 out of 99.

★★★ | Minimum Deposit: $200 Regulated by: FSA Crypto: Yes |

Overview

IC Markets Global is a regulated Forex and CFD provider focused on delivering institutional-grade tools, pricing, and technology to retail traders. With cutting-edge infrastructure and a trader-first approach, it has become a go-to platform for day traders, scalpers, and beginners seeking performance, speed, and trust.

Frequently Asked Questions

Why was IC Markets Global founded?

IC Markets Global was established to bridge the gap between retail and institutional traders. It aimed to provide access to superior trading infrastructure, raw spreads, and pricing models traditionally reserved for investment banks and high-net-worth clients.

Is IC Markets Global a safe platform to trade on?

Yes. IC Markets Global is a regulated broker that adheres to stringent financial standards. Client funds are held in segregated accounts with top-tier banks, and an independent external auditor ensures ongoing regulatory compliance and transparency.

Our Insights

IC Markets Global stands out as a technologically advanced and transparent trading partner. With strong regulatory compliance, low spreads, and institutional-grade tools, it’s designed to serve both experienced and entry-level traders looking for performance and reliability.

★★★ | Minimum Deposit: $200 Regulated by: FSA Crypto: Yes |

Why IC Markets Global is a Top Choice for Serious Traders

IC Markets Global stands out as a powerhouse for Forex and CFD trading, especially among MetaTrader 4 users. With Raw Pricing, cutting-edge tech, and 24/7 support, the broker offers an unmatched trading ecosystem. Whether you’re a scalper or a beginner, IC Markets Global delivers performance without compromise.

| Feature | Description | Benefit | Verdict |

| Spreads/Pricing | Raw Spreads from 0.0 pips, no markup pricing | Ideal for scalpers and pros | Highly competitive |

| Technology | NY4/LD5 server hosting, top-tier liquidity providers | Lightning-fast execution | Trader-friendly infrastructure |

| Support/Service | 24/7 multilingual support, experienced forex professionals | Peace of mind and reliability | Excellent for all experience levels |

| Platforms | MetaTrader 4/5 cTrader TradingView | Flexibility and accessibility | Comprehensive platform offering |

Frequently Asked Questions

What is Raw Pricing at IC Markets Global?

Raw Pricing refers to institutional-grade pricing directly sourced from liquidity providers without markups. This ensures traders access some of the tightest spreads in the market, especially on major currency pairs, making it ideal for scalpers and high-frequency traders.

Does IC Markets Global support fast trade execution?

Yes. IC Markets Global hosts its servers in top-tier NY4 and LD5 data centers, using fiber-optic connections to liquidity sources. This results in ultra-low latency, faster execution, and better pricing—especially critical for traders who rely on precision and speed.

Our Insights

IC Markets Global blends institutional-level infrastructure with retail accessibility. From Raw Spreads starting at 0.0 pips to unmatched execution speed and platform diversity, it’s engineered for serious traders. With trustworthy regulation and full transparency, IC Markets Global earns its place as a top-tier broker.

★★★ | Minimum Deposit: $200 Regulated by: FSA Crypto: Yes |

Fees, Spreads, and Commissions

IC Markets Global sets a high standard in Forex and CFD trading with some of the lowest spreads available globally. By aggregating quotes from over 25 liquidity providers, it delivers tight spreads, deep liquidity, and highly competitive commissions, perfect for serious traders seeking precision and cost efficiency.

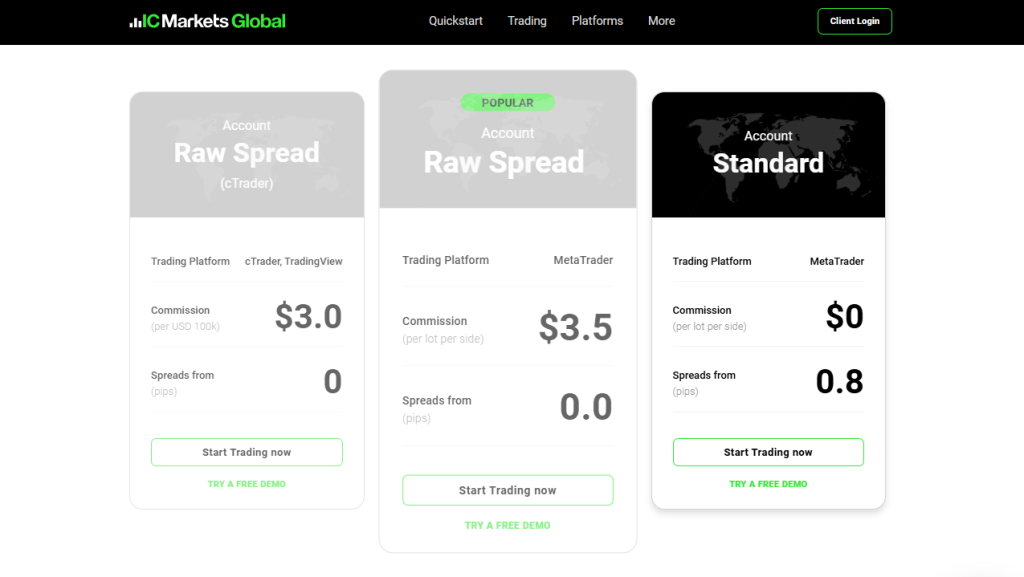

| Account Type | Platform | Spreads from | Commission |

| Raw Spread | MetaTrader 4/5 | 0.0 pips | $3.50 per side, per lot |

| Raw Spread | cTrader TradingView | 0.0 pips | $3 per $100k traded |

| Standard Account | MetaTrader 4/5 | From 1.0 pip (typical) | $0 (spread-only pricing) |

Frequently Asked Questions

How low are the spreads at IC Markets Global?

IC Markets Global offers variable spreads starting from 0.0 pips on its Raw Spread accounts. The average spread on EUR/USD is around 0.1 pips, among the lowest globally. This tight pricing is powered by deep liquidity from 25+ providers across MetaTrader, cTrader, and TradingView platforms.

What are the commission rates for IC Markets Global accounts?

Commissions vary by platform and account type. On MetaTrader Raw Spread accounts, the standard rate is $3.50 per side per lot. On cTrader and TradingView, it’s $3 per 100,000 USD traded. Standard accounts on MetaTrader are commission-free, making them ideal for beginners.

Our Insights

Whether you’re a high-frequency scalper or a cost-conscious beginner, IC Markets Global offers ultra-tight spreads and flexible commission structures. With Raw and Standard account options and access to world-class platforms, it ensures professional-grade pricing across all trade sizes and instruments.

★★★ | Minimum Deposit: $200 Regulated by: FSA Crypto: Yes |

Minimum Deposit and Account Types

IC Markets Global offers a versatile range of account types tailored to different trading styles – from scalpers and algo traders to beginners. With Raw Pricing, deep liquidity, and access to top platforms like MetaTrader, cTrader, and TradingView, the broker provides an institutional-grade trading environment for all levels.

Frequently Asked Questions

Which IC Markets Global account is best for scalping?

The Raw Spread account on MetaTrader is designed for scalpers and expert advisors. It features spreads from 0.0 pips, $3.50 commission per side, and low-latency execution via the NY4 data center, ideal for fast-paced, high-frequency trading strategies.

Is there a commission-free option for beginners?

Yes. The Standard Account on MetaTrader comes with zero commissions and spreads starting from 0.8 pips. It’s ideal for new traders who prefer simple cost structures and are just starting out in Forex or CFD trading.

Our Insights

IC Markets Global caters to all trader profiles with purpose-built account types. Whether you’re an algo trader needing raw pricing or a discretionary trader preferring simplicity, you can count on fast execution, tight spreads, and trusted infrastructure under a regulated broker.

★★★ | Minimum Deposit: $200 Regulated by: FSA Crypto: Yes |

How To Open an IC Markets Account

To register an account with IC Markets, follow these easy steps:

- Navigate to the IC Markets Website and choose the green “Open a Live Account” option.

- Choose the account that best suits your requirements.

- Complete the application form.

- Fund your account

- Download Your Trading Platform

Select your desired platform and download the program to your computer or mobile device.

★★★ | Minimum Deposit: $200 Regulated by: FSA Crypto: Yes |

Safety and Security

IC Markets Global operates under the strict oversight of the Seychelles Financial Services Authority (FSA), giving traders peace of mind through high compliance standards, capital adequacy, and segregated client funds. Its licensing and transparency measures help build trust in its international operations.

| Feature | Details | Benefit to Traders | Regulatory Body |

| License | FSA License No. SD018 | Legally authorised to operate as a securities dealer | Seychelles Financial Services Authority (FSA) |

| Fund Segregation | Client funds held in segregated top-tier bank accounts | Added protection and transparency | FSA Regulation |

| Compliance Measures | External audits AML KYC Risk Controls | Trust and operational transparency | Required by FSA |

| Legal Framework | Securities Act & FSA Conduct of Business Regulations | Regulatory consistency and investor protection | Enforced by FSA |

Frequently Asked Questions

Is IC Markets Global regulated and licensed to offer trading services?

Yes, IC Markets Global is regulated by the Financial Services Authority (FSA) of Seychelles under License No. SD018. The broker complies with strict regulatory standards, including risk management controls, external audits, and client fund segregation policies.

How does IC Markets Global protect clients’ funds?

Client funds are held in segregated accounts with top-tier banks, ensuring they remain separate from company operational funds. IC Markets Global also adheres to the Securities Act and AML regulations, maintaining secure and compliant financial practices for all traders.

Our Insights

IC Markets Global meets international regulatory standards through its FSA license, rigorous internal controls, and transparent client fund handling. For traders seeking a compliant and well-supervised broker, IC Markets Global offers a trustworthy trading environment backed by ongoing audits and legal safeguards.

★★★ | Minimum Deposit: $200 Regulated by: FSA Crypto: Yes |

Trading Platforms and Software

IC Markets Global offers a diverse suite of trading platforms, MT4, MT5, cTrader, cTrader Copy Trading, and TradingView, each tailored for different trading styles and experience levels. From automation-ready systems to advanced analytics and social trading, these platforms deliver speed, flexibility, and world-class execution environments.

| Platform | Best For | Key Feature | Mobile/Desktop Access |

| MetaTrader 5 | Advanced Algo Traders | MQL5 automation fast execution | Desktop Web Mobile |

| MetaTrader 4 | All-Level Traders | EA support raw spreads | Desktop Web Mobile |

| cTrader | Speed Transparency | Level II DOM Smart Stop Out | Desktop Web iOS Android |

| TradingView | Charting Social | 400+ indicators real-time trading | Desktop Web Mobile |

★★★ | Minimum Deposit: $200 Regulated by: FSA Crypto: Yes |

MetaTrader 5

IC Markets Global’s MetaTrader 5 offers a cutting-edge trading experience for forex and CFD traders. With institutional-grade pricing, fast execution, and advanced tools, MT5 from IC Markets Global caters to everyone from algorithmic traders to high-frequency scalpers, providing a reliable and flexible multi-asset environment.

| Feature | Details | Trader Benefit | Functionality |

| Spreads | From 0.0 pips (avg. 0.1 on EUR/USD) | Low-cost trading | Raw Pricing across asset classes |

| Execution Speed | NY4 Equinix Server <1ms latency | Fast, precise order execution | Ideal for scalpers HFT |

| Trading Tools | Advanced charting Level II DOM, MQL5 | Supports manual/automated trading | Multi-device compatibility |

| Account Access | Raw/Standard account types supported | Flexibility for all trader profiles | MT5 desktop mobile WebTrader |

What makes MetaTrader 5 at IC Markets Global different from other brokers?

IC Markets Global enhances MT5 with raw spreads from 0.0 pips, low-latency execution via NY4 servers, and deep interbank liquidity from up to 25 pricing providers. With no trading restrictions, MT5 here supports high-speed, high-volume, and automated trading strategies.

Can I automate trading with IC Markets Global’s MT5?

Yes, MetaTrader 5 supports fully automated trading using Expert Advisors (EAs) built in MQL5. Traders can use built-in bots or code their strategies, and even test them using the improved strategy tester available on the platform.

★★★ | Minimum Deposit: $200 Regulated by: FSA Crypto: Yes |

MetaTrader 4

MetaTrader 4 with IC Markets Global remains a powerhouse for retail and professional forex traders. Its raw spreads, lightning-fast execution, and automation-ready environment make it a top-tier platform for those seeking low-cost, flexible, and reliable trading conditions in global markets.

| Feature | Details | Trader Benefit | Technology Support |

| Spreads | From 0.0 pips (avg. 0.1 on EUR/USD) | Extremely low-cost trading | 25+ pricing providers |

| Execution Speed | NY4 server <1ms latency | Fast execution ideal for scalpers | VPS & HFT support |

| Trading Tools | Autochartist, Trading Central, EA use | Advanced technical insights & automation | MultiTerminal MQL4 |

| Platform Access | Standard/Raw Spread accounts | Choice based on trading style | Desktop mobile WebTrader |

Why is MetaTrader 4 still popular among forex traders?

MT4’s intuitive interface, stable performance, and broad support for Expert Advisors make it a favorite among beginners and pros alike. IC Markets Global enhances the platform with raw spreads from 0.0 pips, near-instant execution, and unrestricted trading strategies.

What are the key benefits of trading MT4 through IC Markets Global?

Traders gain access to 25+ liquidity providers, tight spreads, flexible lot sizing, and deep integration with tools like Autochartist and Trading Central. IC Markets Global also supports advanced features like multi-account management via MT4 MultiTerminal.

★★★ | Minimum Deposit: $200 Regulated by: FSA Crypto: Yes |

cTrader

The IC Markets Global cTrader platform offers traders a sleek, powerful interface with unmatched execution speed and market transparency. Designed for high-performance trading, cTrader with IC Markets Global is the ideal choice for those who demand depth, speed, and freedom in every trade.

| Feature | Details | Trader Benefit | Technology |

| Spreads | From 0.0 pips, avg. 0.1 on EUR/USD | Ultra-low-cost trading | Raw Pricing with 25+ providers |

| Execution Speed | Servers in LD5 Equinix (London) | Millisecond order execution | Ideal for scalpers/HFT |

| Advanced Tools | DOM VWAP Smart Stop Out real-time reports | Better risk and order management | cTrader Automate Copy Trading |

| Platform Access | Standard/Raw Spread accounts | Flexibility for any trading strategy | Desktop Web Mobile iOS Mac |

What makes the cTrader platform unique at IC Markets Global?

With institutional-grade infrastructure, raw pricing from top liquidity providers, and servers in London’s LD5 IBX Equinix data centre, IC Markets Global’s cTrader ensures lightning-fast trades, real-time liquidity, and the lowest spreads, making it ideal for high-frequency and discretionary traders alike.

Is cTrader better for beginner or advanced traders?

cTrader offers an intuitive interface perfect for beginners, while also supporting advanced tools like Level II pricing, Smart Stop Out, and multiple order types that appeal to experienced traders. It strikes a strong balance between simplicity and functionality.

★★★ | Minimum Deposit: $200 Regulated by: FSA Crypto: Yes |

cTrader Copy Trading

With IC Markets Global’s cTrader Copy Trading, investors can automatically mirror the strategies of top-performing traders in real time. Powered by Spotware’s trusted technology, the platform offers complete transparency, intelligent risk controls, and flexible management—all within a powerful multi-device ecosystem.

| Feature | Details | Investor Benefit | Technology |

| Strategy Replication | Mirrors top traders with equity-adjusted precision | Hands-off investing with real-time syncing | Spotware Copy Trading Engine |

| Transparency Analytics | View historical performance and in depth analytics | Make informed decisions before investing | Strategy Profiles + Risk Tools |

| Control Flexibility | Add/remove funds anytime, manage exposure levels | Stay in control while automating strategy | Auto-adjusted open positions |

| Multi-Device Support | Access on Web, iOS, Android, Mac, Windows | Track and manage portfolios anywhere | Unified cross-platform experience |

How does cTrader Copy Trading work at IC Markets Global?

You choose a strategy provider from a fully transparent profile list, and the platform mirrors their trades in your separate investor account. Copying is equity-adjusted, ensuring proportional exposure and real-time performance tracking.

Is cTrader Copy Trading suitable for passive investors?

Yes. It’s ideal for investors who prefer hands-off trading. You maintain full control over deposits, withdrawals, and risk levels, while the system handles precise trade replication from strategy providers.

★★★ | Minimum Deposit: $200 Regulated by: FSA Crypto: Yes |

TradingView

Experience the industry’s most powerful charting and social trading platform – TradingView, fully integrated with IC Markets Global. With over 50 million users, TradingView is trusted for its advanced analytics, deep customization, and community-driven insights. Now, you can trade directly from your charts using your IC Markets Global account.

| Feature | Details | Trader Benefit | Technology |

| World-Class Charting | 15+ chart types 110+ tools 400+ built-in indicators | Precision in market analysis | TradingView Web and Desktop |

| Real-Time Execution | One-click trading directly from charts | Fast, seamless trade placement | cTrader-powered integration |

| Alerts/Strategy Tester | 13 alert types + historical strategy simulation | Never miss an opportunity | Custom alerts and performance reports |

| Multi-Device Sync | Use desktop browser, or mobile with full account sync | Trade anywhere, anytime | Cloud-based data and workspace sync |

Can I use any IC Markets Global account type with TradingView?

Yes. TradingView integrates seamlessly with compatible IC Markets Global accounts via the cTrader connection. You can execute trades directly from your charts with low spreads and micro-lot trading.

How do I start trading with IC Markets Global on TradingView?

Simply open or connect your IC Markets Global account to TradingView, fund your account, and start trading. Synchronisation is automatic across browser, mobile, and desktop versions.

★★★ | Minimum Deposit: $200 Regulated by: FSA Crypto: Yes |

Frequently Asked Questions

Which platform is best for automated trading at IC Markets Global?

MetaTrader 5 and MetaTrader 4 are ideal for automated trading via Expert Advisors. MT5 offers more powerful backtesting, while MT4 remains a trusted standard. cTrader Automate is another strong choice, especially for coders using C#.

Can beginners use IC Markets Global’s advanced platforms?

Yes. Platforms like cTrader and TradingView offer intuitive interfaces, social features, and analytical tools that help beginners learn while trading. Copy Trading also allows passive investors to follow experienced traders without needing deep technical skills.

Our Insights

IC Markets Global’s platform variety covers all trader types, from algo-savvy professionals to hands-off investors. With fast execution, raw spreads, and cross-device access, each platform brings unique advantages. Whether you’re after precision charts or hands-free investing, there’s a tailored solution here.

★★★ | Minimum Deposit: $200 Regulated by: FSA Crypto: Yes |

Markets Available for Trade

IC Markets Global gives traders access to a diverse range of global markets, including forex, indices, commodities, stocks, bonds, futures, and cryptocurrencies. With tight spreads, high leverage, and deep liquidity, the platform supports round-the-clock trading opportunities across multiple asset classes on world-class platforms.

| Market | Instruments Available | Leverage (Up to) | Trading Hours |

| Forex | 61 currency pairs | 1:1000 | 24/5 |

| Stocks CFD | 2100+ global stocks | 1:20 | Market hours |

| Cryptocurrencies | 21 major crypto pairs | 1:200 (MT) | 24/7 |

| Commodities | 20+ energy, metal, agri | 1:1000 | Market hours (Varies) |

Frequently Asked Questions

What makes IC Markets Global’s market range attractive to traders?

IC Markets Global combines raw pricing, flexible leverage, and broad asset selection across forex, indices, commodities, stocks, crypto, bonds, and futures. This allows traders to diversify portfolios, hedge risk, or focus on high-opportunity markets with institutional-grade execution.

Can I trade all asset classes using one account?

Yes. Most IC Markets Global account types, particularly Raw Spread and Standard, allow trading across all available asset classes, including 24/5 access to major markets and 24/7 crypto trading. Supported platforms include MetaTrader 4, MetaTrader 5, cTrader, and TradingView.

Our Insights

With access to 2000+ assets across seven major categories, IC Markets Global empowers traders with broad diversification and high market availability. Whether you’re scalping forex, investing in blue-chip stocks, or speculating on crypto, the platform offers deep liquidity and competitive pricing for every strategy.

★★★ | Minimum Deposit: $200 Regulated by: FSA Crypto: Yes |

Leverage and Margin

IC Markets Global gives traders access to a diverse range of global markets, including forex, indices, commodities, stocks, bonds, futures, and cryptocurrencies. With tight spreads, high leverage, and deep liquidity, the platform supports round-the-clock trading opportunities across multiple asset classes on world-class platforms.

Frequently Asked Questions

What makes IC Markets Global’s market range attractive to traders?

IC Markets Global combines raw pricing, flexible leverage, and broad asset selection across forex, indices, commodities, stocks, crypto, bonds, and futures. This allows traders to diversify portfolios, hedge risk, or focus on high-opportunity markets with institutional-grade execution.

Can I trade all asset classes using one account?

Yes. Most IC Markets Global account types, particularly Raw Spread and Standard, allow trading across all available asset classes, including 24/5 access to major markets and 24/7 crypto trading. Supported platforms include MetaTrader 4, MetaTrader 5, cTrader, and TradingView.

Our Insights

With access to 2000+ assets across seven major categories, IC Markets Global empowers traders with broad diversification and high market availability. Whether you’re scalping forex, investing in blue-chip stocks, or speculating on crypto, the platform offers deep liquidity and competitive pricing for every strategy.

★★★ | Minimum Deposit: $200 Regulated by: FSA Crypto: Yes |

Deposit and Withdrawal

IC Markets Global provides a user-friendly funding and withdrawal system that supports bank transfers, cards, e-wallets, and crypto wallets. With no internal fees and secure transaction handling, it’s designed to give traders fast, reliable access to funds with minimal friction and maximum flexibility.

| Method | Available For | Fees (IC Markets) | Typical Speed |

| Bank Wire | Deposit Withdraw | None | 2–5 business days |

| Credit/Debit Cards | Deposit Withdraw | None | 1–3 business days |

| E-Wallets | Deposit Withdraw | None | Within 24 hours |

| Crypto Wallets | Deposit Withdraw | None | Within 24 hours (varies) |

Frequently Asked Questions

Does IC Markets Global charge any fees for deposits or withdrawals?

No, IC Markets Global does not charge internal fees on deposits or withdrawals. However, traders should be aware that external fees from banks or payment providers may still apply depending on the method chosen.

How fast are withdrawals processed at IC Markets Global?

Withdrawal speed depends on the payment method. While bank wires and cards may take 2–5 business days, crypto and e-wallet transactions are typically processed within 1 business day, offering faster access to funds.

Our Insights

IC Markets Global stands out with its zero-fee policy and wide selection of funding options. Whether you use traditional banking or digital wallets, transactions are processed securely and efficiently, making it one of the most convenient brokers for managing your trading capital.

★★★ | Minimum Deposit: $200 Regulated by: FSA Crypto: Yes |

Educational Resources

IC Markets Global’s educational resources are crafted to build trader confidence through structured learning. From Forex basics to CFD advantages, users gain access to video tutorials, platform walkthroughs, and market insights. Whether you’re new or experienced, the learning tools cater to every trading journey.

Frequently Asked Questions

What can new traders expect from IC Markets Global’s education center?

New traders can explore beginner-friendly lessons on Forex, trading strategies, risk management, and chart analysis. The resources are designed to ease newcomers into global markets with clear explanations and visual aids.

Are the tutorials and learning tools suitable for all trading platforms?

Yes. IC Markets Global’s educational videos and guides cover platform-specific topics for MetaTrader 4, MetaTrader 5, cTrader, and TradingView, ensuring traders know how to navigate tools, place trades, and customize charts confidently.

Our Insights

IC Markets Global excels in trader education by offering a solid mix of videos, articles, and platform guidance. These tools help users at all levels improve their knowledge, sharpen their skills, and trade with clarity across multiple asset classes and platforms.

★★★ | Minimum Deposit: $200 Regulated by: FSA Crypto: Yes |

Customer Support

IC Markets Global prioritizes round-the-clock customer care. Whether you’re trading from Asia, Africa, or Latin America, their multilingual support is available 24/7 by phone or email. With region-specific hotlines and dedicated departments, getting prompt and professional help has never been easier for global traders.

| Support Channel | Availability | Regions Covered | Purpose |

| Phone Support | 24/7 | Global, incl. TH, ID, ZA, VN, CO | Real-time issue resolution |

| Email Departments | 24/7 | Global (4 departments) | Specific queries (support, accounts, etc.) |

| Contact Form Callback | 24/7 | All Regions | Quick follow-up from the team |

| Office Location | Seychelles | Global headquarters | Licensed under FSA (SD018) |

Frequently Asked Questions

How can I contact IC Markets Global for support?

You can reach the IC Markets Global support team 24/7 via phone, email, or online contact form. Dedicated hotlines are available for Thailand, Indonesia, Vietnam, Colombia, and South Africa, with emails directed to specific departments for faster service.

Is IC Markets Global support available in my region?

Yes. IC Markets Global offers region-specific contact numbers and multilingual assistance across several countries. No matter your time zone or trading issue, their global support network ensures timely, localised help.

Our Insights

IC Markets Global stands out with its responsive, multilingual 24/7 customer support. Whether you’re a new trader or managing an existing account, you can rely on timely assistance through local hotlines or email, backed by a strong regulatory presence and global infrastructure.

★★★ | Minimum Deposit: $200 Regulated by: FSA Crypto: Yes |

Insights from Real Traders

⭐⭐⭐⭐

I’ve been trading with IC Markets Global for over a year now, and I couldn’t be happier. The order execution is lightning-fast, and spreads on major pairs like EUR/USD are consistently near zero. It’s a true ECN experience.

Harlo

⭐⭐⭐⭐⭐

I had an issue with my account setup, and the live chat team resolved it within minutes. They were professional, patient, and genuinely helpful. It’s rare to find 24/7 support that’s responsive and knowledgeable!

Cindy

⭐⭐⭐

As someone who uses both MetaTrader and TradingView, I love that IC Markets Global offers all major platforms. Everything integrates smoothly, and the flexibility with deposit methods and zero fees is a massive plus.

Dave

★★★ | Minimum Deposit: $200 Regulated by: FSA Crypto: Yes |

Customer Reviews and Trust Scores

IC Markets Global consistently receives high praise from traders, especially for its support, execution speed, and low spreads. Review platforms rate it between 4.8 out of 5, reflecting exceptional satisfaction among international users.

| Platform | Trust Score | Main Praises | Primary Complaints |

| Trustpilot | 4.8 | Fast support, tight spreads, reliable service | Occasional slow withdrawals |

| TradingView | 4.7 | Professional execution, transparency | Rare price anomalies flagged |

| Forex Peace Army | 4.0 | Long-term reliability, no requotes | Some bank delays |

★★★ | Minimum Deposit: $200 Regulated by: FSA Crypto: Yes |

Trader Discussions and Forums

Community feedback highlights IC Markets Global’s strengths in live chat support, execution, and liquidity, though some raise awareness about account migration issues and platform warnings.

| Platform | Discussion Topics | Tone |

| Forex Factory | Migration of accounts outside Australia | Cautious |

| Fast Skrill withdrawals vs. slow wire | Positive practical |

|

| Forex Peace Army | Long-term reliability praised | Positive |

| r/Forex | Some accuse price manipulation | Mixed to critical |

★★★ | Minimum Deposit: $200 Regulated by: FSA Crypto: Yes |

Employee Feedback on IC Markets Global

Employee reviews show mixed indicators with solid feedback on work environment but below-average overall ratings.

| Source | Rating (5) | Employee Highlights | Concerns |

| Glassdoor | 2.8 | Excellent office. Feels like a family, Career progression. | Low overall rating, mixed |

★★★ | Minimum Deposit: $200 Regulated by: FSA Crypto: Yes |

IC Markets vs AvaTrade vs Exness – A Comparison

Pros and Cons

| ✓ Pros | ✕ Cons |

| Ultra-tight spreads from 0.0 pips | Regulated only by FSA (Seychelles) |

| Supports MT4, MT5, cTrader, TradingView | No cent accounts |

| Leverage up to 1:1000 | Overnight holding fee on Islamic accounts |

| No deposit or inactivity fees | Some features/platforms may be complex for beginners |

| Broad asset selection & copy trading options | Limited stock CFD offering compared to equity brokers |

References:

In Conclusion

IC Markets Global delivers a robust, regulated, and technologically advanced trading environment, featuring raw pricing, low spreads, and high-speed execution.

Specifically designed for traders of all levels, it offers top-tier platforms, diverse markets, and strong safety protocols. As a result, it stands out as an ideal choice for serious and ethical trading worldwide.

Faq

Yes, it is licensed by the Seychelles FSA under License No. SD018.

The minimum deposit is $200 for all account types.

MT4, MT5, cTrader, and TradingView are fully supported.

Yes, swap-free accounts are available on all major platforms.

Spreads start from 0.0 pips with Raw accounts; average is ~0.1 pips for major pairs.

IC Markets does not support Mobile Money options.

- Overview

- Why IC Markets Global is a Top Choice for Serious Traders

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How To Open an IC Markets Account

- Safety and Security

- Trading Platforms and Software

- Markets Available for Trade

- Leverage and Margin

- Deposit and Withdrawal

- Educational Resources

- Customer Support

- Insights from Real Traders

- Customer Reviews and Trust Scores

- Trader Discussions and Forums

- Employee Feedback on IC Markets Global

- IC Markets vs AvaTrade vs Exness - A Comparison

- Pros and Cons

- In Conclusion