Trading Binance With Crypto Signals

Getting started with Binance trading signals doesn’t need to be complicated. In this guide, we’ll show you exactly how to start trading cryptocurrency signals on Binance, why you should, and how to find the best crypto signals.

What are trading signals?

Trading signals are a set of instructions to buy or sell an asset based on analysis, usually given with a take profit target and stop loss. They’re typically issued by a signal provider that uses either technical or fundamental analysis (or both) to form a trade idea that they then pass on to you, often for a fee. These signals can be generated automatically by a piece of software set up to monitor the market for opportunities, or can be manually generated by an individual/team dedicated to scouring the markets.

While trading signals have existed for years in traditional markets, such as forex or stocks, crypto trading signals are a relatively new phenomenon. As crypto has much lower barriers to entry, there are hundreds of crypto trading signal providers, some specializing in Binance signals, that are ready to start guiding your trades. Because of the high volatility of cryptocurrencies, every day there are many lucrative opportunities that are ready to be exploited, and using trading signals is a way of streamlining this process.

So what does a crypto trading signal look like? Well, it might be that a provider has noticed that a set of indicators is showing that Bitcoin will increase in price over the next seven days. They might then announce that their followers should enter at $21,000, with a profit target of $25,000 and a stop loss at $19,000. Some providers will also manage a signal, telling their followers whether to add or take off risk.

Pros and cons of trading signals

While crypto and Binance trading signals might seem like a no-lose situation, it’s worth considering the downsides of signals. Let’s take a look at some of the pros and cons.

Pros

An extra pair of eyes

If you’re trading multiple markets across different timeframes, it can be hard to keep an eye on everything that’s going on. Watching the markets 24/7 can be tiring for some traders, so signals can act as your own trading assistant that monitors the markets for you.

They make money

Kind of an obvious point, but a decent signal provider will make you money. Even if they charge for their crypto trading signals, a winning provider will usually make you more money than the cost of the service, especially if you’re trading a larger account.

Offers a fresh perspective

If you have a bias about where you think a market is heading, then receiving an opposing trading signal might bring you round to the idea that you’re wrong, especially if your provider is more experienced than you. This isn’t a bad thing; if you’re being challenged on your opinions as a trader and can reflect on why a particular trade went wrong, you’re growing your skills.

Alleviate risk

Making decisions on where you think price is headed carries risk; you could be wrong and potentially lose money. Using trading signals alleviates some of this risk as you have another factor to consider that might end up saving you money.

Educational tool

If you’re new to the game, crypto signals might teach you what the pros are thinking. By following their trades and analyzing what worked (or didn’t work), you can incorporate this newfound knowledge into your own strategy and become a better trader.

Cons

Can lose money

Of course, Binance trading signals aren’t a silver bullet to creating wealth. Otherwise, we’d all be driving Ferraris on the way to the bank. Some, mainly free providers, will give subpar signals. In combination with poor risk management, signals can cause you to lose a lot of money if you’re not careful.

Most require upfront payment

If you’re trading a small account, it can be daunting if the provider you’re looking at charges hundreds a month. Even if they’re not, sacrificing a decent amount of money for a service you’ve never tried can be a big ask that many aren’t prepared for.

Placing trust in someone or something else’s opinions

As trading signal services rarely offer free trials (although some do), you end up having to trust opinions. With some scam trading signal services out there, it’s difficult to know whether the reviews have been fluffed up. When you’re actually using a genuine service, you still have to put your faith in a person’s ability to trade well. This effect can be compounded with algorithmic trading signals, where the risk of a software glitch giving you a completely wrong signal can wipe you out.

Not the same as live trading

Unless you’re using crypto signals as a tool alongside your regular trading, signals will never give you the experience you need to become a decent trader. Sure, they will help you find opportunities and learn why something worked, but actually trading an account and forming your own opinions is a much better way to learn how to trade.

Why you should use Binance for trading signals

Binance is the world’s biggest exchange in terms of daily trading volume. Founded in 2017, it’s grown to be the primary exchange for crypto investors, trading around $15b in volume every day. Because of its mammoth size, Binance has over 400 cryptocurrencies for its customers to trade, making it ideal for users of crypto signals that trade a variety of altcoins. Not convinced? Let’s take a look at some more reasons why you should use Binance for trading signals.

Very low fees

Binance has a massive client base and so aims to keep fees low. If you have a monthly trading volume of less than $1m, then Binance charges 0.1%. They also recently announced 0% fees for trading BTC pairs on the spot market. For example, if you’re setting an entry price taken from a Binance trading signal, you’d pay around $2 for a $2000 trade.

If you use Binance’s native token, Binance Coin (BNB), to pay fees, you’ll also pay 25% less than the standard rate. If your signal provider is issuing signals frequently, having an exchange that offers low fees is vital so that these costs don’t affect your profit.

Great deposit/withdrawal options

On Binance, there’s no minimum deposit needed to get started – ideal if you’re just testing a Binance signal. There are also plenty of deposit and withdrawal options, with many deposit options carrying no fees. There are some small fees on certain withdrawal options, but these are minuscule compared to other exchanges.

Easy-to-use layout

While Binance can initially look overwhelming, if you’re just trading signals, it’s actually quite easy to use. We’ll run through how to trade in a second, but after a few trades, the layout becomes intuitive, and trading with it will become second nature.

Futures and Margin accounts

Binance offers both Futures and Margin accounts, which differ slightly but ultimately allow you to leverage your money for greater returns. Some Binance trading signal providers will use leverage to boost profits, particularly if trading on lower timeframes. Be aware that this also increases the potential for losses.

Security

Binance has excellent security features, on top of an insurance fund if the exchange ever got hacked. It features a mandatory 2FA system, which will send you a text or an email with a code every time you log in. If you want to increase security further, it’s possible to require new logins and withdrawals to need an email, text, and authenticator code before proceeding.

Languages

Finally, Binance operates internationally and offers 17 different languages, which means that no matter where you’re from, you’ll be able to set up Binance trading signals on a platform that speaks your language.

How to use Binance for trading signals

Now, let’s learn exactly how to use a trading signal on Binance. We’ll pretend that we’ve received a Binance Futures signal so that you can also understand how to use Binance Futures. If you’re not interested in leverage, the principles are very similar for Spot Trading.

What you’ll need:

- A Binance account. Sign up on the Binance website or the Binance.US website if you’re from the U.S. You’ll need to pass Know-Your-Customer (KYC) to begin trading.

- Funds. We’d recommend depositing $50 to start with, although you can deposit as much or as little as you like.

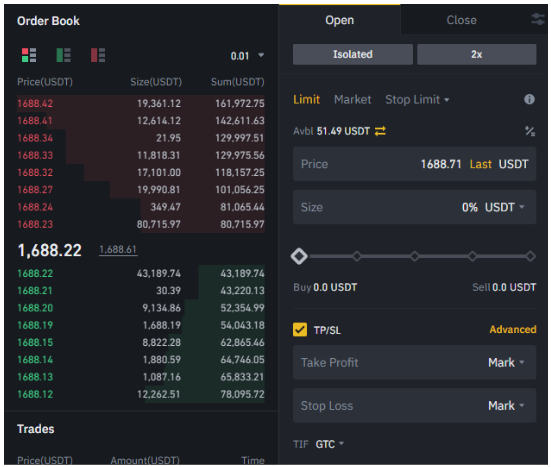

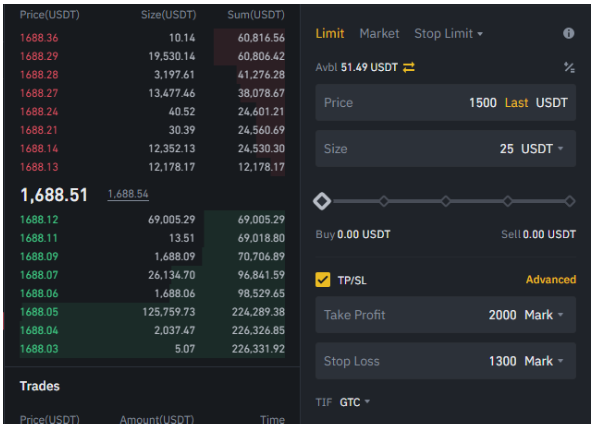

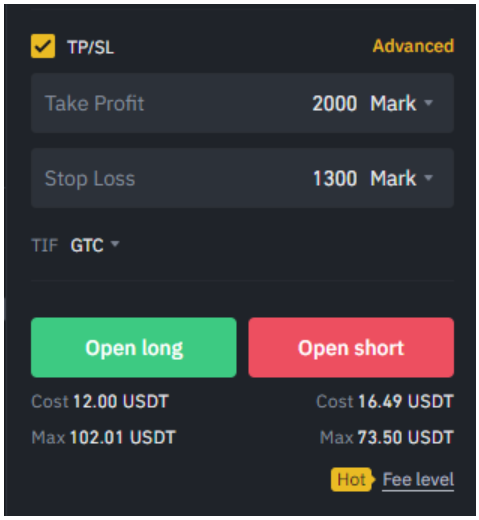

- A Binance trading signal. We’ll say that the FXLeaders team has issued an alert to buy Ethereum (ETH) at $1500 using 2x leverage, with a target of $2000 and a stop loss of $1300.

1. Find USD-M Futures on the homepage. It’s under Derivatives. If you’re not using leverage, click Spot under Trade.

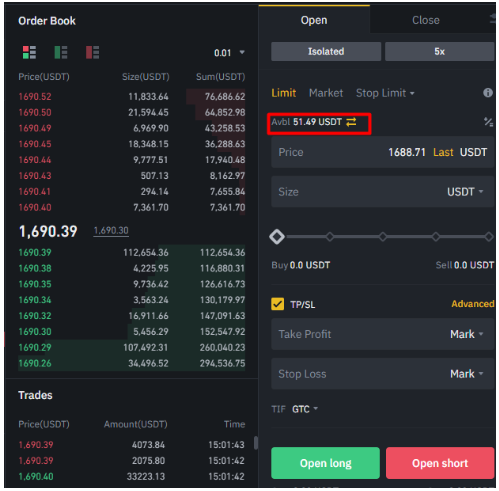

2. If you need to move money into your Futures account, tap the arrows in the trading ticket on the right of the trading terminal, then transfer money from your Spot account to your Futures account.

3. Navigate to the signal’s pair. When you’re in the trading terminal, click here (the red box). Then, search your pair.

4. With your signal’s parameters in mind, look at the trading ticket on the right-hand side. First, set your leverage and make sure it’s set to isolated. This will reduce your overall risk if you have multiple Binance Future signal positions open at once.

5. Let’s put in the details from our signal. It’s up to you how much of your account you’d like to use with the trade, as it depends on your risk tolerance and how much you would be okay with losing. For us, we’ll say that we want to open a position worth $25.

6. Now, just click Open Long!

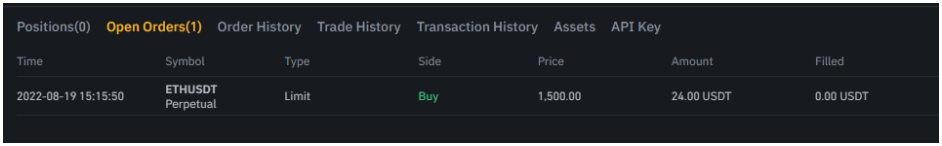

7. Our order now goes to Open Orders and we wait for Ethereum’s price to hit $1500. We can also see our fee being applied to the amount.

The only thing left to do now is to wait for our order to be filled! It’s really that simple to get started with trading crypto signals on Binance. There are more advanced aspects, like taking profit without closing the whole position, that we won’t cover today. In general, the steps above will be the only steps you need for the majority of Binance trading signals.

How to find the best trading signals

Now that we know how to use Binance for trading signals, it’s worth briefly covering how to find the best providers. As mentioned, there are plenty of dishonest providers out there that have been known to fake reviews and winnings. Use the criteria below to help determine if the provider is really up to scratch.

Are they transparent?

Every decent signal provider should be honest about their wins and losses. The last thing you want is a signal provider that claims to have a fantastic win rate with no proof to back it up. Instead, you want someone that admits their losses, as this is a sign they’re genuine.

How long have they been in the game?

If you’re going with a signal provider that’s only been around for a couple of months, the likelihood of something going wrong will increase. They might get bored, or have a bad day and not know how to handle it. Whatever the reason, a seasoned team of professionals (like we have at FXLeaders) with plenty of experience will always be a better choice.

What’s their track record like?

Of course, you want a provider with a good performance history in trading but also as a service. A good provider will likely have a consistent, positive win rate over years of trading, backed up by credible reviews.

Do they offer anything else besides signals?

While some providers will just offer signals, the best will usually offer something alongside them. It could be a trading room, live updates, or the methodology behind a particular trade. If they give you the opportunity to learn alongside making money, then grab the chance with both hands.

Is there a free trial?

Free trials indicate that they’re not just out for your money. They’re looking to grow their business and customer base and believe that you’ll want to buy their service once you see their signals. This shows that they are invested in long-term growth and your profits.

What’s your gut telling you?

Lastly, use your intuition to tell you whether something seems too good to be true. You’ll generally know once you’ve found the right provider because everything will look completely genuine. If you have any doubts whatsoever, stay away. It’s simply not worth the risk.

Our trading signals

At FXLeaders, we offer a set of free and paid crypto trading signals that have performed exceptionally well over the years. They’re crafted by our handpicked team of industry experts that have been in the crypto markets since the beginning. Using a combination of proprietary tools, technical analysis, and fundamental analysis, we’ve built a fantastic strategy that has been consistently netting profits for our followers for years now.

Take a look at some of these pages to find out more:

Crypto Signals

How to Use Our Crypto Signals

Make the Most out of Crypto Trading Signals

We look forward to having you on board!