Last Updated: Jul 01, 2025 03:21:33 PM (GMT)

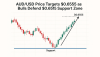

AUD/USD: The current market price is 0.6542, reflecting a marginal change of +0.08% from the previous close. Today’s high-impact international economic events, including USD ISM Manufacturing PMI (forecast: 49.2), may influence market volatility.

Support and Resistance Levels Key support levels are 0.6524, 0.6510, and 0.6500, while resistance levels stand at 0.6550, 0.6570, and 0.6590. The pivot point is 0.6530.

Indicators RSI is currently at 47.71, indicating a neutral momentum. The ADX shows a weakening trend at 18.72, while the 50-day SMA is 0.6540, and the 200-day EMA is at 0.6543. Parabolic SAR indicates an uptrend, with the current SAR at 0.6524.

Market Sentiment With the price below the pivot point (0.6530), the outlook is bearish, supported by RSI and ADX trends.

AUD/USD Signals & Technical Analysis

Market Sentiment

Trend Indicators

Oscillators

Moving Averages

Pivot

About the AUD/USD (Australian dollar & US Dollar)

The AUD/USD pair is the abbreviated term for the Australian dollar and the US dollar, nicknamed Aussie or the Aussie dollar. Before we get into the particulars, what exactly does the term AUD/USD mean?

The exchange rate tells you how many US dollars (quote currency) are required to purchase one Australian dollar (base currency). For example, if the pair is trading at 0.73, it takes 0.73 US Dollars to buy 1 Australian Dollar.

The Australian dollar is known as a commodity currency due to the role of Australia in global commodity production and export, trading in metals, fuel, meat and other raw materials. For example, AUD/USD exhibits a long-term positive correlation with the value of gold. Since the Australian dollar is a first currency (base currency), the pair is called a direct currency.

Breaking Down ‘AUD/USD’

AUD/USD is the fourth most actively traded currency pair, representing around 7% of total forex market turnover. Its popularity is due, in part, to Australia’s political and economic stability, as well as the government’s limited interventions in the forex market. Despite this, it isn't one of the six currencies that form the US dollar index (DXY).

It was first introduced in 1966, replacing the Australian pound. At the time, it was pegged to the British pound at a rate of $2 to £1. After abandoning this peg and moving to the U.S. dollar in 1967, it eventually moved to become a free-floating (not pegged) currency in 1983.

What Determines the AUD/USD Exchange Rate?

There are two main factors that determine the AUD/USD exchange rate:

Reserve Bank of Australia and U.S. Federal Reserve Monetary Policy:

The Reserve Bank of Australia and Federal Reserve control the supply of money in the market to keep the economy on track. A dovish policy, also known as expansionary policy, weakens the currency as the monetary supply increases. In contrast, a hawkish monetary policy (contractionary policy) strengthens the currency as central banks increase interest rates, contracting the monetary supply.

Economic Events:

Any movement in the U.S. and Australian economic events determines the exchange rates. Top-of-the-line economic events include:

- Gross Domestic Product (GDP).

- Employment data, like Unemployment Rates and Non-Farm Payrolls (U.S. only).

- Industrial Output data.

- Consumer Price Index (CPI) and Producer Price Index (PPI), particularly in Australia.

- Export and International Trade data.

Better than forecast data increases the demand for the related currency and impacts the value of either the Australian dollar or the U.S. Dollar, causing fluctuations in the AUD/USD exchange rate as investors rush in to buy either currency.

Let’s take a closer look at some of these events.

Gross Domestic Product

The Gross Domestic Product (GDP) is a central measure of economic growth in the region and is the forerunner of U.S. and Australian economic prosperity.

Employment Change

The U.S. dollar and Aussie dollar are both sensitive to changes in employment, as both typically like to maintain low levels of unemployment. High unemployment typically indicates weakness in the economy and drives the respective currency down.

Consumer Price Index

Since one of the main goals of the RBA is to maintain price stability, they keep an eye on inflation indicators such as the CPI. If the annual CPI deviates from the central bank target of 2-3%, the RBA could use its monetary policy tools to keep inflation in check.

Export and International Trade Data

The Australian economy is heavily dependent on trade, accounting for one-fifth of GDP, with its top trade partner, China, relying on Australian imports of coal, oil, and gold. Changes in the rate of imports and exports can significantly affect the Australian economy and its currency.

Other AUD/USD Price Factors

These aren’t the only factors, however. There are others, such as:

Metal, grain, and other commodity production

Australia is a largely commodity-driven economy, exporting cereal grains, meat, aluminum, iron, gold, and various other commodities. If data shows that production is falling, perhaps due to reduced demand from their importers, this is a negative sign for the Australian economy.

Demand in other countries

As Australia is a massive supplier of raw materials to Asia, knock-on effects can be felt in the Australian economy. For example, if the U.S. reduces its imports from China, China will produce less and demand fewer supplies from Australia, weakening demand for the Australian dollar.

Commodity prices

When commodity prices are high, this typically creates recessionary pressures in importing countries like Europe, the U.S., and Japan. However, higher commodity prices are often good for the Australian economy and can cause it to look healthier when the rest of the world is struggling. This makes AUD an attractive place to put your money when times are tough.

Carry trades

Carry trades are a phenomenon often seen in Japan, where investors will take advantage of ultra-low interest rates to borrow in Yen and invest in other countries. Because Australia typically carries higher interest rates, converting that Yen into the Australian dollar and investing in AUD-denominated assets can provide a yield even if the pair doesn’t move a cent. Overall, this increases the demand for AUD.

Natural disasters

As Australia is effectively a vast desert, with only 10% being habitable by humans, wildfires, cyclones, and floods are common. Events like these can cause tremendous destruction and disruption to Australia’s vital commodity production.

Currency correlation

AUD/USD shares several currency correlations, particularly with its neighbor New Zealand, with NZD/USD holding a 97.1% correlation. It also has a slight correlation with the price of crude oil, which Australia is a small exporter of, and gold. Gold prices are highly correlated with AUD (although this does weaken from time to time), as Australia is the third biggest gold excavator in the world.

AUD/USD Recent Events

Coronavirus

While millions stayed home in Australia and the U.S. as Covid took hold, economic activity plummeted in both of these service-oriented economies. As investors fretted over the impacts of the pandemic on commodity exports, AUD/USD plunged while investors looked for safe-haven assets to put their money in.

Rate Hikes

As inflation has picked up in both economies, the RBA and Fed have been keen to raise interest rates to slow spending. The Fed has been more aggressive in its interest rate hikes, meaning that demand for the dollar has picked up while AUD has lagged behind, causing AUD/USD to drop.

Inflation

While inflated prices at home have prompted rising interest rates, rising commodity prices have somewhat boosted the Australian dollar. As commodities rose in the wake of the Russia-Ukraine conflict, the pair opened at 0.71 at the start of 2022 and crossed 0.75 by April.

Lack of Chinese demand

Being Australia’s top trading partner, the performance of China and its level of demand is vital. When demand drops, so does the Aussie dollar. As China faces its own headwinds and a resurgence of Covid cases and lockdowns, AUD/USD has declined on releases of poor Chinese economic data.

AUD/USD Specifications

The AUD/USD is traded in amounts denominated in the US Dollar.

Standard lot Size: 100,000

Mini lot size: 10,000

One pip in decimals 0.0001

Pip Value: $10

Formula

Profit/Loss = (Bid Price – Ask Price) X Contract Size X Number of Lots

Sidebar rates

- <% signal.pair %>