XM Review

- XM Review - Analysis of Brokers' Main Features

- Overview

- Detailed Summary

- Safety and Security

- Reviewed Account Types

- How To Open an Account

- Trading Platforms and Software

- Fees, Spreads, and Commissions

- Which Markets can You trade?

- XM Leverage and Margin

- XM Deposit and Withdrawal

- Educational Resources

- Pros and Cons

- Conclusion

Overall, XM can be summarised as a highly regulated Forex Broker specializing in Forex and CFD. XM offers access to 55 currency pairs, excellent customer support and it has a trust score of 97 out of 99.

| 🔎 Broker | 🥇 XM |

| 💴 Minimum Deposit | $5 USD |

| 🎁 Bonus Offers | ✅Yes |

| 📈 Account Types | Micro Account, Standard Account, XM Ultra-Low Account, Shares Account |

| ⏰ Support Hours | 24/7 |

| 🆓 Demo Account | ✅Yes |

| 🚀 Open an Account | 👉 Click Here |

XM Review – Analysis of Brokers’ Main Features

- ☑️Overview

- ☑️Detailed Summary

- ☑️Safety and Security

- ☑️Account Types

- ☑️To Open an Account

- ☑️Trading Platforms and Software

- ☑️Fees, Spreads, and Commissions

- ☑️Which Markets Can You Trade with?

- ☑️Leverage and Margin

- ☑️Deposit and Withdrawal

- ☑️Educational Resources

- ☑️Pros and Cons

- ☑️Conclusion

- ☑️Frequently Asked Questions

Overview

This broker is a renowned online firm specializing in forex and CFD trading. Founded in 2009, this broker’s Group has become a significant player in the trading world by offering its clients a diverse range of products.

It operates under regulation from various financial authorities, including the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Investments Commission (ASIC), and the International Financial Services Commission Belize (IFSC).

This provides traders with additional trustworthiness and security when dealing with them. One of its differentiating aspects is its user-centric strategy, which provides clients with diverse trading products.

This includes over 55 currency pairs in the Forex market and a broad selection of CFDs on commodities, precious metals, energy, and equity indexes. Such an extensive portfolio caters to various trader interests and offers numerous options for diversification investing techniques.

XM is also distinguished for its excellent technology infrastructure. The broker provides the popular MetaTrader 4 and MetaTrader 5 platforms, which are noted for their reliability and extensive analytical tools.

Detailed Summary

| 🔎 Broker | 🥇 XM |

| 📈 Established Year | 2009 |

| 📉 Regulation and Licenses | FSCA, IFSC, ASIC, CySEC, DFSA, FCA |

| 📊 Ease of Use Rating | 5/5 |

| 🎁 Bonuses | $30 no-deposit bonus, Trade and Win, Referral Program, 50% + 20% deposit bonus |

| ⏰ Support Hours | 24/7 |

| 🖱️ Trading Platforms | MetaTrader 4, MetaTrader 5, XM App |

| ⚙️ Account Types | Micro Account, Standard Account, XM Ultra-Low Account, Shares Account |

| 💴 Base Currencies | USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, ZAR |

| 📌 Spreads | From 0.6 pips (XM Ultra-Low Account, EUR/USD) |

| 📍 Leverage | 1:1000 |

| 💵 Currency Pairs | 55, minor, major, and exotic pairs |

| 💶 Minimum Deposit | $5 USD |

| 💷 Inactivity Fee | Yes, $15 once-off after 12 months of inactivity, then $5 per month |

| 🥰 Website Languages | English, Malaysian, Chinese Simplified, Chinese Traditional, Russian, French, Italian, German, Polish, Spanish, Portuguese, and several others |

| 💰 Fees and Commissions | Spreads from 0.6 pips, commissions from $1 per Share |

| 🤝 Affiliate Program | ✅Yes |

| ❌ Banned Countries | The United States, Canada, Israel, the Islamic Republic of Iran |

| ✔️ Scalping | ✅Yes |

| ↪️ Hedging | ✅Yes |

| 📐 Trading Instruments | Forex, cryptocurrencies, stock CFDs, commodities, equity indices, precious metals, energies, individual shares, Turbo Stocks |

| 🚀 Open an Account | 👉 Click Here |

Can I trust XM with my investments?

Yes, you can trust it with your assets because it is regulated by numerous recognized financial bodies, including CySEC, ASIC, and IFSC, which ensure high financial rules and practices are followed.

What kind of trading do they specialize in?

XM specializes in forex and CFD trading, providing various goods such as currency pairings, commodities, equities indexes, and precious metals.

Safety and Security

This broker is dedicated to furnishing its clientele with a safe trading milieu and utilizes several advanced security features.

Firstly, they meticulously adhere to stringent regulatory norms and operate under the surveillance of multiple financial regulating agencies such as CySEC, ASIC, and IFSC. This conformity guarantees compliance with elevated fiscal standards alongside optimal operational transparency.

Regarding digital security, XM employs resilient data encryption methods throughout its trading platforms to safeguard customers’ personal and financial details.

This encompasses SSL (Secure Socket Layer) technology that encrypts information transferred between client devices and XM servers, effectively forestalling any interception or unauthorized access.

They have also implemented two-factor authentication (2FA) for account access, adding an extra security layer beyond the username and password.

This feature dramatically minimizes the chance of illegal account access by requiring a second form of verification, which is often a code sent to the client’s mobile device.

They protect funds in financial transactions by using segregated accounts. This means that clients’ funds are kept separate from the company’s operational funds, which protects them in the unlikely case of the broker’s financial instability or insolvency.

How do they ensure the security of my personal information?

Protects your personal and financial information from illegal access with powerful data encryption technologies such as SSL technology.

What measures does XM take to safeguard my funds?

It safeguards customer funds by keeping them in segregated accounts, separate from the company’s operations cash, in case of the broker’s financial issues.

Reviewed Account Types

| 🔎 Account Type | 🥇 Micro Account | 🥈 Standard Account | 🥉 XM Ultra-Low Account | 🏅 Shares Account |

| ☑️ Best Suited | Ideal for beginners | Ideal for casual traders | Ideal for day traders, scalpers | Ideal for longer-term strategies and investment |

| 📈 Markets | All | All | All | Shares, Share CFDs |

| 💴 Commissions | None | None | None | $1 per share |

| 📉 Platforms | All | All | All | All |

| 📊 Trade Size | 0.01 – 100 lots | 0.01 – 50 lots | 0.01 – 100 lots | 1 – 50 lots |

| 💶 Minimum Deposit | 5 USD | 5 USD | 5 USD | 10,000 USD |

| 🚀 Open an Account | 👉 Click Here | 👉 Click Here | 👉 Click Here | 👉 Click Here |

Micro Account

This is an excellent choice for new traders entering the forex markets with a small initial commitment. This account is designed to facilitate trading in smaller lot sizes, with lots consisting of 1,000 units of the base currency, much smaller than the typical 100,000 units.

It caters to a global audience by providing diverse base currency options such as USD, EUR, and GBP. The leverage ratio adjusts according to the account balance, offering flexibility and a controlled environment for risk management.

Notably, this account type includes negative balance protection, an average spread of 1.7 pips for key pairs such as EUR/USD, no commission fees, and a high limit of 300 lots for maximum open or pending orders.

On MetaTrader 4 and 5, the minimum trade volume is 0.1 lot, allowing for hedging and accommodating Islamic traders through a particular account option. The lowest deposit requirement is only $5, making it affordable for beginners.

Standard Account

It is designed for a broader range of traders, from beginners to more seasoned investors. It streamlines trading by focusing on simple bid-and-ask prices free of additional commission expenses.

This account allows trading in typical lots of 100,000 base currency units and supports the same base currencies as the Micro Account. Like the Micro Account, it offers customizable leverage settings based on account balance, ensuring appropriate risk management for various trading methods.

The account retains the same average spread of 1.7 pips on key currency pairings such as EUR/USD while charging no commissions. The maximum number of open or pending orders is limited to 300 lots, with a minimum trade volume of 0.1 lot.

Hedging is permissible, and the account has an Islamic Account option. The minimum deposit remains $5, making it an intriguing option for traders seeking a blend of usefulness and affordability.

Ultra-Low Account

This is a specialized offering for currency pair traders seeking competitive pricing. It offers slender spreads starting at 0.7 pips for commonly traded pairs like EUR/USD and a commission-free structure.

Traders can choose between Standard Ultra, which involves a position size of 100,000 units, and Micro Ultra, which caters to smaller trading volumes of 1,000 units.

The account maintains the same leverage choices as its predecessors, ensuring adaptability to different account sizes and risk preferences. The Ultra-Low Account also includes negative balance protection for retail accounts, ensuring traders’ losses do not exceed their account balance.

It allows for many open or pending orders, with a cap set at 300 items, allowing traders to execute their trading strategies.

Shares Account

The Shares Account directly exposes traders to major firms and banks. This account type converts traders into shareholders, entitling them to dividends proportional to their investment.

It operates without leverage, purely on the MT5 platform, and is only available through XM businesses regulated by the Belize FSC.

The account is only denominated in USD and allows you to trade individual shares. It does not support negative balance protection and has a spread set by the stock exchange. Commissions start at $1 per share, with a limit of 50 lots for open or pending orders.

The minimum transaction volume is 1 lot, and hedging is not permitted. The account has a lot of limits based on each share and offers an Islamic Account option. The minimum deposit is $10,000, much more than other account types, reflecting the account’s concentration on more serious, equity-oriented traders.

Demo Account

Furthermore, the Demo Account provides a risk-free introduction to XM’s trading environment, allowing new traders to practice and improve their trading skills. This trial account uses virtual funds to simulate real-market circumstances without putting any money at risk.

Traders can use XM’s trading interface to test strategies for various markets, including forex, indices, stocks, and commodities. It is vital to remember that this account has a limited lifespan; if it is inactive for more than three months, it will expire. This feature promotes constant engagement and learning.

Islamic Account

Their Islamic Account is accessible in all three primary account types: micro, standard, and ultra-low. It meets the needs of Islamic traders by providing a swap-free trading environment with no additional fees.

This is a notable divergence from industry norms, as brokers frequently charge administrative fees rather than swaps on Islamic accounts.

Clients who use the MetaTrader 4 or MetaTrader 5 platforms provided by Trading Point of Financial Instruments Ltd. (Cyprus) can choose this account to ensure compliance with Islamic finance principles while accessing the entire range of XM’s trading services.

Does XM offer an account type with ultra-low spreads?

Indeed, They offer an Ultra-Low Account with spreads as low as 0.6 pips on the EUR/USD currency pair.

Are there different leverage options available across all account types?

They offer numerous leverage possibilities, including up to 1:1000 for smaller account balances, which vary according to the account type and size.

How To Open an Account

- Go to their website and click “Open a Real Account.”

- Choose an account type.

- Complete the account application form.

- Select a trading platform (MT4 or MT5).

- Specify an account leverage.

- Verify your identity.

- Fund your account.

- Once your account has been validated, you can fund it with various methods, including bank wire transfers, credit cards, and e-wallets.

What documents do I need to open an account?

To open an account with XM, you must supply identification documents such as a passport or ID card and proof of residency in the form of a utility bill or bank statement.

How can I register for an Ultra-Low Account?

You can sign up for an Ultra-Low Account by going to the website, clicking ‘Open a Real Account,’ selecting the Ultra-Low Account option, and following the registration steps.

Trading Platforms and Software

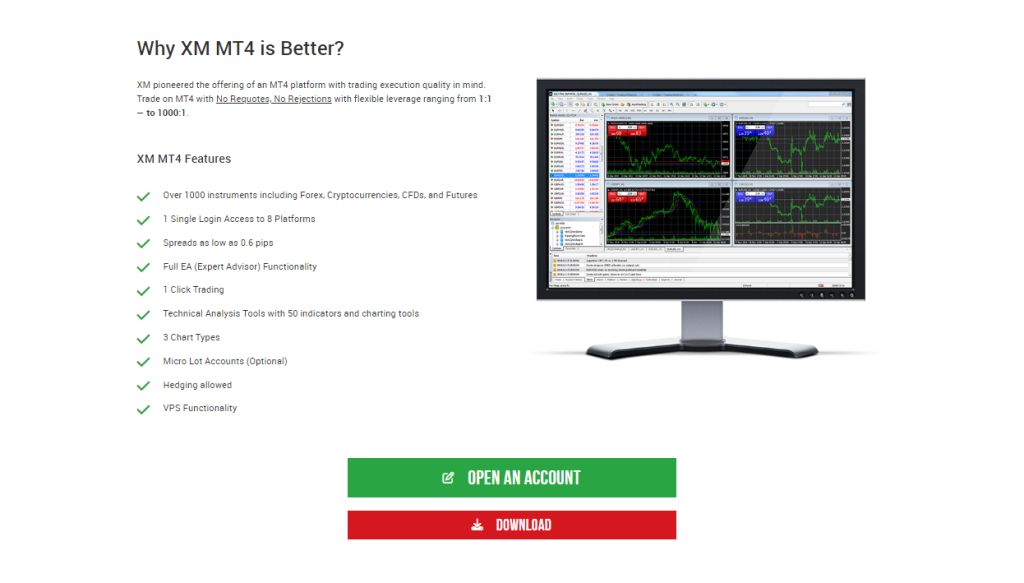

MetaTrader 4

This broker offers MetaTrader 4 (MT4), a platform that has garnered widespread acclaim among traders on a global scale. The popularity of MT4 can be attributed to its seamless blend of user-friendliness and robust functionality.

Notably, MT4 distinguishes itself through its adaptable interface, permitting users to tailor the platform’s layout to align with their preferences, enhancing their overall trading experience.

A key hallmark of MT4 is its inclusivity. It accommodates an extensive spectrum of languages, rendering it accessible to a diverse and international audience. This multi-language support underscores the platform’s commitment to catering to the needs of a global clientele.

MT4 further bolsters its reputation by incorporating advanced technical analysis tools. These tools are indispensable for traders, as they provide access to various time frames, a rich array of indicators, and essential drawing tools that are instrumental in conducting comprehensive market analyses.

MetaTrader 5

MetaTrader 5 represents a significant advancement over its predecessor, incorporating additional features and capabilities. Designed to accommodate the needs of both novice and seasoned traders, MT5 offers an expanded toolkit for market participants.

A notable enhancement is introducing support for both hedging and netting, affording traders a broader spectrum of choices in devising their trading strategies. This versatility enables traders to align their tactics precisely with their specific objectives.

Further enhancing its utility, MT5 incorporates an economic calendar as a valuable resource for staying abreast of market events and news.

This feature gives traders the insights to make more informed and calculated trading decisions, thereby mitigating risks and maximizing opportunities.

Mobile App

The mobile application is meticulously crafted to deliver an uninterrupted and seamless trading experience to users on both Android and iOS devices. It places a paramount emphasis on security, offering login options based on device compatibility, such as fingerprint and face recognition.

This not only ensures a high level of security but also enhances the convenience of access.

One of the app’s standout features is its ability to provide real-time notifications and alerts about market dynamics and account updates. This feature enables traders to remain well-informed, even away from their workstations.

Furthermore, the application equips users with essential charting and analytical tools at their fingertips, granting easy access to critical information indispensable for informed decision-making.

In addition to its robust analytical capabilities, the mobile app boasts extensive trading functionality. Users can effortlessly execute trades, swiftly manage positions, and monitor real-time prices, facilitating sound trading decisions regardless of location.

What trading platforms do they offer?

They provide the industry-standard MetaTrader 4 and MetaTrader 5 platforms.

Is there a mobile trading option available?

They offer trading on Android and iOS smartphones, providing capabilities.

Fees, Spreads, and Commissions

Spreads

They have designed its spread structure to be flexible and responsive to various trading styles and preferences. The brokerage firm offers variable spreads that adjust in line with market conditions, effectively emulating the dynamic environment of interbank forex markets.

For high-profile currency pairs such as EUR/USD, XM’s competitive edge is reflected by exceptionally low spreads starting from just 1 pip.

However, it should also be noted that the exact amount varies depending on account type – traders utilizing an Ultra-Low account will typically benefit even further from reduced costs.

It is recommended that individuals looking into or engaged in frequent trades or those following scalping strategies pay special attention to this aspect as it can significantly impact their overall transactional expenses.

Commissions

Their compensation framework varies depending on the type of account and traded instrument. Popular types of accounts, such as Micro, Ultra-Low, and Standard Accounts, do not incur commission fees for forex or CFD transactions due to them factoring in their fees into spreads that are raised proportionately to operational expenses.

Conversely, traders utilizing Shares Account should expect a vastly different fee system structure: commissions start at $1 per share for stocks like Amazon or Apple, followed by incremental increases based on stock liquidity before reaching up to $9 per share on other instruments.

This tiered approach reflects discrepancies associated with trading volumes derived from distinct shares’ levels of market fluidity, thereby contributing to differing costs levied during trades involving varying financial instruments via XM.

Overnight Fees

Overnight fees, also known as swap fees, are a crucial part of trading with this broker, particularly for positions held overnight.

These fees differ depending on several parameters, including the type of financial instrument, the direction of the position (long or short), and the magnitude of the trade. For example, a long position in EUR/USD results in a swap of -8.48 pips, while a short position results in 1.52 pips.

Similarly, the long swap on the US100 Cash is -3.29 pips, while the short swap is 0.63 pips. For XAU/EUR, the long swap is -21.46 pips, while the short swap is 15.81. NGAS Cash costs are -0.6 pips for long positions and -2.37 pips for short positions.

Understanding overnight fees is critical for traders looking to manage their trading costs and overall profitability efficiently.

Deposit and Withdrawal Fees

An advantage aspect of trading with them is the absence of deposit or withdrawal charges. In essence, traders have unhindered liberty to transfer their funds within and outside their respective trading accounts without bearing supplementary expenses from this broker.

Through this strategy, the overall quality of a trader’s experience is improved by curbing operational costs, enabling them to manage and allocate capital resources while maintaining efficiency adeptly.

Inactivity Fees

They have implemented a charging scheme for dormant accounts. If a live trading account falls dormant after 12 months, it is subject to a $15 maintenance fee. Following the initial charge, the account incurs a $5 monthly inactivity fee.

This cost applies as long as the account is dormant. Traders should know these costs and manage their accounts properly to avoid excessive expenses.

Currency Conversion Fees

Additionally, transaction costs associated with currency conversion apply to traders who engage in transactions involving multiple currencies. Such a fee is levied on deposits or withdrawals made by traders in non-base account currencies.

This cost varies depending on the specific currency pair and is calculated using prevailing exchange rates.

Therefore, it is vital for traders to fully comprehend these expenses, as they can significantly impact overall trading costs, especially when dealing with varying foreign denominations.

Are there withdrawal fees when I take money out of my account?

No, They do not charge withdrawal fees, so you can transfer funds from your account without incurring additional charges.

What kind of fees should I expect for inactivity on my account?

They charge a one-time $15 inactivity fee after 12 months of dormancy, followed by a $5 monthly fee if the account stays inactive.

Which Markets can You trade?

They provide a choice of 55 currency pairs, including major, minor, and exotic currencies. Furthermore:

- 31 cryptocurrencies

- 1,337 stock CFDs

- 8 commodities

- 20 equity indices

- 5 precious metals

- 8 distinct energy commodities

Additionally, the platform provides direct access to 100 individual shares, enabling traders to participate in specific companies.

What types of forex pairs can I trade with XM?

They allow you to trade over 55 forex currencies, including, pairs

Can I trade cryptocurrencies?

Yes, trade around 30 cryptocurrencies as CFDs.

XM Leverage and Margin

They provide a range of leverage choices, from conservative 1:1 to aggressive 1000:1, from beginners to expert traders. With this versatility, you may adjust your trading strategy to your risk tolerance and capital.

However, handling XM’s leverage and margin system necessitates thoroughly comprehending the subtleties.

Understanding Leverage

Leverage effectively increases your trading power, allowing you to handle positions much greater than your deposited cash. Consider having $1,000 and utilizing 100:1 leverage to trade a currency pair such as EUR/USD.

This leverage effectively converts $1,000 into $100,000 of trading power. This increased gain potential increases potential losses.

Margin Explained

Moreover, the margin is the amount of money required to maintain a leveraged position. In the preceding example, with 100:1 leverage and a EUR 100,000/USD trade, your margin would be $1,000 (1% of $100,000). This effectively serves as a security deposit for your broker, covering any potential losses.

Dynamic Leverage

Leverage on certain assets at XM, such as cryptocurrency, is dynamic and adjusts in response to trading activity. As volume increases, so does the required margin percentage, resulting in less effective leverage. This helps to manage risk in volatile markets.

Leverage and Account Equity

Your account equity is the total worth of your trading account, which includes both open positions and available funds.

As your positions change, so does your equity. Maintaining adequate free margin (the gap between used margin and total equity) is critical for avoiding margin calls and potential stop-outs.

Margin Calls and Stop-Outs

Margin calls notify you when your account equity falls below a specific threshold (50% of the required margin), suggesting the possibility of surpassing your available funds.

If you do not reply to the call by adding funds or selling positions, your broker may automatically close positions (stop-out) to safeguard your account from future losses.

Leverage Risks

While leverage might boost earnings, it can also dramatically increase losses. Using excessive leverage without effective risk management might rapidly empty your account. They suggest avoiding high leverage, especially for novices.

Choosing the Right Leverage

Risk tolerance, trading expertise, and instrument choice determine the optimum leverage. Start with lower leverage if you are new to trading or want a more conservative approach. Remember, leverage is a tool, so use it carefully.

Managing Leverage Responsibly

This broker provides tools such as stop-loss orders and risk management resources to assist you in efficiently managing leverage. Use these tools with a well-defined trading strategy to reduce risk and optimize your trading opportunities.

Is leverage available for all trading instruments?

Indeed, most of their trading instruments allow for leverage, but the maximum leverage amount varies depending on the account type and the item being traded.

What happens if my account falls below the required margin?

If your account falls below the needed margin, they will send a margin call; if levels continue to decrease, your positions may be immediately canceled to avoid further losses.

XM Deposit and Withdrawal

| 🔎 Payment Method | 🌎 Country | 💰 Currencies Accepted | ⏰ Processing Time |

| 💳 Credit Card | All | USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, ZAR | Instant – 5 days |

| ↪️ Debit Card | All | USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, ZAR | Instant – 5 days |

| 📈 Bank Wire Transfer | All | USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, ZAR | 1 – 5 days |

| 📉 Local Bank Transfer | All | USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, ZAR | 1 – 5 days |

| 📊 Skrill | All | USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, ZAR | Instant – 1 day |

| 📌 Neteller | All | USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, ZAR | Instant – 1 day |

| 📍 WebMoney | All | USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, ZAR | Instant – 1 day |

Moreover, here is an overview of how to deposit to XM via the most popular Deposit Options:

Bank Wire

- Navigate to the “Funding” area of your Member Area.

- Select “Bank Wire Transfer” as the deposit method.

- Select your selected currency and enter the deposit amount.

- Download and complete the wire transfer instructions specific to your bank.

- Make the transfer from your bank account using the information supplied.

- Inform the broker about the transfer via their web form or email (optional).

Credit or Debit Card

- Select “Credit/Debit Card” as your deposit method in the “Funding” section.

- Enter your card information (number, expiration date, CVV), currency, and amount.

- Verify your identity using the requested SMS or OTP code.

- Click “Deposit” to authorize the transaction using your bank’s security system.

- Funds should be immediately credited to your account.

Cryptocurrency Wallets

- Select “Cryptocurrency Wallets” from the “Funding” menu.

- Select your desired cryptocurrency (Bitcoin, Ethereum, Litecoin, etc.).

- Enter the amount you want to deposit and copy the created cryptocurrency address.

- Open your cryptocurrency wallet and transfer it to the given address.

- The funds should be reflected in your account within minutes, subject to network confirmation times.

e-wallets or Payment Gateways

- Select your preferred e-wallet or payment gateway in the “Funding” section.

- Log in to your preferred provider or establish an account if necessary.

- Enter your deposit amount and follow the on-screen instructions to confirm.

- Following a successful transaction, funds should be instantly credited to your account.

Here is an overview of how to make a Withdrawal from XM via the most popular Withdrawal Options:

Bank Wire

- Obtain access to your XM account.

- Go to the “Withdrawal” area and choose the “Bank Wire” withdrawal option.

- Additionally, you must enter your bank’s name, account number, SWIFT or BIC code, and any other necessary information along with the withdrawal amount.

- Review and verify the transaction. Processing bank wire withdrawals could take two to five business days.

Credit or Debit Card

- Navigate to the ‘Withdrawal‘ area after logging into your account.

- Select “Debit or Credit Card” as the mode of withdrawal.

- Choose the card you want to use and enter the amount you would like to withdraw.

- Verify the information and submit your request.

Cryptocurrency Wallets

- Log into your trading account.

- In the ‘Withdrawal‘ column, choose ‘Cryptocurrency Wallet.’

- Input the withdrawal amount and the wallet details for your cryptocurrency.

- Verify the information and send in your withdrawal request.

- The withdrawal may take longer to reach your cryptocurrency wallet.

e-wallets or Payment Gateways

- Go onto the platform and log into your account.

- Select your preferred e-wallet or payment gateway under the’ Withdrawal’ section (Skrill, Neteller, etc.).

- Indicate the withdrawal amount and provide any required e-wallet information.

- Review and verify the withdrawal. E-wallet withdrawal requests are often handled in a day or two.

How can I deposit into my trading account using a bank wire?

Go to your Member Area, select ‘Bank Wire Transfer’ as the deposit method, and then follow the on-screen instructions to complete the transfer.

Are there any fees for withdrawing from my XM account to my credit card?

No, there are fees for withdrawing funds to a credit card. However, your bank may charge transaction costs.

Educational Resources

In addition, XM Live is a dynamic platform facilitating daily interactions between traders and esteemed financial market professionals. This comprehensive offering includes live webinars, Q&A sessions, and real-time trading displays in specialized segments like “Pip my Trades.”

The platform also fosters engaging dialogues about equities and innovative market concepts. It offers an elaborate schedule for its live education programs and free live currency webinars in several languages, seven days a week.

Are there educational resources available in multiple languages?

Yes, instructional tools, like webinars and tutorials, are available in multiple languages, serving a global audience.

What types of educational resources do they offer for beginner traders?

They provide a variety of educational materials for beginners, such as educational videos, platform tutorials, and live education sessions in the Beginner Room.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| XM provides both MetaTrader 4 and MetaTrader 5, which are known for their cutting-edge technology and user-friendly interfaces | The forex fees are average compared to other brokers, which may be a disadvantage for forex traders |

| XM offers trading in over 1,000 financial instruments across many asset classes | XM's product portfolio is less competitive than other major brokers |

| XM employs variable spreads to provide traders with tighter and more accurate quotes | XM charges an inactivity fee |

| XM offers 24/7 customer care in 30 languages, allowing for secure connection with a dedicated team | XM services are unavailable in Iran, Somalia, Afghanistan, North Korea, Canada, and the United States |

| XM provides a few account types, including Ultra-Low, Micro, Standard, and Zero accounts, to fulfill the needs of different traders | FCA regulations prevent UK clients from trading cryptocurrency CFDs |

| XM provides instant deposit and withdrawal options, including bank transfers, credit cards, and e-payments like Skrill and Neteller, with no fees | XM's maximum leverage varies per client jurisdiction, potentially limiting trading methods for certain traders |

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA | USD 100 | Visit Broker >> |

| 🥈 |  | Read Review | FMA, FSA | USD 50 | Visit Broker >> |

| 🥉 |  | Read Review | FSCA, CySEC, DFSA, FSA, CMA | USD 0 | Visit Broker >> |

| 4 |  | Read Review | ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB | USD 200 | Visit Broker >> |

| 5 |  | Read Review | FCA, CySEC, FSCA, SCB | USD 100 | Visit Broker >> |

| 6 |  | Read Review | CySEC, MISA, FSCA | USD 25 | Visit Broker >> |

| 7 |  | Read Review | CySEC, FCA, FSA, FSCA, Labuan FSA | USD 100 | Visit Broker >> |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker >> |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker >> |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker >> |

Conclusion

Moreover, according to our research, they stand out as a forex and CFD broker with a strong reputation thanks to their adherence to regulatory standards and commitment to offering a safe trading environment.

Yes, they have various leverage options.

Occasionally they give bonuses and promotions to new and existing customers.

They are a safe broker, And multiple reputable financial regulators, resulting in a secure trading environment.

The fees and commissions differ depending on the account type and the instruments traded. They often provide competitive spreads with low fees.

They provide multilingual customer service around the clock via various channels such as live chat, phone, and email.

Withdrawals normally take 24 hours to process, though this can vary based on the withdrawal type and the client’s bank processing times.

They provide a range of account types to accommodate different trading styles and needs, such as Micro, Standard, Ultra-Low, and Share accounts.

They are situated in Limassol, Cyprus, and are regulated by the Cyprus Securities and Exchange Commission.

They offer numerous educational tools, such as webinars, articles, and video lessons.

They allow clients to trade various financial assets, including over 55 FX currency pairs, numerous CFDs on stock indices, commodities, precious metals, energy, and over 30 cryptocurrencies.

The minimum deposit is $5, providing flexibility for experienced and inexperienced traders.

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |

XM is a very safe broker and I do not think any trader out there doubts it. The broker is very popular amongst traders for good reason.

Yeah… thats very true. I do not think I have met a trader yet who does not know the broker. However, I think it might have to do with region… it might be more popular in some regions than others. I have not traveled everywhere, but I am just making an intelligent guess since that is how most things are.

Nice and comprehensive review. I am glad that the broker I recently chose to trade has an excellent rating. I mean I explored a lot before I made the decision, and what sealed the deal for me was their promotions. You start immediately with a $30 no-deposit bonus, and then a two-tier bonus of 50% and 20% is waiting for you when you deposit your trading account.

XM offers a lot of types of trading accounts with various beneficial conditions and I am sure everyone will find a suitable account that aligns with their trading strategies.

I chose the ultra low standard account and there are low spreads starting from 0,6 pips, high leverage up to 1:1000 and hedging mode allowed. By the way, the minimum deposit threshold is 5$.

XM’s platform offers a lot of advanced features and tools. This is great for experienced traders looking for a powerful platform, but would love 24/7 support instead of 24/5 as I Trade over the weekends.

XM’s got everything I want to trade, from forex to stocks, but sometimes their support takes a while to get back to me.

I love the variety XM offers – it keeps my portfolio interesting. Just wish their customer service was a bit faster.

Can’t complain about XM’s selection of instruments – it’s huge. But sometimes I get stuck waiting for support to answer my questions.

XM’s the place to be if you like to trade a bit of everything. Just be prepared to wait a bit if you need help.

I’ve diversified my portfolio nicely thanks to XM’s wide range of instruments. However, their customer service could be more responsive.

Good day Chloe,

Thank you for your review. XM takes customer service very seriously I am sure the will improve and investigate this matter. We are glad to hear that they are providing a wide range of instruments to assist with your trading style.

XM’s platform is intuitive and well-designed. But those withdrawal fees for certain methods definitely add up.

I can’t fault XM’s platform – it’s smooth and user-friendly. Just keep those withdrawal fees in mind when choosing your method.

XM’s platform is perfect for beginners. Just be aware of the withdrawal fees before you start trading.

XM’s educational materials have helped me learn so much. But I’ve noticed the spreads can get pretty wide when the market gets crazy.

I appreciate all the learning tools XM provides. Just watch out for those spreads – they can fluctuate depending on market conditions.

I am kinda new in this sphere and I had some questions about accounts and platforms, and before I even wrote to support, I found almost all my answers in FAQs. Moreover, support answered relatively fast and I got all the info I needed

Oh WOW what a pleasure to hear , XM is a very transparent broker and well established !! Thank you and welcome to the trading world 🙂

XM is great for newbie traders because of their educational resources. However, the spreads aren’t always the most competitive.

XM is an very user-friendly platform, and gives great customer service . your input is very helpful!! Thank you

I’ve learned a lot from XM’s educational materials. But the spreads can definitely be better, especially during volatile times.

Its great to hear the tools that XM’s are providing are assisting you in your learning structure.

XM’s educational platform is top-notch. It’s just a shame the spreads can get so wide sometimes.

Thank you so much for your review. Your input is valuable to us as well as XM!!

As a VIP member, XM’s customer support is top-notch. But I wish they had more robust social trading features.

Thank you for taking the time to Review us. Great to have a VIP add some input.

XM really takes care of its VIP clients. But if you’re into social trading, they’re not the best option.

That’s a great point! XM is definitely known for spoiling their VIP clients with exclusive events and workshops. We thank you for your review. XM will value your input.

Maybe I am not an expert yet, but one doesn’t need to be an expert to see that trading on this platform is cost effective.

Okay, the spreads can be arguable, although I think of them as tight ones, but what no one can argue is their commission structure. Some of the common fees with other brokers are absent here, like the swap fees.

Thank you for taking the time to review XM, You’re absolutely right! It’s fantastic that you’re finding this platform cost-effective, even as a new trader. Tradable markets are all about finding an edge, and minimizing fees is a smart way to do that.

The VIP treatment at XM is great. But if they expanded their social trading options, that would be awesome.

I hear you completely! XM definitely seems to understand how to pamper their VIP clients. Those exclusive events and workshops sound fantastic!

I love the personalized support I get as an XM VIP. However, their social trading platform is pretty basic.

Have you spoken to your dedicated representative can offer any insights or alternative solutions for social trading within XM’s platform. They might be aware of upcoming features or suggest workarounds.

XM’s VIP customer support is amazing. But if you’re looking for a more social trading experience, you might want to look elsewhere.

XM sounds like a great choice for someone who values excellent customer support, but maybe not the best for social aspects of trading.

I decided to share my history with XM. I switched here briefly from another company just to test myself in the competition. After doing well and seeing the conditions, I stayed here. So much time has passed, and I didn’t regret my choice.

Thank you for taking the time to share your experience. We are so happy to hear XM is providing to all your needs.

XM offers a comprehensive range of trading instruments and an easy-to-use platform. Their educational resources have significantly improved my trading skills.

We are grateful for your review! It truly makes a difference, Thank you

Trading with XM has been a smooth experience. Their platform is intuitive, and their market analysis is always detailed and reliable.

We’re so glad you had a positive experience! Thanks for sharing your review.

I highly recommend XM for their wide selection of trading instruments and user-friendly interface. Their customer support is knowledgeable and responsive.

Thank you so much for this review. Totally agree customer support is very important to have in the trading industry.

XM’s trading platform is top-notch, offering a wide variety of instruments. Their educational materials are extremely helpful for traders of all levels.

Thank you for the review , it give beginner traders confident hearing such great input.

Very satisfied with XM’s trading services. Their platform is efficient, and their educational resources are invaluable for improving trading strategies.

We are so glad that you are happy with XM’s platform and their offerings.

XM provides exceptional trading tools and a vast range of instruments. Their platform is easy to navigate, and their customer support is always ready to assist.

Thank you so much for sharing your experience with us.

XM’s platform is well-designed and user-friendly. Their educational resources have helped me become a more confident trader.

This is great news. We are thrilled you have found a platform that works well and has helped you so much.

I appreciate the variety of instruments available on XM’s platform. Their customer support team is always prompt and helpful.

Thank you for your review on XM’s platform. We are pleased to hear your input.

This is a really solid broker with multiple international regulations. These guys have if not best, maybe one of the best reputations in the market, trusted by many brokers. They have earned their reputation by being consistent.

Thank you so much for taking the time to do a review. We truly appreciate your input.