Blackbull Markets Review

Overall, BlackBull Markets is a leading forex and CFD broker focusing on technology coupled with a wide range of tradable assets. BlackBull Markets offers access to both the MetaTrader 4 and MetaTrader 5 trading platforms and has a trust score of 90 out of 99.

| 🔎 Broker | 🥇 Blackbull Markets |

| 📈 Established Year | 2014 |

| 📉 Regulation and Licenses | FSA, FMA |

| 📊 Ease of Use Rating | 3/5 |

| 🎁 Bonuses | None |

| ⏰ Support Hours | 24/7 |

| 💹 Trading Platforms | TradingView, cTrader, MetaTrader 5, MetaTrader 4, WebTrader, BlackBull CopyTrader, BlackBull Shares, BlackBull Trade |

| 📌 Account Types | ECN Standard, ECN Prime, ECN Institutional |

| 💴 Base Currencies | USD, EUR, GBP, AUD, NZD, SGD, CAD, JPY. ZAR |

| 📈 Spreads | From 0.1 pips EUR/USD |

| 📉 Leverage | Up to 1:500 |

| 💵 Currency Pairs | 60+; major, minor, and exotic pairs |

| 💶 Minimum Deposit | 0 USD |

| 💷 Inactivity Fee | None |

| 🥰 Website Languages | English |

| 🪙 Fees and Commissions | Spreads from 0.1 pips, commissions from $6 per standard lot, round turn |

| 🫶 Affiliate Program | ✅Yes |

| ❌ Banned Countries | United States, Canada |

| 📈 Scalping | ✅Yes |

| 📉 Hedging | ✅Yes |

| 📐 Trading Instruments | Forex, shares, commodities, futures, indices |

| 🚀 Open an Account | 👉 Click Here |

Blackbull Markets – Analysis of the Brokers’ Main Features

- ☑️ Overview

- ☑️ Detailed Summary

- ☑️ Safety and Security

- ☑️ Account Types

- ☑️ How To Open an Account

- ☑️ Trading Platforms and Software

- ☑️ Fees, Spreads, and, Commissions

- ☑️ Leverage and Margin

- ☑️ Which Markets can You trade?

- ☑️ Deposit and Withdrawal

- ☑️ Educational Resources

- ☑️ Pros and Cons

- ☑️ In Conclusion

- ☑️ Frequently Asked Questions

Overview

BlackBull Markets, established in 2014 in Auckland, New Zealand, is a leading forex and CFD broker focusing on technology, institutional conditions, and customer service.

BlackBull Markets offers a wide range of tradable assets, including forex, commodities, indices, and equities. It offers options for MetaTrader 4 and 5 or its in-house web-based platforms.

Its unique features include rapid execution speeds, tight spreads, and extensive liquidity through its network of financial institutions.

BlackBull Markets operates under the regulatory oversight of the Financial Markets Authority in New Zealand and the Financial Services Authority in Seychelles. It is committed to continuous innovation to provide an optimal trading environment for its clients.

How does BlackBull Markets ensure a high-quality trading environment for its clients?

BlackBull Markets is subject to strict regulatory scrutiny from the FMA in New Zealand and the FSA in Seychelles, which ensures continual innovation and a dedication to offering an ideal trading environment.

Can traders use MetaTrader platforms with BlackBull Markets?

Yes, BlackBull Markets offers alternatives for MetaTrader 4 and 5 and in-house web-based platforms for various trading requirements.

Detailed Summary

| 🔎 Broker | 🥇 Blackbull Markets |

| 📈 Established Year | 2014 |

| 📉 Regulation and Licenses | FSA, FMA |

| 📊 Ease of Use Rating | 3/5 |

| 🎁 Bonuses | None |

| ⏰ Support Hours | 24/7 |

| 💹 Trading Platforms | TradingView, cTrader, MetaTrader 5, MetaTrader 4, WebTrader, BlackBull CopyTrader, BlackBull Shares, BlackBull Trade |

| 📌 Account Types | ECN Standard, ECN Prime, ECN Institutional |

| 💴 Base Currencies | USD, EUR, GBP, AUD, NZD, SGD, CAD, JPY. ZAR |

| 📈 Spreads | From 0.1 pips EUR/USD |

| 📉 Leverage | Up to 1:500 |

| 💵 Currency Pairs | 60+; major, minor, and exotic pairs |

| 💶 Minimum Deposit | 0 USD |

| 💷 Inactivity Fee | None |

| 🥰 Website Languages | English |

| 🪙 Fees and Commissions | Spreads from 0.1 pips, commissions from $6 per standard lot, round turn |

| 🫶 Affiliate Program | ✅Yes |

| ❌ Banned Countries | United States, Canada |

| 📈 Scalping | ✅Yes |

| 📉 Hedging | ✅Yes |

| 📐 Trading Instruments | Forex, shares, commodities, futures, indices |

| 🚀 Open an Account | 👉 Click Here |

Safety and Security

BlackBull Markets takes customer security seriously and employs many safeguards to protect funds and personal information.

They keep customer money in segregated accounts with top-tier banks, ensuring they are always separate from the company’s working funds. In addition, BlackBull Markets uses strong encryption technology to safeguard critical data flows during transactions and logins.

The broker is also open about its regulatory compliance, which is monitored by the Financial Markets Authority (FMA) in New Zealand and the Financial Services Authority (FSA) in Seychelles. This provides an additional degree of responsibility and industry supervision.

What steps does BlackBull Markets take to ensure platform security?

To provide its traders with a safe trading environment, BlackBull Markets implements various security measures, including constant monitoring of its platforms.

Can traders enable two-factor authentication (2FA) for their BlackBull Markets accounts?

Yes, BlackBull Markets offers two-factor authentication (2FA), which provides additional protection to client accounts during the login process.

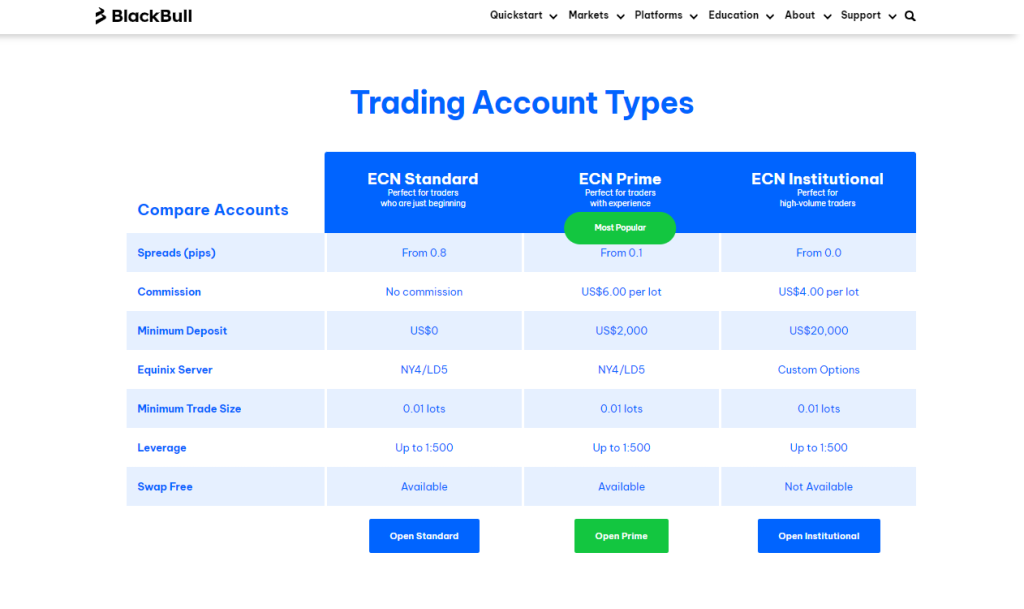

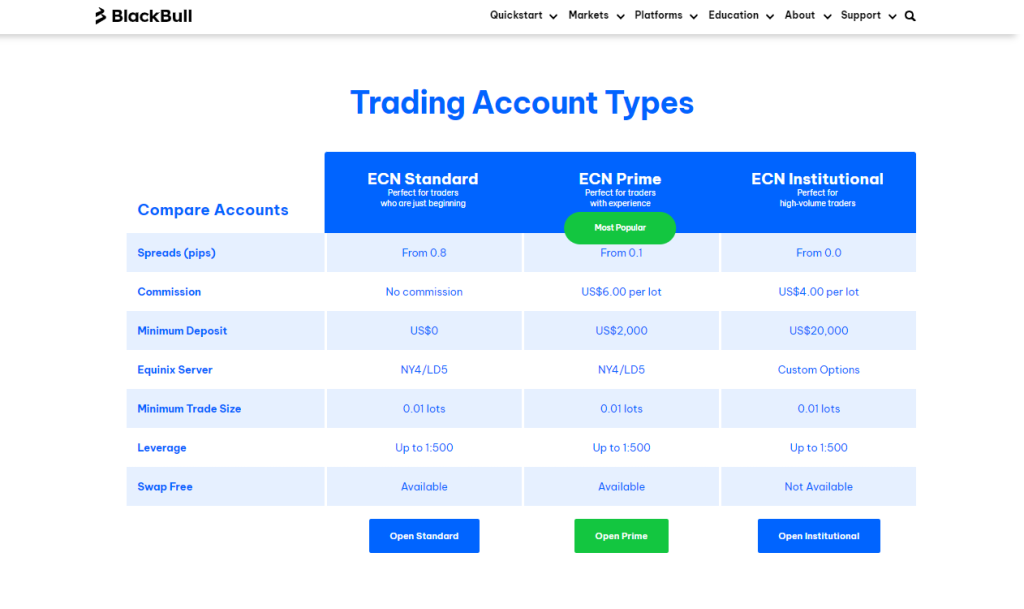

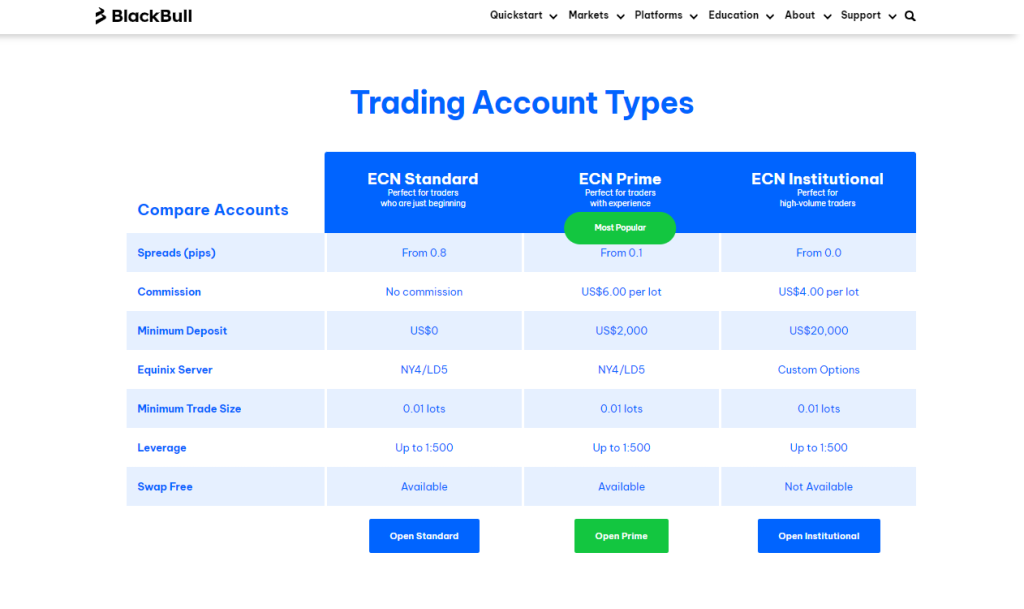

Account Types

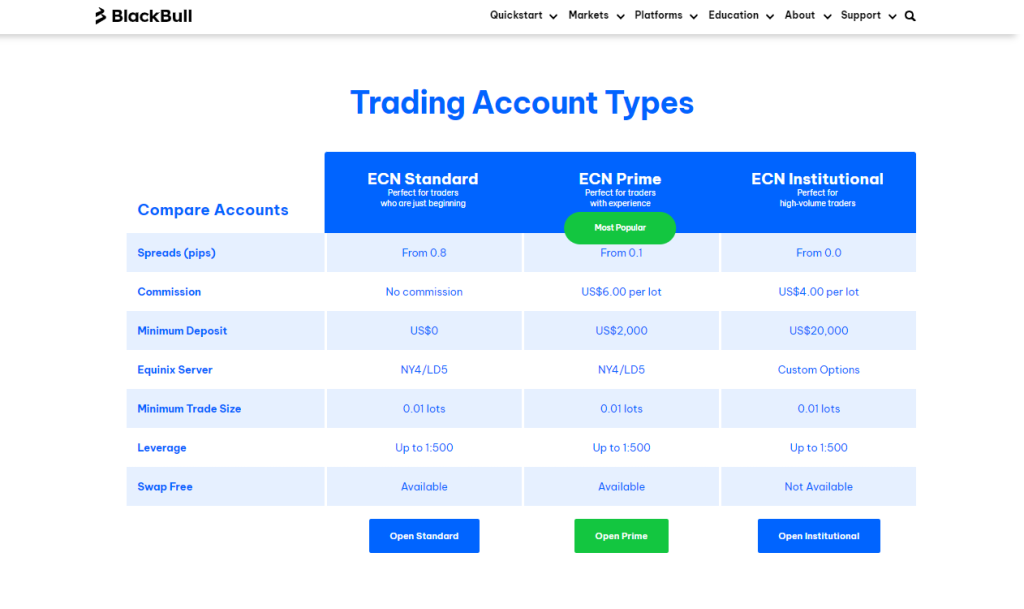

| 🔎 Account Type | 🥇 ECN Standard | 🥈 ECN Prime | 🥉 ECN Institutional |

| 🩷 Best Suited | Ideal for casual traders | Ideal for experienced traders and scalpers | Ideal for professional and institutional traders |

| 📈 Markets | All | All | All |

| 💴 Commissions | None | $6 per round turn | Flexible |

| 📉 Platforms | All | All | All |

| 📊 Trade Size | From 0.01 lots | From 0.01 lots | From 0.01 lots |

| 💹 Leverage | 1:500 | 1:500 | Flexible |

| 💵 Minimum Deposit | 0 USD | 2,000 USD | 20,000 USD |

| 🚀 Open an Account | 👉 Click Here | 👉 Click Here | 👉 Click Here |

ECN Standard Account

BlackBull Markets’ Standard Account is an introductory-level service for novice traders with several advantages.

With no minimum deposit requirement, this account facilitates commission-free trading at a starting spread of 0.8 pips. Regarding asset classes, users can access all primary options while utilizing the MetaTrader 4 compatibility feature effortlessly.

ECN Prime Account

Targeted towards seasoned traders seeking tighter spreads and lower trading fees, the Prime Account necessitates a deposit of $2,000 and boasts starting spreads as narrow as 0.1 pips with a round-turn fee of $6 per lot traded.

This account type is offered on MetaTrader 4 and MetaTrader 5 platforms.

ECN Institutional Account

Designed for institutions and high-volume traders, the Institutional Account requires a minimum deposit of $20,000. In exchange for this commitment, customers will enjoy customized liquidity solutions and some of the narrowest spreads available on the platform.

The account capitalizes on advanced trading infrastructure and offers numerous connection options to clients seeking premium services.

Demo Account

The Demo Account offered by BlackBull Markets simulates the trading conditions of a real account, enabling traders to practice and experiment with different techniques without risking their funds. It provides invaluable experience that can be utilized when investing in live markets.

Islamic Account

The Sharia-compliant Islamic Account caters to traders adhering to the principles of Sharia law and offers swap-free terms. In most aspects, the account’s functionality would be comparable with its regular equivalent based on the base account type (i.e., Regular, Prime, or Institutional).

Is there a BlackBull Markets account that offers MetaTrader 4 compatibility?

Yes, all BlackBull Markets accounts, including ECN Standard and ECN Prime, are compatible with MetaTrader 4 and other trading platforms.

What is the ideal BlackBull Markets account for a casual trader?

BlackBull Markets’ ECN Standard Account is perfect for casual traders. It provides extensive market access with no minimum deposit or fees.

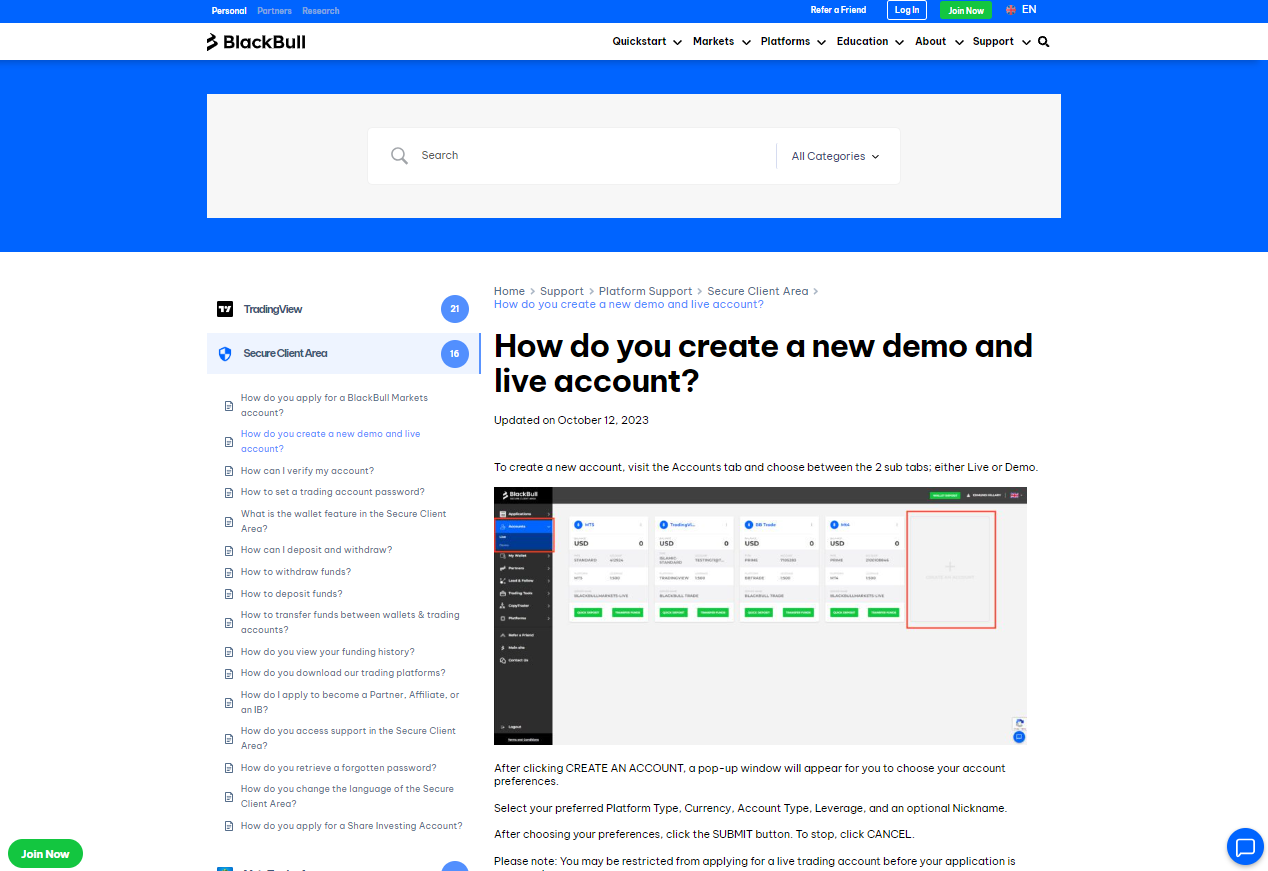

How To Open an Account

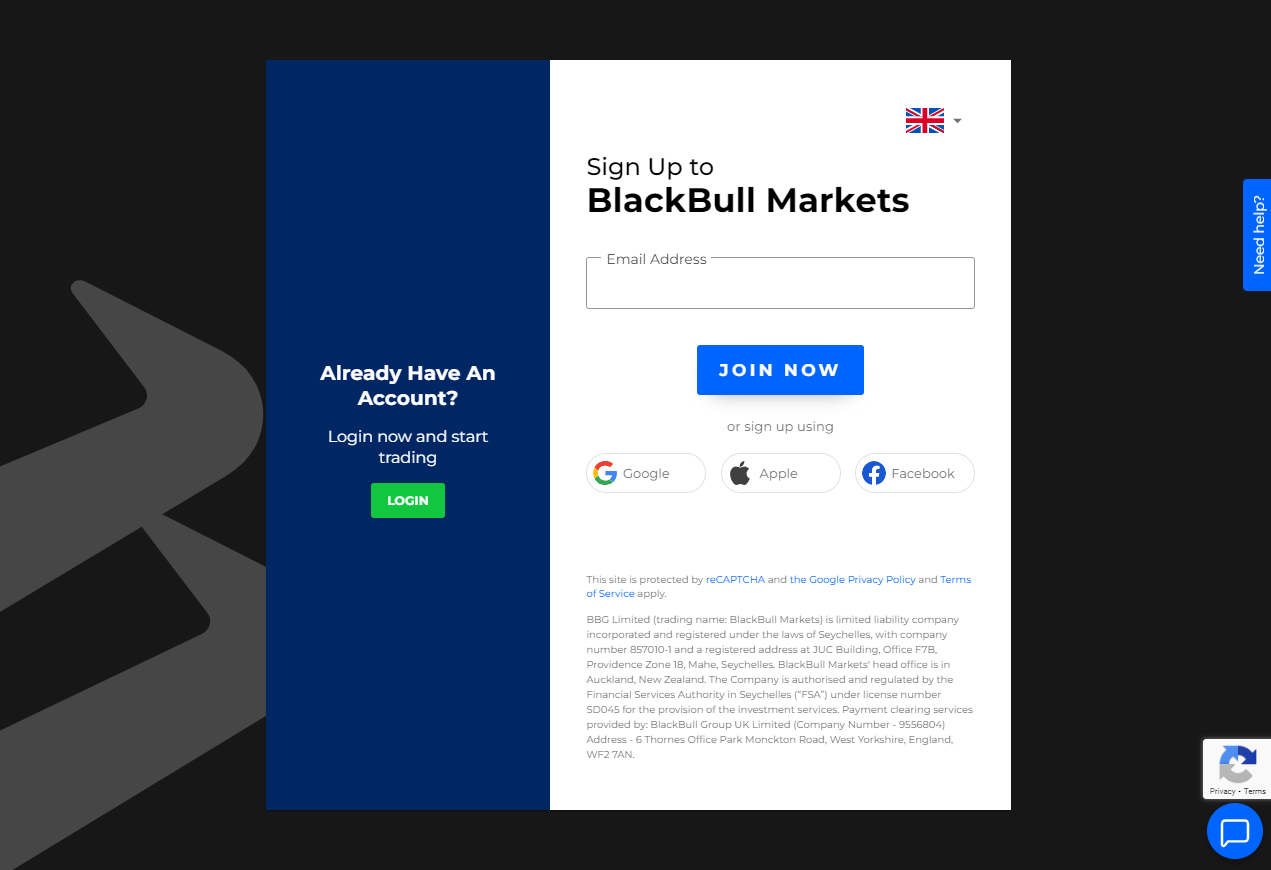

- To register an account with BlackBull Markets, follow these steps:

- Visit the BlackBull Markets official website and click on the large “Sign Up” or “Open an Account” button.

- You will be redirected to the registration form.

- Sign up with your email, Google account, Facebook account, or Apple ID to get started.

- Include correct personal information and choose a strong password for your account.

- Choose a base currency for your trading account.

- Choose the account type that best meets your trading requirements.

- Comply with Know Your Customer (KYC) rules by submitting the required paperwork.

- The BlackBull Markets staff will review your application and accompanying materials.

- This procedure normally takes less than 24 hours.

- You will get a confirmation email containing your login information when your account is accepted.

- Log onto your BlackBull Markets account and go to the area of the deposit.

- Select your desired deposit method (bank transfer, credit/debit card, or e-wallet).

- Follow the steps to deposit money into your trading account.

- Download MetaTrader 4 and MetaTrader 5, or use the web-based interface provided by BlackBull Markets. Log in using your account credentials, browse the markets, and make trades.

How long does it take for BlackBull Markets to approve a new account?

Account approval at BlackBull Markets normally happens within 24 hours after submitting the required papers.

Can I practice trading without risk at BlackBull Markets before investing real money?

Yes, BlackBull Markets provides a Demo Account, which allows traders to experience trading in real-market circumstances without risking real money.

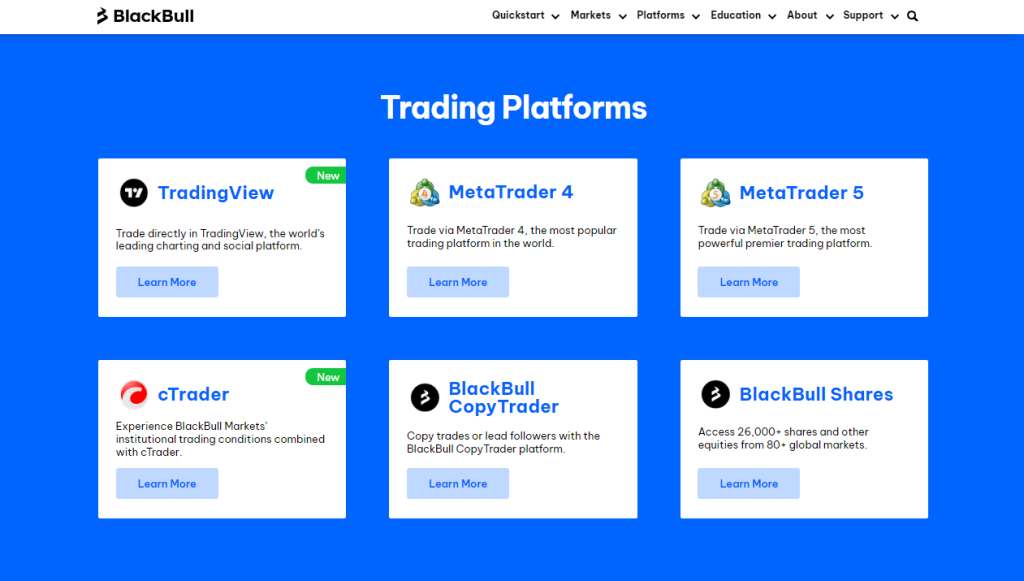

Trading Platforms and Software

- BlackBull Markets integrates directly with TradingView, a top charting tool known for its social features. Furthermore:

- Algorithmic trading and a simple interface make cTrader popular.

- For traders who prefer industry-standard platforms, MetaTrader 4 is on offer.

- MetaTrader 5 has all the characteristics of MT4 and more.

- CopyTrader helps traders find and follow successful investors by performance. While maintaining account management, followers may automatically copy prominent traders’ methods.

Can I use MetaTrader 5 with my BlackBull Markets trading account?

Yes, BlackBull Markets supports the MetaTrader 4 and MetaTrader 5 platforms and other proprietary and web-based systems.

Does BlackBull Markets offer a platform for social copy trading?

BlackBull Markets offers BlackBull CopyTrader, a software that enables traders to replicate the trades of expert traders.

Spreads and Fees

Spreads

BlackBull Markets offers competitive spreads, notably via its Prime Account, with spreads from 0.1 pips on EUR/USD. BlackBull Markets’ spreads fluctuate according to the instrument, account type, and market circumstances.

The Standard Account provides broader spreads but no fees, but the Prime and Institutional Accounts offer much narrower spreads in exchange for a commission on every transaction.

Commissions

Commission costs apply to BlackBull Markets’ Prime and Institutional Account categories. These fees are levied on each lot exchanged, and the actual amount varies depending on the item.

This fee is clear and calculated round-turn, starting from $6 per standard lot traded. Furthermore, this means you pay when you start and cancel a position.

Overnight Fees

Overnight fees are incurred when a leveraged position is held overnight. These are based on the current interest rate difference between the traded currencies or asset classes.

They can be both positive and negative, and they alter regularly. The BlackBull Markets website lets you compute an estimated overnight cost for your trades.

Deposit and Withdrawal Fees

BlackBull Markets often does not impose deposit fees. However, your selected payment provider may. It is essential to double-check the words. BlackBull Markets may charge internal withdrawal fees of $5 or an equal amount, depending on the method and currency.

Inactivity Fees

If your BlackBull Markets account is inactive for a lengthy period (often three months or more), you may be charged an inactivity fee.

This charge normally depends on your account’s base currency and balance. Keep an eye on their client agreement or contact BlackBull Markets assistance for accurate inactivity charge information.

Currency Conversion Fees

If your BlackBull Markets account base currency varies from the currency denomination of the asset you are trading, a currency conversion charge will be applied. Conversion rates are often competitive but include these extra fees in your calculations.

How competitive do BlackBull Markets offer the spreads?

BlackBull Markets charges competitive spreads, notably via its Prime Account, with spreads beginning at 0.1 pips on EUR/USD.

Does BlackBull Markets charge an inactivity fee?

Yes, BlackBull Markets may levy an inactivity fee if an account is not utilized for trading for three months or longer.

Leverage and Margin

BlackBull Markets provides a range of leverage options from 1:30 to 1:500 to suit different trading techniques and risk tolerances. Risk tolerance, trading strategy, market volatility, account size, and regulatory constraints determine the margin required for transactions.

The platform emphasizes the importance of margin as collateral for leveraged transactions and free margin as available funds for new positions.

Furthermore, BlackBull Markets updates margin needs through its MT4/MT5 trading platforms, notifying traders with margin calls at 75% and stop-outs at 50% margin levels, indicating the need for more money or position closures to avoid liquidation.

What should I do if I receive a margin call from BlackBull Markets?

If you get a margin call from BlackBull Markets, you must deposit more funds or liquidate positions to raise your margin level beyond the minimum threshold.

What is the risk of using maximum leverage with BlackBull Markets?

While employing the maximum leverage of 1:500 at BlackBull Markets might raise possible gains, it also considerably increases the danger of large losses, particularly in turbulent markets.

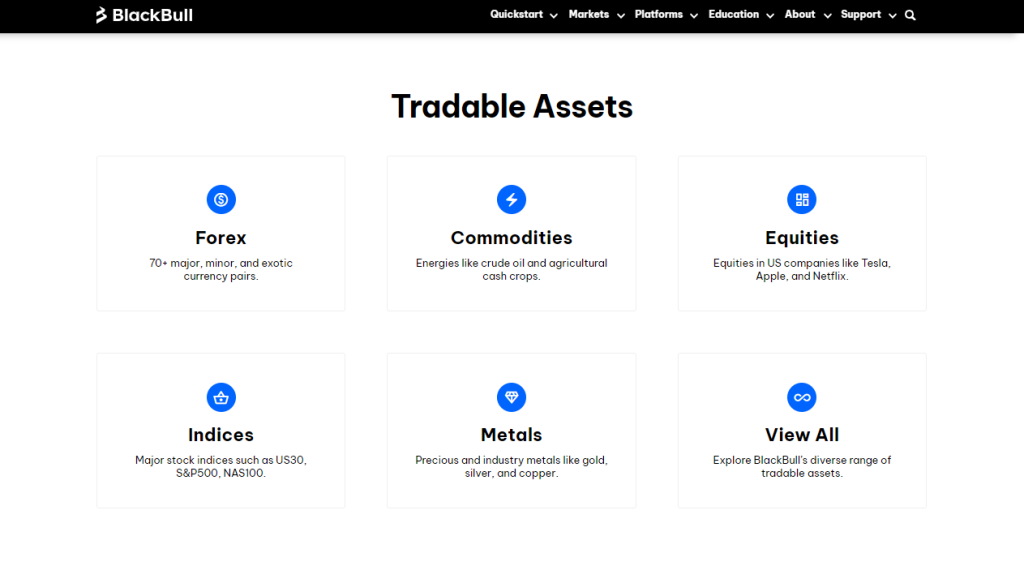

Which Markets can You trade?

BlackBull Markets offers the following trading instruments and products:

- Diverse currency pairings, including major, minor, and exotic currencies.

- 26,000+ share CFDs

- Key global indexes such as the S&P 500, Dow Jones, and NASDAQ.

- CFDs on precious metals like gold and silver.

BlackBull Markets allows traders to trade futures contracts based on various underlying assets, providing exposure to commodities, interest rates, and more. Futures trading has fixed expiration dates, which may give chances for hedging current holdings.

What leverage options does BlackBull Markets offer for forex trading?

BlackBull Markets provides leverage options of up to 1:500 for forex trading, allowing traders to magnify possible wins and losses.

Does BlackBull Markets offer trading on futures contracts?

Yes, BlackBull Markets offers trading on futures contracts based on various underlying assets, such as commodities and interest rates.

Deposit and Withdrawal

| 🔎 Payment Method | 🌎 Country | 🪙 Currencies Accepted | ⏰ Processing Time |

| 💳 Debit/Credit Card | All | Multi-currency | ⚡Instant |

| 💷 Use Pay | China | CNY | ⚡Instant |

| 💶 Skrill | All | Multi-currency | ⚡Instant |

| 💵 Poli | New Zealand | NZD | ⚡Instant |

| 💰 PaymentAsia | Thailand | THB | ⚡Instant |

| 💴 SEPA | All | EUR, GBP | ⚡Instant |

| 💳 Neteller | All | Multi-currency | ⚡Instant |

| 💷 HexoPay | Canada | CAD | ⚡Instant |

| 💶 Help2Pay | All | EUR, USD | Instant – 48 hours |

| 💵 FXPay | All | EUR, USD | Instant – 48 hours |

| 💰 Fasapay | All | USD | Instant – 48 hours |

| 💴 Crypto | All | USDT ERC-20, USDT TRC-20, BTC, ETH | Instant – 2 days |

| 💳 China Union Pay | All | Multi-currency | ⚡Instant |

| 💷 Boleto | Brazil | BRL | ⚡Instant |

| 💶 Beeteller | Brazil | BRL | ⚡Instant |

| 💵 Bank Transfer | All | Multi-currency | 1 – 2 days |

| 💰 AstroPay | All | Multi-currency | ⚡Instant |

| 💴 Local Bank Transfer | India | INR | 30 – 90 minutes |

Deposit Options:

Bank Wire

- BlackBull Markets enables both local and international bank transactions.

- Log in to BlackBull Markets’ secure client area and choose the “My Wallet” option.

- Choose “Bank Wire Transfer” as the deposit method.

- BlackBull Markets will give you the relevant bank account data.

- Make a wire transfer from your bank account to the supplied BlackBull Markets account.

- Provide any reference numbers necessary.

Credit or Debit Card

Log in to BlackBull Markets’ secure client area and go to the “My Wallet” section. Choose “Credit or Debit Card” as your deposit method.

Enter your card information (card number, expiry date, CVV), the amount you want to deposit, and any further verification procedures requested by your card issuer.

Cryptocurrency Wallets

- Log in to BlackBull Markets’ secure client area and go to the “My Wallet” section.

- Choose your preferred cryptocurrency as the deposit method.

- You will get a unique crypto wallet address or QR code for your BlackBull Markets account.

- Send crypto from your external wallet to this address.

e-wallets or Payment Gateways

BlackBull Markets accepts many e-wallets and payment gateways, including Skrill, Neteller, FasaPay, and China UnionPay.

To access your BlackBull Markets account, go to the “My Wallet” section and choose your preferred e-wallet or payment option. You should be taken to the payment provider’s website to log in and confirm the transaction.

When approved, funds will be sent to your BlackBull Markets account.

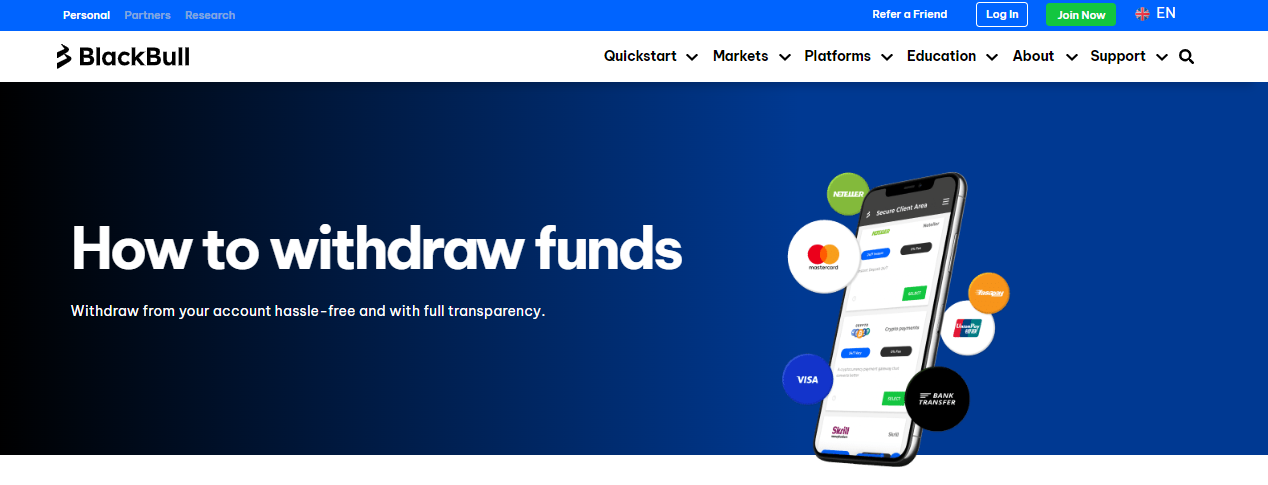

Withdrawal Options:

Bank Wire

- To withdraw money by bank wire, log in to BlackBull Markets’ secure client area and go to the “My Wallet” option.

- Choose “Bank Wire Transfer” as your withdrawal method.

- Enter your bank account information (account name, bank name, SWIFT/BIC code, IBAN, etc.).

- Enter the amount you want to withdraw and submit the request.

Credit or Debit Cards

- Log in to BlackBull Markets’ secure client area and go to the “My Wallet” section.

- Choose “Credit or Debit Card” as your withdrawal method.

- In general, the amount you may withdraw is restricted to the amount you put on your card.

- Enter the amount and submit the request.

Cryptocurrency Wallets

To withdraw cryptocurrencies from BlackBull Markets, go to the “My Wallet” section after logging in to the secure client area. Choose your cryptocurrency as the withdrawal method.

Enter your external wallet address and the amount you want to withdraw.

e-wallets or Payment Gateways

Log in to BlackBull Markets’ secure client area and go to the “My Wallet” section. Select your preferred e-wallet or gateway. Enter the withdrawal amount and then follow the on-screen instructions.

Do BlackBull Markets charge any deposit or withdrawal fees?

BlackBull Markets does not charge any deposit fees. However, internal withdrawal costs of $5 or similar may apply depending on the method and currency.

Can traders use cryptocurrency to fund their BlackBull Markets account?

Yes, BlackBull Markets allows cryptocurrency deposits such as USDT ERC-20, USDT TRC-20, BTC, and ETH, and processing timeframes range from immediate to two days.

Educational Resources

BlackBull Markets offers the following educational resources:

- Education Hub

- Instructional resources

- Trading Courses

- Live and on-demand webinars

- Seminars

BlackBull Markets provides a demo account for new and current customers to practice their trading talents.

Are the educational resources at BlackBull Markets available to all traders?

Yes, BlackBull Markets offers all traders a vast collection of instructional tools to improve their trading knowledge and abilities.

Can I practice trading strategies with a Demo Account at BlackBull Markets?

Yes, BlackBull Markets provides a Demo Account, replicating real-market circumstances and allowing traders to test strategies without risking real money.

Pros and Cons

| ✅ Pros | ❌ Cons |

| BlackBull Markets employs top-tier infrastructure to provide fast execution times and dependable connection | The website can be difficult to navigate at first |

| BlackBull Markets is known for its customer support helpfulness and responsiveness | BlackBull Markets charges a fee for withdrawals |

| Webinars, tutorials, and other resources appeal to a variety of skill levels | The Prime Account's $2,000 initial deposit may be a barrier for new traders |

In Conclusion

According to our findings, BlackBull Markets seems an excellent alternative for traders looking for a dependable broker with competitive trading conditions, institutional-grade technology, and a commitment to transparency.

Due to regulatory restrictions, BlackBull Markets does not accept customers from the United States. Before joining, make sure the broker may legally function in your country of residence.

Withdrawal processing times vary according to the method. BlackBull Markets attempts to fulfill withdrawal requests within 24 hours. However, depending on your payment provider, the funds may take longer to reach your account.

BlackBull Markets generally generates revenue from spreads (the difference between bid and ask prices) and fees on particular account types. While there is not necessarily a commission fee, the cost of spreads is essentially included in the trade price.

BlackBull Markets has no minimum deposit for their Standard Account. However, Prime and Institutional accounts have higher minimum deposit requirements of $2000 and $20,000, respectively.

Yes, BlackBull Markets provides mobile trading applications for the MetaTrader 4 and MetaTrader 5 platforms, which are accessible on iOS and Android smartphones. These applications provide mobile access to markets, portfolio management, and trading capabilities.

🏆 7 Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |

Blackbull provides exceptional trading services with a user-friendly platform. Their market analysis is detailed and reliable.

Thank you for taking the time to leave a review! We’re thrilled to hear Blackbull’s improvements across all aspects are being noticed. We appreciate your feedback and keep striving to get even better!

The customer support at Blackbull is outstanding. Their trading tools and market insights are invaluable.

Thank you for this great review!

Blackbull offers a seamless trading experience with excellent market analysis. Highly recommend their services.

We appreciate your taking the time to leave a positive review

Highly satisfied with Blackbull. Their platform is efficient, and their market insights are always spot-on.

Thank you for your review! We’re thrilled to hear you’ve noticed Blacblull’s improvements across the board. Positive feedback like yours motivates us to keep getting better!

Blackbull’s trading platform is user-friendly and reliable. Their customer service is top-notch.

Good day Daniela ,

Thank you for your review!

Great experience with Blackbull. Their customer service is responsive, and their trading platform is efficient.

Blackbull provides reliable trading tools and detailed market analysis. Their platform is user-friendly.

Blackbull’s trading services are exceptional. Their platform is easy to navigate, and their market insights are very accurate.

Highly recommend Blackbull for their reliable trading services and detailed market analysis. Their platform is excellent.

Thank you for your positive feedback Blackbull is a great platform we cant agree more with your review .

Blackbull has a user-friendly platform and excellent customer support. Their market analysis is always accurate.

Blackbull is a great, and always creating new tools and content for clients . they are with out a doubt one of the best!

Thank you for your feedback .

Blackbull offers exceptional brokerage services with clear market analysis. Their platform is efficient and reliable.

Always great to hear that a broker is providing clear market analysis for traders , helps with decision making 🙂

Blackbull’s trading tools and market analysis are top-notch. Their customer service is always helpful and responsive.

Top Service we love to hear that . Makes us so proud to be promoting their platform.

Very satisfied with Blackbull’s trading services. Their market insights are detailed and very useful.

Glad to hear you’re happy with BlackBull! Their focus on market analysis is definitely a plus for traders.

Blackbull provides top-notch trading services. Their platform is easy to navigate, and their market analysis is very detailed.

Thanks for sharing your positive experience with BlackBull! It’s always valuable for new traders to hear firsthand accounts from satisfied users.

Impressed with Blackbull’s market analysis and trading tools. Their platform is reliable and efficient.

Blackbull’s platform is very easy to use and simple , I agree they are on the right track.

Blackbull delivers excellent trading services with clear, detailed market insights. Their platform is user-friendly.

Thank you for the great review, BlackBull Markets seems to have it all.

Blackbull offers outstanding trading services. Their platform is easy to use, and their market analysis is very accurate.

Thank you for taking the time to review Blackbull’s platform .You sound like a happy trader which is great.

Blackbull offers a superb trading experience with a platform that’s both intuitive and efficient. Their market analysis is consistently insightful, helping me make informed trading decisions effortlessly.

Thank you for taking the time to give such detailed review about Blackbull’s platform.

I am highly impressed with Blackbull’s dedication to customer support. Their responsive team coupled with detailed market analysis ensures I always feel supported and informed in my trading journey.

We can not agree with you more. Customer service is vital in the trading industry. Thank you for your review

Blackbull provides exceptional brokerage services with a user-friendly platform. Their market insights are detailed and reliable, making them a standout choice for both new and experienced traders alike.

Thank you for the great feedback on Blackbull. We are so glad they are making trading easy for beginners too.

Highly satisfied with Blackbull’s trading platform, which is not only easy to navigate but also robust in its functionality. Their market analysis is comprehensive and spot-on, guiding my trading strategies effectively.

We are so pleased to hear such a great review. Thank you for sharing your experience with us.

Blackbull’s commitment to delivering top-notch trading tools and market analysis is commendable. Their platform is reliable and efficient, ensuring a seamless trading experience every time.

Fantastic review. Thank you for sharing your experience with us.

I’ve had a great experience with Blackbull. Their platform is user-friendly, their customer service is responsive, and their market insights are incredibly useful for making informed trading decisions.

Having great customer service is critical in the trading industry. We are so please Backbull is proving all the required tool and information.

Blackbull stands out for its excellent trading services. Their platform is intuitive and their market analysis is detailed, providing a solid foundation for successful trading outcomes.

Wow, what a great review. Thank you for taking the time to share your experience.

Impressed with Blackbull’s market analysis capabilities and the effectiveness of their trading tools. Their platform is reliable, making them a trustworthy partner in the competitive world of trading.

We are so glad to hear you are happy trading on Blackbull’s platform. Thank you for your review.