BDSwiss Review

- BDSwiss Review - Analysis of Brokers' Main Features

- Overview

- Detailed Summary

- Safety and Security

- Account Types

- How To Open a BDSwiss Account

- Trading Platforms and Software

- Fees, Spreads, and, Commissions

- Which Markets Can You Trade with BDSwiss?

- Deposits and Withdrawals

- Educational Resources

- Pros and Cons

- Conclusion

Overall, BDSwiss can be summarised as a trustworthy and highly regulated Forex Broker that is very competitive in terms of its trading and nontrading fees. They offer access to exceptional Customer Support, and multiple account types and have a trust score of 91 out of 99.

| 🔎 Broker | 🥇 BDSwiss |

| 📈 Regulation | CySEC, FSC, FSA, BaFin, Mwali International Services Authority |

| 📉 Trading Platforms | MetaTrader 4, MetaTrader 5, BDSwiss Web, BDSwiss Mobile |

| 💴 Minimum Deposit | 10 USD |

| ⏰ Support Hours | 24/5 |

| ⚙️ Account Types | Cent, Classic, VIP, Zero Spread, Islamic, Demo |

| 🆓 Demo Account | ✅Yes |

| ☪️ Islamic Account | ✅Yes |

| 📊 Leverage | 1:2000 |

| 🚀 Open an Account | 👉 Click Here |

BDSwiss Review – Analysis of Brokers’ Main Features

- ☑️ Overview

- ☑️ Detailed Summary

- ☑️ Safety and Security

- ☑️ Account Types

- ☑️ How To Open an Account

- ☑️ Trading Platforms and Software

- ☑️ Fees, Spreads, and, Commissions

- ☑️ Markets You Can Trade with BDSwiss?

- ☑️ Deposits and Withdrawals

- ☑️ Educational Resources

- ☑️ Pros and Cons

- ☑️ Conclusion

- ☑️ Frequently Asked Questions

Overview

This broker is a financial services provider renowned for its comprehensive offerings. Moreover, They have grown significantly. Additionally, solidified its presence in multiple cities, including Berlin and Germany.

Furthermore, the observance of regulatory requirements is a fundamental aspect of this broker’s operations and the firm falls under the jurisdiction of various regulatory bodies.

This includes the Financial Services Commission (FSC) in Mauritius, the Financial Services Authority (FSA) in Seychelles, the Financial Sector Conduct Authority (FSCA) in South Africa, and the Mwali International Services Authority.

Detailed Summary

| 🔎 Broker | 🥇 BDSwiss |

| 📈 Established Year | 2012 |

| 📉 Regulation | CySEC, FSC, FSA, BaFin, Mwali International Services Authority |

| 4️⃣ Ease of Use Rating | 4/5 |

| 🎁 Bonuses | None |

| ⏰ Support Hours | 24/5 |

| 🖱️ Trading Platforms | MetaTrader 4, MetaTrader 5, BDSwiss Web, BDSwiss Mobile |

| 📌 Account Types | Cent, Classic, VIP, Zero Spread, Islamic, Demo |

| 🪙 Base Currencies | ZAR, USD, EUR, GBP, etc. |

| 📊 Spreads | From 0.0 pips EUR/USD |

| 💹 Leverage | 1:2000 |

| 💰 Currency Pairs | 53; Minor, Major, and Exotic Pairs |

| 💴 Minimum Deposit | 10 USD |

| 💵 Inactivity Fee | ✅ Yes, 10% after 3 months |

| 😮💨 Website Languages | English, Czech, German, Italian, Spanish, Korean, French, Norwegian, Polish, Danish, Arabic, Malaysian, Thai, Vietnamese, Filipino, Hindi, Indonesian, Chinese, Portuguese, Romanian, Turkish, Russian |

| 💶 Fees and Commissions | Spreads from 0.0 pips, commissions from $2 on Indices |

| 🤝 Affiliate Program | ✅Yes |

| ❌ Banned Countries | The United States, Belgium, and other OFAC-sanctioned regions |

| 📍 Scalping | ✅Yes |

| ▶️ Hedging | ✅Yes |

| ⚙️ Trading Instruments | Forex, Commodities, Shares, Indices, Cryptocurrencies |

| 🚀 Open an Account | 👉 Click Here |

What awards has BDSwiss received that establish its credibility in the financial services sector?

They have received honors such as “Best FX & CFD supplier” from International Investor Magazine and “Best Trading Conditions” from World Finance Magazine, bolstering their image as reliable financial services suppliers.

Safety and Security

This broker stresses the security of its customers’ assets and data by using a multifaceted approach to safety. Furthermore, Client monies are housed in segregated accounts, keeping them distinct from the company’s operational cash.

Additionally, account segregation is important in safeguarding customers from the possibility of firm collapse and ensuring that their cash is not utilized for any other reason. In terms of regulatory compliance, They are committed to upholding rigorous standards.

Moreover, the platform operates under the watchful eye of esteemed financial authorities such as the Cyprus Securities and Exchange Commission (CySEC), the Financial Services Authority (FSA), the Financial Services Commission (FSC), and the Mwali International Services Authority.

How do they ensure the security of client funds?

They protect customer money by keeping them in segregated accounts distinct from the company’s operational finances, preventing corporate bankruptcy or abuse.

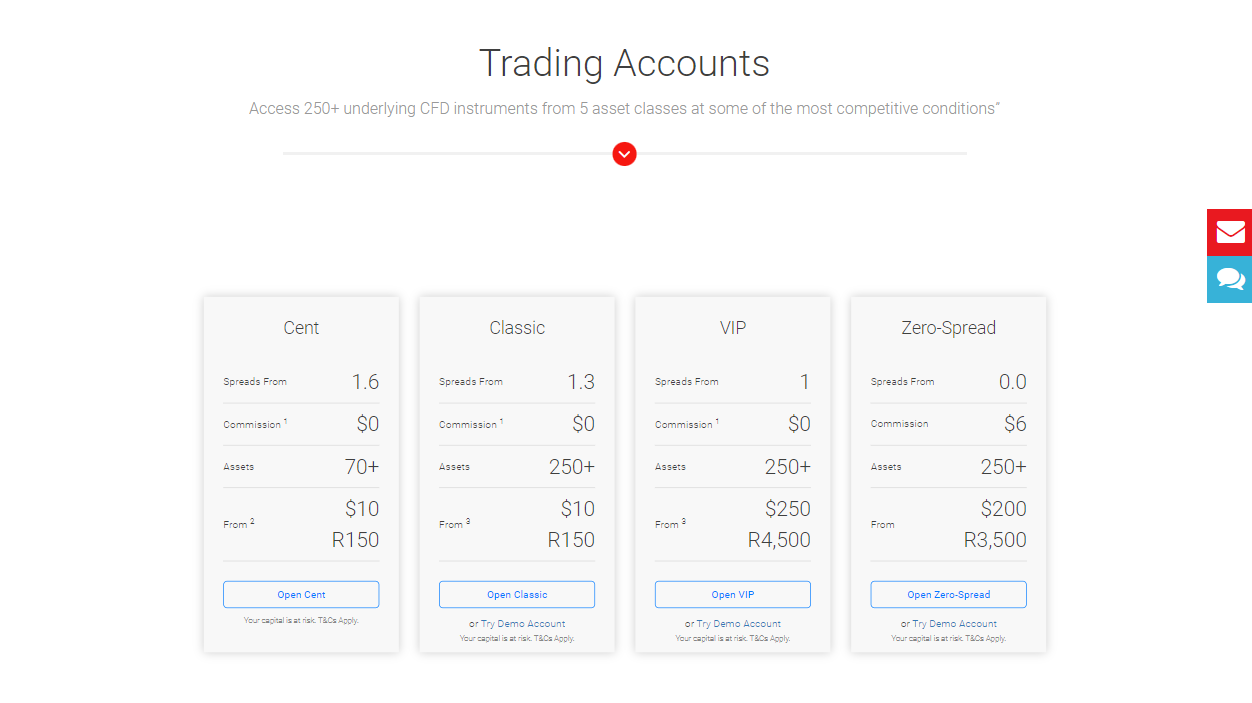

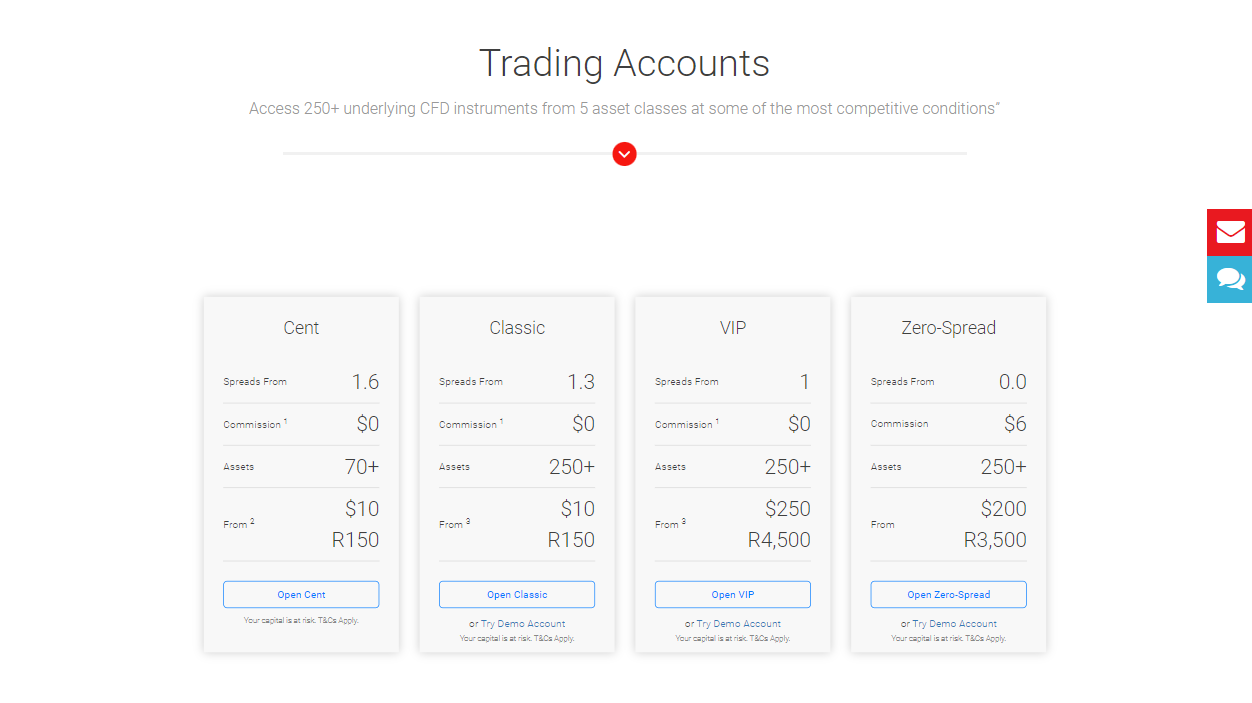

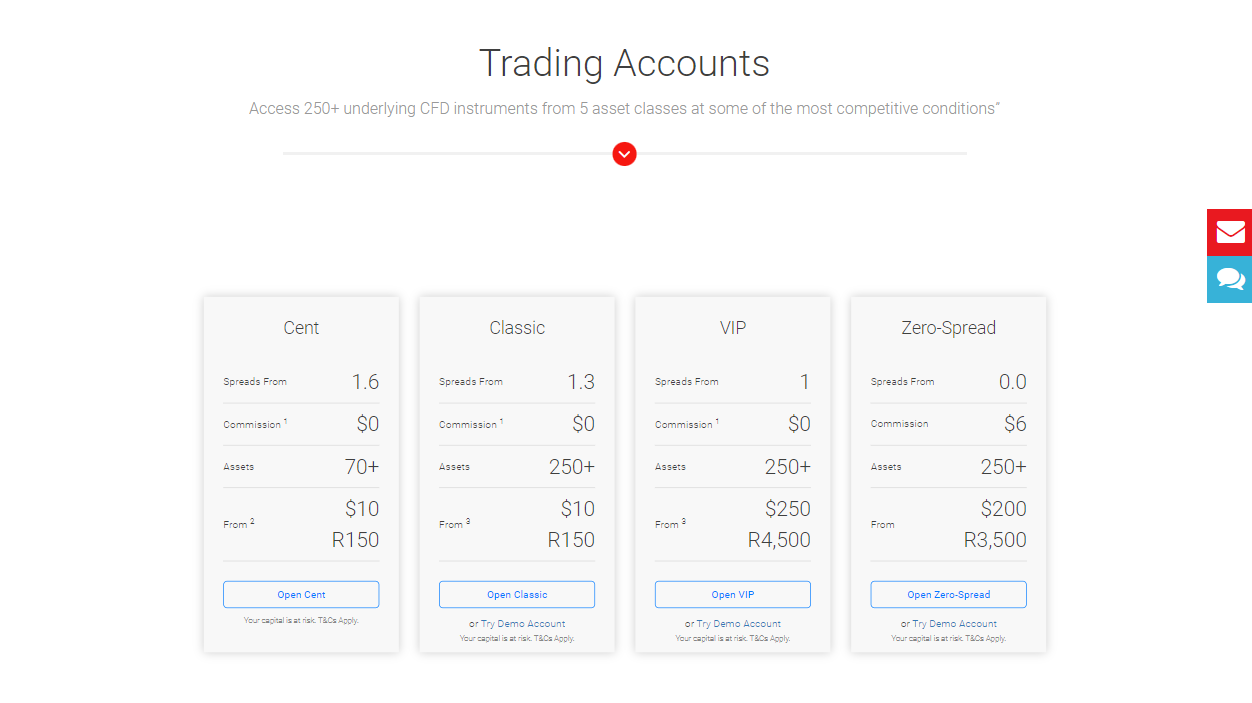

Account Types

| 🔎 BDSwiss Account | 🥇 Cent | 🥈 Classic | 🥉 VIP | 🏅 Zero Spread |

| ☑️ Availability | All, but suited to beginners | All | All, but suited to more experienced traders | All; but ideal for scalpers |

| 📈 Markets | Forex, Stocks, Indices, Commodities, Crypto CFDs | Forex, Stocks, Indices, Commodities, Crypto CFDs | Forex, Stocks, Indices, Commodities, Crypto CFDs | Forex, Stocks, Indices, Commodities, Crypto CFDs |

| 💴 Commissions | $2 on indices, 0.15% on shares | $2 on indices, 0.15% on indices | $2 on indices, 0.15% on indices | $2 on indices, 0.15% on indices, $6 on Forex and commodities |

| 📉 Platforms | All | All | All | All |

| 📊 Trade Size | From 0.01 lots | From 0.01 lots | From 0.01 lots | From 0.01 lots |

| 💹 Leverage | 1:2000 | 1:2000 | 1:2000 | 1:2000 |

| 💷 Minimum Deposit | 10 USD | 10 USD | 250 USD | 250 USD |

| 🚀 Open an Account | 👉 Click Here | 👉 Click Here | 👉 Click Here | 👉 Click Here |

Cent Account

The Cent account is an ideal starting place for beginner traders. Moreover, the opportunity to trade in smaller lot sizes worth pennies considerably decreases financial risk, making it an appealing option for individuals beginning with a tiny investment.

Classic Account

The Classic account is designed for frequent retail traders with some market experience, providing a balance of cost-effectiveness and a wide range of trading options an average EUR/USD spread of 1.3 pips, and a maximum leverage of 1:2000. Moreover, it offers over 250 trading products, including Forex and different CFDs.

Furthermore, trading indexes and shares incur a commission fee. Additional benefits include quick credit card withdrawals of up to €/$/£2,000, no deposit or credit card withdrawal fees, and access to all trading platforms.

VIP Account

The VIP account is designed for experienced traders who handle large quantities. In addition, it provides decreased spreads, with an average of 1 pip on EUR/USD and a maximum leverage of 1:2000.

Furthermore, the minimum deposit is 250 USD, making it ideal for traders seeking an enhanced trading experience with additional bonuses.

Zero-Spread Account

The Zero Spread account is intended for day traders and scalpers, with transaction spreads averaging 0.0 pips on EUR/USD.

In addition, the account charges commissions on stocks, Forex, and commodities but offers the same priority service and trading tools as the VIP account.

Furthermore, The minimum deposit is cheaper than the VIP at 250 USD, making it an appealing choice for traders seeking to reduce the spread and additional expenses.

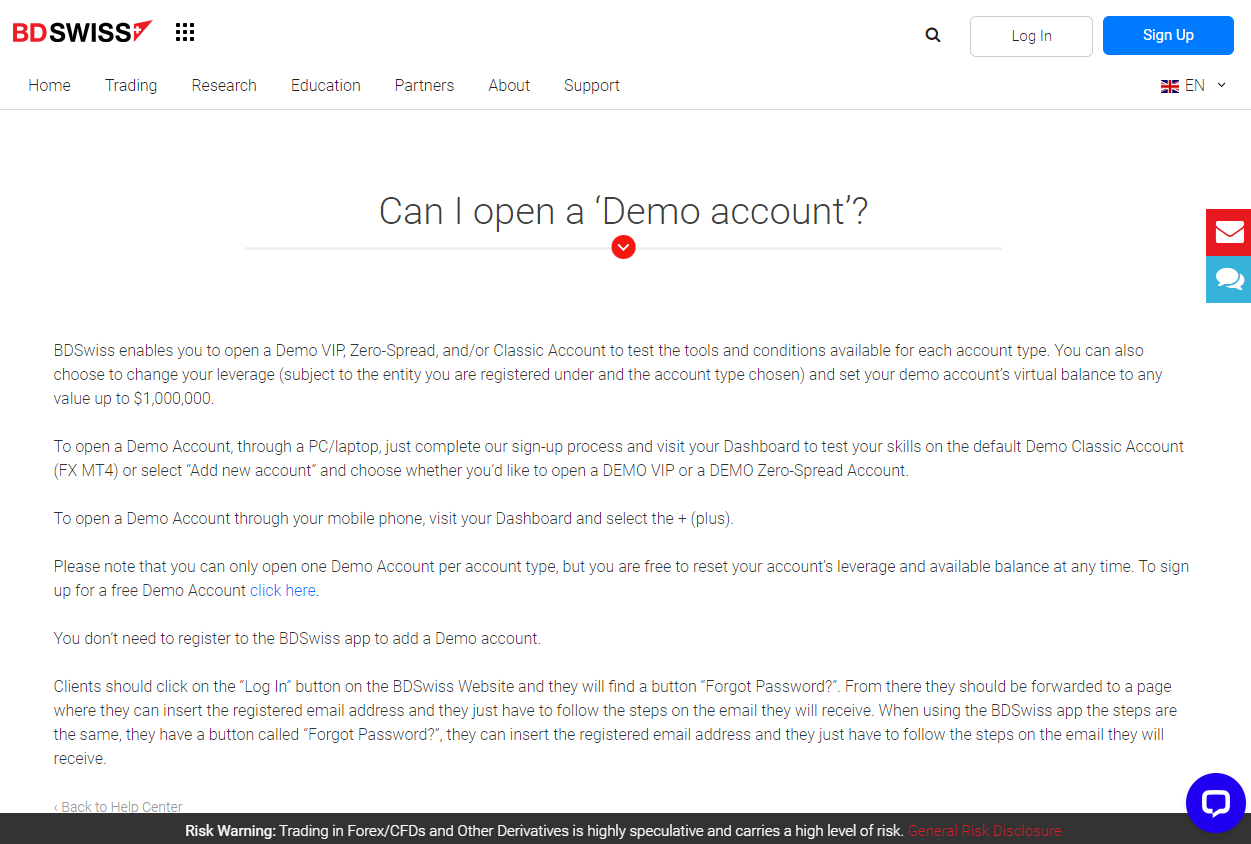

Demo Account

The Demo account is a good starting place for traders new to the Forex and CFD markets. It offers a simulated trading environment with 100,000€/$/£ virtual capital, enabling users to practice and fine-tune their trading techniques without incurring financial risk.

Moreover, the account is useful for learning about the trading platform’s capabilities, and market trends and building trading confidence.

It is an important step for people who want to shift to live trading after getting sufficient market knowledge to open a Demo Account.

Islamic Account

This broker also caters to Muslim traders by providing an Islamic Account per Sharia law. This Swap-Free account waives all interest and overnight swap costs for up to ten calendar days per position.

Moreover, standard exchange fees or credits may apply to positions held for an extended period. Additionally, the Islamic account is only for Muslim traders; BDSwiss may ask for confirmation of religious affiliation to guarantee that the account is utilized for its original purpose.

What is the difference between Cent and Classic accounts?

The Cent account is meant for novices, with a low minimum deposit and lower lot sizes. In contrast, the Classic account is designed for experienced retail traders, providing a balance of cost-effectiveness and a greater selection of trading options.

How To Open a BDSwiss Account

- Go to the official website and find the “Sign Up” button on the site.

- Select an account that meets your trading goals and ambitions.

- Complete the registration form and include your basic information.

- To comply with legislation, they demand identification verification.

- Choose your favorite deposit method from various alternatives.

- The minimum deposit amount varies by account type.

- Once your account has been financed and validated, you may begin trading!

What identification documents are required to verify a BDSwiss account?

They require a government-issued picture ID and evidence of residence, such as a utility bill or bank statement, to verify an account.

Trading Platforms and Software

- MetaTrader 4

- MetaTrader 5

- BDSwiss Mobile

- BDSwiss Web

MetaTrader 4

MetaTrader 4 (MT4) is a popular trading platform noted for its user-friendly design and powerful functionality. It is a popular option among worldwide traders due to its simplicity and usefulness.

MT4 works perfectly with the BDSwiss trading conditions, offering dynamic leverage and attractive spreads.

This platform provides traders with sophisticated charting tools and technical analysis skills. Consequently, traders can make educated trading choices in the ever-changing Forex and CFD markets.

MetaTrader 5

MetaTrader 5 (MT5) is a powerful trading platform that offers a wide range of capabilities. It enables various trading products and timeframes, complementing BDSwiss’ vast asset portfolio.

The combination of MT5 and BDSwiss characteristics, such as quick execution and access to deep liquidity, make it an excellent alternative for traders of all skill levels.

MT5 expands analytical capabilities with enhanced tools and an economic calendar, appealing to traders using fundamental and technical research.

Mobile

The Mobile setup is a simple and versatile trading app available to traders worldwide. It smoothly combines BDSwiss’ trading conditions and capabilities, giving traders access to global markets anytime and anywhere.

This mobile software benefits traders who need to respond quickly to market changes or want to trade on their mobile devices.

With a user-friendly structure and real-time data, traders may keep informed while rapidly conducting trades using the app’s interfaces.

Web

The WebTrader is a web-based trading platform that does not need any program downloads. It provides a simplified trading experience and access to critical trading tools and functions.

As a result, the platform effortlessly interacts with its competitive conditions, such as narrow spreads and flexible leverage options, making it a popular choice among traders worldwide.

Moreover, WebTrader’s user-friendly interface and smooth execution appeal to rookie and expert traders who want simplicity and efficiency in their trading operations.

Is mobile trading available?

Yes, They provide mobile trading via their Mobile app, which enables traders to manage their accounts and trade from anywhere.

Fees, Spreads, and, Commissions

Spreads and Commissions

Their trading expenses are heavily influenced by variable spreads that fluctuate according to market circumstances. Major currency pairings often have tight spreads, making them cost-effective to trade.

Depending on your account type, you may be charged commissions. Additionally, VIP Account customers will normally pay a 0.15% fee on shares.

However, Zero Spread Account users may pay $6 for Forex and commodities, $2 for indices, and 0.15% for shares.

Overnight, Deposit and Withdrawal Fees

They do not impose fees for deposits or withdrawals. Therefore, allowing traders to handle their assets effectively and without extra charges.

Inactivity and Currency Conversion Fees

There is a 10% levy fee for non-activate accounts for over three months. Traders should be aware of this policy to avoid further penalties.

Furthermore, They may charge currency conversion fees for transactions or account funding in currencies other than the base currency.

Are there any commission fees associated with BDSwiss trading accounts?

Yes, there are charges fees on some transactions, depending on the account type and the instruments exchanged, such as $2 on indices and 0.15% on stocks for most account types.

Which Markets Can You Trade with BDSwiss?

- 53 currency pairings

- 6 commodities

- 14 indexes

- 128 stocks

Furthermore, They provide 27 cryptocurrencies for trading, allowing traders to participate in the unpredictable cryptocurrency market by taking positions in digital currencies such as Bitcoin, Ethereum, and other altcoins.

Does BDSwiss provide trading options for cryptocurrency CFDs?

Indeed, this broker provides CFD trading on 27 cryptocurrencies, enabling traders to participate in the unpredictable cryptocurrency market.

Deposits and Withdrawals

This broker offers traders a wide selection of trusted deposit options and withdrawal methods, including EFT, Credit/Debit Cards, and Mobile Solutions. Additionally,

| 🔎 Payment Method | 🌎 Country | 💴 Currencies Accepted | ⏰ Processing Time |

| 💳 Credit/Debit Card | All | EUR, GBP, USD | Instant Deposits, Withdrawals in 24 hours |

| 📈 Electronic Funds Transfer (EFT) | South Africa | ZAR | Instant Deposits, Withdrawals in 24 hours |

| 📉 Korapay | Nigeria | NGN | Instant Deposits, Withdrawals in 24 hours |

| 📱 Mobile Solutions (OZOW, M-PESA, Vodafone, Airtel, TiGO, MTN, etc.) | South Africa, Kenya, Ghana, Tanzania, Uganda, Benin, Burkina Faso, Ivory Coast, Guinea-Bissau, Mali, Niger, Senegal, and Togo | ZAR, KES, GHS, TZS, XOF, UGX | Instant Deposits, Withdrawals in 24 hours |

| 📊 Electronic Wallets (GCash, Pay Maya, etc.) | Thailand, Indonesia, Philippines, Vietnam, Malaysia | THB, IDR, PHP, VND, MYR | Instant Deposits, Withdrawals in 24 hours |

| 💹 Pix | Brazil | BRL | Instant Deposits, Withdrawals in 24 hours |

| 🐝 Beeteller | Brazil, Chile, Colombia, Costa Rica, Mexico, Peru, Guatemala | BRL, CLP, COP, CRC, MXN, PEN, GTQ, USD | Instant Deposits, Withdrawals in 24 hours |

| 🪙 Cryptocurrency Wallets | All | BTC, BCH, ETH, PAX, TUSD, USDT, USDC, LTC, XRP, DASH, ZCASH, ADA | Instant Deposits, Withdrawals in 24 hours |

| 💻 Bank Wire Transfer | All | EUR, USD, GBP, PLN, CHF, SEK, DKK, NOK | 1 -5 days on deposits, Withdrawals in 24 hours |

Here is an overview of how to deposit to BDSwiss via the most popular Deposit Options:

Bank Wire

- Log in to your account.

- Navigate to the ‘Deposits’ area and Choose ‘Bank Wire Transfer’ as your desired deposit method.

- Enter the deposit amount and any further information.

- Obtain the banking information supplied by BDSwiss.

- To conduct a wire transfer, visit your bank’s online or in-person platform.

- To initiate the transfer, enter the banking information given.

- Finalize the transaction by confirming the payment with your bank.

- Funds will be credited to your trading account after the bank confirms the transfer.

Credit or Debit Card

- Start by logging in to your account.

- Visit the ‘Deposit’ or ‘Funding’ area.

- Select ‘Credit/Debit Card’ as the deposit method.

- Enter your card information and specify the deposit amount.

- Confirm and approve the transaction.

- The deposit should be immediate, and the cash should soon be in your trading account.

Cryptocurrency Wallets

- Firstly, log in to your account and select the ‘Deposit’ option,

- Next, select ‘Cryptocurrency Wallets’ from the list.

- Thirdly, Choose the coin you want to use for the deposit.

- Enter the amount you want to deposit in your account’s base currency.

- A unique wallet address or QR code will be generated for the transaction.

- Open your crypto wallet and click the “Send money” option.

- Use the specified wallet address or scan the QR code.

- Enter the amount of crypto to be sent and then confirm the transaction.

- The funds will be converted to your trading account’s base currency and deposited.

e-wallets or Payment Gateways

- Firstly, log in to your account and additionally navigate to the ‘Deposit’ area

- Additionally, Pick ‘e-Wallets’ or the payment gateway you want to use.

- When asked, log into your e-Wallet account or provide the required credentials.

- Enter your deposit amount on the e-Wallet interface.

- Confirm payment and provide any rights needed by the e-wallet service.

- Lastly, the cash will be transferred.

Here is an overview of how to make Withdrawal from BDSwiss via the most popular Withdrawal Options:

Bank Wire

- Firstly, Go to the ‘Withdrawal’ or ‘Funds Management’ area.

- Select ‘Bank Wire Transfer’ as your withdrawal option.

- Fill out the withdrawal form with your financial information

- Enter the amount that you want to withdraw.

- Lastly, Submit a withdrawal request.

- Wait for BDSwiss to complete your withdrawal.

- This may take several business days.

- Check your bank account for the money after the specified processing time.

Credit or Debit Card

- Log in to your trading account and Go to the ‘Withdrawals’ section.

- In addition, select ‘Credit/Debit Card’ as your withdrawal method.

- Select the card you previously used to deposit.

- Determine the withdrawal amount and complete all necessary security verification processes.

- Lastly, submit a withdrawal request.

- Following processing, funds will be paid back to the card.

Cryptocurrency Wallets

- Firstly, log in to your trading account Navigate to the ‘Withdrawal’ area.

- Secondly, Choose ‘Cryptocurrency Wallets’.

- Choose the coin you want to withdraw.

- Enter your crypto wallet address to get the money.

- Enter the withdrawal amount and make sure it is within the allowed limits.

- Please confirm the data and submit your withdrawal request.

- The cash will be sent to your crypto wallet.

- Furthermore, in our experience, They are a strong challenger, providing a diverse range of financial products across many asset classes

e-wallets or Payment Gateways

- Firstly, log in to your account

- Navigate to the ‘Withdrawal’ section and pick ‘e-Wallets.’

- Select your e-wallet provider from the available alternatives.

- Enter the email address or account information linked with your e-wallet.

- Please specify the amount you intend to withdraw and confirm the withdrawal information.

- Finally, submit your request.

- However, e-wallets often provide faster withdrawal speeds than bank transfers and credit or debit cards.

Does BDSwiss charge fees for depositing or withdrawing funds?

They require a government-issued picture ID and evidence of residence, such as a utility bill or bank statement, to verify an account.

Educational Resources

BDSwiss Forex Glossary is a compilation of major trading words and meanings that is a must-have resource for new and seasoned traders.

Furthermore, As a result, it helps traders understand the unique vocabulary used in Forex and CFD trading.

- Educational videos

- Seminars

- Articles, tutorials, and interactive content

- Live instructional webinars

- eBooks

For traders seeking a more customized learning experience, They provide one-on-one VIP sessions and trusted customer support.

Can beginners learn how to trade with BDSwiss’ educational tools?

Novices will benefit from their extensive instructional department, which includes information appropriate for beginning traders.

Pros and Cons

| ✅ Pros | ❌ Cons |

| BDSwiss offers an impressive number of markets that can be traded | There is an inactivity fee applied to dormant accounts |

| There are account levels for all types of traders | The spreads on popular accounts are wide, starting from 1.5 pips |

| BDSwiss is a highly reputable, award-winning broker regulated globally | Commission fees apply to all account types |

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA | USD 100 | Visit Broker >> |

| 🥈 |  | Read Review | FMA, FSA | USD 50 | Visit Broker >> |

| 🥉 |  | Read Review | FSCA, CySEC, DFSA, FSA, CMA | USD 0 | Visit Broker >> |

| 4 |  | Read Review | ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB | USD 200 | Visit Broker >> |

| 5 |  | Read Review | FCA, CySEC, FSCA, SCB | USD 100 | Visit Broker >> |

| 6 |  | Read Review | CySEC, MISA, FSCA | USD 25 | Visit Broker >> |

| 7 |  | Read Review | CySEC, FCA, FSA, FSCA, Labuan FSA | USD 100 | Visit Broker >> |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker >> |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker >> |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker >> |

Conclusion

Moreover, in our experience, BDSwiss is a strong challenger, providing a diverse range of financial products across many asset classes. Additionally, its tight regulatory structure and many jurisdictions create a safe trading environment that fosters confidence among traders.

Spreads vary by asset and account type.

Yes, several regulatory entities require BDSwiss to follow strict client protection and operational best practices.

Yes, fractional share trading is accessible on some equities via the BDSwiss platform.

No, there are no current bonuses available.

Withdrawals are processed within 24 hours. However, cash might take 2–5 business days to reach your account, to banking procedures.

Minimum deposits vary by account type, ranging from $10 for Cent and Classic accounts to $250 for VIP and Zero-Spread accounts.

Yes, They provide swap-free accounts that adhere to Sharia standards, avoiding interest costs.

They are located in Zurich, Switzerland, and have offices worldwide.

Yes, Withdrawal fees may apply based on the method used, and the amount withdrawn.

They provide the mainstream MetaTrader 4 and 5 platforms and their own customized online and mobile trading platforms.

Yes, a free demo account with virtual money so you may practice trading.

BDSwiss lets traders trade over 250 financial assets, including forex pairings, commodities, indices, stocks, and cryptocurrencies, creating a diverse portfolio for varied trading methods and risk appetites. Beginners and experienced traders may diversify their portfolios with this wide offering.

Yes, They provide various instructional tools, like webinars, video lessons, and articles, to assist novices in learning about trading.

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |