6 Best cTrader Forex Brokers

Last Update: April 8th, 2024

6 Best cTrader Forex Brokers revealed. We have explored and tested several prominent Forex brokers to identify the list of 6 best brokers below.

In this in-depth guide you’ll learn:

- What is a cTrader Supported broker?

- The Best cTrader Platform?

- Best cTrader brokers in South Africa.

- What is cTrader prop firms?

- Is cTrader better than Meta Trader?

- Minimum deposit for cTrader.

- Pros and cons of each broker.

- Popular FAQs about cTrader brokers.

And lots more…

So, if you’re ready to go “all in” with 6 best cTrader brokers…

Let’s dive right in…

🏆 10 Best Forex Brokers

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA | USD 100 | Visit Broker >> |

| 🥈 |  | Read Review | FMA, FSA | USD 50 | Visit Broker >> |

| 🥉 |  | Read Review | FSCA, CySEC, DFSA, FSA, CMA | USD 0 | Visit Broker >> |

| 4 |  | Read Review | SFSA, FSCA, CySec* | USD 5 | Visit Broker >> |

| 5 |  | Read Review | FCA, CySEC, FSCA, SCB | USD 100 | Visit Broker >> |

| 6 |  | Read Review | FCA, FINMA, FSA, ASIC | USD 0 | Visit Broker >> |

| 7 |  | Read Review | CySEC, FCA, FSA, FSCA, Labuan FSA | USD 100 | Visit Broker >> |

| 8 |  | Read Review | Not Regulated | 0.001 BTC | Visit Broker >> |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker >> |

| 10 |  | Read Review | CySEC,MISA, FSCA | USD 20 | Visit Broker >> |

6 Best cTrader Forex Brokers

- ☑️IC Markets – Strong Reputation for Reliability.

- ☑️ FP Markets – a Comprehensive Trading experience.

- ☑️Pepperstone – Known for its Cutting-edge technology.

- ☑️RoboForex – The best Responsive Customer Support.

- ☑️FxPro – Stands out for its Competitive Pricing.

- ☑️Fondex – Known for Commitment to Transparency.

What is a cTrader broker?

cTrader is a sophisticated Forex trading platform known for its user-friendly interface and advanced trading features. Some Forex brokers offer access to cTrader to provide traders with access to the global currency markets, offering various tools for analysis, execution, and risk management to facilitate efficient trading experiences.

Top 6 cTrader Brokers

| 🔎 Broker | 🚀 Open an Account | 💶 Min. Deposit | ✅ Demo Account |

| 🥈 IC Markets | 👉 Click Here | 200 USD | ✅Yes |

| 🎖️ FP Markets | 👉 Click Here | 100 USD | ✅Yes |

| 🥉 Pepperstone | 👉 Click Here | 100 USD | ✅Yes |

| 🥇 RoboForex | 👉 Click Here | 10 USD | ✅Yes |

| 🏅 FxPro | 👉 Click Here | 100 USD | ✅Yes |

| 🥉 Fondex | 👉 Click Here | 100 USD | ✅Yes |

IC Markets

Overview

IC Markets is a leading Forex broker renowned for its transparency, low spreads, and lightning-fast execution speeds.

With a strong reputation for reliability and professionalism, IC Markets caters to both beginner and experienced traders worldwide.

At IC Markets, traders have access to the popular cTrader platform, which offers advanced charting tools, customizable interface, and lightning-fast execution.

The cTrader platform provided by IC Markets allows traders to execute trades with precision and speed, utilizing a wide range of technical indicators and charting options to analyze the market effectively.

Moreover, IC Markets stands out for its deep liquidity from top-tier liquidity providers, ensuring competitive pricing and minimal slippage.

The broker also offers a diverse range of trading instruments beyond Forex, including CFDs on indices, commodities, and cryptocurrencies.

Overall, IC Markets provides a comprehensive trading environment coupled with excellent customer support, making it a preferred choice for traders seeking reliable access to the Forex markets.

Unique Features

| Feature | Information |

| 🏛️ Regulation | ASIC, CySEC, FSA, SCB |

| 📲 Social Media Platforms | LinkedIn You Tube |

| 💻 Trading Accounts | cTrader Account, Raw Spread Account, Standard Account. |

| 📊 Trading Platforms | MetaTrader 4 MetaTrader 5 cTrader IC Social Signal Start Zulu Trade |

| 💰 Minimum Deposit | HKD1,564.52 in $200 |

| 📉 Trading Assets | Forex Indices Stocks Commodities Cryptocurrencies Bonds Futures |

| HKD-based Account? | ❌No |

| HKD Deposits Allowed? | ✔️ Yes |

| Bonuses for traders? | ❌No |

| 📈 Minimum spread | From 0.0 pips |

| 💻 Demo Account | ✔️ Yes |

| ☪️ Islamic Account | ✔️ Yes |

| 👉 Open Account | 👉 Open Account |

IC Markets Pros and Cons

| ✅Pros | ❌Cons |

| IC Markets is a popular broker regulated by several top entities globally | Leverage is capped according to the financial instruments |

| The trading conditions are competitive | There might be limitations on the availability of certain instruments |

| IC Markets is known for its robust and feature-rich technology and platforms | There is a rigorous and extensive verification process that could take some time to navigate |

| IC Markets offers extensive educational material and superior customer support |

Trust Score

IC Markets has a high trust score of 87%.

FP Markets

Overview

FP Markets is a renowned Forex broker offering traders access to the powerful cTrader platform alongside MetaTrader options.

With cTrader, FP Markets delivers an intuitive interface, advanced charting tools, and lightning-fast execution, empowering traders to analyze markets efficiently and execute trades with precision.

Traders benefit from tight spreads on a wide range of tradable assets including Forex pairs, commodities, indices, and cryptocurrencies, ensuring competitive pricing and optimal trading conditions.

FP Markets offers multiple account types tailored to suit various trading styles and experience levels, from beginners to seasoned professionals.

Beyond its trading platforms and diverse asset selection, FP Markets stands out for its commitment to transparency, customer service excellence, and regulatory compliance.

With deep liquidity and reliable execution, FP Markets continues to be a preferred choice for traders worldwide seeking a comprehensive trading experience.

Unique Features

| Feature | Information |

| 🏛️ Regulation | ASIC, CySEC, FSCA, FCA and FSA |

| 🏛️ HKSFC regulation? | ❌ No |

| 📲 Social Media Platforms | LinkedIn You Tube |

| 💻 Trading Accounts | MT4/5 Standard Account, an MT4/5 Raw Account, an MT4/5 Islamic Standard Account, and an MT 4/5 Islamic Raw Account |

| 📊 Trading Platforms | MetaTrader 4 MetaTrader 5 cTrader IRESS FP Markets App |

| 💰 Minimum Deposit | $100 |

| 📉 Trading Assets | Forex Shares Indices Commodities Cryptocurrencies Bonds ETFs |

| ➕ Bonuses for traders? | ❌ No |

| 📈 Minimum spread | From 0.0 pips |

| 💻 Demo Account | ✔️ Yes |

| ☪️ Islamic Account | ✔️ Yes |

| 👉 Open Account | 👉 Open Account |

FP Markets Pros and Cons

| ✔️ Pros | ❌ Cons |

| The cutting-edge technology architecture of FP Markets is advantageous to traders. | Owing to FP Markets' global orientation, support for certain local payment methods could be limited. |

| Traders can take advantage of comprehensive customer support provided by a skilled and committed crew. | Although FP Markets offers a wide range of products, certain traders may be interested in local or specialist markets that they do not offer. |

| Traders have the option of trading with a broker who is subject to regulation by a variety of international regulatory bodies, including the FSA, FSC, ASIC, FSCA, and CySEC. | Withdrawal fees are assessed by FP Markets for a number of payment options. |

| For traders who wish to advance their trading expertise, FP Markets provides a whole educational package. | |

| In order to accommodate traders' diverse demands and trading preferences, FP Markets offers a range of account kinds. | |

| Traders can use platforms like MetaTrader 4, cTrader, IRESS, and MetaTrader 5 to get access to sophisticated charting and analytical tools. | |

| Traders can diversify their trading methods across asset classes by having access to a large range of global markets through FP Markets. | |

| FP Markets keeps its minimum commission arrangements and competitive spreads in place. |

Trust Score

FP Markets has a high trust score of 87%.

Pepperstone

Overview

Pepperstone is a prominent Forex broker known for its cutting-edge technology, competitive pricing, and exceptional customer service.

Among its suite of trading platforms, Pepperstone offers the popular cTrader platform, which provides traders with advanced charting tools, customizable interface, and lightning-fast execution.

Through the cTrader platform, Pepperstone clients can access a wide range of Forex pairs, commodities, indices, and cryptocurrencies, allowing for diversified trading opportunities.

The platform’s intuitive design and robust features enable traders to analyze markets effectively and execute trades with precision.

Pepperstone prides itself on offering tight spreads, low commissions, and reliable execution, making it an attractive choice for both beginner and experienced traders.

With a strong focus on transparency and regulatory compliance, Pepperstone ensures a secure and trustworthy trading environment for its clients.

Overall, Pepperstone stands as a reputable broker committed to providing traders with innovative technology and optimal trading conditions.

Unique Features

| Feature | Information |

| 🏛️ Regulation | ASIC, BaFin, CMA, CySEC, DFSA, FCA and SCB |

| 📲 Social Media Platforms | LinkedIn You Tube |

| 💻 Trading Accounts | Standard Account Razor Account Professional Account Demo Account Islamic Account |

| 📊 Trading Platforms | MetaTrader 4 MetaTrader 5 cTrader TradingView Capitalise.ai |

| 💰 Minimum Deposit | AU$200 |

| 📉 Trading Assets | Forex Indices Shares Commodities Cryptocurrencies ETFs Currency Indices |

| 💲 USD-based Account? | ✔️ Yes |

| 💲 USD Deposits Allowed? | ✔️ Yes |

| ➕ Bonuses for traders? | No |

| 📈 Minimum spread | From 0.0 pips |

| 💻 Demo Account | ✔️ Yes |

| ☪️ Islamic Account | ✔️ Yes |

| 👉 Open Account | 👉 Open Account |

Pepperstone Pros and Cons

| ✅ Pros | ❌ Cons |

| provides an execution model with no dealing desk | Peppertone only offers trading through two retail accounts. |

| offers trading on the globally known and preferred MetaTrader 4 and 5, together with cTrader. | Negative balance protection is only available for UK/EU clients. |

| is multi-regulated and complies with all regulations, policies, and procedures to ensure client fund safety in various jurisdictions | While commission-free, the retail account has wide spreads. |

| Traders looking to diversify their portfolios can profit from Pepperstone's provision of CFDs on indices, commodities, cryptocurrencies, and shares. | The large selection of platforms might overwhelm beginner traders. |

| offers fairly cheap spreads on various financial assets, including currency pairs, indices, commodities, and equities. | Pepperstone does not offer a proprietary trading platform. |

| Customer service has a dedicated support team that is available 24/7 | The range of educational materials and trading tools offered by Pepperstone is not as extensive as that of other brokers. |

Trust Score

Pepperstone has a high trust score of 92%.

RoboForex

Overview

RoboForex is a distinguished Forex broker offering the powerful cTrader platform alongside other trading options. Regulated by several authorities, including CySEC and IFSC, RoboForex ensures a secure trading environment for its clients.

Traders can choose from a variety of account types, tailored to suit different trading preferences and experience levels.

With a diverse selection of trading assets including Forex pairs, commodities, indices, stocks, and cryptocurrencies, RoboForex provides ample opportunities for traders to diversify their portfolios.

The broker is also known for its responsive customer support, available 24/7 to assist clients with any inquiries or issues they may encounter.

Moreover, RoboForex offers comprehensive educational resources, including tutorials, webinars, and market analysis, to help traders enhance their skills and stay informed about market developments.

With its commitment to regulatory compliance, robust account options, extensive asset selection, attentive customer support, and educational initiatives, RoboForex stands as a reputable choice for traders seeking a reliable and comprehensive trading experience.

Unique Features

| Feature | Information |

| 🏛️ Regulation | FSC |

| 📲 Social Media Platforms | LinkedIn You Tube |

| 💻 Trading Accounts | Prime, ECN, RStocksTrader, ProCent, Pro |

| 📊 Trading Platforms | MetaTrader 4 MetaTrader 5 RStocks Trader cTrader |

| 💰 Minimum Deposit | $10 |

| 📉 Trading Assets | Forex Indices Stocks Metals Oil Futures |

| 💲 USD-based Account? | ✔️ Yes |

| 💲 USD Deposits Allowed? | ✔️ Yes |

| ➕ Bonuses for traders? | ✔️ Yes |

| 📈 Minimum spread | From 0.0 pips |

| 💻 Demo Account | ✔️ Yes |

| ☪️ Islamic Account | ✔️ Yes |

| 👉 Open Account | 👉 Open Account |

RoboForex Pros and Cons

| ✅Pros | ❌Cons |

| RoboForex provides several account types, including cent accounts | Some traders have complained about customer service's responsiveness and efficacy |

| The broker offers CopyFX, a tool for copy trading that is useful for both beginners and experienced traders searching for diversity | RoboForex's bonus programs might be complex and difficult to grasp, particularly for inexperienced traders. |

| RoboForex features a loyalty program that offers cashback and other advantages to active users | |

| The broker accepts a variety of payment options, including cryptocurrency, for deposits and withdrawals | |

| RoboForex offers MetaTrader 4 and 5, which provide traders with freedom and superior capabilities |

Trust Score

RoboForex has a high trust score of 87%.

FxPro

Overview

FxPro is a leading Forex broker renowned for its commitment to transparency, innovation, and client satisfaction.

Among its suite of trading platforms, FxPro offers the sophisticated cTrader platform, providing traders with advanced charting tools, customizable interface, and lightning-fast execution.

The cTrader platform offered by FxPro enables traders to access a wide range of Forex pairs, commodities, indices, and cryptocurrencies, facilitating diversified trading strategies.

FxPro stands out for its competitive pricing, tight spreads, and deep liquidity, ensuring optimal trading conditions for clients.

Moreover, FxPro offers a range of standout features for traders, including negative balance protection, flexible leverage options, and multiple account types to cater to various trading styles and preferences.

With a strong focus on regulatory compliance, security, and technological innovation, FxPro continues to be a preferred choice for traders worldwide seeking a reliable and comprehensive trading experience.

Unique Features

| Feature | Information |

| 🏛️ Regulation | FCA, CySEC, SCB, FSCA, FSC |

| 📲 Social Media Platforms | LinkedIn You Tube |

| 💻 Trading Accounts | Standard Account, Pro Account, Raw+ Account, and ECN Account |

| 📊 Trading Platforms | MetaTrader 4 MetaTrader 5 cTrader FxPro App |

| 💰 Minimum Deposit | $100 |

| 📉 Trading Assets | Forex Indices Shares Metals Cryptocurrency CFDs Energies Futures |

| 💲 USD-based Account? | ✔️ Yes |

| 💲 USD Deposits Allowed? | ✔️ Yes |

| ➕ Bonuses for traders? | ✔️ Yes |

| 📈 Minimum spread | N/A |

| 💻 Demo Account | ✔️ Yes |

| ☪️ Islamic Account | ✔️ Yes |

| 👉 Open Account | 👉 Open Account |

FxPro Pros and Cons

| ✅ Pros | ❌Cons |

| Offers the famous MetaTrader 4 and 5 platforms, as well as its own user-friendly FxPro platform | While the FxPro app is easy to use, it lacks the capability of specialist trading applications |

| On cTrader accounts with instant execution, execution is generally reliable, with minimal slippage and no requotes | cTrader accounts could face greater commissions |

| Educational materials and tools are available to assist novice traders learn and improve their tactics | Compared to other brokers, the product offering is limited, with a concentration primarily on forex and CFDs |

| FxPro is well-regulated by the FCA, FSCA, FSC, CySEC, and SCB, which provides some security and peace of mind | FxPro charges an inactivity cost after 6 months of no trading |

| Competitive spreads, especially on cTrader accounts with raw spreads starting at 0 pips | FxPro has previously faced regulatory inquiry but resolved without admitting wrongdoing |

Trust Score

FxPro has a high trust score of 90%.

Fondex

Overview

Fondex is a reputable Forex broker known for its commitment to transparency, innovation, and client satisfaction. Fondex offers the sophisticated cTrader platform, renowned for its advanced charting tools, customizable interface, and lightning-fast execution.

Through cTrader, Fondex provides traders access to a wide range of Forex pairs, commodities, indices, and cryptocurrencies, allowing for diversified trading strategies. Fondex stands out for its competitive pricing, offering tight spreads and low commissions to ensure cost-effective trading for clients.

Moreover, Fondex provides a variety of account types tailored to suit different trading preferences and experience levels, from beginners to advanced traders.

With its comprehensive selection of trading assets, advanced trading platform, and transparent pricing structure, Fondex continues to be a preferred choice for traders seeking a reliable and comprehensive trading experience.

Unique Features

| Feature | Information |

| 🏛️ Regulation | CySEC |

| 📲 Social Media Platforms | LinkedIn You Tube |

| 💻 Trading Accounts | Live Trading Account |

| 📊 Trading Platforms | cTrader |

| 💰 Minimum Deposit | $0 |

| 📉 Trading Assets | Commodities, Shares, Indices, Cryptos |

| 💲 USD-based Account? | ✔️ Yes |

| 💲 USD Deposits Allowed? | ✔️ Yes |

| ➕ Bonuses for traders? | No |

| 📈 Minimum spread | From 0.0 pips |

| 💻 Demo Account | ✔️ Yes |

| ☪️ Islamic Account | ✔️ Yes |

Fondex Pros and Cons

| ✅ Pros | ❌Cons |

| provides access to the cTrader platform, known for its advanced charting tools, customizable interface, and fast execution speeds. | research tools may not be as extensive as those offered by some competitors, potentially limiting analysis capabilities for traders. |

| offers competitive pricing with tight spreads and low commissions, enhancing cost-effectiveness for traders. | educational resources may be limited compared to some other brokers, potentially limiting learning opportunities for traders. |

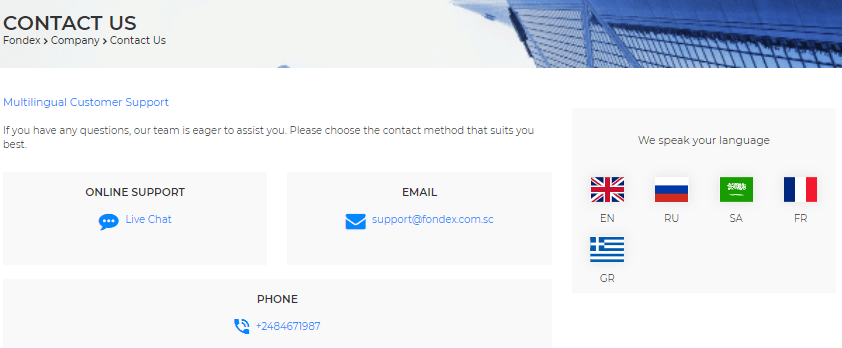

| offers a wide range of trading instruments including Forex pairs, commodities, indices, and cryptocurrencies, allowing for diversified trading strategies. | offers customer support, the availability or responsiveness of support channels may vary, which could impact the assistance provided to traders. |

| is regulated by the Cyprus Securities and Exchange Commission (CySEC), providing traders with a secure trading environment and regulatory oversight. | may offer fewer bonus promotions compared to some other brokers, which could be a drawback for traders seeking additional incentives |

| offers various account types to cater to different trading preferences and experience levels, from beginner to advanced traders. | cryptocurrency offering may be relatively limited compared to some other brokers, potentially restricting trading opportunities in this asset class. |

Trust Score

Fondex has a trust score of 80%.

Conclusion

Overall, the best Forex brokers offering cTrader combine advanced technology, competitive pricing, regulatory compliance, and diverse trading opportunities to provide traders with exceptional experiences. With features like advanced charting tools and fast execution speeds, these brokers empower traders to navigate the Forex market with confidence and efficiency.

Frequently Asked Questions

What is cTrader?

cTrader is a popular trading platform known for its advanced charting tools, customizable interface, and lightning-fast execution. It stands out for its user-friendly design and features like Level II pricing, making it a preferred choice for many traders.

Which Forex brokers offer cTrader as a trading platform?

Several reputable Forex brokers offer cTrader, including Pepperstone, FxPro, IC Markets, RoboForex, and Fondex. These brokers provide access to the cTrader platform alongside other trading options, catering to a diverse range of traders.

What are the advantages of using cTrader for Forex trading?

cTrader offers numerous advantages, including advanced charting capabilities, fast order execution, and a wide range of technical indicators. It also provides transparency in pricing and depth of market (DOM) features, allowing traders to make informed decisions.

Can I use cTrader on mobile devices?

Yes, cTrader is available as a mobile application for both iOS and Android devices. The mobile app offers full functionality, enabling traders to monitor the markets, execute trades, and access account information on the go.

Are there any fees associated with using cTrader or trading through brokers that offer it?

While cTrader itself is typically offered for free by brokers, there may be trading-related fees such as spreads, commissions, and overnight financing charges. These fees vary depending on the broker and the type of account you choose. It’s essential to review the fee structure provided by your chosen broker before trading.