Admirals Review

- Analysis of Brokers' Main Features

- Overview

- Detailed Summary

- Safety and Security

- Account Types

- How To Open an Account

- Trading Platforms and Software

- Fees, Spreads, and Commissions

- Which Markets Can You Trade?

- Leverage and Margin

- Deposit and Withdrawal

- Admirals Educational Resources

- Admirals Pros and Cons

- In Conclusion

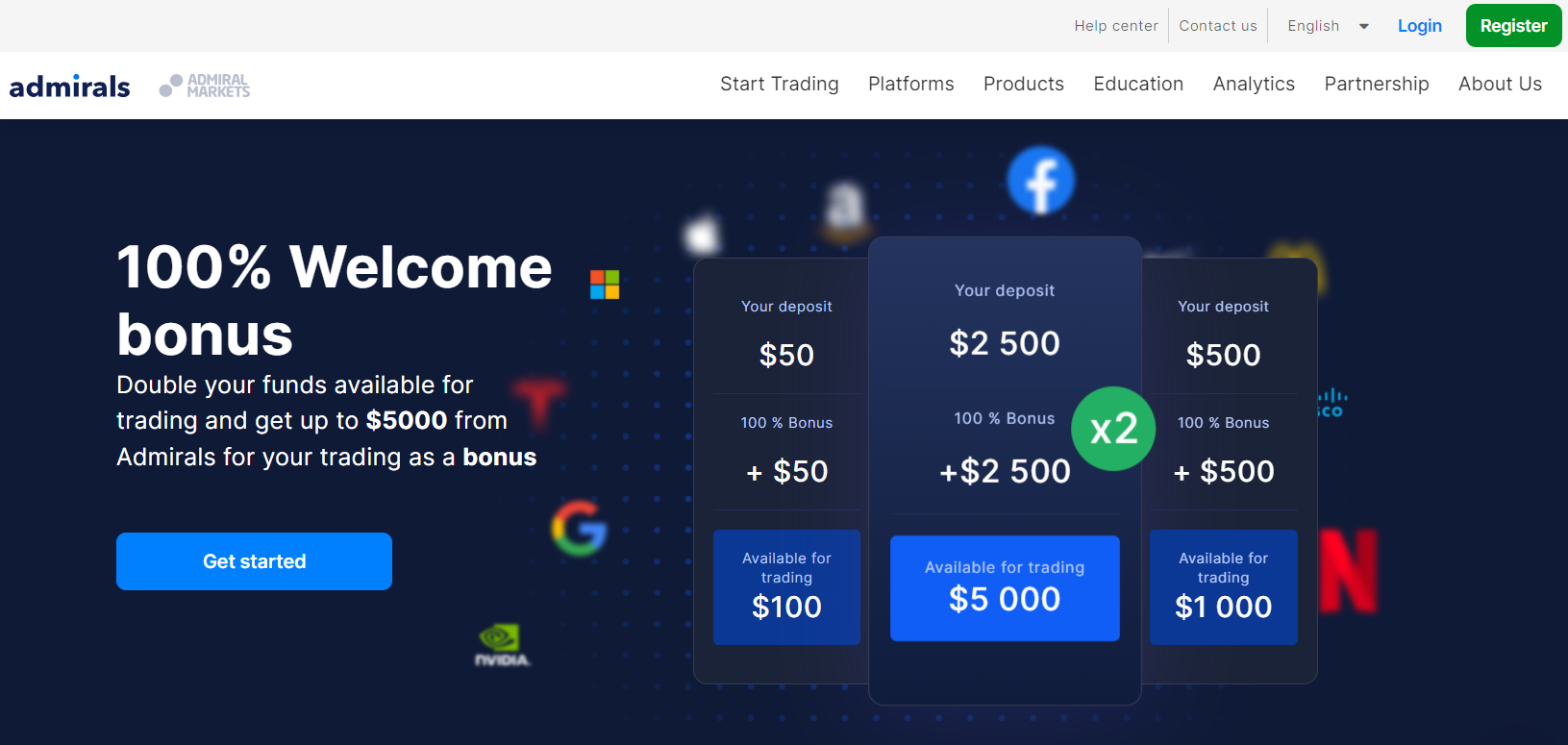

Overall, Admirals can be summarized as trustworthy and regulated with competitive trading fees. Admirals previously known as Admiral Markets offers an array of trading products and accounts tailored to diverse traders’ needs. Admirals have a trust score of 84 out of 99.

| 🔎Broker | 🥇Admirals |

| 💴Minimum Deposit | 25 USD |

| 🎉Established Year | 2001 |

| ⏰Support Hours | 24/5 |

| 💻Trading Platforms | MetaTrader 4, MetaTrader 5, Admirals App |

| 📈Account Types | Trade.MT4, Zero.MT4, Trade.MT5, Invest.MT5, Zero.MT5, Bets.MT5 |

| 🚀 Open an Account | 👉 Click Here |

Analysis of Brokers’ Main Features

- ☑️ Overview

- ☑️ Detailed Summary

- ☑️ Safety and Security

- ☑️ Account Types

- ☑️ How to Open an Admirals Account

- ☑️ Trading Platforms and Software

- ☑️ Fees, Spreads, and Commissions

- ☑️ Markets Can You Trade with Admirals?

- ☑️ Leverage and Margin

- ☑️ Deposit and Withdrawal

- ☑️ Educational Resources

- ☑️ Pros and Cons

- ☑️ In Conclusion

- ☑️ Frequently Asked Questions

Overview

Having commenced operations in 2001, Admirals (previously Admiral Markets) is a renowned online trading service supplier. The firm’s principal location is London, the financial hub of the UK, with supplementary branches in various regions, including Jordan, Australia, Cyprus, and South Africa, among others.

The company’s dedication to catering to a varied customer base is evidenced by its extensive presence, which offers an array of trading products and accounts tailored to diverse traders’ needs.

The broker’s operations are founded on regulatory compliance, boasting several tier-1 licenses from the acclaimed Financial Conduct Authority (FCA) in the UK and the Australian Securities and Investment Commission (ASIC).

These regulations are supplemented by tier-2 and tier-3 licenses from regulatory bodies such as CySEC, FSCA, and JSC, which provide a well-regulated trading environment.

Admirals offers an Islamic account for Sharia-compliant trading and a conventional demo account active for 30 days.

One notable feature of their product is the support for various trading methods, including scalping, hedging, and using Expert Advisors (EAs), which may appeal to new and seasoned traders.

Detailed Summary

| 🔎Broker | 🥇Admirals |

| 🎉Established Year | 2001 |

| 🚨Regulation and Licenses | FCA, ASIC, CySEC, JSC,FSCA, FSA,CMA |

| 💯Ease of Use Rating | 5/5 |

| 💰Bonuses | ✅Yes, referral bonus, welcome bonus, no-deposit bonus, cashback program |

| ⏰Support Hours | 24/5 |

| 📈Trading Platforms | MetaTrader 4, MetaTrader 5, Admirals App |

| 📉Account Types | Trade.MT4, Zero.MT4, Trade.MT5, Invest.MT5, Zero.MT5, Bets.MT5 |

| 💴Base Currencies | EUR, USD, GBP, CHF, BGN, CZK, HRK, HUF, PLN, RON |

| 💹Spreads | From 0.0 pips |

| 📊Leverage | Up to 1:1000 |

| 💵Currency Pairs | 80+, major, minor, and exotic pairs |

| 💶Minimum Deposit | 25 USD |

| 💷Inactivity Fee | ✅Yes, $10 per month after 2 years of inactivity |

| 💻Website Languages | English, German, French, Italian, Romanian, Spanish, Portuguese, Russian, Polish, and others |

| 💰Fees and Commissions | Spreads from 0.0 pips, commissions from $0.02 |

| 👥Affiliate Program | ✅Yes |

| 🌎Banned Countries | Canada, the United States, Japan, Malaysia, Singapore, and some other countries |

| ✳️Scalping | ✅Yes |

| 🧱Hedging | ✅Yes |

| 📈Trading Instruments | ESG, Forex, Crypto CFDS, Indices, Stocks, ETFs, Bonds |

| 🚀 Open an Account | 👉 Click Here |

What regulations apply?

Admirals are regulated by numerous respected authorities, including the FCA in the United Kingdom, ASIC in Australia, and CySEC in Cyprus, ensuring high accountability and security.

Can I trade cryptocurrencies?

Yes, Admirals provides CFD trading on cryptocurrencies, enabling traders to bet on the price swings of popular cryptocurrencies without holding the underlying asset.

Safety and Security

Admirals prioritize the protection of its customers’ finances and personal information by using a holistic approach to online safety.

The broker guarantees that customer assets are maintained in segregated accounts, an important safeguard that separates clients’ money from the company’s operating finances, adding an extra layer of security against fund abuse. This segmentation guarantees that customers’ assets are only utilized for trading purposes.

In addition to account segregation, Admirals is a member of compensation funds, which provide additional financial protection to traders.

Clients under the authority of regulatory bodies such as the FCA, for example, are entitled to up to £85,000 in compensation via the Financial Services Compensation Scheme (FSCS) in the case of the broker’s bankruptcy. Similar programs exist in other locations, offering a safety net for traders.

How do Admirals safeguard personal and financial information?

Admirals use SSL encryption to protect the transfer of personal and financial information and also use two-factor authentication (2FA) for account access and transactions.

What should I do if I suspect unauthorized access to my?

If you suspect unauthorized access to your account, please immediately alert Admiral’s customer service. Changing your password and examining your account activities frequently is also recommended.

Account Types

| 🔑Account type | 🥇Trade.MT4 | 🥈Zero.MT4 | 🥉Trade.MT5 | 🎖️Zero.MT5 | 🏅Invest.MT5 | 🥇Bets.MT5 |

| 📌Availability | All | All | All | All | All | UK only |

| 💰Commissions | None | From $1.8 | From $0.02 per share | From $0.05 per lot on cash indices | From $0.02 per share | None |

| 💻Platforms | MetaTrader 4 | MetaTrader 4 | MetaTrader 5 | MetaTrader 5 | MetaTrader 5 | MetaTrader 5 |

| 📊Trade Size | 0.01 – 500 lots | 0.01 – 200 lots | 0.01 – 500 lots | 0.01 – 500 lots | Up to 500 lots | 0.01 – 500 lots |

| 💹Leverage | 1:30 retail, 1:500 pro, 1:1000 (Seychelles) | 1:30 retail, 1:500 pro, 1:1000 (Seychelles) | 1:30 retail, 1:500 pro, 1:1000 (Seychelles) | 1:30 retail, 1:500 pro, 1:1000 (Seychelles) | None | 1:30 retail, 1:500 pro, 1:1000 (Seychelles) |

| 💷Minimum Deposit | From 25 USD | From 25 USD | From 25 USD | From 25 USD | From $1 | From 100 GBP |

| 🚀 Open an Account | 👉 Click Here | 👉 Click Here | 👉 Click Here | 👉 Click Here | 👉 Click Here | 👉 Click Here |

Trade.MT4

Access to the MetaTrader4 platform is granted through a Trade.MT4 account allows traders to delve into numerous currencies, commodities, energy, and stock CFDs with an initial deposit of $25.

The minimum position size is 0.01 lots, while competitive spreads commence from just 0.5 pips. Coupled with market execution and most instruments incurring zero fees, this option provides great value for those seeking affordability without sacrificing performance capability.

Zero.MT4

The Zero.MT4 account on the MetaTrader4 platform is designed for experienced traders, with spreads as low as 0 pips and commission payments starting at $1.8 per lot. A $25 (depending on region) minimum deposit is needed to access various markets, including 45 currency pairs, commodities, and energy.

This account type is intended for high-frequency traders who want to take advantage of market execution and the possibility of zero spreads to improve the effectiveness of their trading strategies.

Trade.MT5

The Trade.MT5 account caters to retail traders who like MetaTrader5’s enhanced capabilities. Depending on region, the account requires a $25 initial deposit and provides access to a diverse range of products, with an average spread beginning at 0.5 pips.

Traders can enjoy commission-free trading on various assets, with a $0.02 per share fee on stocks and ETF CFDs. It is ideal for individuals looking for a wide selection of tradable instruments at competitive prices.

Invest.MT5

The Invest.MT5 account, designed for stock and ETF traders, provides immediate market access with a $1 minimum investment. This account does not provide leverage, reflecting the nature of investing instead of trading.

It offers commission-based trading beginning at $0.02 per share, with spreads as low as 0 pips. This account best suits traders seeking long-term investments and direct market access via the MetaTrader 5 platform.

Zero.MT5

The Zero.MT5 account provides professional and skilled traders with MetaTrader5 platform features, including spreads from 0 pips and fees from $1.8 per lot.

With a concentration on currency and commodities, it has a minimum deposit of $25 and provides market execution for high-frequency and algorithmic trading techniques. This account is perfect for traders seeking low spreads and a competitive trading environment.

Admirals Bets.MT5

The Bets.MT5 account is only accessible to UK traders and allows for tax-free spread betting gains. It takes a minimum deposit of 100 GBP and allows trading on 35 forex currency pairs with spreads beginning at 0.5 pips and no commission fees.

The account offers market execution and leverage of up to 1:500 for professional clients. It is a specialized account for people interested in spread betting on currency markets using the MetaTrader5 platform.

Admirals Demo Account

The Demo Account provides a risk-free platform for novice and experienced traders to practice and improve their trading techniques.

This account simulates the live market dynamics and is almost identical to actual trading, with the major exception of slippage, which is essentially absent in a demo environment. Traders must register with basic personal information before using the full range of functions available on the MT4 and MT5 trading platforms for 30 days.

This short time frame stimulates active inquiry and learning. For traders who later create a genuine account, the demo period does not end, providing a continuing chance to test tactics.

The demo account demonstrates Admirals’ commitment to trader education and preparation, laying the groundwork for intelligent trading without financial risk.

Islamic Account

This account is for traders who follow Sharia law, which restricts interest accrual. This swap-free account option is available for the Trade.MT5 account type and ensures that no interest or swap modifications affect overnight holdings, per Islamic finance rules.

This account type is especially attractive to individual and institutional investors of the Islamic religion since it has no upfront or incremental fees. Trading circumstances are similar to normal accounts, providing no strategy limitations, including using Expert Advisors.

However, an Islamic Account Administration charge is levied on positions maintained for longer than a certain period, which varies per instrument, ensuring fairness and competition while upholding ethical standards.

These specialized accounts demonstrate Admirals’ inclusiveness and commitment to providing bespoke trading solutions to satisfy the demands of a broad customer base.

Professional Account

Ideal for experienced traders seeking more leverage and complete trading expertise. This account type is accessible to Wholesale Clients who fulfill certain qualifying requirements and is distinguished by leverage of up to 1:500, access to reward programs, and special features not available to retail clients.

To qualify as a Wholesale Client, traders must undergo a rigorous application procedure and meet tough wealth or experience criteria, ensuring that only informed people with the financial ability take on the increased risks associated with greater leverage.

While the Professional Account provides more freedom and benefits, it does not have the same regulatory safeguards as regular traders under the Corporations Act 2001, such as AFCA dispute resolution services and enforcing CFDs product intervention measures.

This distinction ensures that Admirals maintain a responsible trading environment while providing experienced traders the tools they need to execute aggressive trading tactics.

Is there a demo account option?

Yes, Admirals offers a 30-day trial account, enabling traders to practice trading methods in a risk-free environment under genuine market circumstances.

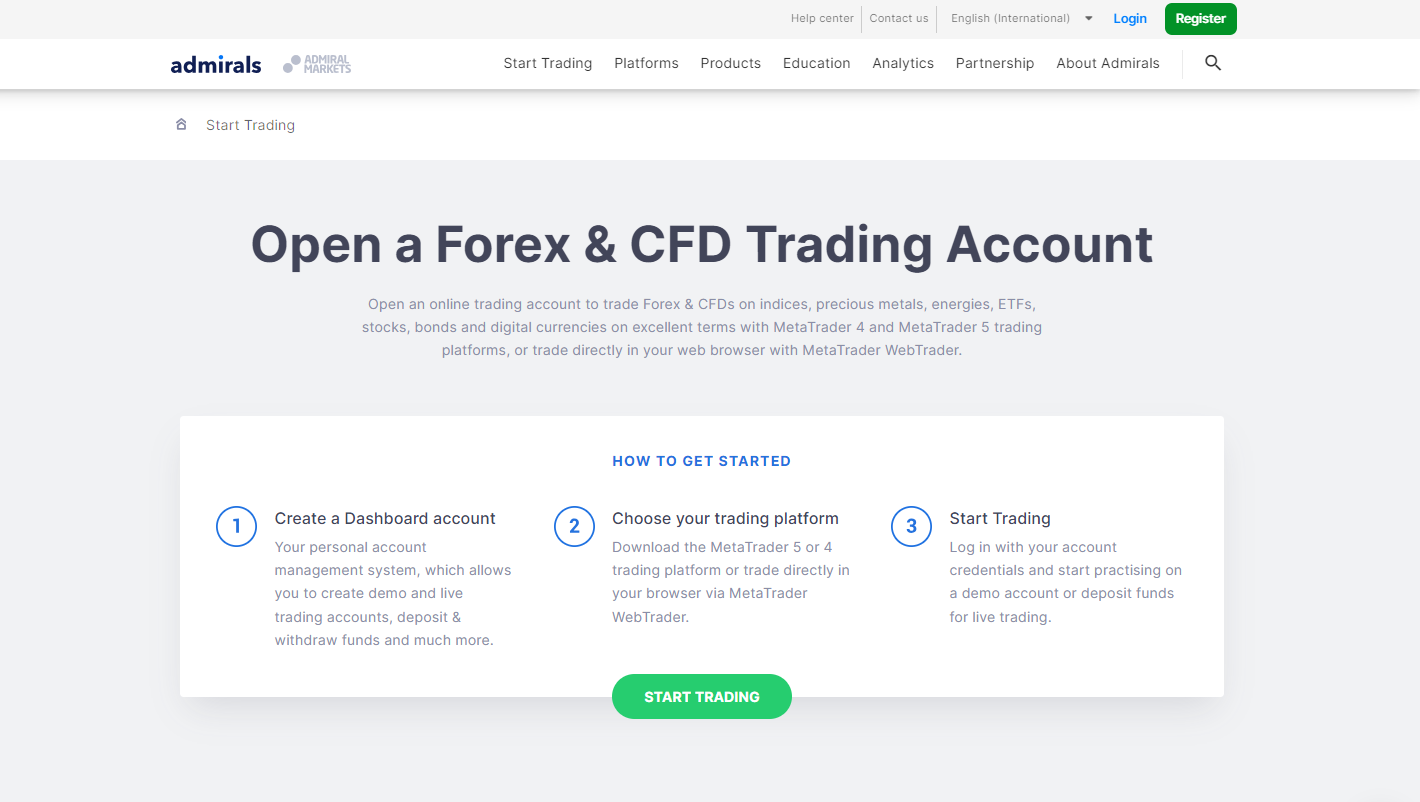

How To Open an Account

- To register an account with Admirals, follow these steps:

- Visit Admirals’ official website and browse the “Start Trading” section.

- Create your Dashboard account.

- Enter your email address and a secure password, and choose your country of residence.

- Click on “Create Account”.

- Select your account type (person or legal entity), your trading intent (investment or trading), and your preferred account type (Trade, Zero, or Invest).

- Upload clear copies of your government-issued identification and proof of residence (utility bill, bank statement). Admirals prioritize security. Thus, this step is critical.

- Select your desired deposit method (bank transfer, e-wallet, etc.) and follow the steps.

- Admirals provides MetaTrader4 and 5 in desktop, mobile, and online editions.

- To access your platform, log in using your account credentials.

What documents are required to open an account?

To create an account with Admirals, you must supply a government-issued ID and a current utility bill or bank statement as evidence of residency.

How long does it take to open a trading account?

Yes, Admirals enable traders to create several trading accounts, providing the freedom to handle various trading strategies independently.

Trading Platforms and Software

MetaTrader4 (MT4)

Admirals’ MetaTrader4 software is renowned for being robust and comprehensive. It accommodates traders of all proficiency levels with an uncomplicated user interface that does not compromise breadth or technical capabilities.

MT4 offers diverse analytical tools, charting abilities, and automated trading functions using Expert Advisors (EAs). Its integration into Admirals’ platform grants access to one of the industry’s most dependable and reputable trading environments.

MetaTrader5 (MT5)

With advanced capabilities to give traders an edge, MetaTrader5 (MT5) succeeds its MT4 predecessor. Apart from accommodating a wider variety of trading instruments, the platform allows more comprehensive back-testing for automated trading algorithms.

Despite having sophisticated features such as technical indicators and extended periods fitted with improved graphical tools, MT5 boasts a simple interface design.

With Admirals, using the innovative MT5 to enhance complexity in trade techniques aligns with their commitment to providing progressive marketplace environments that enable development through technology-driven solutions.

Mobile App

Admirals Mobile App caters to constantly moving traders with its simple and concise interface equipped with essential trading features.

The app delivers live market updates, immediate order execution capabilities, and comprehensive account management functions at their fingertips without location constraints.

Its design prioritizes quick market access for swift decision-making and efficient position handling regardless of one’s whereabouts.

This seamless integration provides an uninterrupted mobile trading experience that keeps traders connected to Admirals’ platform round the clock, thereby guaranteeing up-to-date market information while monitoring their Admirals accounts conveniently through handheld devices.

Can I trade on my mobile?

Yes, the Admirals Mobile App enables you to manage your account and trade using your smartphone.

Fees, Spreads, and Commissions

Spreads

Admirals has designed its spread structure to cater to different trading strategies and trade volumes, offering competitive market entry options. It offers a starting spread of just 0.0 pips for major currency pairs – an ideal setup for high-volume traders and scalpers seeking profitable trades from small price fluctuations.

The Zero.MT4 and Zero.MT5 accounts further facilitate this low-spread environment, catering specifically to seasoned professionals in the field.

Commissions

Admirals offers a variable pricing policy, with charges starting at $0.02 per share for stock and ETF CFDs, making it an affordable option for traders. The fee system benefits frequent traders by curtailing overhead expenses that may accumulate over time.

Overnight Fees

Other expenses include overnight fees, sometimes swap fees, which are levied for positions that remain open after the trading day ends. These costs vary based on the instrument and the nature of the transaction.

Fee transparency guarantees that traders are fully aware of any possible expenses paid throughout their trading activity, allowing for proper cost evaluation and management.

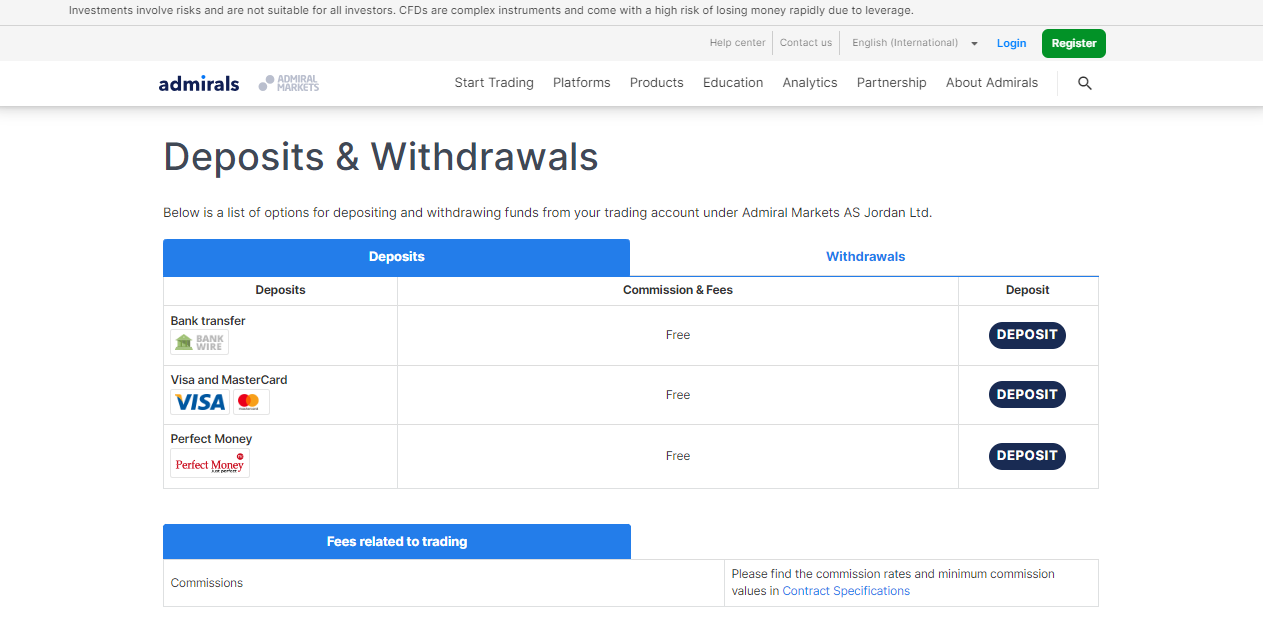

Deposit and Withdrawal Fees

The Broker maintains a competitive advantage by not charging deposit fees; however, traders should be aware of possible withdrawal costs, which may vary depending on the method.

A thorough comprehension of Admirals’ spread, and fee structure allows traders to navigate cost-effectively using the broker’s services.

Inactivity Fees

If an account is inactive for 24 months, it will incur a $10 cost. This implies that if an account holder does not make any transactions or activity in their account for two years, they will be charged a $10 inactivity fee.

Account holders must be watchful and conduct frequent transactions to avoid this cost.

Currency Conversion Fees

A 0.3% currency conversion charge applies to all currency conversion transactions. This cost is charged when money is transferred from one currency to another, equaling 0.3% of the entire amount being converted.

Account holders should be aware of this cost when conducting foreign transactions or dealing with numerous currencies in their financial activities.

Are there any hidden fees?

Admirals emphasizes clarity in its charge system, with no hidden costs. All possible expenses, including spreads, fees, and exchange rates, are explicitly stated on their website.

How competitive are the fees compared to other brokers?

Admirals’ rates are competitive in the market, with low spreads and fair charges, making it an appealing choice for traders seeking cost-effective trading options.

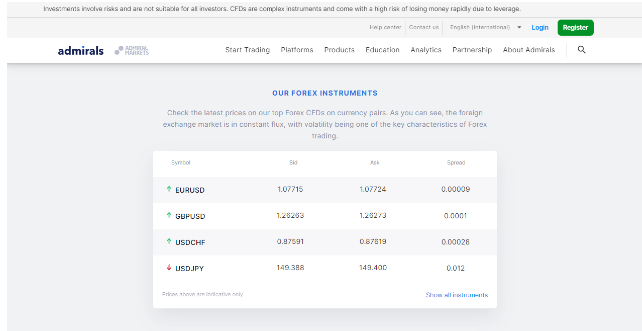

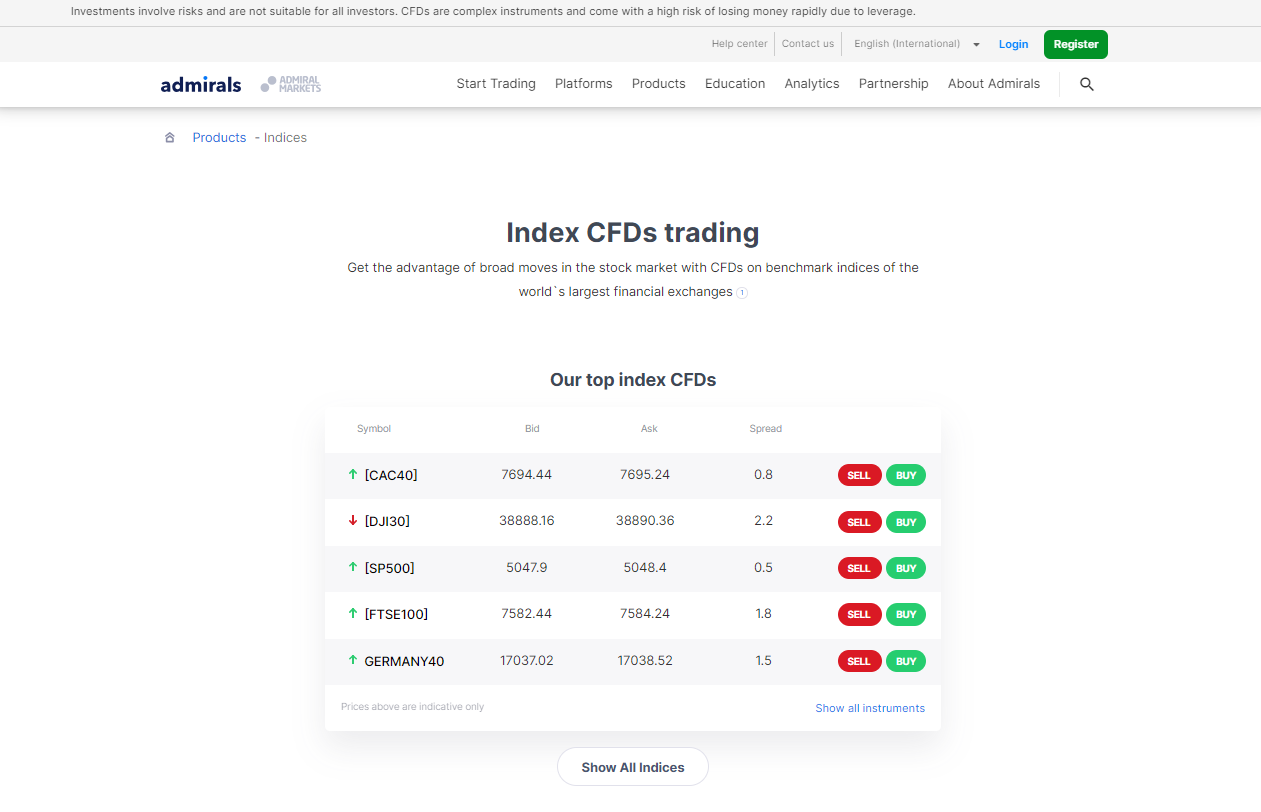

Which Markets Can You Trade?

Admirals offers the following trading instruments and products:

- 80+ currency pairings

- 42+ cryptocurrencies

- 29+ commodities

- 40+ indices are accessible for trading.

- Over 4,500 equities

- More than 400 ETFs

Additionally, Admirals offer trading on two bond CFDs, enabling traders to bet on future price changes in government debt instruments.

Can I trade forex?

Indeed, Admirals provides broad forex trading possibilities, including access to more than 50 currency pairings.

Can I Trade Commodities?

Admirals allow traders to speculate on price changes for over 28 different commodities.

Leverage and Margin

Admirals’ forex and CFD leverage empowers retail and professional traders to extend their trading capabilities.

By offering the option of taking on market positions far exceeding their initial investment, Admirals enables its users to utilize margin deposits, which act as a reliable assurance for maintaining leveraged positions. Such an opportunity is particularly useful when opening up currency pair trades in forex trading.

Admirals establish variable leverage restrictions for different products, with retail customers able to leverage up to 1:30 on key currency pairings. Different assets have equivalent leverage limitations, such as 1:20 for non-major currency pairings and some indexes and 1:10 for other commodities.

Stocks, ETFs, and bonds have leverage of up to 1:5, which reflects their various risk profiles. The maximum leverage for CFDs on digital currencies such as Bitcoin is 1:2.

How is the margin calculated?

Margin is computed by dividing the trade’s total value by its leverage ratio. For example, a $100,000 investment with 1:100 leverage would need a $1,000 margin.

What are the risks associated with high leverage?

High leverage may greatly raise both potential gains and losses. Admirals emphasize the need for risk management methods to reduce the hazards associated with leveraged trading.

Deposit and Withdrawal

Here is an overview of how to deposit to Admirals via the most popular Deposit Options:

Bank Wire

Log in to your Admirals Trader’s Room, Navigate to the ‘Deposit’ area, and choose ‘Bank Wire’ from the available options. Choose the bank account you wish to send money from, enter the deposit amount in your chosen currency, and confirm the information.

Admirals will offer you their bank information and a unique reference number for your transaction. To start the wire transfer, visit your bank’s online platform or a branch. Make sure to include the unique reference number issued by Admirals.

Once the transaction is completed, the money may take a few business days to appear in your trading account.

Credit or Debit Card

You can log in to your Admirals Traders Room and go to the ‘Deposit’ area and pick ‘Credit/Debit Card’. Enter your card information, including the card number, expiration date, and CVV code, plus the amount you want to deposit.

You may need to complete an extra security verification step with your bank (such as 3D Secure). Confirm the transaction and the cash will be deposited to your trading account nearly immediately.

Cryptocurrency Wallets

Access the Admirals Trader’s Room dashboard and select ‘Deposit,’ followed by the cryptocurrency you wish to use. Enter the deposit amount, and Admirals will issue you with a unique wallet address to your account and transaction.

Next, open your cryptocurrency wallet, input the Admirals’ address, and transmit the money. Confirm the transaction. Depending on network congestion, cryptocurrency transactions are often confirmed within minutes or hours.

e-wallets or Payment

Log into your Admirals Trader’s Room, navigate to the ‘Deposit’ area, and pick your chosen e-wallet or payment gateway. Enter the amount you want to deposit. You will be taken to the e-Wallet or payment gateway page, where you may safely log in to your account. Approve the payment after examining the deposit information.

When you approve the transaction, the deposit is normally handled immediately, and the money should show in your Admirals account quickly.

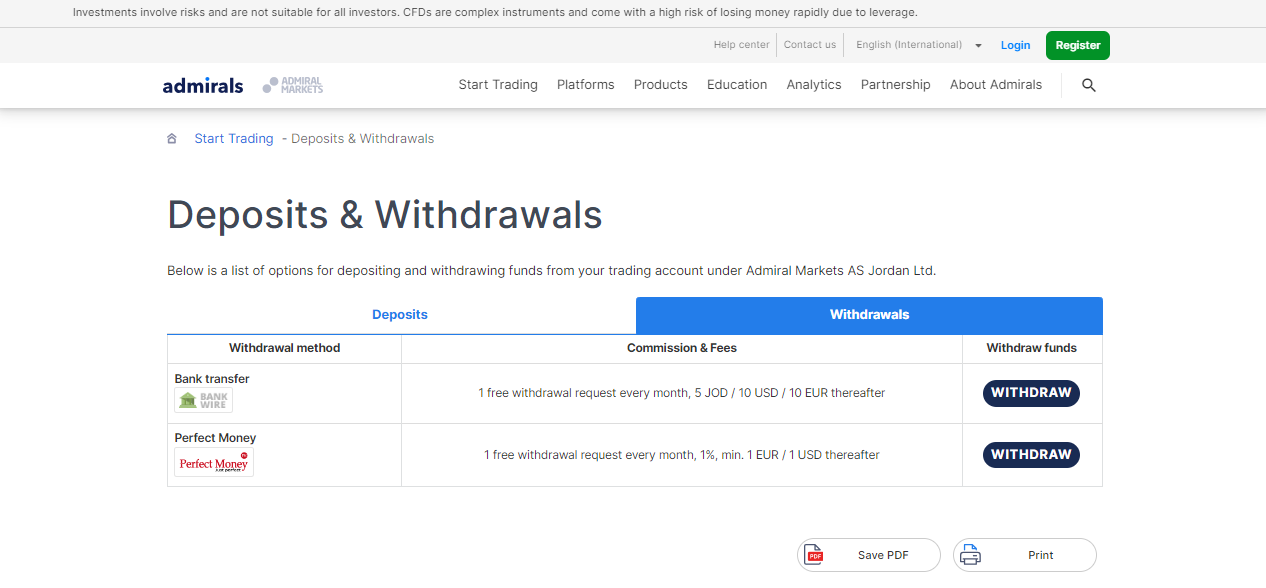

Here is an overview of how to make a Withdrawal from Admirals via the most popular Withdrawal Options:

Bank Wire

Log in to your Admirals Traders Room, navigate to the ‘Withdrawal’ area, and choose ‘Bank Wire’ from the available alternatives. Fill out the withdrawal form with your bank information, including the account name, account number, bank name, SWIFT/BIC code, and bank address.

Enter the amount and currency you want to withdraw. Review the withdrawal information and ensure all bank details are correct to avoid delays. Confirm the withdrawal request. Bank wire transfers might take between 3 and 5 business days to complete.

Credit or Debit Card

Access the Admirals Trader’s Room, go to the ‘Withdrawal’ area, and choose the ‘Credit/Debit Card’ option. To guarantee compliance with the return payment policy, use the same card you used to deposit the withdrawal method.

Specify the withdrawal amount that cannot exceed the amount deposited using the same card. Please confirm the data and submit your withdrawal request. The cash will be credited to your card within 3 to 5 business days, depending on your bank’s processing schedule.

Cryptocurrency Wallets

Log in to your Admirals Trader’s Room, and in the ‘Withdrawal’ column, pick the cryptocurrency option if it is available. Enter the withdrawal amount and your cryptocurrency wallet address. Ensure the wallet address is valid since transactions to the incorrect address cannot be reversed.

Confirm your withdrawal. The time it takes for the cryptocurrency network to complete the withdrawal may vary depending on the cryptocurrency utilized and the current network traffic.

e-wallets or Payment Gateways

Log in to your Admirals Traders Room dashboard and Choose ‘Withdrawal’ from the list of choices, then choose your e-wallet. Enter the amount that you want to withdraw.

Provide any extra information your e-Wallet service requests, such as the account ID or email address linked with the e-Wallet. Confirm the transaction. Withdrawals to e-wallets are usually handled within 24 hours but may take up to three business days.

How do I withdraw funds from my account?

To withdraw money, log into your Trader’s Room, pick the withdrawal option, choose your chosen method, and submit the request.

Are there any fees for depositing or withdrawing funds?

No, Admirals does not impose deposit fees; withdrawal fees may apply depending on the method utilized.

Admirals Educational Resources

Users can engage with live experts in interactive sessions to learn about complex subjects and get real-time market information. These webinars are often free, but registration is required, and they may not be ideal for their learning style.

Traders can also immerse themselves in a vast collection of articles and tutorials that cover various subjects and appeal to different skill levels. This self-paced learning approach enables you to explore at your leisure, but be aware that quality and accuracy may vary. Always check the author’s trustworthiness before depending completely on this material.

The Zero to Hero program walks you through the essentials step by step, and it may provide a more interesting experience than individual materials. However, remember that this training may not be free or geared towards experienced traders. Before enrolling, carefully study the course structure and reviews.

Are educational resources accessible to all traders?

Yes, Admirals’ educational tools are intended to appeal to traders of all skill levels, from beginner to advanced, and are available to all registered customers.

Can I start trading with no prior experience using educational resources?

Yes, Admirals’ instructional offerings are comprehensive enough to provide a rookie trader with the information required to begin trading. However, practicing on a demo account is also advisable.

Admirals Pros and Cons

| ✅ Pros | ❌ Cons |

| Admirals has zero-pip spreads on certain accounts and instruments | Fractional share trading is not offered |

| There is a large range of financial instruments that can be traded, divided according to the region and regulation under which traders sign up | Inactivity fees apply |

| Admirals offers MetaTrader 4 and 5 across devices | Admirals does not offer a Cent Account |

| Traders can expect comprehensive educational material from Admirals | Admirals is a market maker, which means they serve as the counterparty in all deals. This might be a disadvantage for traders who wish to compete with other traders |

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA | USD 100 | Visit Broker >> |

| 🥈 |  | Read Review | FMA, FSA | USD 50 | Visit Broker >> |

| 🥉 |  | Read Review | FSCA, CySEC, DFSA, FSA, CMA | USD 0 | Visit Broker >> |

| 4 |  | Read Review | ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB | USD 200 | Visit Broker >> |

| 5 |  | Read Review | FCA, CySEC, FSCA, SCB | USD 100 | Visit Broker >> |

| 6 |  | Read Review | CySEC, MISA, FSCA | USD 25 | Visit Broker >> |

| 7 |  | Read Review | CySEC, FCA, FSA, FSCA, Labuan FSA | USD 100 | Visit Broker >> |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker >> |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker >> |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker >> |

In Conclusion

In our experience, Admirals stands out as a powerful force in the forex and CFD brokerage industry thanks to its comprehensive array of trading platforms, vast training materials, and strong security measures.

The popular MetaTrader 4 and 5 platforms are accessible, with user-friendly interfaces and extensive features. Furthermore, Admirals offers a user-friendly mobile app.

No, Admirals does not currently allow fractional share purchases.

Withdrawals with Admirals can be instant or take up to 5 days, depending on the process and withdrawal method.

Admirals has some of the lowest industry costs, with various account kinds to suit your needs.

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |