Gold Soars to $1,713 – Dollar Weakens Ahead of FOMC and GDP Figures

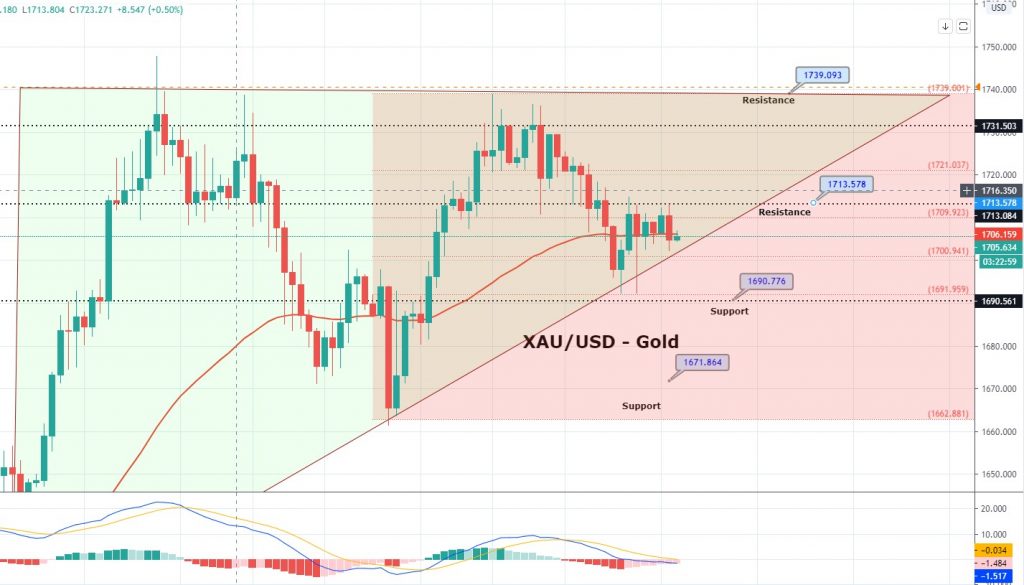

Gold has completed 61.8% Fibonacci retracement at 1,690, while the precious metal bounced off over 1,690 level. On the 4 hour timeframe...

The safe haven metal prices stopped their three-day losing streak and rose from the $1,703 to $1,713 while representing 0.16% gains on the day possibly as the US dollar lost its ground against majors in the wake of risk-on market sentiment. However, the latest gains in the stocks failed to drop the gold prices because the yellow metal normally moves inversely to stocks.

At the time of writing, GOLD is currently trading at 1,722.60 and consolidating in the range between 1,718.55 and 1,728.60. The expectation from the US Federal Reserve meeting which is scheduled to happen later in the day has already raised investor confidence. Investors will keep their eyes on whether the FED will leave interest rates near zero, and if it will deliver any further measures to control the economic fallout from COVID-19. Moreover, the European Central Bank is also scheduled to meet on Thursday.

At the USD front, the greenback is being sold and has dropped to multi-week lows against the Japanese Yen currency and suffered notable declines against the growth-linked currencies like the Aussie dollar and the New Zealand dollar as it loses its safe haven demand due to risk-on market sentiment. The Dollar index (DXY) climbed from the 13-day low of 99.45 reached during Tuesday’s American trading hours but ran out of steam near 99.90 early Wednesday, as the S&P 500 futures and Asian stocks rose.

Gold – XAU/USD – Daily Technical Levels

Support Resistance

1706.9 1734.7

1691.6 1747.2

1679.1 1762.5

Pivot Point 1719.4

Gold has completed 61.8% Fibonacci retracement at 1,690, while the precious metal bounced off over 1,690 level. On the 4 hour timeframe, a bullish crossover of 50 EMA may drive buying in gold until 1,720. Recently, gold is crossing over 50 EMA at 1,712, which may bring more buying until 1,720/21 level. Good luck!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account