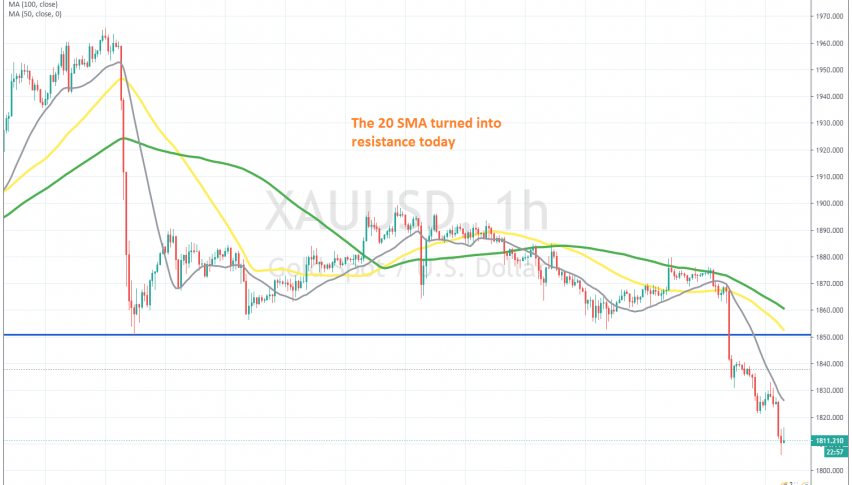

The Decline Picks up Pace in Gold, as the 20 SMA Turns into Resistance

Gold resumed the downtrend today, as soon as the 20 SMA approached on the H1 chart

It seems like the uptrend in GOLD is over. Gold moved above $ 2,000 in early August, after being bullish for a couple of years, but made a swift reversal down back then, falling close to $1,850. The area around that level turned into support for Gold, holding until yesterday.

On US election week we saw a surge in Gold, as the USD turned bearish, but the climb ended and the price turned down again after the coronavirus vaccine from Pfizer two weeks ago. In the last two weeks, Gold was trading sideways until yesterday.

Yesterday, the US services and manufacturing reports showed that both sectors were expanding pretty fast this month, against expectations for a cool down. As a result, the USD turned bullish and the sentiment improved in financial markets, which sent safe havens lower.

Earlier today we saw a weak retrace up, but it ended as soon as the 20 SMA (grey) caught up with the price on the H1 chart. This shows that the selling pressure is quite strong in Gold. We missed the chance to go short today, but will follow the price action to see if we can get a retrace higher, which we can sell.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account