Gold Supported by US Fiscal Stimulus, Pandemic Worries

Gold is trading somewhat steady amid thin liquidity in global markets towards the end of the year, enjoying support from a weaker dollar

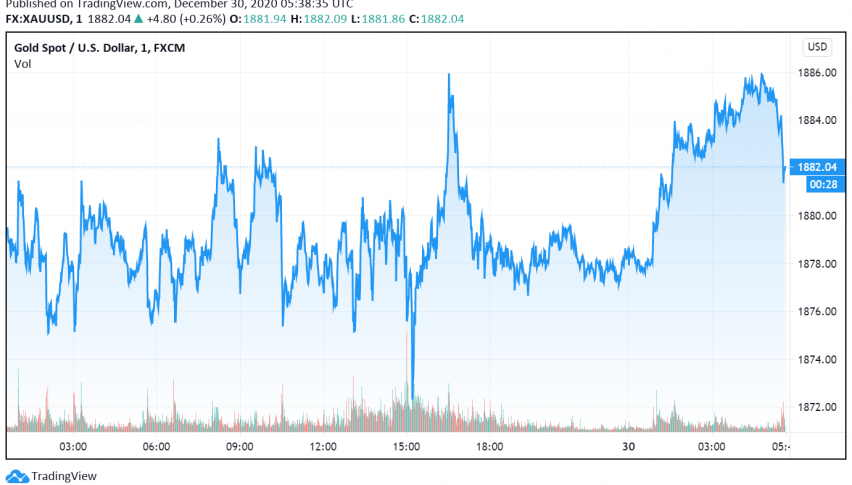

Gold is trading somewhat steady amid thin liquidity in global markets towards the end of the year, enjoying support from a weaker dollar amid possible delay in the rollout of stimulus checks from the coronavirus relief package to support the US economy. At the time of writing, GOLD is trading at a little above $1,882.

With most traders away on holiday, gold prices exhibited mixed trading through the previous session, with the market sentiment remaining upbeat over the Brexit deal and the latest round of stimulus measures in the US. The positive news about Britain and EU narrowly avoiding a no-deal Brexit and the US economy receiving stimulus to offset some of the pandemic-driven damage have dented the safe haven appeal of the precious metal.

Meanwhile, news of the stimulus weakened the US dollar, which shares a negative correlation with the yellow metal, helping support its prices in global markets. The latest spike in cases and hospitalizations across several parts of the world and the discovery of more contagious strains of coronavirus are also keeping losses in the yellow metal under control.

Despite the rollout of the COVID-19 vaccines across some countries, the global economy is likely to be impacted further by the latest wave of infections that have prompted governments to reimpose lockdowns and restrictions in many regions. Worries about the economic impact of the pandemic are also lending support to gold prices, and are likely to keep them high in the near future.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account