Daily Brief, February 15 – Everything You Need to Know About Gold!

The precious metal gold prices were closed at 1823.91 after placing a high of 1830.71 and a low of 1810.39. Gold prices extended their losse

The GOLD prices closed at 1,823.91, after placing a high of 1,830.71, and a low of 1,810.39. The GOLD prices extended their losses for the second consecutive day on Friday, but remained consolidated. Most of the intraday losses in the gold prices were recovered during a late trading session, but the yellow metal failed to reverse its direction, ending the day with minor losses. Despite these minor losses on Friday, the GOLD prices managed to end the week higher, after posting losses for the previous two-weeks.

The main reasons behind the downward momentum in the GOLD prices on Friday were the rising US dollar and US Treasury yields. However, the GOLD prices remained supported by the hopes of more stimulus in the world’s largest economy, and posted the best week in the last three weeks.

On Friday, US House of Representatives Speaker Nancy Pelosi said that she expects US lawmakers to complete the legislation based on President Joe Biden’s $ 1.9 trillion coronavirus relief bill by the end of February. This means that the Senate intends to finalize the coronavirus relief by the end of the month, and these hopes started weighing on the US dollar, helping the gold prices to recover most of their intra-day losses on the day.Pelosi suggested that the House hopes to pass the coronavirus relief bill by the end of the month, and that she sees the bill getting signed into law before March 14, ahead of the expiration of key unemployment programs. The fears that former President Donald Trump’s impeachment trial could delay the passage of the bill were also lifted after Senate Majority Leader Chuck Schumer gave his assurance.

Furthermore, Schumer appeared to endorse the House proposal for stimulus check eligibility, saying that he was working to include a $ 15-per-hour minimum wage rate in the legislation. He was referring to Wednesday’s decision by the House Committee on Education and Labor, which approved an increase of the minimum wage to $ 15, as part of its stimulus bill that would be phased in by 2025. The House Committee also approved a proposal to give airlines another $ 14 billion, as part of President Joe Biden’s $ 1.9 trillion coronavirus stimulus bill. These developments in terms of the stimulus package kept the US dollar under pressure and limited the losses in GOLD on the day.

However, on the vaccination front, on Friday, the US government announced further deals for 100 million additional vaccine doses from Pfizer and Moderna. In response to this additional order for the vaccine, the nation’s top infectious disease official, Anthony Fauci, said that this should increase the country’s vaccine supply sufficiently by April, to allow anyone to get a shot of vaccine. This news raised the hopes for economic recovery and gave strength to the US dollar, ultimately weighing on the gold prices.

Support Resistance

1,816.14 1,843.04

1,805.47 1,859.27

1,789.24 1,869.94

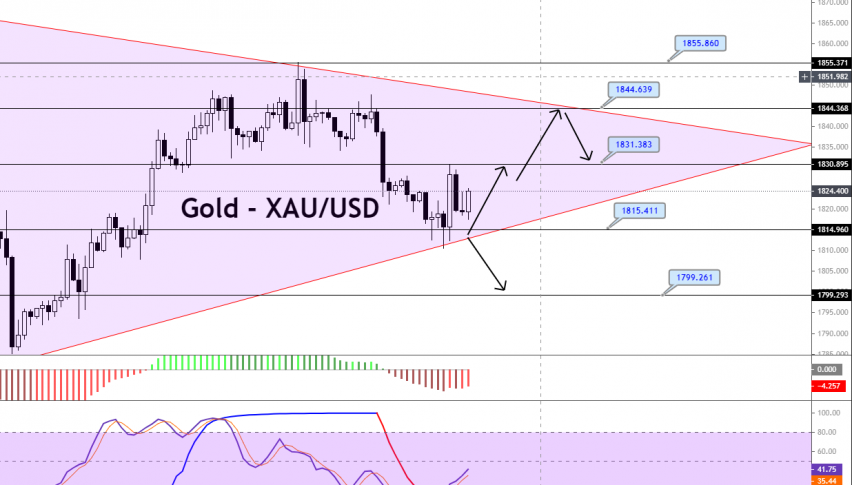

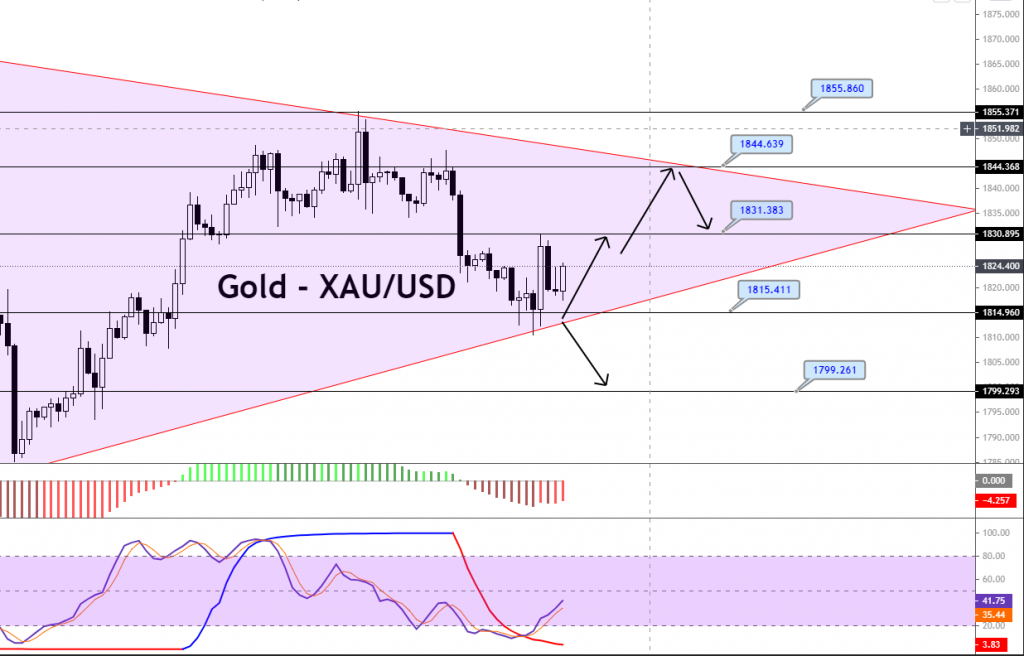

Pivot Point: 1,832.37GOLD is trading sideways, within a narrow trading range of 1,831 and 1,815, amid a lack of volatility in the market. The precious metal has also formed a symmetrical triangle pattern on the two-hourly timeframes, extending resistance at the 1,844 level, with a support area of 1,815. On Monday, the bullish breakout at 1,831 could extend the buying trend until the 1,844 resistance level, whereas the violation of the support level of 1,815 could drive sharp selling until the 1,799 mark. The MACD and other oscillators support a selling bias, but we can only take a sell trade upon a breakout at 1,815. Good luck!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account