Daily Brief, February 26 – Everything You Need to Know About Gold on Friday!

The precious level gold prices were closed at 1769.92 after placing a high of 1805.52 and a low of 1765.59. On Thursday, gold prices plunged

On Thursday, Fed Vice-Chair Randal Quarles cautioned that efforts were needed to provide more stimulus to the economy, as this could decrease some of the risks at the bank by temporarily helping borrowers to stay afloat. Quarles said that he backed efforts by the government to support people and businesses during the coronavirus pandemic. However, he warned that the support has made it difficult to determine whether borrowers would be able to keep up with loans, with their own finances or with government support. He also said that in its future risk assessment, the Fed must figure out a way to measure the real impact of the pandemic on borrowers.

On the other hand, Atlanta Fed President Raphael Bostic said that bond yields remain comparatively low, despite a recent increase, and that the Federal Reserve does not need to address the recent surge in yields. Furthermore, the Vice-Chair of the Federal Reserve, Richard Clarida, said that his outlook on the US economy was very bullish. He said that he sees inflation at the Fed’s 2% goal by the end of the year, after temporarily rising above the target level, due to the base effect. Clarida said that the biggest risk to the outlook for the US economy was the course of the coronavirus, and that the Fed’s current monetary policy settings were appropriate, both for now and for the rest of the year.

All these comments by Fed officials strengthened the US dollar and put further pressure on the declining prices of the yellow metal on Thursday. On the data front, at 18:30 GMT, the Prelim GDP for the quarter came in, showing a decline to 4.1%, against the expected 4.2%, which weighed on the US dollar and capped any further losses in gold. In January, the Core Durable Goods Orders rose to 1.4%, against the projection of 0.6%, supporting the greenback and adding to the losses in gold. The Durable Goods Orders for January also rose, coming in at 3.4%, against the expected 0.9%, which lent strength to the US dollar and dragged the yellow metal further down.

For the quarter, the Prelim GDP Price Index rose to 2.1%, against the expected 2.0%, supporting the US dollar and dragging the gold prices down. Last week, the Unemployment Claims dropped to 730K, against the expected 828K, which boosted the US dollar, and weighed on the yellow metal prices. At 20:00 GMT, the Pending Home Sales for January came in, showing a drop to -2.8%, against the expected 0.2%, which weighed on the greenback and limited the losses in the GOLD prices.

The US dollar was strong across the board on Thursday, amid the better-than-expected US macroeconomic data. The strong report suggesting fewer unemployment claims from last week triggered fears of faster inflation and raised the yields on bonds. The US 10-year Treasury note rose above 1.5%, to its highest level in one year, which is what we saw before the outbreak of the coronavirus pandemic. The rising US Treasury yields strengthened the already strong US dollar and dragged the yellow metal prices to the downside.

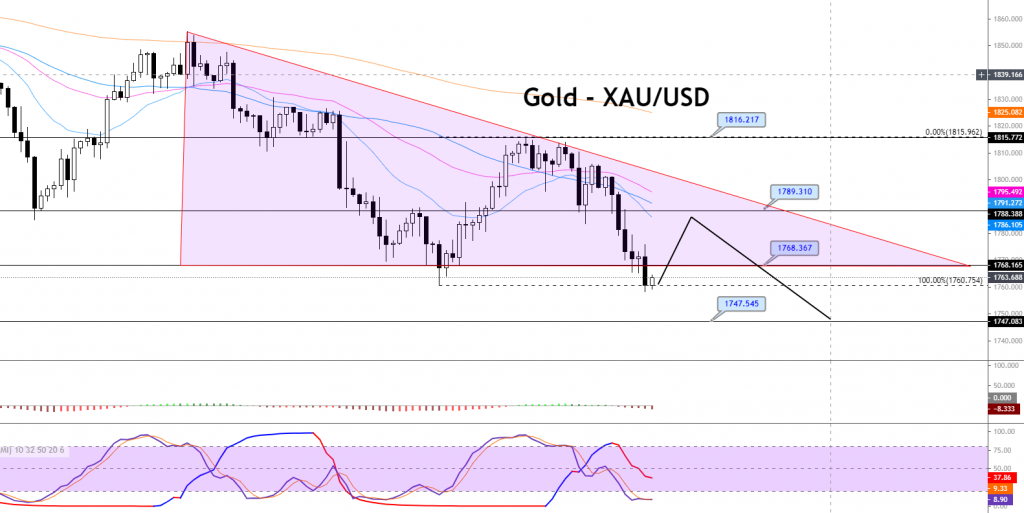

Support Resistance

1,782.40 1,813.20

1,766.90 1,828.50

1,751.60 1,844.00

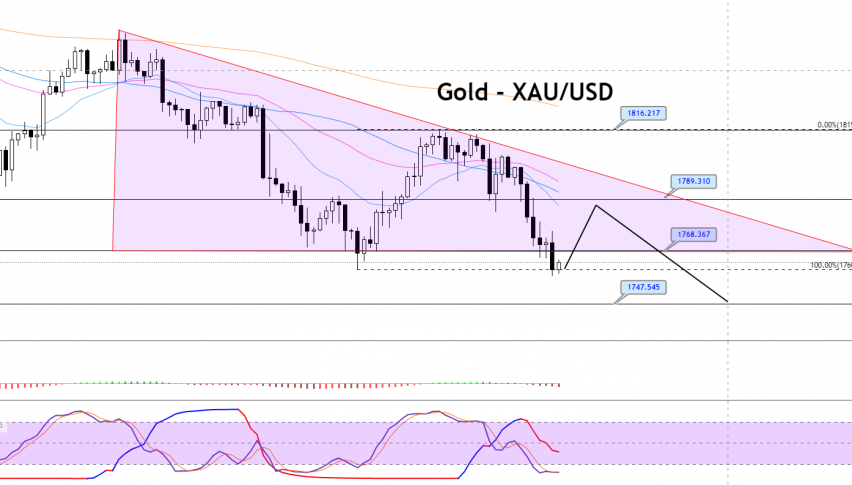

Pivot Point: 1,797.70The GOLD price continues to trade bearishly at the 1,764 level, gaining immediate support at 1,760. The closing of candles over this level is likely to trigger a buying trend until the 1,773 area. The 20 & 50 periods EMA support a selling bias in GOLD. Thus, a selling trend could be seen below the 1,769 level today, whereas violation of the 1,760 level could extend selling until 1,754. Good luck!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account