Gold Price Prediction: Sideways Trading Range Breakout, Quick Update on Sell Signal!

During Tuesday's Asian trading session, the yellow metal gold prices struggled to maintain their intraday positive move to near 2-month high

| (%) | ||

MARKETS TREND The market trend factors in multiple indicators, including Simple Moving Average, Exponential Moving Average, Pivot Point, Bollinger Bands, Relative Strength Index, and Stochastic. |

During Tuesday’s Asian trading session, the yellow metal prices struggled to maintain their intraday positive move to near 2-month highs and remained bullish around well above the $1,775 level. However, the ongoing bearish bias surrounding the U.S. dollar was seen as a key factor that helped the dollar-denominated commodity (gold) to stay bid. The stance pressuring the U.S. dollar was that the Fed will keep rates low for a longer period, making U.S. bond yields weaker and contributes to the U.S. dollar losses.

Meantime, the upbeat market sentiment, backed by multiple factors, also played its key role in undermining the safe-haven U.S. dollar, which lends some additional support to the bullion prices to stay bullish. Moreover, the renewed fears of another deadly wave of coronavirus infections probe the market risk-on mood, which was seen as another key factor that lends an additional boost to the bullion prices. On a different note, the prevalent market upbeat sentiment, backed by incoming positive U.S. economic data and the expectations of U.S. stimulus, was seen as one of the key factors that kept the lid on any additional gains in the safe haven metal. Also capping the gains could be the fast coronavirus (COVID-19) vaccinations in the U.S., the U.K., and Israel. At the time of writing, the bullion price is trading at 1,772.29 and consolidating in the range between 1,765.65 and 1,775.74.

Despite the escalating coronavirus (COVID-19) cases and geopolitical tensions, the market trading sentiment managed to extend its recent strong positive move and gained some follow-through traction on the day. The reason could be tied to the incoming positive U.S. economic data, which suggests that the U.S. economy is on the way to recovery. In the meantime, the renewed hopes over the $2.25 trillion U.S. infrastructure spending plan provided an additional lift to the market trading sentiment. Furthermore, the upbeat market mood could also be associated with the fast coronavirus (COVID-19) vaccinations in the U.S., the U.K., and Israel. Also supporting the mood could be the reports suggesting that the U.K., Australia, and New Zealand authorities recently eased activity restrictions and travel guidance. However, the prevalent buying bias surrounding the market sentiment was seen as a key factor that kept the lid on any additional gains in GOLD prices.

At the USD front, the broad-based U.S. dollar failed to stop its previous day’s downbeat performance and remained bearish on the day as investors continue to cheer the market risk-on mood, which tend to undermine the safe haven U.S. dollar. Meanwhile, the Fed’s stance that it will keep rates low for a longer period also pushes the U.S. dollar lower. It is worth mentioning that fewer bets for an earlier than expected Fed lift-off, along with hopes that any spike in inflation is expected to be temporary, dragged the key greenback to over one-month lows. Therefore, the declines in the U.S. dollar were seen as one of the key factors that help gold to stay bid as the price of the yellow metal is inversely related to the price of the U.S. dollar. The U.S. Dollar Index that tracks the greenback against a bucket of other currencies dropped to 90.945.

Altern4tvely, the renewed concerns over another deadly wave of coronavirus infections probe the market risk-on mood, which is another key factor that lends an additional boost to the bullion prices. Also on the same side are fears of US-China and US-Russia tussles. It is worth recalling that the U.S. imposed sanctions on Russia over election interference and hacking, which recently gained major market attention.

In the absence of the major data/events on the day, traders will keep their eyes on the US-China and US-Russia headlines, which may entertain markets. Apart from this, the risk catalysts like geopolitics and the virus woes will not lose their importance. The U.S. dollar price movement will continue to play a key role in gold’s direction across the ocean.

Gold Daily Support and Resistance

S1 1729.21

S2 1752.68

S3 1762.06

Pivot Point 1776.14

R1 1785.53

R2 1799.61

R3 1823.07

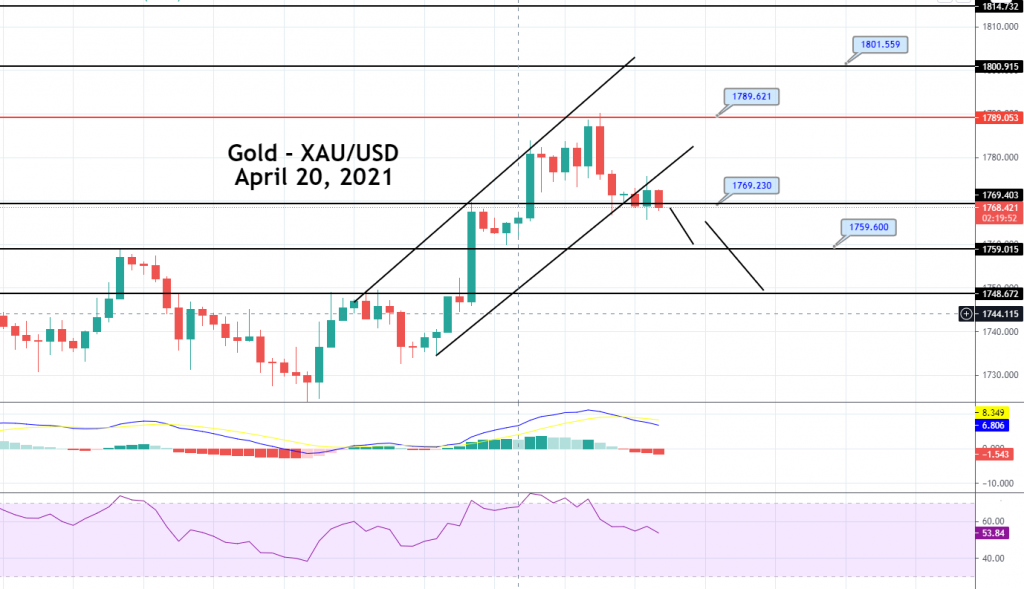

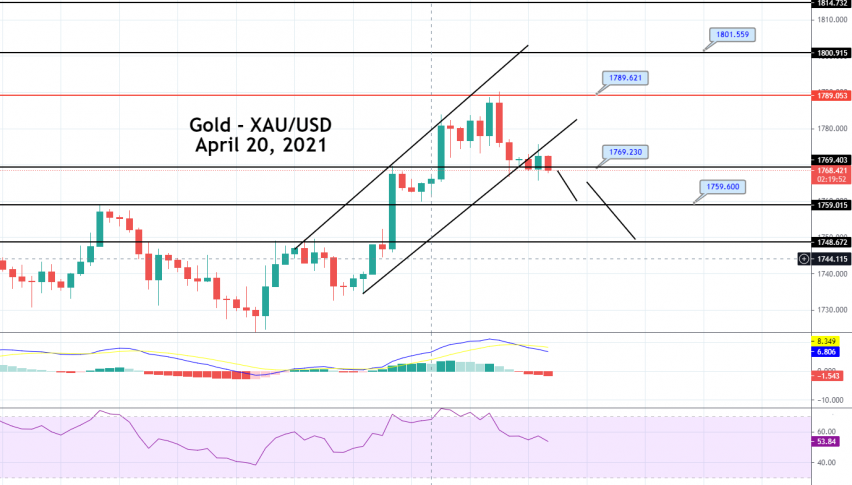

The precious metal gold has violated the narrow trading range of 1,769 – 1,759, and now it’s trading at 1,779 level. On the higher side, GOLD is likely to face resistance at 1,784 level. A bullish breakout of this level can extend buying trend until 1,784 and 1,800 level. On the lower side, the price is likely to gain support at 1,769 area. The idea is to take a sell trade below 1,769 support levels today and even a bullish breakout of 1,784 level. Good luck!

| (%) | ||

MARKETS TREND The market trend factors in multiple indicators, including Simple Moving Average, Exponential Moving Average, Pivot Point, Bollinger Bands, Relative Strength Index, and Stochastic. |

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account