Gold Struggles Under $1,800 – 50 Days EMA to Underpin $1,784

Gold price struggles to find demand near the $1,800 level at the start of the week, as bulls succumb to bearish pressures amid a cautious

Gold price struggles to find demand near the $1,800 level at the start of the week, as bulls succumb to bearish pressures amid a cautious risk sentiment. A five-member house of representatives arrived in Taiwan on Sunday, less than two weeks after House Speaker Nancy Pelosi’s contentious visit, undermining investor confidence. Markets believe that the delegation’s presence in Taipei will elicit a strong reaction from Beijing, possibly resulting in additional military exercises.

Furthermore, investors are cautious ahead of the release of the minutes from the Fed’s July meeting on Wednesday, which may provide new insights into the policymakers’ likely debate over the size of the next rate hike. Markets currently price in a 55% chance of the Fed raising interest rates by 50 basis points next month. Softer US inflation last week put a damper on Fed rate hikes in the coming months.

Uncertainty about the Fed’s next policy move, combined with the US-China conflict, supports the US dollar’s safe-haven appeal, weighing on GOLD prices in USD. The dollar retains a significant portion of Friday’s gain, triggered by a significant increase in the Michigan Consumer Sentiment Index. The preliminary August estimate of the University of Michigan consumer sentiment index increased by 3.6 points to 55.1, up from 51.5 in July.

The bright metal’s downside appears to be limited, for the time being, thanks to a pullback in Treasury yields from across the curve following Friday’s steep rebound. The benchmark 10-year Treasury yields retreated after encountering stiff resistance below the key level of 3.0%.

The focus now shifts to the FOMC minutes, due this Wednesday, for investors to re-price the Fed’s tightening outlook. The tone for markets will be set by Chinese activity data and US industrial figures.

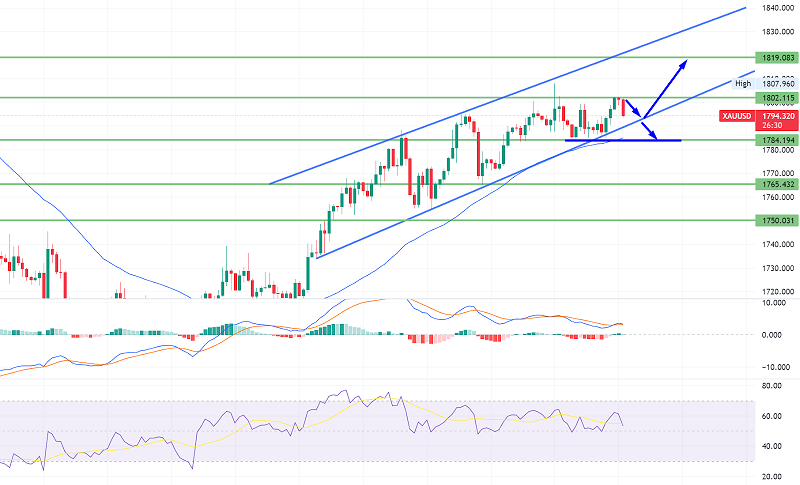

Gold Technical Outlook

Gold price reached our first anticipated objective of 1802.80 and encountered firm resistance there, indicating a bearish bias influenced by stochastic negativity, and it may experience a brief dip before resuming its upward trend.

In general, we will continue to predict a positive trend for the forthcoming period, supported by the EMA50, until the price breaks 1779.25 and holds below it, noting that a break of 1802.80 will push the price to 1831.95.

Today’s trading range is likely to be between 1780.00 support and 1815.00 resistance.

Today’s projected trend: Bullish

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account