USD Starting the Week in Retreat but Comes Back Again

The USD was slipping lower in the European session, but it has reversed higher after the ISM manufacturing prices showed a jump in April

Last week was mostly mixed as the economic data from the US leaned both ways, although there was some prevalent USD weakness. The European markets were closed for the Labour Day holiday, resulting in a quiet session overall. The US dollar remained steady, supported by news that JP Morgan will acquire First Republic Bank. This could lead to follow-up moves in US trading.

The JPY performance has been poor after the mild, extending its losses from last week, with USD/JPY reaching its 200-day moving average near the 137.00 mark. Market players are awaiting the start of the week on Wall Street, and the focus will be on key central bank policy decisions that will set the tone for trading in May.

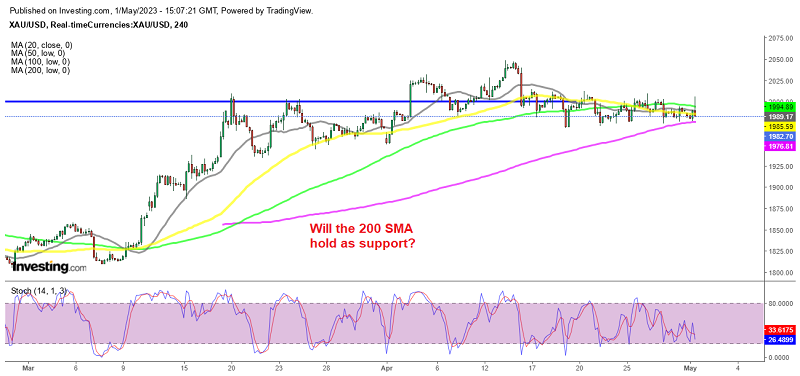

Gold H4 Chart – The 200 SMA Holds As Support

Range-bound trading continues for Gold

GOLD has been trading in a range since the middle of April, with the high at around $2,010 while the low comes somewhere around $1,977. Earlier today we saw a bounce off the 200 SMA (purple) which has been acting as support on the H4 chart and XAU reached $2,005 as the USD fell through an air pocket. But the higher ISM manufacturing prices have sent the USD higher again and Gold lower. Now let’s see if this moving average will hold the decline for Gold, because the price has returned back to it too quickly, which is exhausting the support.

EUR/USD has dropped below trend line support and is currently trading at a new session low of 1.0971. Last week’s swing lows were between 1.09618 (Friday) and 1.09653 (Monday low), while Tuesday and Wednesday’s lows were at 1.0963, which falls within that range. If the pair falls below these lows, it could potentially reach 1.09491, where the 38.2% retracement of the move up from the April 24 low is located. If it falls further, traders will likely look at the 1.0925 to 1.09438 swing area for potential support.

Gold XAU Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account