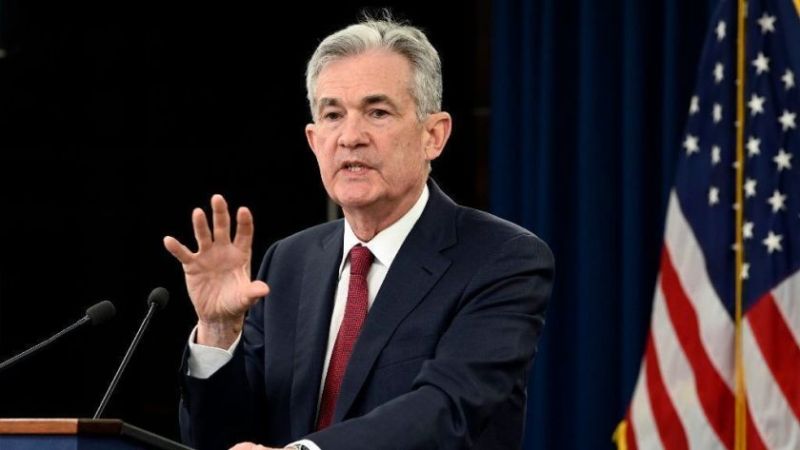

USD Back on the Bullish Trend After FED Powell’s Higher Rates Comments

The USD has been in dout in recent weeks, but it is resuming the larger uptrend now as Powell pushes for higher rates

The USD was retreating since October, as the FED softened the rhetoric, while the economic data was getting weaker and inflation was slowing as well. But, the economic data has improved in the last two days and inflation is showing signs of being stubbornly high again, so the USD started to gain some momentum. FED members have given hawkish signals on higher rates, although markets have been cautious, as they waited for a signal from Powell, which they got today.

Below are some of Jerome Powell’s comments:

“The recent economic data suggests that interest rates may be higher than previously thought, and if more data supports this, the pace of rate hikes may increase. The market is currently pricing in a 42% chance of a 50 basis points hike on March 22, with the peak expected to be between 5.50-5.75%. The question is whether the dollar can continue to rise in this scenario.”

Last week, we heard some hawkish comments from FED’s Waller, and the bond markets turned around, with buyers stopping ahead of 5% in 2s and 4% for the 30-year treasuries to try and top-tick yields. While buying bonds may seem like a good idea given the returns, buying the USD on higher interest rates may be a better option if the FED continues hiking to 5.75%.

For the USD to continue to rally, there may need to be a stronger push toward higher rates. However, the risks of strong economic data are two-sided, as disappointing data could also impact the dollar. The chance of a 50 basis points hike may dwindle if jobs data is soft on Friday, which would be negative for the dollar. However, next week’s CPI data may present a new set of risks.

EUR/USD Daily Chart – The 20 SMA Has Turned Into Resistance

EUR/USD resumes the downtrend again

Overall, the USD performance may be closely tied to data releases, and the market may be trading data point to data point. So, while we remain bullish on the US Dollar, we will take caution and try to sell retraces higher on most risk currencies, such as in EUR/USD, GOLD , or commodity Dollars. We opened a sell EUR/USD signal a while ago after Powell’s comments, as well as another one in AUD/USD , both of which closed in profit.

Gold XAU Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account