FxPro Review

- FXPro Review - Analysis of Brokers' Main Features

- Overview

- Detailed Summary

- Security Measures

- Account Types

- How To Open an Account

- Trading Platforms and Software

- FxPro Fees, Spreads, and, Commissions

- Which Markets Can You Trade?

- Leverage and Margin

- FxPro Deposit and Withdrawal

- FxPro Educational Resources

- Pros and Cons

- In Conclusion

Overall, FxPro is a trustworthy and highly regulated Forex Broker that is very well-known for its competitive spreads and innovative trading tools. FxPro offers access to a Beginner Friendly Demo Account and has a trust score of 94 out of 99.

| 🔎 Broker | 🥇 FxPro |

| 💴 Minimum Deposit | 100 USD |

| 💵 Inactivity Fee | None |

| 💶 Fees and Commissions | Spreads from 0.0 pips, commissions from $7 per round turn on Forex |

| 🤝 Affiliate Program | ✅Yes |

| 🌎 Banned Countries | The United States, Canada, Iran |

| 📈 Scalping | ✅Yes |

| 📉 Hedging | ✅Yes |

| 5️⃣ Ease of Use Rating | 4/5 |

| ⏰ Support Hours | 24/5 |

| 🚀 Open an Account | 👉 Click Here |

FXPro Review – Analysis of Brokers’ Main Features

- ☑️ Overview

- ☑️ Detailed Summary

- ☑️ Security Measures

- ☑️ Account Types

- ☑️ How To Open an Account

- ☑️ Trading Platforms and Software

- ☑️ Fees, Spreads, and, Commissions

- ☑️ Which Markets Can You Trade?

- ☑️ Leverage and Margin

- ☑️ Deposit and Withdrawal

- ☑️ Educational Resources

- ☑️ Pros and Cons

- ☑️ In Conclusion

- ☑️ Frequently Asked Questions

Overview

Founded in 2006, FxPro is a reputable online brokerage business with a worldwide presence, offering traders a wide range of trading products and platforms.

Charalambos Demosthenous founded the firm in Cyprus, where it first concentrated on retail forex brokering before becoming well-known for its competitive spreads and innovative trading tools.

FxPro’s dedication to quality is obvious in its adherence to stringent regulation, which is regulated by the UK’s Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission. This commitment to compliance has enabled FxPro to grow into other markets, including South Africa, the Bahamas, and Mauritius.

Throughout its history, FxPro has stressed client education and assistance, providing extensive online courses and technical analysis seminars. Its demo accounts allow traders to develop their abilities in a risk-free environment before moving on to actual trading.

Detailed Summary

| 🔎 Broker | 🥇 FxPro |

| 📈 Established Year | 2006 |

| 📉 Regulation and Licenses | FCA, CySEC, SCB, FSCA, FSC |

| 5️⃣ Ease of Use Rating | 4/5 |

| 🎁 Bonuses | None |

| ⏰ Support Hours | 24/5 |

| 📌 Trading Platforms | FxPro Platform, MetaTrader 4, MetaTrader 5, cTrader, FxPro App |

| 📍 Account Types | Standard, Pro, Raw+, ECN |

| 🪙 Base Currencies | USD, EUR, GBP, CHF, PLN, AUD, JPY, ZAR |

| 📈 Spreads | From 0.0 pips |

| 📉 Leverage | 1:500 |

| 💴 Currency Pairs | 70; major, minor, exotic pairs |

| 💵 Minimum Deposit | 100 USD |

| 💶 Inactivity Fee | None |

| 💷 Fees and Commissions | Spreads from 0.0 pips, commissions from $7 per round turn on Forex |

| 🤝 Affiliate Program | ✅Yes |

| ❌ Banned Countries | The United States, Canada, Iran |

| 📈 Scalping | ✅Yes |

| 📉 Hedging | ✅Yes |

| 📊 Trading Instruments | Forex, futures, indices, shares, metals, energies, crypto CFDs |

| 🚀 Open an Account | 👉 Click Here |

How many trading instruments does FxPro offer?

FxPro provides over 2,100 trading products, including forex, futures, indices, stocks, metals, energy, and cryptocurrency CFDs.

Can I trade cryptocurrencies with FxPro?

Yes, FxPro allows trading on crypto CFDs, although availability varies by the customer’s country of residency.

Security Measures

One of FxPro’s top priorities is safeguarding its clients’ finances and personal information, which it accomplishes by implementing a range of strict protocols.

Firstly, FxPro maintains a clear distinction between client funds and its operational capital to ensure that traders’ investments are kept in individual accounts at major global establishments.

This separation is essential in securing customers’ money against potential financial troubles within the company itself.

In addition, FxPro is devoted to complying with regulations and holds approval from esteemed agencies such as the UK’s Financial Conduct Authority (FCA) and Cyprus Securities and Exchange Commission (CySEC), among others.

Adhering strictly to these regulatory standards ensures exceptional operational integrity and safeguards their customers’ safety.

FxPro employs contemporary encryption techniques to safeguard its customers’ personal and financial data in internet security. The adoption of secure socket layer (SSL) technology enciphers all information shared between clients and FxPro servers, thwarting unauthorized access.

In addition, safeguarding clients from possible financial losses beyond their initial deposit is offered by FxPro through negative balance protection. This feature becomes increasingly vital in dynamic markets where unpredictable fluctuations can lead to substantial monetary setbacks.

What kind of online security measures does FxPro implement?

FxPro employs SSL (Secure Socket Layer) technology to encrypt data transmissions and safeguard users’ personal and financial information.

How can I ensure my trading account is secure with FxPro?

FxPro suggests using strong, unique passwords, activating two-factor authentication (2FA) if possible, and staying watchful against phishing attacks.

Account Types

| 🔎 Account Type | 🥇 Standard | 🥈 Pro | 🥉 Raw+ | 🏅 ECN |

| 🩷 Best Suited | Suitable for casual traders | Ideal for professional traders | Suitable for cost-effective, fast-paced trading | Suitable for scalpers, day, and algorithmic traders |

| 📈 Markets | All | All | All | All |

| 📉 Commissions | None; only the spread is charged | None; only the spread is charged | $3.5 per side, $7 per round turn | $3.5 per side, $7 per round turn |

| 📊 Platforms | All | All | All | All |

| 💹 Trade Size | 0.01 lots - unlimited | 0.01 lots – unlimited | 0.01 lots – unlimited | 0.01 lots – unlimited |

| 📌 Leverage | 1:500 | 1:500 | 1:500 | 1:500 |

| 💴 Minimum Deposit | 100 USD | 1,000 USD | 1,000 USD | 30,000 USD over 2 months |

| 🚀 Open an Account | 👉 Click Here | 👉 Click Here | 👉 Click Here | 👉 Click Here |

Standard Account

The Standard Account offered by FxPro presents an extensive selection of trading products free from commission expenses, catering to traders who prefer uncomplicated pricing formats.

With a minimal investment of $100, traders can engage in forex and indices markets at 1.2 pips on prime currency pairs.

The absence of charges combined with micro-lot trading (0.01 lots) establishes an inclusive platform for all skill levels; especially beneficial to novice financial market traders intending small investments into trade activities.

Pro Account

The Pro Account by FxPro is ideal for seasoned traders who favor a more economical trading experience and narrower spreads. By depositing $1,000 at the onset, one can avail of starting spreads as low as 0.6 pips on popular currency pairs without any additional commissions to pay.

This account primarily caters to investors grappling with large amounts of trade voluminous transactions; they may leverage up to 1:500 while accessing a vast array of diverse trading products.

Raw+ Account

FxPro offers a budget-friendly option for traders called the Raw+ Account, which boasts raw spreads that begin at 0.0 pips partnered with a $3.5 commission per side.

To open one requires a minimum deposit of $1,000, and it appeals particularly to scalpers and high-volume traders who benefit from near-zero spreads on essential Forex pairs.

Consequently, this account’s pricing strategy can greatly decrease transaction costs when trading in huge volumes or regularly, making it highly competitive among its counterparts within the industry space.

ECN Account

Intended for elite traders, FxPro’s ECN Account demands a substantial deposit of $30,000 within 60 days.

With spreads starting from an impressive 0 pips and a charge of $3.5 per side trade, this account is reserved for seasoned investors seeking optimal pricing and exceptional liquidity to support extensive trading activities.

Featuring institutional-grade execution speeds and efficiently catering to diverse product choices, the ECN environment ensures superior performance standards, befitting experienced professionals with sizable portfolios.

Demo Account

The Demo Account at FxPro is an excellent instructive and practice tool for traders who want to develop their skills. It simulates real-market situations using virtual funds, enabling risk-free trading practices.

The account only expires in 180 days, allowing traders to use all of FxPro’s platforms and products. This account particularly benefits novice traders by introducing them to the trading environment or experienced ones to test out strategies easily.

Islamic Account

The Islamic Account provided by FxPro caters to Sharia-compliant traders. It offers a swap-free option, where administration fees are charged instead of overnight interest payments after a specific duration.

This account is crucial for individuals who adhere to Islamic finance principles and need access to global markets without ethical constraints affecting their choices. The same range of products and platform features as normal accounts are available with this account type.

Can I trade on leverage with FxPro accounts?

Yes, FxPro provides leverage options, the degree of which varies based on the account type and the instrument being traded.

What account types does FxPro offer?

FxPro provides a variety of account categories, including Standard, Pro, Raw+, and ECN accounts, each tailored to individual trading needs and preferences.

How To Open an Account

- To register an account with FxPro, follow these steps:

- Begin the process by going to the FxPro website and browsing the registration page.

- After submitting the initial form, check your email for a confirmation pin.

- You will next be prompted to complete a questionnaire about your financial knowledge and trading experience

- Choose your favorite trading platform from the alternatives available.

- To meet regulatory requirements, submit a clear copy of your government-issued ID or passport.

- You will get confirmation from FxPro after your papers have been successfully verified and your account approved.

- Finally, after your account has been funded, you may begin trading by accessing FxPro’s wide variety of financial products via your preferred platform.

Can I open a FxPro account from any country?

FxPro allows clients from all around the world. However, regulatory restrictions apply to the United States, Iran, and Canada.

How long does the account verification process take at FxPro?

FxPro’s account verification procedure normally takes up to two business days after you submit all of the relevant documentation.

Trading Platforms and Software

MetaTrader 4

MT4 remains a dominant force within the trading industry, recognized for its robust features and flexibility.

Its vast array of technical analysis options, algorithmic functionalities, and intuitive user interface are automated trading systems called Expert Advisors (EAs), which facilitate strategy automation and backtesting.

FxPro takes pride in offering improved functionality on the already exceptional MT4 platform with one-click trades and effective charting tools to boost trader performance capabilities – both novice and experienced alike.

MetaTrader 5

MetaTrader 5, an improved version of MT4, provides a highly advanced trading platform equipped with brand-new features and enhanced capabilities.

With expanded offerings including extended timeframes, pending order types, various technical indicators, and more sophisticated charts than ever before. The economic calendar is also easily accessible on the platform, adding to its functionality.

FxPro’s implementation of MetaTrader 5 offers traders access to diverse financial markets via an updated, user-friendly interface while opening up new opportunities for additional trade instruments and position hedging – making it a great prospect for those seeking top-notch multi-asset platforms.

cTrader

The trading community is witnessing a remarkable innovation in the form of FxPro’s cTrader platform, equipped with advanced technical analysis and charting features presented via its sleek UI.

The distinguishing aspect that sets it apart from competitors is Level II pricing providing complete market depth for greater transparency. Additionally, traders can leverage algorithmic capabilities to create bespoke trading robots or indicators using this cutting-edge tool.

Integrating cTrader has enabled FxPro to cater more effectively to discerning clients seeking faster order execution and a wider variety of trade types suitable for modernized sophisticated operations.

Proprietary App

The FxPro App is a trading solution that caters to the demands of today’s mobile-first environment. It provides traders with all the features from its desktop versions, such as real-time market data and account management tools in a portable format.

The app is designed for ease of use so traders can efficiently execute transactions anywhere they go while accessing advanced charting capabilities.

By prioritizing user experience, FxPro demonstrates its commitment to technological innovation and enhancing convenience for traders.

Proprietary Trading Platform

For traders seeking a tailored trading encounter, FxPro provides its unique trading platform. This advanced system blends the most exceptional tools, analytics, and execution speeds that FxPro has to offer.

Custom platforms aim to provide an uncomplicated yet distinctively different way of executing trades than traditional offerings. To address diverse client needs, brokers like FxPro utilize self-created systems to provide bespoke solutions for client’s specific demands.

Does FxPro provide a web trading platform?

Yes, FxPro provides online versions of the MetaTrader 4, MetaTrader 5, and cTrader platforms.

Can I use Expert Advisors (EAs) with FxPro?

Yes, FxPro supports Expert Advisors on MetaTrader platforms.

FxPro Fees, Spreads, and, Commissions

Spreads

The spread structure of FxPro is highly competitive and can vary depending on the financial instrument and account type traders use.

The Pro Account, meant for high-volume trading, has ultra-low spreads starting at 0.6 pips. In contrast, wider spreads are often found in the Standard Account that caters to retail investors but involves no commissions, thus making pricing easier to understand.

FxPro offers effective real-time market circumstances without false markups, making it a favorite among traders who seek transparency and honesty regarding pricing strategies.

Popular currency combinations like EUR/USD have a lower possible start, around 1.2 points. However, more obscure instruments may feature larger margins between the bid and ask prices (spreads).

Commissions

Commission fees do not apply to the Standard or Pro Accounts. Instead, the broker cost is factored into the spread. This strategy provides transparency for traders who use these account types.

However, the Raw+ and ECN Accounts have a distinct cost structure. Traders who choose these accounts may take advantage of zero-pip spreads, which might appeal to those looking for extremely low pricing.

However, charges are charged individually, beginning at $3.5 per side, depending on the financial item being exchanged. This pricing structure is intended to appeal to traders who value narrow spreads and are ready to pay a commission for the benefit.

Overnight Fees

An excavation fee will be charged when a position is kept open overnight. The amount of cost varies depending on the type of instrument and the nature of the position (long or short).

FxPro is transparent about its pricing structure derived from interbank interest rates for currency exchanges. Traders must remain cautious as these fees may add up considerably if positions are held for extended periods.

Deposit and Withdrawal Fees

FxPro’s customer-centric approach means that it does not levy charges for deposits or withdrawals. This benefits traders as they can easily manage their funds without worrying about fees eroding their profits.

Nevertheless, one must keep in mind that while FxPro refrains from imposing additional costs, the financial organizations involved in facilitating these transactions might impose such fees.

Hence, traders need to verify the existence of any applicable charges with their payment service providers or banks before proceeding further.

Inactivity Fees

Traders who maintain inactive accounts for an extended duration without engaging in trading activities may face a fee. This policy encourages traders to cancel accounts or engage in more trading operations.

Further information on the terms and conditions regarding these charges is available through FxPro’s client agreement or by contacting customer service directly.

Currency Conversion Fees

A conversion fee may be charged When trading accounts in a currency other than their deposit or withdrawal currency. This charge compensates for the currency exchange procedure and is computed using the current interbank rates.

While FxPro aims to provide competitive rates, traders should be aware of currency volatility, which can affect the effective rate at which transactions are converted.

Are there swap fees for holding positions overnight at FxPro?

Yes, FxPro charges swap costs for positions held overnight, which vary depending on the instrument and account type.

Does FxPro offer any rebates or discounts on spreads and fees?

Yes, FxPro has a lucrative rebate program that offers Introducing Brokers from 40% of the spread back on accounts.

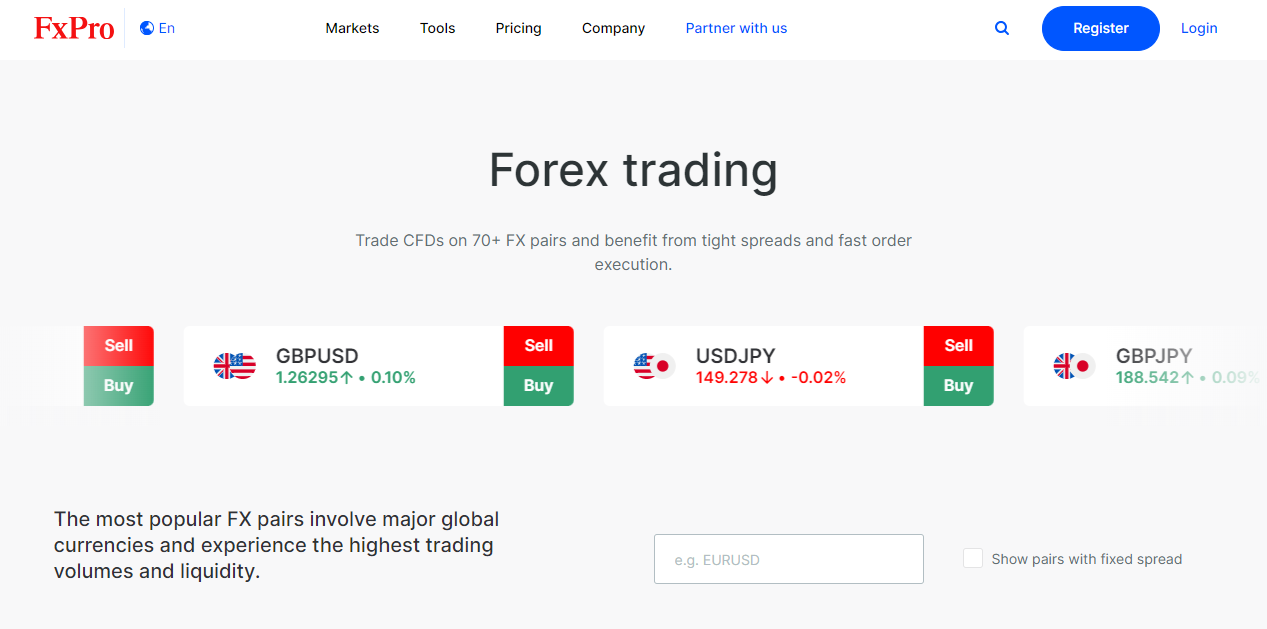

Which Markets Can You Trade?

FxPro offers the following trading instruments and products:

- Over 70 currency pairings

- 24 futures contracts

- 19 spot market indices

- More than 2000 stock CFDs are available

- Seven precious metals

- three spot energy commodities

FxPro trades over 18 cryptocurrencies, although it is worth noting that this option is not available to FxPro UK Ltd’s retail clients.

How many forex pairs does FxPro offer?

FxPro provides trading on more than 70 forex currency pairs.

Are ETFs available for trading at FxPro?

No, FxPro does not presently provide ETFs for trading.

Leverage and Margin

FxPro offers a leverage model that adjusts according to the trading circumstances of its clients. By providing additional market exposure, leveraging allows traders to take larger positions than their initial investment would otherwise permit.

FxPro’s array of leverages encompasses multiple options, especially for certified professionals; it grants retail customers ratios as high as 1:200 on major forex pairs and even more elevated ones for those classified under this category.

It is important to note that leveraging may lead to higher potential profits, but it also poses a greater risk of losses surpassing the initial investment. Only a fraction of the trade’s overall value must be used as a margin to open and sustain a leveraged position.

For instance, at an exchange rate for EUR/USD set at 1.13798, for traders to leverage 1 lot (100,000 units) with a ratio of 1:200, they would need approximately $500 worth of margin funds.

What happens if I do not meet the margin requirements at FxPro?

If your account exceeds the required margin amount, FxPro will issue a margin call, and trades may be forced to be liquidated to avoid additional losses.

Are there any tools at FxPro to help manage leverage and margin?

Yes, FxPro’s website has a margin calculator feature that allows you to estimate the needed margin for your trades.

FxPro Deposit and Withdrawal

| 🔎 Payment Method | 🌎 Country | 🪙 Currencies Accepted | ⏰ Processing Time |

| 💴 Bank Transfers | All | USD, EUR, GBP, CHF, PLN, AUD, JPY, ZAR | 1 – 7 days |

| 💵 Credit/Debit Cards | All | USD, EUR, GBP, CHF, PLN, AUD, JPY, ZAR | Instant – 1 day |

| 💶 Neteller | All | USD, EUR, GBP, CHF, PLN, AUD, JPY, ZAR | Instant – 1 day |

| 💷 PayPal | All | USD, EUR, GBP, CHF, PLN, AUD, JPY, ZAR | Instant – 1 day |

| 💴 Skrill | All | USD, EUR, GBP, CHF, PLN, AUD, JPY, ZAR | Instant – 1 day |

| 💵 UnionPay | All | USD, EUR, GBP, CHF, PLN, AUD, JPY, ZAR | Instant – 1 day |

Deposit Methods:

Bank Wire

- Log into your FxPro Direct account.

- Navigate to the ‘Deposit‘ section.

- Choose ‘Bank Transfer‘ as your deposit option.

- Follow the on-screen steps to retrieve FxPro’s bank information.

- Use these data to request a bank wire transfer from your financial institution.

- The funds are normally deposited to your FxPro account within one working day after reaching their bank.

Credit or Debit Card

- To deposit using a credit or debit card, go onto your FxPro Direct account.

- Go to the ‘Deposit’ area and choose ‘Credit/Debit Card’.

- Enter the amount you want to deposit.

- Enter your card information and make the deposit.

e-wallets or Payment Gateways

- Login to your FxPro Direct account.

- Click on the ‘Deposit’ tab.

- Choose your favorite e-wallet.

- Input the deposit amount.

- You will be routed to the e-wallet website to finish the transaction.

Withdrawal Methods:

Bank Wire

- Login to your FxPro Direct account.

- Navigate to the ‘Withdrawal‘ area and choose ‘Bank Wire‘ as your withdrawal method.

- Fill in your account number, the bank’s SWIFT/BIC code, and other relevant information.

- Enter the amount that you want to withdraw.

- Review and submit your withdrawal request, ensuring that all details are valid.

Credit or Debit Cards

- Access your FxPro Direct account.

- Go to the ‘Withdrawal‘ section and choose ‘Credit/Debit Card‘ as a withdrawal method.

- Select the card you previously used to make a deposit or input the card details to add a new one.

- Determine the withdrawal amount.

- Confirm your information and submit your withdrawal request.

e-wallets or Payment Gateways

- Sign in to your FxPro Direct account.

- Select ‘Withdrawal‘, then select your favorite e-wallet.

- If you have already deposited using the e-wallet, it should be accessible for selection

- Otherwise, you may be required to input your e-wallet account information.

- Enter the amount that you want to withdraw.

- Confirm your withdrawal information and submit the request.

How long does it take to process withdrawals at FxPro?

FxPro processes withdrawals within one business day, although the time it takes for funds to reach your account varies depending on the method.

Is there a minimum withdrawal amount at FxPro?

No, FxPro does not need a minimum withdrawal amount.

FxPro Educational Resources

FxPro offers the following educational resources:

- Nine interactive online courses geared at novices.

- Four courses explore fundamental analysis’s complexities.

- Five courses that walk traders through technical analysis topics.

- Four courses cover the mental and emotional elements of trading

Topics such as the sunk cost fallacy and the escalation of commitment are discussed, assisting traders in understanding the psychological dangers that might influence trading decisions.

Are there any advanced courses for experienced traders at FxPro?

Yes, FxPro provides advanced seminars and analytical techniques for experienced traders who want to expand their expertise and improve their tactics.

How can I access FxPro’s educational materials?

FxPro’s instructional materials are available on their website; however, certain resources may require registration or an active trading account.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| MetaTrader 4 and 5 | Basic FXPro App |

| cTrader accounts | Commissions on cTrader accounts |

In Conclusion

According to our findings, FxPro is a forex and CFD broker that serves a broad spectrum of traders, from novices to seasoned pros. FxPro offers various trading options due to its wide choice of financial products, including Forex pairs, futures, indices, shares, metals, and energy.

At FxPro, withdrawal requests are handled in a single business day; however, the withdrawal method may affect how long it takes for funds to post to your account.

Spreads are competitive, particularly on cTrader accounts, where raw spreads begin at 0 pip. On the other hand, these accounts may have greater commission costs than those of certain rivals.

With a $100 minimum deposit required to begin trading, FxPro provides most traders with an affordable starting point.

Yes, FxPro provides a free trial account with virtual funds to practice trading and become acquainted with their platforms before depositing real money.

🏆 7 Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |