Pepperstone Review

- Pepperstone Review - Analysis of Brokers' Main Features

- Overview

- Detailed Summary

- Safety and Security

- Pepperstone Account Types

- How To Open an Account

- Trading Platforms and Software

- Fees, Spreads, and, Commissions

- Which Markets Can You Trade?

- Leverage and Margin

- Deposit and Withdrawal

- Educational Resources

- Pros and Cons

- In Conclusion

Overall, Pepperstone can be summarised as a trustworthy and highly regulated Forex Broker that provides competitive spreads on Contracts for Difference (CFDs). Pepperstone serves a wide range of customers and has a trust score of 98 out of 99.

| 🔎 Broker | 🥇 Pepperstone |

| 💴 Minimum Deposit | AU$200 |

| 📈 Account Types | Standard Account, Razor Account |

| 💵 Base Currencies | USD, GBP |

| 📉 Spreads | From 0.0 pips EUR/USD on the Razor Account |

| 📊 Leverage | 1:500 (Pro), 1:200 (Retail) |

| 💶 Currency Pairs | 70, minor, major, and exotic pairs |

| 🚀 Open an Account | 👉 Click Here |

Pepperstone Review – Analysis of Brokers’ Main Features

- ☑️ Overview

- ☑️ Detailed Summary

- ☑️ Safety and Security

- ☑️ Account Types

- ☑️ How To Open an Account

- ☑️ Trading Platforms and Software

- ☑️ Fees, Spreads, and, Commissions

- ☑️ Which Markets Can You Trade?

- ☑️ Leverage and Margin

- ☑️ Deposit and Withdrawal

- ☑️ Educational Resources

- ☑️ Pros and Cons

- ☑️ In Conclusion

- ☑️ Frequently Asked Questions

Overview

Pepperstone, founded in 2010, has successfully positioned itself as an industry leader in online Forex and CFD trading. Pepperstone serves a wide range of customers, including experienced professionals and curious beginners, through a robust collection of trading instruments, competitive pricing, and a dedication to honesty.

Pepperstone’s fundamental advantage resides in its commitment to furnishing traders with the necessary tools to navigate the frequently turbulent financial markets.

The investment firm’s extensive portfolio comprises over 1,200 tradable assets, including stocks, forex pairs, cryptocurrencies, indices, and commodities. With diverse options that accommodate various risk tolerances and trading styles, Pepperstone guarantees that each trader will discover the optimal suit within its ecosystem.

In addition to its vast array of instruments, Pepperstone distinguishes itself through the caliber of its trading experience.

Detailed Summary

| 🔎 Broker | 🥇 Pepperstone |

| 📈 Established Year | 2010 |

| 📉 Regulation and Licenses | ASIC, BaFin, CMA, CySEC, DFSA, FCA and SCB |

| 5️⃣ Ease of Use Rating | 5/5 |

| 🎁 Bonuses | ✅Yes |

| ⏰ Support Hours | 24/7 |

| 📊 Trading Platforms | TradingView, MetaTrader 4, MetaTrader 5, cTrader, Capitalise.ai |

| 📌 Account Types | Standard Account, Razor Account |

| 🪙 Base Currencies | USD, GBP |

| 📍 Spreads | From 0.0 pips EUR/USD on the Razor Account |

| 💹 Leverage | 1:500 (Pro), 1:200 (Retail) |

| 💴 Currency Pairs | 70, minor, major, and exotic pairs |

| 💵 Minimum Deposit | AU$200 |

| 💶 Inactivity Fee | None |

| 🥰 Website Languages | English, Spanish, Russian, Chinese, Vietnamese, Arabic, Indonesian, Italian, French, Laotian, German, Polish |

| 💷 Fees and Commissions | Spreads from 0.0 pips, commissions from AU$7 |

| 🤝 Affiliate Program | ✅Yes |

| ❌ Banned Countries | United States, Canada, Iran, Japan, Iraq, Zimbabwe, Yemen, and others |

| 📈 Scalping | ✅Yes |

| 📉 Hedging | ✅Yes |

| 📐 Trading Instruments | Forex, commodities, indices, currency indices, cryptocurrencies, shares, ETFs |

| 🚀 Open an Account | 👉 Click Here |

Does Pepperstone offer a referral bonus or an active trader program?

Yes, Pepperstone gives both a referral bonus and an active trader program, which rewards high-volume traders with rebates and other benefits.

In which languages is Pepperstone’s website available?

Pepperstone’s website offers numerous language options, including English, Spanish, Russian, Chinese, Vietnamese, Arabic, Indonesian, Italian, French, Laotian, German, and Polish.

Safety and Security

Pepperstone prioritizes the security of its client’s funds and data to a significant degree, utilizing numerous robust safeguards.

Initially, it adheres strictly to regulatory standards overseen by top-tier authorities such as the Australian Securities and Investments Commission (ASIC) and the Financial Conduct Authority of the United Kingdom (FCA). This guarantees that Pepperstone maintains exceptional levels of financial integrity and transparency.

Client funds are stored in segregated accounts with top-tier banks, apart from Pepperstone’s operational funds, thereby protecting clients’ capital from any financial mismanagement by the broker.

This segregation also implies that customer funds cannot be used to repay creditors in the unusual event that Pepperstone experiences financial difficulties.

What measures does Pepperstone take to protect client information?

Pepperstone safeguards customer information with SSL encryption for data transmission and powerful firewalls to prevent unauthorized access.

Does Pepperstone offer any protection against adverse trading conditions?

Yes, Pepperstone provides negative balance protection to keep clients from losing more than their account balance during turbulent trading situations.

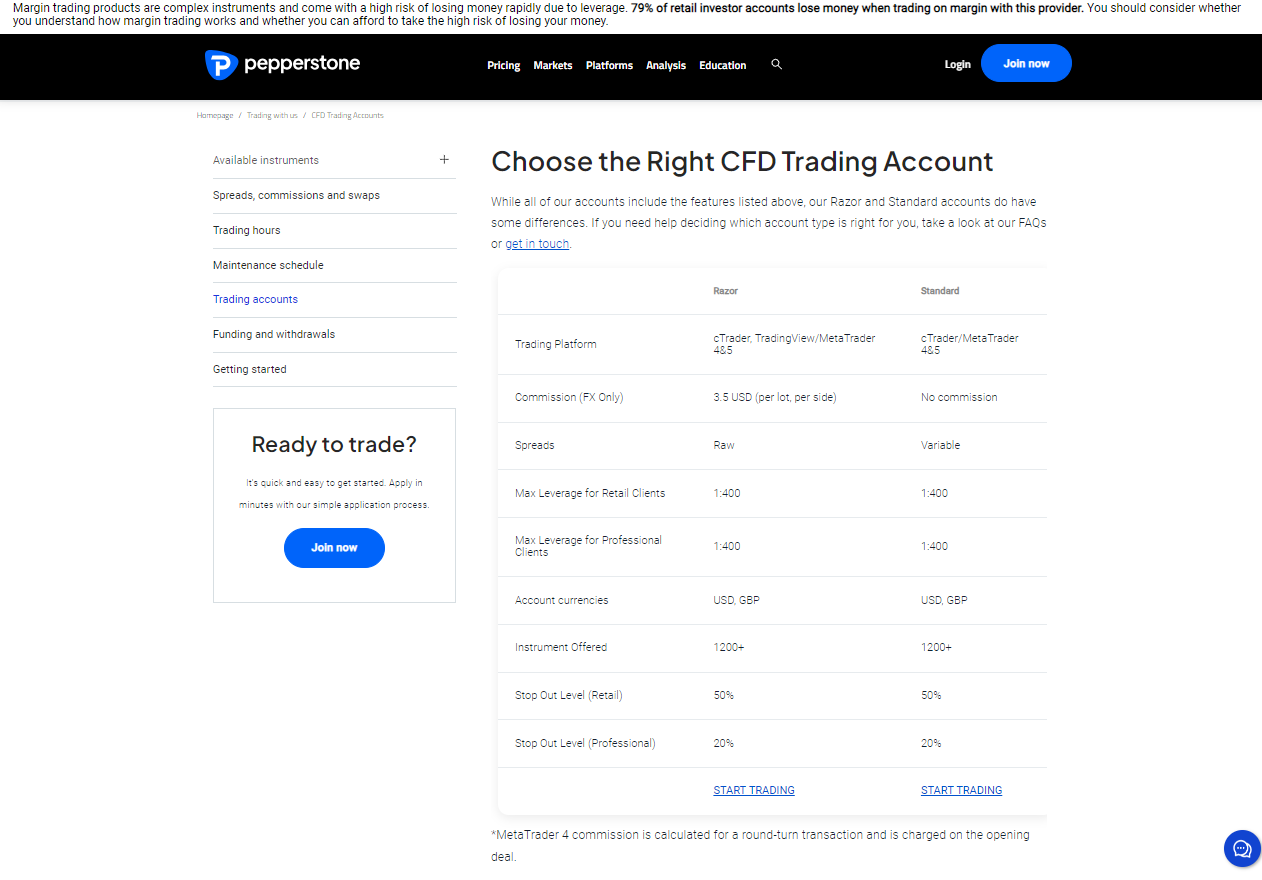

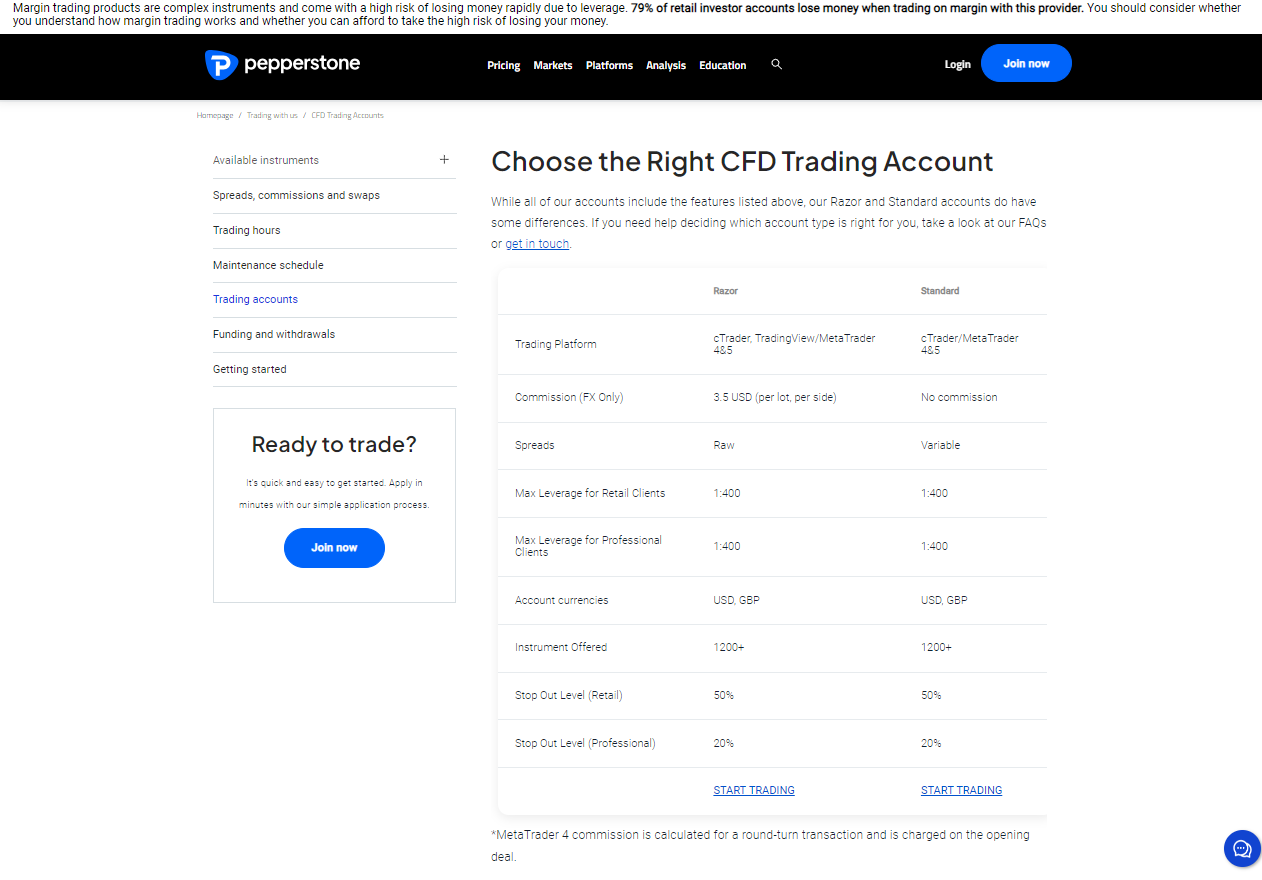

Pepperstone Account Types

| 🔎 Broker | 🥇 Standard Account | 🥈 Razor Account |

| 📈 Availability | All traders. Suitable to all traders despite their skill or objectives | All traders. More suited to scalpers, day traders, automatic traders |

| 📉 Markets | All | All |

| 📊 Commissions | None | From AU$7 per round turn, per standard lot |

| 💹 Platforms | MetaTrader 4, MetaTrader 5, cTrader, TradingView, Capitalise.ai | MetaTrader 4, MetaTrader 5, cTrader, TradingView, Capitalise.ai |

| ⏩ Trade Size | From 0.01 lots – 100 lots per trade | From 0.01 lots – 100 lots per trade |

| ↪️ Leverage | Australia – 1:30 Bahamas – 1:200 Cyprus – 1:30 Dubai – 1:30 Germany – 1:30 South Africa – 1:400 United Kingdom – 1:30 | Australia – 1:30 Bahamas – 1:200 Cyprus – 1:30 Dubai – 1:30 Germany – 1:30 South Africa – 1:400 United Kingdom – 1:30 |

| 💴 Minimum Deposit | AU$200 | AU$200 |

| 🚀 Open an Account | 👉 Click Here | 👉 Click Here |

Standard Account

The Pepperstone Standard Account is an entry-level tier appropriate for inexperienced traders. Commencing at 1 pip provides a commission-free structure in which all trading expenses are incorporated into the spread.

This facilitates budget control and streamlines the fee procedure. It is accessible across multiple platforms, including MetaTrader 4, MetaTrader 5, and cTrader, and provides support for an extensive range of trading strategies, such as scalping and utilizing Expert Advisors.

Traders are granted the flexibility to commence their activities with a minimum deposit of AU$ 200 and trade quantities spanning from 0.01 to 100 lots; there is no upper limit on the maximum trade size.

Standard Accounts offer negative balance protection for retail clients and region-specific leverage, making them an adaptable entry point for financial market exploration.

Razor Account

For sophisticated traders, the Razor Account provides raw spreads starting from 0.0 pips and commissions beginning at AU$7 round turn per 100,000 traded. It is ideal for high-volume trading and scalping, with no dealing desk intervention and an average EUR/USD spread of 0.3 pips.

Like the Standard Account, the Razor supports all trading strategies and permits trading on multiple platforms. It has the same minimum deposit and trading size requirements, protects against negative balances, and offers adaptable location-specific leverage options.

Furthermore, the Razor Account is distinguished by its accurate pricing and swift execution, which are advantageous when employing complex trading strategies.

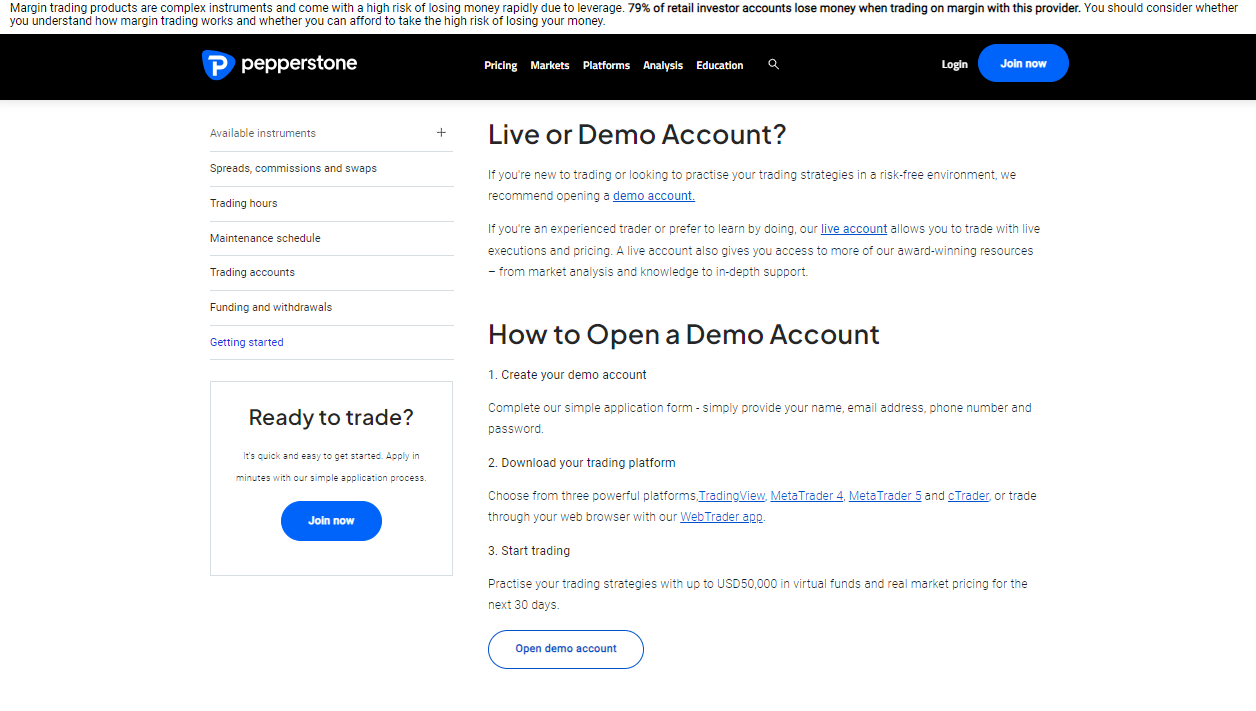

Demo Account

Demo accounts are indispensable for seasoned traders and novices who wish to test strategies without incurring financial risk. The Pepperstone Demo Account grants users complete access to its trading platforms for 30 days while accurately simulating real market conditions.

Traders are encouraged to transition to an active account during this period to maintain access. It provides a pragmatic approach to acquainting oneself with the offerings of Pepperstone and honing trading techniques by utilizing diverse analytical tools and instruments.

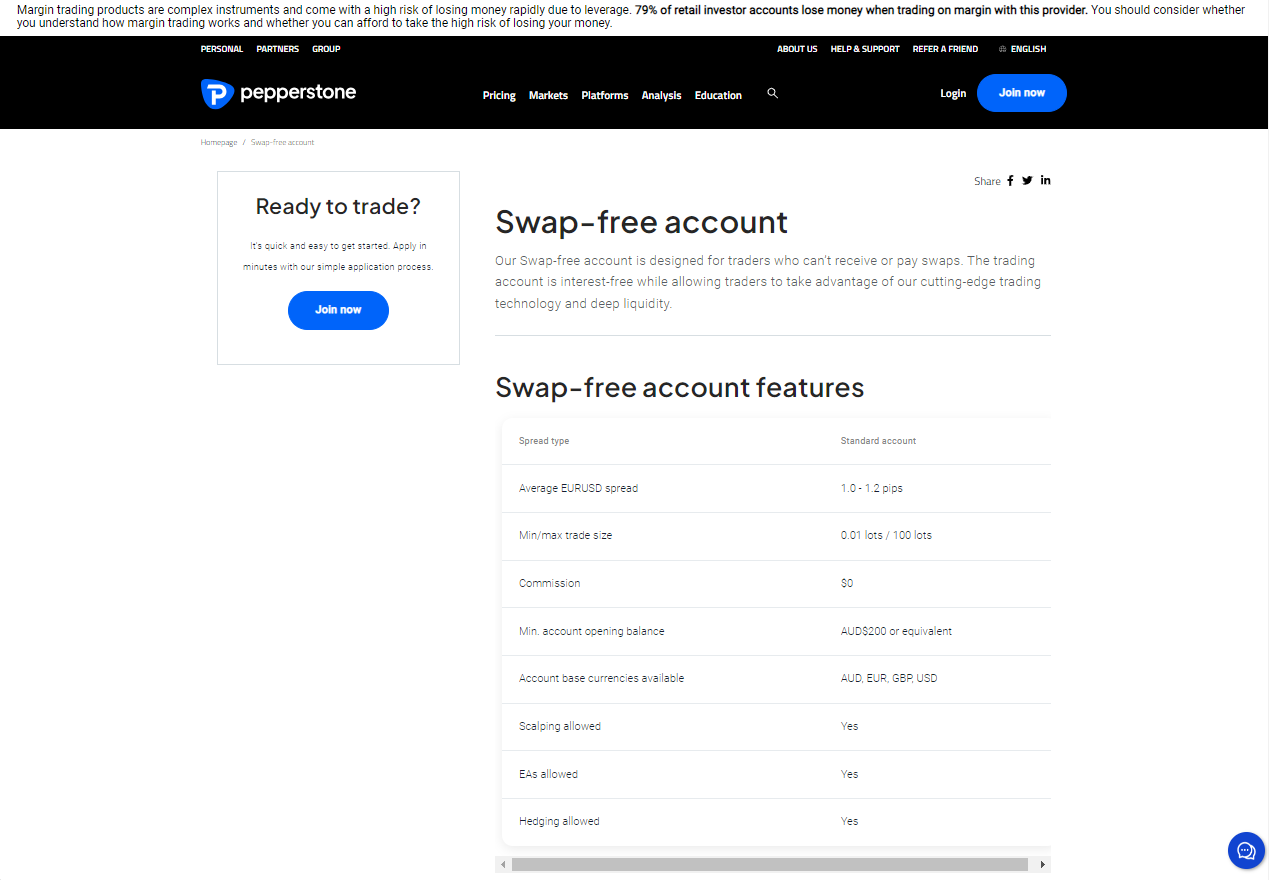

Islamic Account

The Islamic Account from Pepperstone caters to traders who adhere to the tenets of Sharia law, which proscribe specific financial transactions such as swaps. Despite being region-restricted, this account category reflects Pepperstone’s dedication to promoting inclusivity.

It does not charge transaction fees, which is an essential requirement for adhering to the principles of Islamic finance.

A standard minimum deposit is required for the account, which grants access to all trading platforms and supports a vast array of trading strategies.

It is worth noting that positions held for a duration exceeding five days incur an administration fee, underscoring a distinctive cost structure customized to adhere to Islamic trading principles.

Professional Account

The Professional Account is designed for traders with extensive experience and a greater tolerance for risk. This particular account category provides a dedicated account manager, reduced margin requirements, and increased leverage of up to 1:500.

Eligibility is determined by satisfying rigorous requirements, encompassing a substantial trading volume track record. It is an elite option for institutions and individuals searching for sophisticated features that enhance their frequency and trading expertise.

Can traders use scalping and hedging strategies with Pepperstone’s Razor Account?

Yes, scalping and hedging tactics are acceptable when trading using Pepperstone’s Razor Account.

What is the minimum deposit required to open a Pepperstone account?

The minimum deposit required to open a Standard or Razor Account at Pepperstone is AU$ 200.

How To Open an Account

- To register an account with Pepperstone and start trading, follow these steps:

- Go to the Pepperstone Website and click on the “Open Account” option.

- Choose from three options: Standard, Razor, and Swap-Free.

- Provide your personal information, contact information, and trade history.

- A brief quiz allows Pepperstone to check your comprehension of leveraged products and trading risks.

- Upload clear scans or images of your passport or government-issued ID.

- Choose your desired deposit method.

- Choose your preferred platform from MetaTrader 4 and 5, cTrader, or TradingView.

- Use your account credentials to access your platform and browse the various instruments. If you are new to trading, remember to start with a demo account before moving on to the real markets.

What personal information is required to open a Pepperstone account?

To open a Pepperstone account, you must provide your personal information, contact information, and trading history and upload documents for identity and address verification.

How long does it take to open a Pepperstone trading account?

Opening a Pepperstone trading account typically takes one day, assuming sufficient documentation and verification.

Trading Platforms and Software

MetaTrader 4

Pepperstone offers traders access to the renowned MetaTrader 4 (MT4) platform, which boasts remarkable stability and cutting-edge analytical tools.

With a range of charting options, technical indicators, and automated trading features via Expert Advisors (EAs), MT4 is favored by both novice and experienced traders alike for its winning combination of sophistication with simplicity.

Furthermore, MetaTrader 4 provides comprehensive functionality in a user-friendly format that caters to all proficiency levels.

MetaTrader 5

MT5 offers a wider array of functionalities encompassing increased timeframes, technical indicators, graphical objects, and an integrated economic calendar.

Through Pepperstone’s MT5 platform, traders can access diversified markets such as stock CFDs, facilitating greater flexibility in building their trading portfolio.

Moreover, its all-encompassing back-testing environment and support for diverse order types make it desirable to those seeking more thorough analysis and execution capabilities.

cTrader

Pepperstone’s cTrader platform is designed for traders who prefer a more modern interface and improved order execution capabilities. cTrader stands out for its level II pricing, detachable charts, and algorithmic trading assistance via cAlgo.

cTrader is the platform of choice for traders that require direct market access and advanced order types. The platform’s slick design and straightforward pricing scheme appeal to scalpers and day traders who value speed and precision.

Capitalise.ai

The integration of Capitalise.ai by Pepperstone presents a novel facet to automated trading, enabling traders to devise and evaluate their strategies using natural language processing.

This esteemed platform holds particular significance for the set that lacks programming acumen but seeks automation concerning their trading strategies.

With its user-friendly features, Capitalise.ai facilitates the hassle-free conversion of ideas into algorithms, conducting simulations effectively before deploying them in real-time market scenarios, making it an exceedingly viable option for strategy automation.

TradingView

Pepperstone utilizes TradingView, a well-known platform favored by technical traders for its exceptional charting capabilities.

With this integration, users can access up-to-the-minute data and an extensive array of charting tools and social features that enable them to exchange ideas and tactics with other traders.

The tool’s intuitive design streamlines market monitoring, technical analysis tasks, and trade execution processes; it proves particularly advantageous for those who prioritize technical analysis or appreciate input from their peers when making investment decisions.

Does Pepperstone support algorithmic trading on its platforms?

Yes, Pepperstone’s platforms, including cTrader and Capitalise.ai, provide algorithmic trading, enabling automated trading methods.

Can traders use technical analysis tools on Pepperstone platforms?

Yes, technical analysis tools are extensively available throughout Pepperstone platforms, particularly MetaTrader 4 and 5, which have many indicators and customization possibilities.

Fees, Spreads, and, Commissions

Spreads

The spread, or the difference between the ask and bid prices at Pepperstone, varies depending on several variables. Spreads for customers utilizing the Standard Account begin at 1 pip, making it an affordable choice for occasional traders.

On the other hand, the Razor Account is designed for traders with more experience and offers spreads starting as 0.0 pips, reflecting Pepperstone’s competitive pricing in volatile markets.

Because spreads are dynamic, they will alter in reaction to liquidity and market conditions. As such, traders should monitor these changes to maximize their cost management and trading tactics.

Commissions

The commission structure at Pepperstone is very clear, especially for users of the Razor Account. Trade commissions are assessed; FX CFD traders must pay $3.50 for each standard lot traded if an account is denominated in USD.

This clear fee schedule ensures no surprises when executing trades by enabling traders to estimate and forecast trading costs precisely. Many traders value the simplicity and regularity of commissions since it makes it easy to integrate them into the cost-benefit analysis of their trading activity.

Overnight Fees

For positions left open overnight, overnight fees are necessary for forex trading, and Pepperstone is no exception. These charges are computed using the market closing price and the underlying interest rates of the currencies traded in the transaction.

Depending on the direction of the trade and the difference between the two interest rates, they may credit or debit the trader’s account.

Traders should consider these swap rates since they may raise the long-term cost of maintaining positions, especially in markets with significant difference rates.

Deposit and Withdrawal Fees

The lack of fees on most deposit and withdrawal methods is one benefit of trading with Pepperstone. This policy gives traders an affordable way to manage their money.

There is, however, an exemption for foreign bank transfers, where a $20 fee is imposed. Because it could impact the net amount transferred, this fee is essential for traders to consider when transacting internationally or working with currencies other than the base currency of their account.

Inactivity Fees

One noteworthy feature of Pepperstone’s pricing structure that provides traders with a significant benefit is the lack of inactivity fees.

This makes it an appealing choice for sporadic traders or those who might take a break from trading because accounts will not be penalized for failing to execute a trade within a certain time.

It offers traders flexibility and peace of mind by enabling them to keep their accounts open without worrying about incurring extra fees during inactive periods.

Currency Conversion Fees

When traders carry out transactions in a currency other than the base currency of their account, currency conversion costs are incurred. Pepperstone’s clients should be mindful of these possible expenses, as they are contingent upon the current currency rates.

Currency conversion fees have the potential to decrease deposit amounts or raise withdrawal costs, which can have an impact on trade profitability. As a result, traders—especially those who deal with numerous currencies—must account for these fees in their trading budget.

How much does Pepperstone charge in commissions for its Razor Account?

Pepperstone charges commissions starting at AU$7 every round turn and per standard lot on the Razor Account.

Does Pepperstone impose any inactivity fees on traders?

No, Pepperstone does not charge inactivity fees, making it an affordable option for traders not engaging in frequent trading.

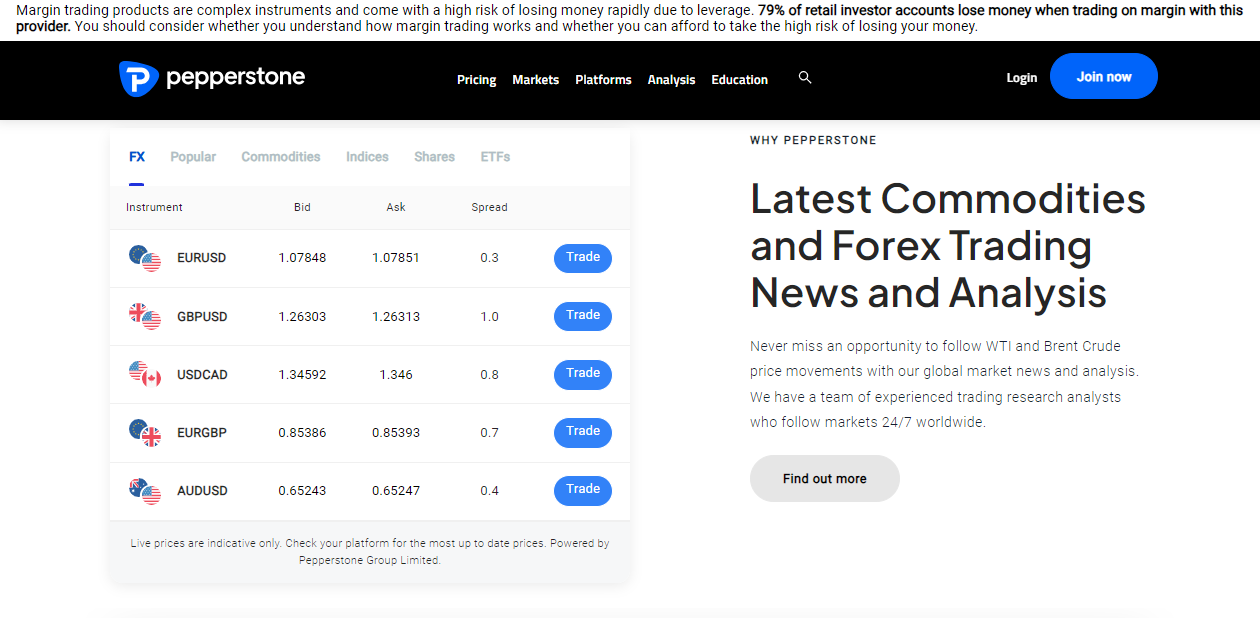

Which Markets Can You Trade?

Pepperstone offers the following instruments and products:

- 70 Forex pairs, including major, minor, and exotic currency pairings

- 17 commodities

- 28 indices

- Over 1,000 shares

There are 100 ETFs accessible for trading, each containing a diversified collection of securities, allowing traders to invest in a wide range of sectors, commodities, and indices using a single instrument.

How many Forex pairs does Pepperstone offer for trading?

Pepperstone provides 70 forex pairs, including major, minor, and exotic currency pairs.

Can I trade cryptocurrencies with Pepperstone?

Yes, Pepperstone offers the possibility of trading 19 cryptocurrencies, catering to traders interested in the digital currency market.

Leverage and Margin

Pepperstone enables traders to enhance their potential returns by providing them with leverage. This tool permits you to manage a greater position size than what your account balance would typically allow.

For example, suppose you have $1,000 in your account, and Pepperstone offers you a leverage of 500:1. This implies you can trade a position for $500,000 with only a $1,000 investment. While this can considerably increase your gains if the market goes in your favor, it amplifies your losses similarly.

However, before diving in, you must first understand the notion of margin, which is the deposit required in your account to hold leveraged positions.

Pepperstone expresses margin requirements as a percentage of the total position size. With a 1% margin requirement, you must deposit $5,000 to hold a $500,000 stake.

Can retail traders access high leverage with Pepperstone?

Yes, retail traders can use leverage of up to 1:30 in Australia, 1:200 in the Bahamas, and different levels in other jurisdictions while trading with Pepperstone.

How does Pepperstone protect clients from negative balance risks associated with high leverage?

Pepperstone offers negative balance protection, ensuring clients do not lose more money than they deposit into their trading accounts.

Deposit and Withdrawal

| 🔎 Payment Method | 🌎 Country | 🪙 Currencies Accepted | ⏰ Processing Time |

| 💴 Visa | All | AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, HKD | 3 to 5 days |

| 💵 Mastercard | All | AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, HKD | 3 to 5 days |

| 💶 Bank transfer | All | AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, HKD | 3 to 7 days |

| 💷 MPESA | All | AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, HKD | Instant – 5 days |

| 💴 PayPal | All | AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, HKD | Instant – 5 days |

| 💵 Bpay | All | AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, HKD | 3 to 5 days |

| 💶 Neteller | All | AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, HKD | Instant – 5 days |

| 💷 POLi | All | AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, HKD | 1 to 3 days |

| 💴 Skrill | All | AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, HKD | Instant – 5 days |

| 💵 China UnionPay | All | AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, HKD | 3 to 5 days |

Here is an overview of how to deposit to Pepperstone via the most popular Deposit Options:

Bank Wire

- Click “Fund Your Account” and choose “Bank Wire Transfer.”

- Select your desired currency and input the transfer amount.

- Download and review the bank wire details.

- Begin the transfer from your local bank.

- Notify Pepperstone of your transfer by filling out the online form or emailing [email protected] with the transaction reference number.

Credit or Debit Card

- Log into your Secure Client Area.

- Click “Fund Your Account” and choose “Credit/Debit Card.”

- Enter your card number, expiry date, CVV, and deposit amount.

- Click “Deposit” to authorize the transaction using your bank’s security system.

- Funds should be credited to your Pepperstone account immediately.

Cryptocurrency Wallets

- Click “Fund Your Account” and select your preferred cryptocurrency (e.g., Bitcoin or Ethereum).

- Copy the Pepperstone crypto wallet address or scan the QR code.

- Open your cryptocurrency wallet and transfer to the specified address.

- Due to blockchain processing times, funds may take up to 24 hours to appear in your Pepperstone account.

e-wallets or Payment Gateways

- Log into your Secure Client Area.

- Click “Fund Your Account” and choose your e-wallet or payment gateway (e.g., PayPal, Skrill, Neteller).

- Log in to your e-wallet or gateway account and authorize the transfer to Pepperstone.

- Enter the transfer amount and the reference number (if any).

- Funds should be credited to your Pepperstone account immediately.

Here is an overview of how to make a Withdrawal from Pepperstone via the most popular Withdrawal Options:

Bank Wire

- Enter your login credentials to access the Pepperstone website’s secure client area.

- Look for your account dashboard’s ‘Funds Management‘ or ‘Withdrawal‘ tab.

- Choose bank wire from the list of withdrawal options.

- Enter the amount you want to withdraw and your bank account information.

- Check the withdrawal information for accuracy, then confirm the request.

- Pepperstone may request you provide extra evidence for compliance purposes.

- Wait for Pepperstone to process your withdrawal.

Credit or Debit Card

- Sign in to the Pepperstone client area.

- Choose “Withdrawal” or a comparable option.

- Select the card withdrawal option.

- Enter the amount that you want to withdraw.

- Double-check the withdrawal information and confirm your request.

Cryptocurrency Wallets

- Enter the Pepperstone client area.

- Select the withdrawal option from your account.

- Choose a cryptocurrency withdrawal if one is available.

- Please specify the amount and provide your cryptocurrency wallet address.

- Ensure all information is valid.

- Finalize your withdrawal.

e-wallets or Payment Gateways

- Go to Pepperstone’s client portal.

- Look for “Withdraw Funds” or anything similar.

- Choose your chosen e-wallet or payment gateway from the options available.

- Type in the amount you want to withdraw.

- Enter your e-Wallet account information or log in using the gateway’s site if required.

- Double-check all of the information and submit your withdrawal request.

Are there any fees for depositing into a Pepperstone account?

No, Pepperstone does not impose fees for most deposit methods; however, a fee is charged for overseas bank transfers.

What currencies can I use to make deposits and withdrawals with Pepperstone?

Pepperstone offers a variety of currencies as deposits and withdrawals, including AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, and HKD.

Educational Resources

Pepperstone offers the following Educational Resources:

- CFD trading resources

- Crucial forex trading instructions

- Content on share trading explains the process of trading share CFDs.

- Webinars

Pepperstone offers a variety of educational videos to visual learners.

Does Pepperstone provide any real-time learning tools for traders?

Yes, Pepperstone offers real-time learning resources, including webinars and live market analysis, allowing traders to apply their expertise to current market conditions.

Are there any automated trading education resources available at Pepperstone?

Yes, Pepperstone provides educational resources on automated trading, such as utilizing tools like Capitalise.ai to create and test trading algorithms.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Pepperstone provides responsive and friendly customer service that is available 24/7 | While trading fees are low, the costs of holding positions overnight can be significant |

| Traders are not charged for account inactivity | Transfers: International bank transfers have a $20 fee |

| There is a lot of educational content available to traders of all skill levels | The variety of platforms and advanced technologies can be overwhelming for novices |

| New users should expect a quick and easy account setup process | Pepperstone is not available in some countries, including the United States |

| Most deposit and withdrawal methods are free of charge, which increases the cost-effectiveness of trading with Pepperstone | Some customers may find Pepperstone's MetaTrader platform too simple in terms of appearance and use |

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA | USD 100 | Visit Broker >> |

| 🥈 |  | Read Review | FMA, FSA | USD 50 | Visit Broker >> |

| 🥉 |  | Read Review | FSCA, CySEC, DFSA, FSA, CMA | USD 0 | Visit Broker >> |

| 4 |  | Read Review | SFSA, FSCA, CySec* | USD 5 | Visit Broker >> |

| 5 |  | Read Review | FCA, CySEC, FSCA, SCB | USD 100 | Visit Broker >> |

| 6 |  | Read Review | FCA, FINMA, FSA, ASIC | USD 0 | Visit Broker >> |

| 7 |  | Read Review | CySEC, FCA, FSA, FSCA, Labuan FSA | USD 100 | Visit Broker >> |

| 8 |  | Read Review | Not Regulated | 0.001 BTC | Visit Broker >> |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker >> |

| 10 |  | Read Review | CySEC,MISA, FSCA | USD 20 | Visit Broker >> |

In Conclusion

According to our research, Pepperstone is a prominent Forex and CFD broker that provides a sophisticated blend of technology innovation and a user-friendly trading experience.

With a regulatory structure overseen by renowned institutions such as ASIC and the FCA and a dedication to client fund security through segregated bank accounts and negative balance protection, it instills a strong sense of trust.

Yes, Pepperstone is well-known for its affordable price, numerous platform options, and excellent customer service. However, leverage can amplify losses, so trade cautiously.

No, Pepperstone is not accepting new clients from the United States due to regulatory constraints.

Yes, Pepperstone is regarded as a safe broker, having been licensed by numerous top-tier financial regulators.

Withdrawals from Pepperstone are typically handled within 24 hours. Still, the time it takes for funds to appear in your account varies depending on the withdrawal method, with bank transfers taking 3-5 business days and e-wallets being faster.

Pepperstone offers MetaTrader 4 and 5, cTrader, Capatalise.ai, and TradingView to cater to various trading styles and technical requirements.

🏆 7 Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |