FXCM Review

- FXCM Review – Analysis of Broker’s Main Features

- Overview

- Detailed Summary

- Security Measures

- Account Types

- How To Open an FXCM Account

- Trading Platforms and Software

- Fees, Spreads, and, Commissions

- Which Markets Can You Trade with FXCM?

- Leverage and Margin

- Deposit & Withdrawal Options

- Educational Resources

- Pros & Cons

- In Conclusion

Overall, FXCM Review can be summarised as a trustworthy and well-regarded entity within the online financial trading arena. This Broker has a global presence in crucial financial hubs like Cyprus and Canada. They has a trust score of 96 out of 99.

| 🔍 Broker | 🥇 FXCM |

| 💵 Minimum Deposit | 50 USD |

| 4️⃣ Ease of Use Rating | 4/5 |

| 🎁 Bonuses | ✅ Yes |

| 🕰️ Support Hours | 24/5 |

| 🚀 Open an Account | 👉 Click Here |

FXCM Review – Analysis of Broker’s Main Features

- ☑️Overview

- ☑️Detailed Summary

- ☑️Security Measures

- ☑️Account Types

- ☑️How to Open an Account

- ☑️Trading Platforms and Software

- ☑️Fees, Spreads and Commissions

- ☑️Which Markets can you Trade with FXCM

- ☑️Leverage and Margin

- ☑️Deposits and Withdrawals

- ☑️Educational Resources

- ☑️Pros and Cons

- ☑️In Conclusion

- ☑️Frequently Asked Questions

Overview

Overall, This Broker is considered low-risk, with an overall Trust Score of 96 out of 100. They are licensed by two Tier-1 Regulators (high trust), two Tier-2 Regulators (average trust), and zero Tier-3 Regulators (low trust). They offer one CFD retail trading account and Spread Betting, Active Trader, and Professional Trader Options on this account.

Detailed Summary

(Foreign Exchange Capital Markets), founded in 1999 under the visionary leadership of Dr. Nicholas Deakin, entered the financial scene to democratize currency trading for individuals.

Headquartered in the United Kingdom, they capitalized on the emerging internet environment of the early 2000s to revolutionize forex trading via online platforms. As large organizations and banks controlled the forex sector, the broker’s revolutionary strategy sought to level the field.

By 2010, it had established itself as a major participant in worldwide retail trading, with a rising customer and well-known brand.

Today, they are a recognized online brokerage with a worldwide reach that includes Hong Kong, Cyprus, Australia, Israel, South Africa, and Canada.

They are committed to regulatory compliance and follow the standards established by reputable agencies. The Financial Conduct Authority (FCA), Australian Securities & Investments Commission (ASIC), Cyprus Securities & Exchange Commission (CySEC), and Financial Sector Conduct Authority (FSCA).

Their compliance with regulatory criteria in Tier 1 countries shows this commitment to consumer security.

Furthermore, their unlimited-duration demo account provides risk-free practice chances, allowing traders to improve their abilities without real-world repercussions.

Their provision of Sharia-compliant shows inclusivity accounts with no exchange costs, which serve the demands of Islamic religion adherents.

With flexible market executions enabled by platforms like Trading Station and MetaTrader 4, they support a wide range of trading methods. From hedging to scalping, appealing to new and experienced traders.

| 🔍 Broker | 🥇 FXCM |

| 🔢Established Year | 1999 |

| 🖋️Regulation and Licenses | FCA, ASIC, CySEC, FSCA |

| 4️⃣Ease of Use Rating | 4/5 |

| 🎁Bonuses | ✅ Yes, referral program, rebates program, active trader rebates program |

| 🕰️Support Hours | 24/5 |

| 📊Trading Platforms | FXCM App, Trading Station, TradingView Pro, MetaTrader 4, Capitalise AI, ZuluTrade |

| ➡️Account Types | CFD Trading Account |

| 💴Base Currencies | Depends on the region and regulatory entity |

| 👉Spreads | From 0.2 pips |

| 📈Leverage | 1:30 (UK), 1:400 (other regions) |

| 💷Currency Pairs | 45; major, minor, exotic pairs |

| 💶Minimum Deposit | 50 USD |

| 💵Inactivity Fee | ✅ Yes, $50 after 12 months of inactivity |

| 🗣️Website Languages | English, French, Chinese, German, Italian, Malay, Spanish, Thai, Bahasa, Arabic, Polish, Russian, and more. |

| 💸Fees and Commissions | Spreads from 0.2 pips, commissions are not charged |

| 🤝Affiliate Program | ✅ Yes |

| ❌Banned Countries | United States, Ukraine, Turkey, Russia, and Iran, along with some other countries |

| 📌Scalping | ✅ Yes |

| 🚩Hedging | ✅ Yes |

| 💍Trading Instruments | Forex, shares, indices, commodities, cryptocurrencies, Forex Baskets, Stock Baskets |

| 🚀 Open an Account | 👉 Click Here |

What year was FXCM founded?

They were founded in 1999, solidifying its position as a veteran of the Internet trading business.

What types of financial instruments can I trade with FXCM?

This broker allows you to trade financial products, including forex, stocks, indices, commodities, and cryptocurrencies.

Security Measures

Extensive security protocols are implemented to safeguard customer funds and confidential data, ensuring a secure trading landscape.

As part of its standard procedure, client assets are held in separate accounts at leading financial institutions. Eliminating the mingling of personal money with operational expenses and bolstering monetary safety measures.

This partition creates distinct limits between corporate property and client possessions, shielding customers’ capital even if internal instability arises.

Moreover, they are affiliated with a compensation fund offering additional customer protection. The Financial Services Compensation Scheme (FSCS) in the United Kingdom ensures coverage of up to £85,000 reimbursement if they fail to fulfill their financial obligations.

To guarantee the security and privacy of data, the broker utilizes sophisticated encryption technologies like Secure Socket Layer (SSL) across its websites and trading platforms.

This type of encryption assures that confidential information – including personal details and transactional records – remains protected against unauthorized access or cyber-attacks during transfer over the internet.

Moreover, it is suggested that implementing strong password protocols and employing two-factor authentication systems where appropriate for better account safety measures.

Does FXCM offer any additional security features for accounts?

The broker provides two-factor authentication (2FA) for account access, adding another protection layer to prevent fraudulent account use.

How does FXCM protect my personal information?

The broker uses modern encryption methods, including SSL encryption, to safeguard personal information and financial transactions from illegal access.

Account Types

| 🔍 Account Type | 🥇CFD Account |

| ⏰Availability | All traders |

| 📊Markets | All available |

| 💵Commissions | None; only the spread is charged |

| 📊Platforms | All |

| ⬆️Trade Size | From 0.01 pips |

| 📈Leverage | 1:400 |

| 💵Minimum Deposit | 50 USD |

| 🚀 Open an Account | 👉 Click Here |

CFD Account

CFD account offers a cost-effective means for traders to participate in the price fluctuations of various assets, all without owning the underlying products. Trading commences with spreads as low as 0.2 pips and is entirely devoid of associated fees.

The minimum trading size is established at 0.01 lots, while leverage can reach up to 1:400, contingent upon adherence to regional regulatory constraints.

Within this particular account framework provided by the broker, traders gain access to various markets, encompassing cryptocurrencies, currencies, commodities, and indices. This tailored solution caters to investors pursuing opportunities spanning diverse asset classes.

In addition, it seamlessly combines low entry costs with transparent pricing practices, ultimately facilitating the potential for returns through capitalizing on market volatility over time.

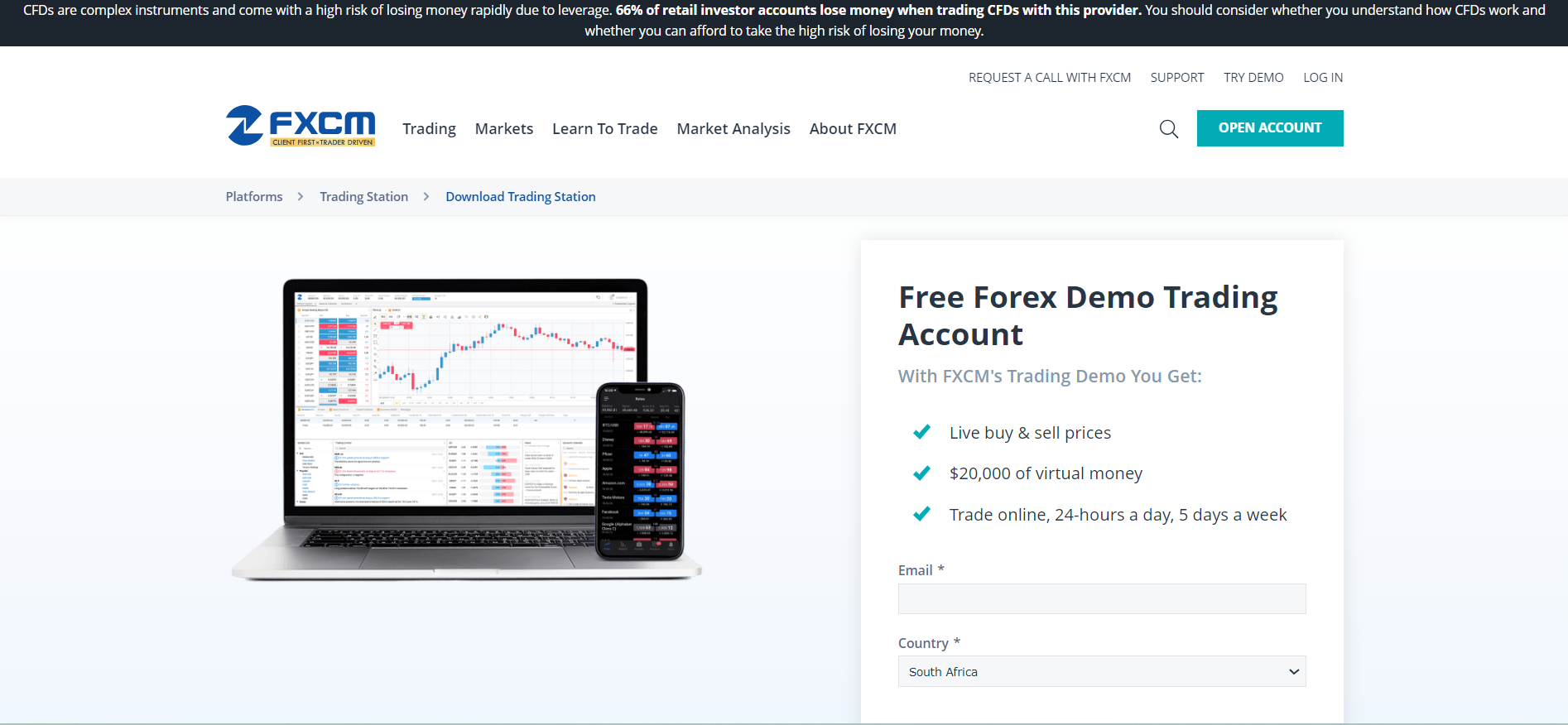

Demo Account

The Demo Account is a valuable training resource for traders of all levels, offering risk-free practice in trading simulations that mimic real-market conditions.

With no restrictions on usage time, active users have access to virtual balances and authentic pricing data along with technical indicators and comprehensive charting tools featured in the platform’s offerings.

The account proves particularly beneficial when experimenting with new tactics or familiarizing oneself with platforms and functions. While studying market dynamics without the pressure of facing genuine financial loss during the learning process.

Islamic Account

The Islamic Account is tailored for traders who adhere to Sharia principles. This account adheres to the religious tenets by exempting overnight holders from paying interest, as it aligns with Islam’s financial norms.

Rather than charging an interest rate on open positions, a consistent fee structure ensures complete transparency in trading expenses.

Unlike conventional CFD accounts, this swap-free option grants access to all products and platforms.

Furthermore, it differentiates itself by accommodating those within the Muslim community seeking a tolerant investment environment that respects their religious customs without compromising the broker services offered.

Professional Account

The Professional Account caters to traders who meet specific requirements, demonstrating significant proficiency and extensive trading activities.

It offers greater leverage options and a distinct set of customer protections compared to retail accounts. Qualified traders enjoy the robust trading tools, broad market reach, and specialist support services.

However, it should be noted that the transition to professional standing relinquishes important retail safeguards.

Therefore, individuals must understand the associated risks before using this account type. This makes it ideal for those with comprehensive financial market knowledge capable of managing heightened risk levels through increased leverage utilization.

What is the minimum deposit required to open an FXCM account?

The minimum deposit to start an account is USD 50.

Can I open a demo account with FXCM?

Yes, you can create a demo account, which includes virtual money for practice trading and is valid for an infinite time if utilized often.

How To Open an FXCM Account

✅Go to the official broker website to start creating an account with them.

✅Once there, look for and select the “Open an Account” or “Open a Forex Account” option, which is typically shown prominently on the front page.

✅To guarantee that you obtain the most up-to-date information and regulatory compliance, select your home country and preferred trading platform from the list of alternatives.

✅After being routed, complete the secure online application form by entering your name, address, employment data, and financial situation.

✅You must submit identity and proof of domicile as part of the registration procedure; these might be utility bills, passports, or driver’s licenses.

✅To continue, read the terms and conditions provided to you, comprehend the privacy statement, and accept the risk disclosure declarations.

✅After completing the application and sending it in for evaluation, you will get a username and password that will allow you to access the client site.

✅Once you can access the client interface, you may use any funding options provided, including credit card and bank transfer, to add money to your account.

✅Now that your account has been paid, you may start trading and interact with the markets using the trading platform of your choice.

Do I need to provide any documents to open an account with FXCM?

Indeed, to create an account, you must supply identity and evidence of domicile, such as a passport and a utility bill.

Can I open more than one trading account with FXCM?

Yes, they allow traders to create several trading accounts, each of which may cater to various trading methods or account kinds.

Trading Platforms and Software

FXCM App

For traders who prioritize the ability to trade on the go, the FXCM App provides a mobile solution. With its intuitive interface, this software presents real-time data and interactive charts alongside trading tools.

Its seamless integration with the trading accounts enables traders to monitor markets, execute trades, and manage portfolios anytime from any location.

The app’s comprehensive functionality and robust security features make it an ideal option for those seeking mobility without sacrificing their entire trading experience.

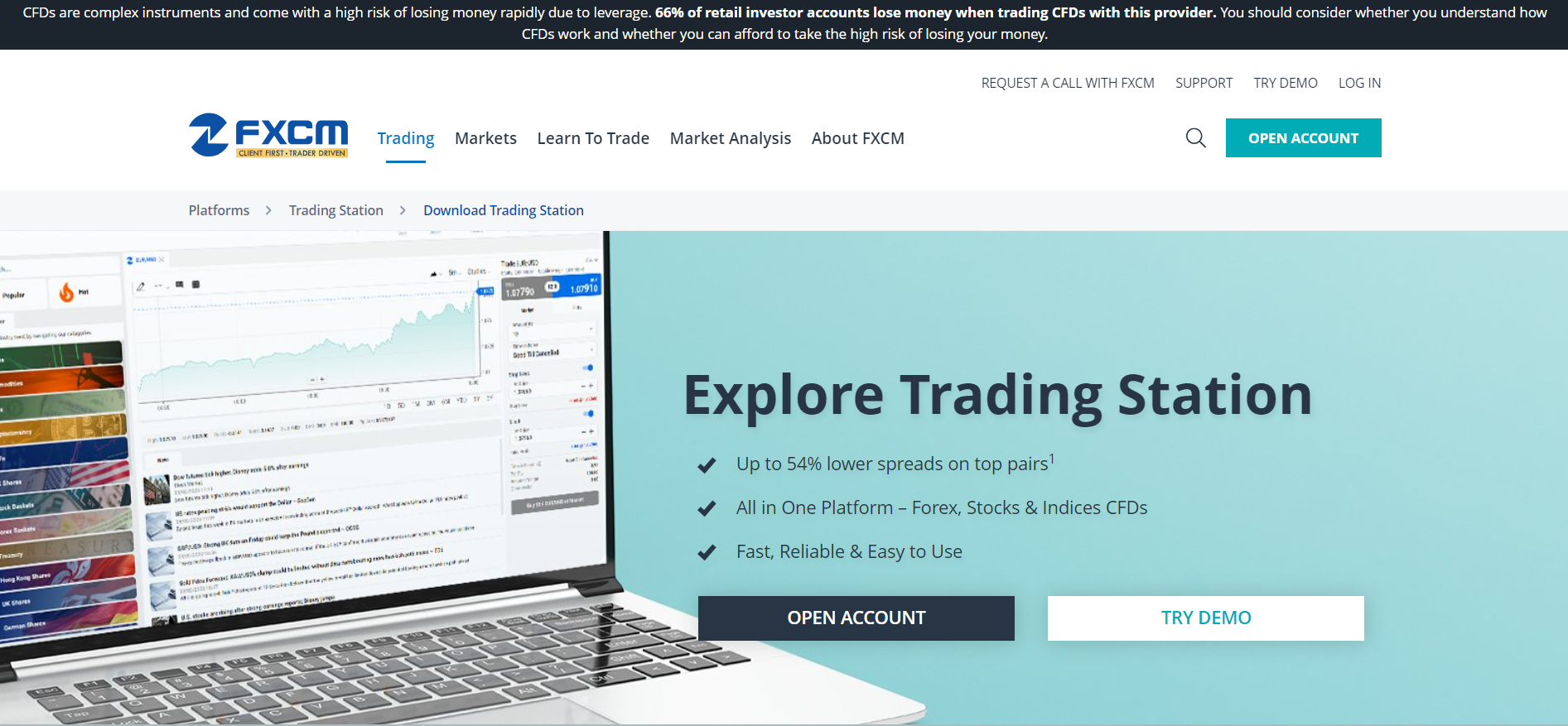

Trading Station

Trading Station is their proprietary platform that offers traders an advanced yet user-friendly trading experience. With its extensive charting features, customizable indicators, and broad back-testing capabilities, the platform caters to novice and seasoned traders.

Known for its intuitive design, Trading Station seamlessly streamlines analytics through market news data and various order types at your fingertips.

The modern interface ensures quick navigation while enabling precise transactions, critical components required by today’s active trader conducting, Thorough market analysis in real-time using sophisticated tools provided within this robust application offering.

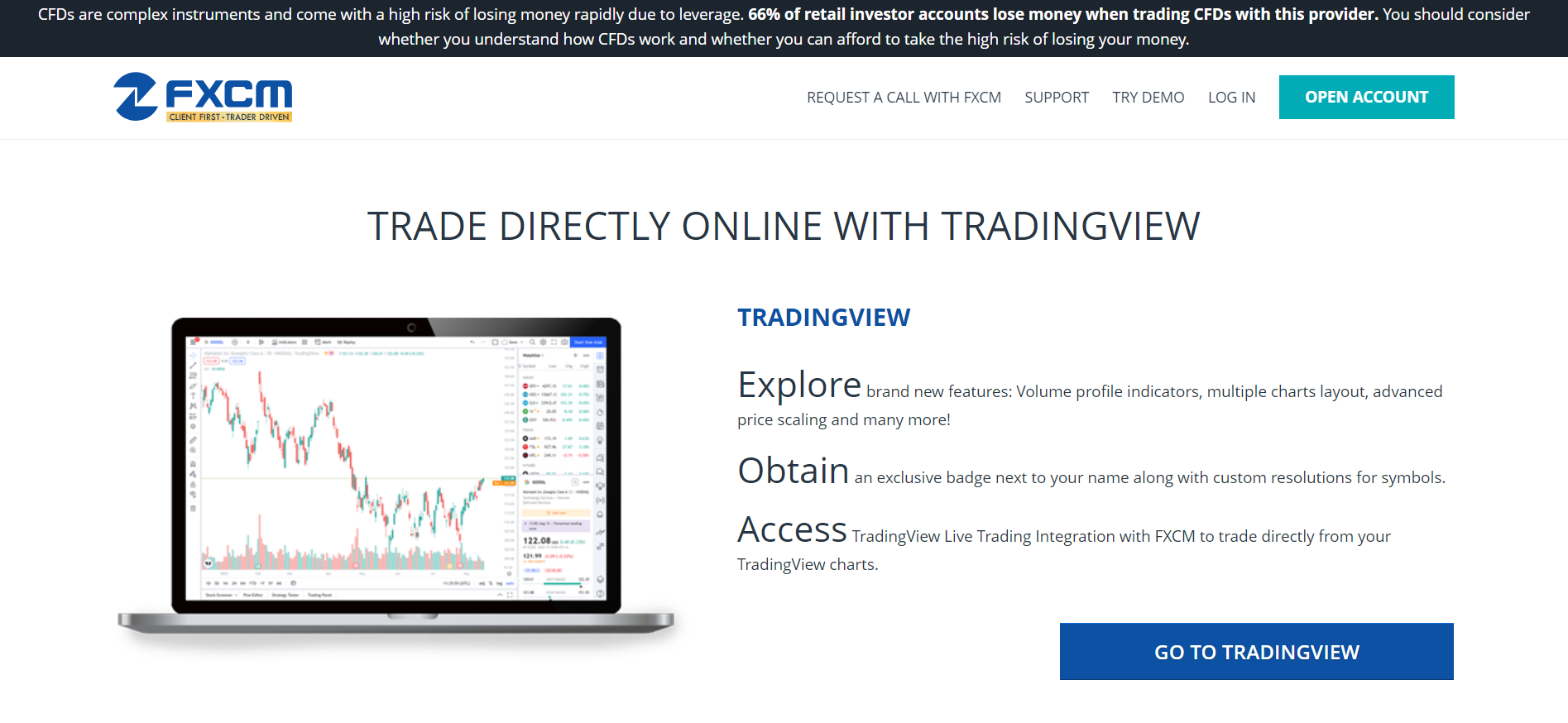

TradingView Pro

Traders strongly prefer TradingView Pro due to its advanced charting capabilities and social networking features.

The platform expertly blends robust tools with an active community of traders who regularly share trade ideas and strategies, resulting in a mutually beneficial trading environment.

This setup is especially, useful for those seeking a professional market evaluation by leveraging the collective expertise offered by other traders’ insights and technical analysis functions.

This broker’s integration with TradingView Pro enables users to access these powerful functionalities while seamlessly managing trades from within the interface.

MetaTrader 4

Renowned for its reliability and extensive analytical tools, MetaTrader 4 (MT4) is a well-liked trading platform that caters to diverse traders.

It draws many due to the sophisticated automated trade functions supported by Expert Advisors (EAs) and its ability to handle multiple order types seamlessly. The expansive charting selections alongside customizable indicators in MT4 simplify thorough market analysis processes.

This Broker showcases its commitment to providing cutting-edge industry-standard resources through its offering of MT4, facilitating advanced methods of trades and algorithmic solutions for clients’ easy use.

Capitalise AI

Capitalise AI is an advanced software that revolutionizes traders’ decision-making and strategies. It harnesses artificial intelligence to allow for the creation and automation of plain commands, thereby minimizing coding requirements.

This distinctive attribute brings algorithmic trading within reach of a more extensive user base. Furthermore, Capitalise AI’s compatibility with this broker empowers traders to leverage market opportunities through sophisticated yet uncomplicated tactics.

ZuluTrade

ZuluTrade is a platform for social trading that empowers traders to discover and duplicate the tactics of proficient traders. It fosters a community-based trading method where users can benefit from the collective knowledge of seasoned market experts.

The FXCM integration allows traders access to this vast pool of information and automates their trades based on signals provided by approved traders.

This synergistic atmosphere is an excellent resource for individuals seeking improvement in trade performance via insights gained from other knowledgeable peers within the broker’s framework.

What trading platforms does FXCM offer?

The broker provides many trading platforms, including the proprietary Trading Station, MetaTrader 4, TradingView Pro, and ZuluTrade.

Does FXCM offer a web-based trading platform?

Yes, they provide a web-based version of the Trading Station platform, allowing convenient access without program installation.

Fees, Spreads, and, Commissions

Spreads

The pricing system relies heavily on its variable spreads, starting from as low as 0.2 pips for popular forex pairings like EUR/USD. Market conditions and liquidity may cause fluctuations in spread values, but they remain highly competitive within the industry.

These tight spreads prove especially advantageous for traders who engage in daily trading or scalping strategies that rely on small price variations for profits.

Additionally, the broker actively aids traders by decreasing their expenses through lower trading costs made possible by narrow spreads.

Therefore, this is a viable option even among cost-conscious traders seeking an edge over competition when attracting new clients with similar preferences at any scale of trade volume levels.

Commissions

This Broker sets itself apart from other brokers by offering a commission-free trading structure on regular accounts. This means that traders only pay spreads and no additional fees.

By eliminating commissions, the cost analysis for traders is simplified, allowing them to focus on potential profits and losses with greater ease.

It prioritizes transparency and affordability in its commission policy, which provides a worry-free trading experience without any hidden costs that could impede profitability or enjoyment of the markets available for trade.

Overnight Fees

When traders hold positions overnight, the charges implemented depend on the position size, financial instrument traded, and current interest rate difference between currencies involved.

These fees are standard in the industry but strive to be competitive, keeping costs low for long-term holdings.

Therefore, effective cost management requires comprehension of these charges, allowing savvy investors flexible trading options without incurring steep penalties.

Deposit and Withdrawal Fees

This broker ensures that its clients can make deposits free of charge. This means traders will not have to pay extra when they want to add funds to their accounts.

However, withdrawing money may involve fees, especially for those conducting international bank wire transactions.

These charges are set according to the cost of transferring funds, and the broker is transparent about them with customers. To avoid unexpected costs during withdrawals, traders should consider these potential fees beforehand while planning their withdrawal strategy.

Inactivity Fees

Accounts that have not undergone any trading in the past year are subject to Inactivity Fees. A fixed yearly fee of $50 will remain until either account funds run out or trades resume.

This expense inspires traders to keep their accounts active or close those they do not use. Traders who take breaks from trading should be mindful of this charge so as not to accumulate needless fees on dormant accounts.

Currency Conversion Fees

When a trade necessitates currency conversion, this broker imposes fees for such alterations. These expenses hinge on the exchanged amount and are assessed as a nominal markup over the prevailing exchange rate.

The magnitude of this markup varies based on transaction size; bigger transactions incur relatively lower costs in proportion to their value.

This multi-tiered mechanism aims at offering attractive rates for significant trades, underscoring their pledge to impartial and competitive pricing structures that serve traders across global markets adequately.

What are the typical spreads for trading with FXCM?

Typical spreads start from 0.2 pips EUR/USD.

What are FXCM’s inactivity fees?

The specific broker levies a $50 yearly inactivity fee to customers who have not traded in the previous 12 months.

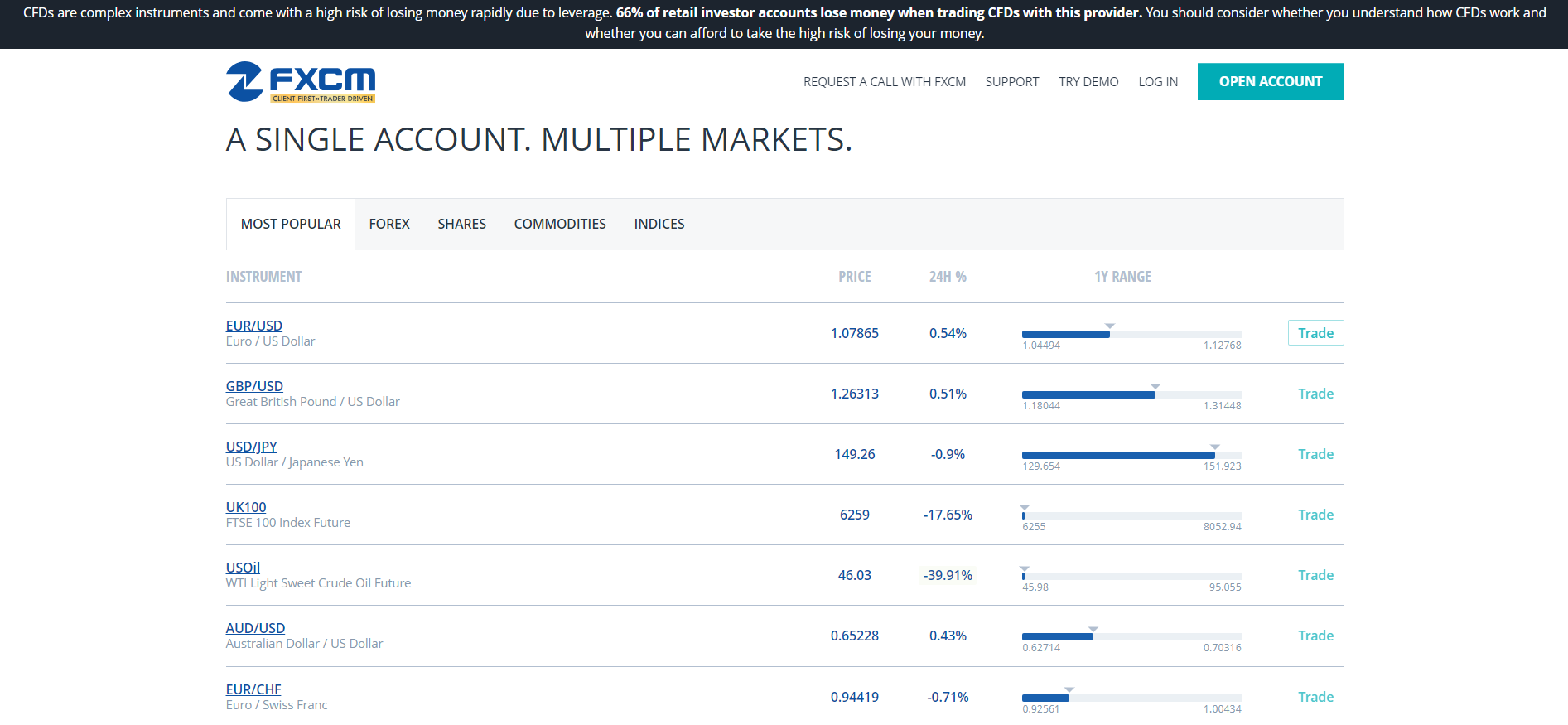

Which Markets Can You Trade with FXCM?

This Broker offers the following trading instruments and products:

✅Forex – Provides a variety of 45 currency pairs, including major, minor, and exotic pairings, to suit a wide range of forex trading preferences and techniques. Depending on the regulatory jurisdiction, traders can profit from attractive spreads and leverage of up to 1:400, allowing for prudent and aggressive forex trading strategies.

✅Shares – With over 200 shares accessible, The broker offers a diverse market for share CFD trading, allowing traders to bet on the price fluctuations of firms in various industries without holding the underlying equities. With access to worldwide firm shares, traders may diversify their portfolios beyond currencies.

✅Indices – Traders have access to seven key global indices, which allow them to trade on larger market patterns and the economic health of individual countries. Indices trading with this broker provide exposure to market sectors and may be used as a hedge against individual stock volatility.

✅Commodities – This broker offers a range of six commodities, including popular commodities like gold and oil. Trading commodity CFDs with them allows traders to enter the commodities market with fewer capital requirements and no need for physical storage.

✅Cryptocurrencies – Traders are allowed to trade five distinct cryptocurrencies, providing an entry point into the dynamic and expanding crypto market. Crypto trading uses CFDs, allowing traders to speculate on cryptocurrency price changes without requiring a digital wallet.

Can I trade shares through FXCM?

Yes, they allow traders to trade share CFDs with access to over 200 business shares.

Does FXCM offer commodities trading?

Yes, traders may trade various commodities, including gold and oil.

Leverage and Margin

Forex leverage and margin are indispensable for traders seeking to establish substantial positions with a small amount of initial capital.

Maximum allowable leverages stand at 30:1 for primary currency pairs, whereas non-major pairings plus gold indices represent 20:1 allowances. Individual stocks, as well as other reference values, reflect the lowest level (5:1), highlighting increased volatility associated therein.

Margin is the equity necessary to commence and maintain a position, acting as a security deposit rather than a transaction fee. The Broker implements tiered margin levels consisting of an entry/maintenance margin and a liquidation margin set at 50% of the former.

Should account equity dip below liquidation margins, active trades will be terminated to prevent further loss.

As market volatility or currency exchange rates fluctuate, so too can required margins, which, are adjusted regularly. Notifying traders, via tools like Tiered Margin Watcher when close approaching calls may occur.

Can leverage and margin requirements change at FXCM?

Yes, the broker periodically alters leverage and margin limits in response to market circumstances and regulatory guidelines.

How does FXCM’s Tiered Margin system work?

Their Tiered Margin system includes an Entry/Maintenance margin for opening positions and a Liquidation margin, typically 50% of the Entry Margin, ensuring that traders have enough equity in their accounts.

Deposit & Withdrawal Options

| 🔍Payment Method | 🌎Country | 💵Currencies Accepted | ⏰Processing Time |

| 💳Credit Card | All | EUR, USD, GBP | Instant – 2 days |

| 💳Debit Card | All | EUR, USD, GBP | Instant – 2 days |

| ✏️CreditPay | All | EUR, USD, GBP | Instant – 2 days |

| 💻Bank Wire Transfer | All | EUR, USD, GBP | Instant – 2 days |

| 👉Skrill | All | EUR, USD, GBP | Instant – 2 days |

| ➡️Neteller | All | EUR, USD, GBP | Instant – 2 days |

| 🌟Klarna. | All | EUR | Instant – 2 days |

| 📌Rapid Transfer | All | EUR, GBP | Instant – 2 days |

| 🖋️Local Bank Transfer Philippines | Philippines | PHP | Instant – 2 days |

| 🏦Local Bank Transfer | Vietnam | VND | Instant – 2 days |

| 🛎️Local Bank Transfer LATAM | Mexico | MXN | Instant – 2 days |

| 🚨Local Bank Transfer Malaysia | Malaysia | MYR | Instant – 2 days |

| 🎈Local Bank Transfer Indonesia | Indonesia | IDR | Instant – 2 days |

Deposits Methods:

Bank Wire

✅With your login credentials, access your MyFXCM account.

✅Click the “Deposit Funds” link and choose “Bank Wire Transfer” from the available deposit methods.

✅The bank account information required for the wire transfer will be sent to you by the broker; note this information.

✅Use the information supplied by the broker to start a wire transfer by going to your bank’s website or stopping by a branch.

✅Add the money you want to put into your trading account to the transfer.

✅Save the wire transfer confirmation or receipt for your records and future use.

✅After the broker has completed the payment, the money should appear in your trading account in one to two business days.

Credit or Debit Card

✅Enter your login information to access your MyFXCM account.

✅Select the “Credit or Debit Card” option in the “Deposit Funds” section.

✅Enter the amount you want to deposit and your card’s data, including the number, expiration date, and CVV code.

✅After you confirm the transaction, the money should be credited instantly to your account, depending on how long the broker takes to complete.

e-Wallets or Payment Gateways

✅Log in to the client area of MyFXCM.

✅Choose your favorite e-wallet or payment gateway, such as Skrill or Neteller, by clicking “Deposit Funds.”

✅After entering the desired deposit amount, you will be sent to the login page for the payment gateway or e-wallet.

✅Check the payment by logging into your payment gateway or e-wallet account.

✅Shortly after the transfer is finished, you will receive a transaction confirmation, and the deposit will show up in your trading account.

Withdrawals Methods

Bank Wire

✅Enter MyFXCM and log in.

✅Choose “Bank Wire Transfer” under “Withdraw Funds” as your withdrawal option.

✅Enter your bank information on the withdrawal form, including the account number, routing number, and bank name.

✅After entering the desired withdrawal amount, submit the form.

✅After the broker processes the withdrawal, the money will typically be sent to your bank account in two business days.

Credit or Debit Cards

✅Log in to MyFXCM.

✅Choose the “Credit or Debit Card” withdrawal option after selecting “Withdraw Funds.”

✅Select the withdrawal destination for the card you used to make the initial deposit.

✅After you have specified the withdrawal amount, send in your request.

✅The withdrawal will be processed back to the card by the broker, which can take a few business days to appear on your account.

e-Wallets or Payment Gateways

✅Access your MyFXCM account.

✅Go to the ‘Withdraw Funds‘ area and pick an e-wallet or payment gateway provider.

✅Enter the amount that you want to withdraw.

✅To confirm the transaction, you may be prompted to enter into your e-wallet or payment gateway account.

✅Submit the withdrawal request, and the broker will execute it; funds should be in your e-wallet within one to two business days.

What deposit methods are available at FXCM?

This broker accepts various deposit options, including credit and debit cards, bank wire transfers, and e-wallets like Skrill and Neteller.

Are there any fees for depositing or withdrawing funds with FXCM?

Deposits are typically free of charge. However, withdrawals, particularly via bank wire, may incur costs depending on the method and area.

Educational Resources

This specific broker offers the following educational resources:

✅Trading Guides provide comprehensive instructional materials to improve traders’ knowledge and performance. These manuals often cover various subjects, from forex and CFD trading fundamentals to advanced trading methods and market analysis.

✅The instructions can be published in formats like PDFs, e-books, and online articles to accommodate diverse learning styles.

✅Trading Tools – Trading tools help traders make educated decisions. These tools may include technical analysis software, charting apps, market scanners, and risk management calculators.

✅These tools help traders assess market patterns, find trading opportunities, and successfully handle transactions.

✅Top Reads – They offer a handpicked assortment of articles, books, and publications to keep traders updated on market trends, trading tactics, and financial insights. This material would be valuable for ongoing learning and remaining current in the changing trading world.

✅Free Online Live Classroom – The broker provides live online lessons to help traders learn straight from market pros. These involve live market analysis, question-and-answer sessions, and trading strategy demos.

✅The live format enables interactive learning and rapid feedback, which may be valuable for traders of all levels.

Does FXCM provide trading tools for beginners?

Yes, trading tools and resources are offered specifically for novices, such as basic trading tutorials and demo accounts for practice.

Where can I find FXCM’s trading guides?

The trading instructions are accessible on their website and include subjects ranging from forex basics to sophisticated trading tactics.

Pros & Cons

| ✅ Pros | ❌ Cons |

| Multitude of educational materials | High Currency conversion fees |

| Multiple Account Types | Narrow asset portfolio |

| 24-hour multilingual customer | Limited Trading Platforms |

Our Review Methodology: For each of our broker evaluations, we investigate, evaluate, analyze, and compare what we feel to be the most crucial criteria to consider when selecting a broker. Based on our findings, this evaluation comprises positives, disadvantages, and an overall score. We want to assist you in locating the ideal broker for your requirements.

Please remember the following text: “Our broker review should not be considered financial advice. Traders should seek professional financial advice before making investment decisions.”

Addendum/Disclosure: No matter how diligently we strive to maintain accuracy, the forex market is volatile and may change anytime, even if the information supplied is correct when going live.

Investor Warning: Foreign currency trading on margin is associated with an elevated risk and may not be appropriate for all South African investors.

Before engaging in foreign currency or Contract for Difference (CFD) trading, you must evaluate your investing goals, expertise, appetite for risk, and willingness to be exposed to risk. In addition, you should not start investing capital you cannot afford to lose because you could lose part of your original investment.

In Conclusion

According to our research, this broker distinguishes itself as a respected Forex and CFD broker. It combines decades of market experience with a comprehensive offering that appeals to a diverse range of traders.

No, MetaTrader 5 is not available from FXCM.

Withdrawals at FXCM are executed quickly, usually within one to two business days, depending on the withdrawal type and the account’s verification status.

Yes, they provide CFDs for Bitcoin and other major cryptocurrencies.

The minimum deposit necessary to start a trading account with FXCM is 50 USD, making it accessible to traders with various budgets.

Withdrawals are normally processed using the same mechanism as deposits, with processing timeframes varied according to the method.

Yes, FXCM is regarded as a safe broker, since it is authorized by respectable financial regulators worldwide and implements stringent security measures to secure customer assets and personal information.

No, not everywhere. However, it is available in some places. Check your region’s policy.

FXCM allows clients to trade in Forex, stocks, indices, commodities, and cryptocurrencies, providing diverse trading options across several marketplaces.

Yes, they provide mobile trading apps for iOS and Android smartphones.

FXCM is based in the United Kingdom and has other offices in key financial areas worldwide to serve its worldwide clients.

🏆 7 Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |