ATC Brokers Review

Overall, ATC Brokers can be summarised as a trustworthy and highly regulated Forex Broker that is very competitive in terms of its trading fees. ATC Brokers offers an easy-to-use social copy trading platform with excellent customer support. ATC Brokers has a trust score of 90 out of 99.

| 🔎 Broker | 🥇 ATC Brokers |

| 📈 Established Year | 2005 |

| 📉 Regulation and Licenses | FCA, CIMA |

| 📊 Ease of Use Rating | 3/5 |

| 🎁 Bonuses | None |

| ⏰ Support Hours | 24/5 |

| 🖱️ Trading Platforms | MetaTrader 4 |

| 📌 Account Types | Live Trading Account |

| 🪙 Base Currencies | USD, GBP, EUR |

| 📈 Spreads | 0.3 pips EUR/USD |

| 📉 Leverage | 1:200 |

| 💰 Currency Pairs | 37; minor, major, and exotic pairs |

| 💴 Minimum Deposit | $2,000 |

| 💵 Inactivity Fee | ✅ Yes, $50 after 6 months of inactivity |

| 🥰 Website Languages | English, Spanish, Chinese, Arabic |

| 💶 Fees and Commissions | Spreads from 0.3 pips, commissions from $1 |

| 🫶 Affiliate Program | ✅Yes |

| ❌ Banned Countries | United States |

| 🖇️ Scalping | ✅Yes |

| 📍 Hedging | ✅Yes |

| 📐 Trading Instruments | Forex, indices, commodities, cryptocurrencies |

| 🚀 Open an Account | 👉 Click Here |

Analysis of Brokers’ Main Features

- ☑️ Brokers Overview

- ☑️ Brokers Detailed Summary

- ☑️ Brokers Safety and Security

- ☑️ Brokers Account Types

- ☑️ To Open an ATC Brokers Account

- ☑️ Brokers Trading Platforms and Software

- ☑️ Brokers Fees, Spreads, and, Commissions

- ☑️ Brokers’ Leverage and Margin

- ☑️ Which Markets Can You Trade with ATC Brokers?

- ☑️ Brokers Deposit and Withdrawal

- ☑️ Brokers’ Pros and Cons

- ☑️ In Conclusion

- ☑️ Frequently Asked Questions

Overview

ATC Brokers, founded in 2005 by industry experts dedicated to accessible and transparent trading, has completely altered the online brokerage environment. Furthermore, ATC Brokers’ objective is to provide traders of all skill levels with the tools, resources, and assistance they need to navigate global markets.

ATC Brokers has grown from its humble beginnings to become a worldwide known organization that provides various assets such as forex, commodities, indices, and cryptocurrency. In addition, ATC Brokers stresses technical innovation, providing cutting-edge trading systems built for speed, flexibility, and sophisticated analysis.

ATC Brokers strives to establish a collaborative and educational atmosphere. The organization offers market information, news updates, and complete learning tools to assist customers in making educated choices.

ATC Brokers is dedicated to the success of its clients, whether they are experienced traders or fresh to the market. It provides low spreads, excellent customer service, and a strong commitment to ethical financial practices.

What regulatory authorities oversee ATC Brokers?

ATC Brokers is regulated by the UK’s Financial Conduct Authority (FCA) and the Cayman Islands Monetary Authority (CIMA).

Does ATC Brokers offer services to international clients?

Yes, ATC Brokers provides trading services to a worldwide customer, subject to country-specific rules.

Detailed Summary

| 🔎 Broker | 🥇 ATC Brokers |

| 📈 Established Year | 2005 |

| 📉 Regulation and Licenses | FCA, CIMA |

| 📊 Ease of Use Rating | 3/5 |

| 🎁 Bonuses | None |

| ⏰ Support Hours | 24/5 |

| 🖱️ Trading Platforms | MetaTrader 4 |

| 📌 Account Types | Live Trading Account |

| 🪙 Base Currencies | USD, GBP, EUR |

| 📈 Spreads | 0.3 pips EUR/USD |

| 📉 Leverage | 1:200 |

| 💰 Currency Pairs | 37; minor, major, and exotic pairs |

| 💴 Minimum Deposit | $2,000 |

| 💵 Inactivity Fee | ✅ Yes, $50 after 6 months of inactivity |

| 🥰 Website Languages | English, Spanish, Chinese, Arabic |

| 💶 Fees and Commissions | Spreads from 0.3 pips, commissions from $1 |

| 🫶 Affiliate Program | ✅Yes |

| ❌ Banned Countries | United States |

| 🖇️ Scalping | ✅Yes |

| 📍 Hedging | ✅Yes |

| 📐 Trading Instruments | Forex, indices, commodities, cryptocurrencies |

| 🚀 Open an Account | 👉 Click Here |

Safety and Security

ATC Brokers prioritizes strong security measures to secure their customers’ assets and personal information.

The company is governed by authoritative agencies such as the Financial Conduct Authority (FCA) in the United Kingdom and the Cayman Islands Monetary Authority (CIMA), which ensures severe financial requirements are met.

Client money is maintained in segregated accounts with renowned banks, which separate them from the company’s capital and provide an added degree of security.

Furthermore, ATC Brokers uses powerful encryption technology to secure online transactions and protect sensitive data, reducing the possibility of illegal access.

How does ATC Brokers protect my personal information?

ATC Brokers uses powerful encryption technology to protect its customers’ personal and financial information.

What regulatory protections are in place for ATC Brokers’ clients?

Clients of ATC Brokers are safeguarded by the FCA and CIMA’s regulatory requirements, which require strong financial and operational restrictions.

Account Types

| 🔎 Account Types | 🥇 Live Trading Account |

| 🩷 Availability | All |

| 📈 Markets | All |

| 💴 Commissions | From $1 |

| 📉 Platforms | MetaTrader 4 |

| 📊 Trade Size | From 0.01 lots |

| 💹 Leverage | Up to 1:200 |

| 💶 Minimum Deposit | $2,000 |

| 🚀 Open an Account | 👉 Click Here |

Live Trading Account

ATC Brokers caters to both individuals and businesses with their live trading accounts. To open an individual account, customers need a minimum deposit of $2,000.

A Straight Through Processing (STP) methodology is used for this type of account, which grants direct access to liquidity sources, resulting in instant transaction execution times. MetaTrader 4 offers features like comprehensive trade reports, a full charting package, and automated trading using Expert Advisors functionality.

Customers can take advantage of affordable spreads starting at 0.3 pips on major currency pairings accompanied by round turn cost at just $0.60 per small contract invested.

Demo Account

Traders can safely practice their trading methods with ATC Brokers’ demo account, duplicating the genuine trading environment. This trial version enables traders to enter simulated transactions and access live market prices for 60 days.

New or seasoned traders can use this opportunity to familiarize themselves with the platform while testing out different strategies effectively.

The demo account offers real-time data and charts, as well as MT4 Trading Platform accessibility to provide a realistic pre-live trade experience you might expect on an actual investment journey, ensuring that users are ready before creating a new live account

Does ATC Brokers offer Islamic accounts?

No, ATC Brokers do not offer Islamic Accounts.

Can I open a demo account with ATC Brokers before trading live?

Yes, ATC Brokers provides a demo account where traders may practice techniques risk-free.

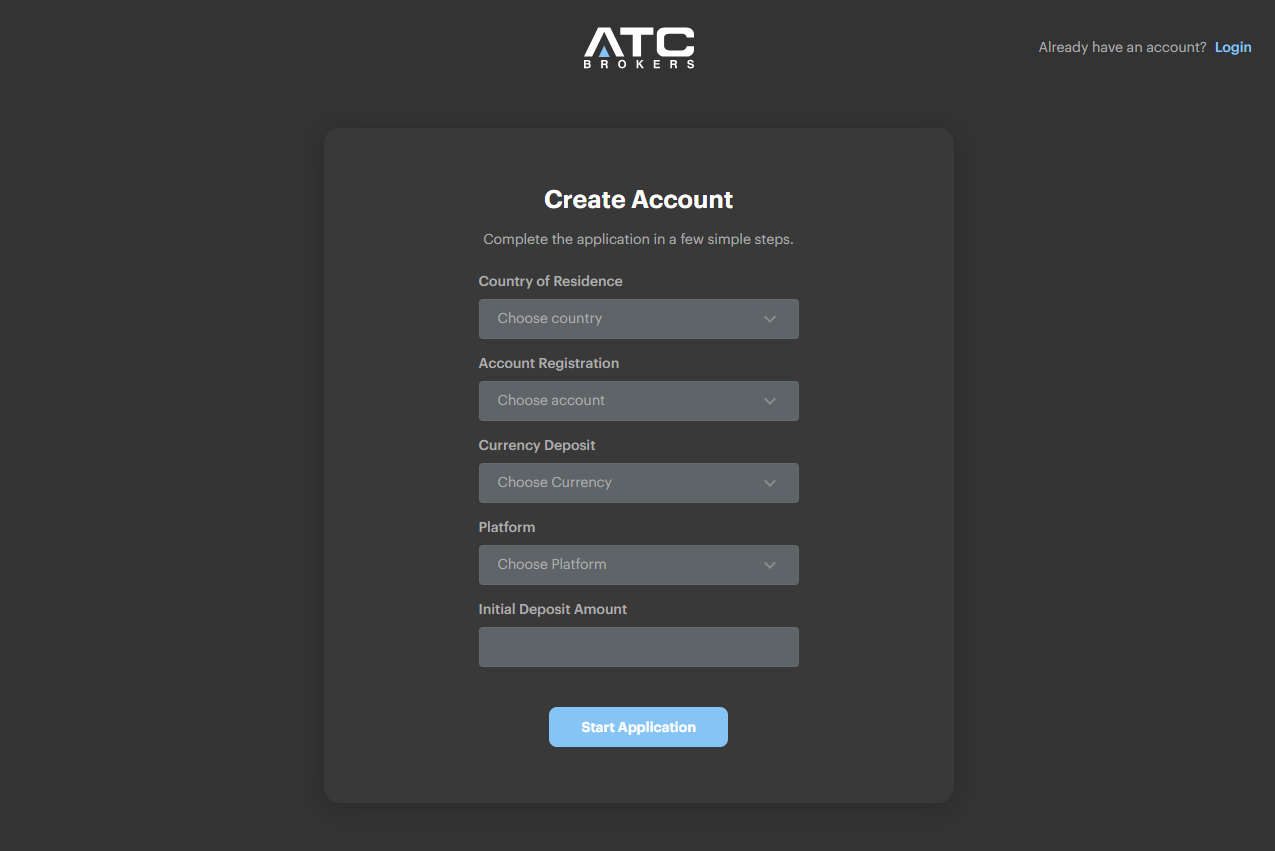

How To Open an ATC Brokers Account

To register an account with ATC Brokers, follow these steps:

✅Go to the ATC Brokers website and find the “Open an Account” option.

✅You will be sent to an online application form once you click the “Open an Account” button.

✅You must complete this form with your personal information, contact information, trading history, and financial situation.

✅ATC Brokers, like other licensed brokers, need you to confirm your identity and address as part of the account opening procedure. This usually entails uploading a government-issued identity document (such as a passport or driver’s license) and a recent utility bill or bank statement that proves your residence.

✅After your papers are authenticated, you must set up your trading account settings. This involves choosing your account type (individual or business), base currency, leverage, and, if necessary, creating a professional account.

✅Before you can begin trading, you must fund your account. ATC Brokers offers various financing alternatives, including bank wire transfers and credit/debit cards.

✅After you have created and financed your account, download ATC Brokers’ trading platform. They provide the MetaTrader 4 platform, which can be downloaded straight from their site.

✅Install the platform onto your desired device.

✅After installing the MetaTrader 4 software, login using the credentials supplied by ATC Brokers. You should have received them via email after completing your account registration.

✅Now that you have logged in, you can begin trading. You should start with tiny transactions or utilize a demo account to learn the platform and trading tactics.

What documentation do I need to provide to open an ATC Brokers account?

You must produce a government-issued ID and a current utility bill or bank statement to verify your identity and address.

Is there a screening process for new ATC Brokers account applicants?

ATC Brokers performs a rigorous screening procedure, including KYC, to guarantee regulatory compliance.

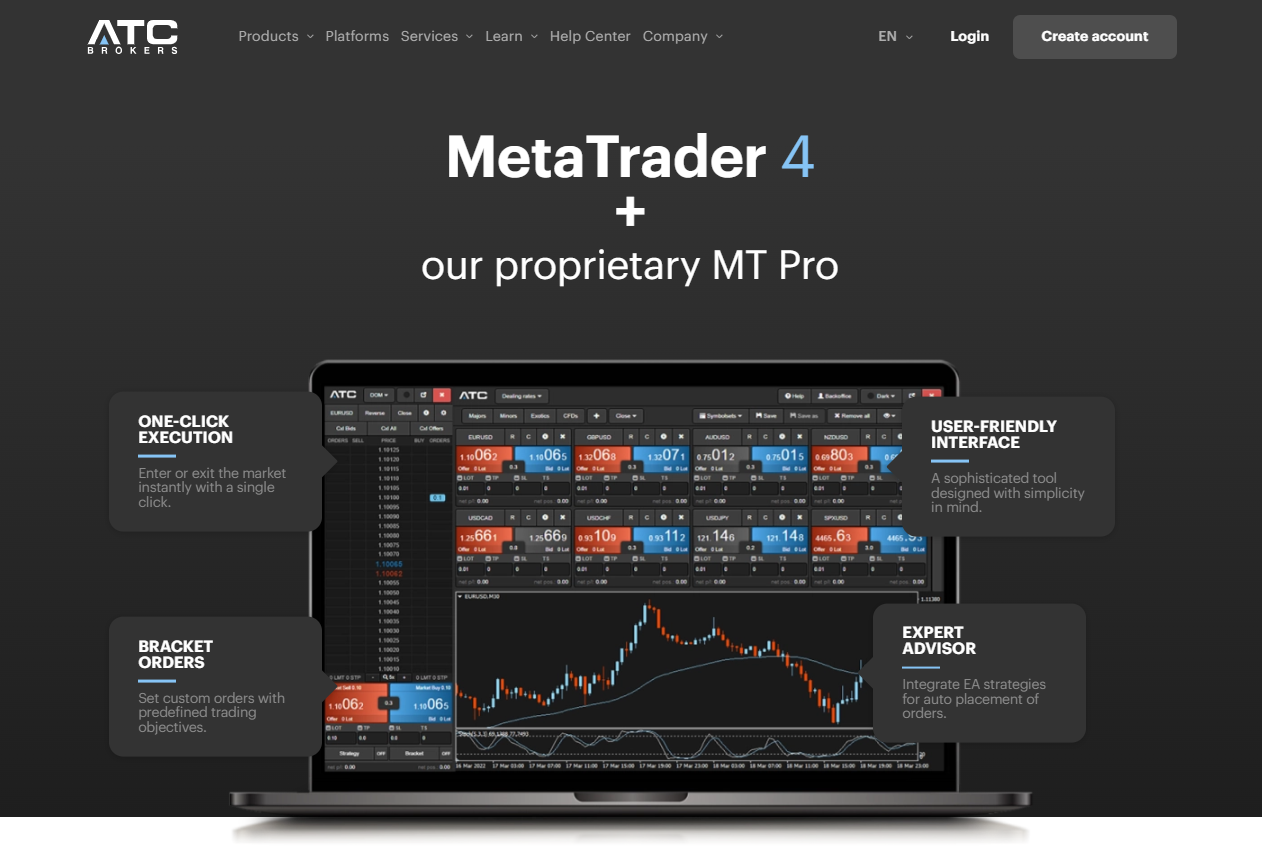

Trading Platforms and Software

ATC Brokers uses the acclaimed MetaTrader 4 (MT4) platform to give customers a smooth and robust trading experience. MT4’s adaptability makes it very popular among traders.

It has an easy-to-use interface with many complex charting features and configurable indicators. This enables detailed technical analysis tailored to various trading strategies.

Furthermore, ATC Brokers directly connects with MT4, offering real-time market data and quick execution times. Traders may access ATC Brokers’ attractive spreads and a variety of financial instruments straight from the site.

For traders seeking automation, MT4 includes Expert Advisors (EAs), which enable the deployment of bespoke trading algorithms and ensure strategy execution even while you are offline.

Does ATC Brokers have a mobile trading app?

Yes, ATC Brokers provides the MT4 mobile app, which enables users to monitor their accounts and trade on the road.

Are there any unique features in ATC Brokers’ MT Pro software?

ATC Brokers’ MT Pro software enhances trading with capabilities such as one-click execution and bespoke bracket orders.

Fees, Spreads, and, Commissions

Spreads

ATC Brokers offers reasonable spreads for key currency pairings, starting from 0.3 pips EUR/USD.

Commissions

The platform charges fixed commission fees for forex trading. The costs are $1.00 round turn for a small contract (10,000 lot size) and $10.00 round turn for a regular contract (100,000 lot size), which apply to transactions using USD as the base currency.

These fees are part of ATC Brokers’ pricing structure for carrying out deals on behalf of its customers.

Overnight Fees

ATC Brokers does not provide specific information on overnight fees or swap rates levied or credited for keeping a trade open overnight. Typically, these costs vary by market and position (long or short) and are industry-standard.

Deposit and Withdrawal Fees

ATC Brokers did not disclose any deposit fees, suggesting that depositing money may not entail extra charges. However, withdrawal costs vary depending on the method utilized.

For example, foreign wire transfers are expensive, but credit/debit card withdrawals are free. Skrill Wallet transactions incur a 1% transaction charge.

Inactivity Fees

ATC Brokers impose inactivity fees if there has been no buying or selling activity for at least six months. The cost is $50.00 in the currency of your account. Brokers often employ this strategy to promote active trading accounts or to persuade traders to terminate accounts they no longer utilize.

Currency Conversion Fees

Currency conversion fees are often charged when traders deal in currency pairings other than their account’s base currency. These fees cover translating earnings, losses, margins, and other financial data into the account’s base currency.

How do ATC Brokers charge commissions on trades?

ATC Brokers charges commissions at a predetermined rate per lot size, with particular values varying based on the item transacted.

What are the overnight fees charged by ATC Brokers?

ATC Brokers’ overnight costs, also known as swap rates, vary according to the exact instrument and deal amount.

Leverage and Margin

Firstly, ATC Brokers has different leverage and margin requirements for its Cayman Islands and UK retail divisions. Secondly, In the Cayman Islands, traders can access high leverage of up to 200:1, allowing for large market exposure with lower starting capital.

Additionally, The margin is calculated based on the base currency, with margins as low as USD 50 for USD base currency pairings at 200:1 leverage. In contrast, the UK retail division provides lower leverage levels, leading to greater margin needs.

Lastly, ATC Brokers also uses notification and liquidation levels on the MT4 platform to control risks, with warnings appearing at 120% margins and liquidation starting at 50% for UK retail customers.

What happens if I reach the liquidation level on my ATC Brokers account?

ATC Brokers will begin liquidating holdings with the largest losing deal if the margin level exceeds 100% for Cayman Islands division customers or 50% for UK retail clients.

How do I avoid a margin call with ATC Brokers?

To prevent a margin call at ATC Brokers, carefully monitor your holdings, utilize stop-loss orders, and have enough cash in your account.

Which Markets Can You Trade with ATC Brokers?

✅Firstly, ATC Brokers offers the following trading instruments and products:

✅ATC Brokers offers forex trading options in over 37 major, minor, and exotic pairings, with leverage of up to 1:200 on majors.

✅ATC Brokers has a restricted index offering compared to other brokers. There is the option to trade indexes that indicate the performance of certain stock market sectors. Still, the range is limited, concentrating mostly on big markets and excluding individual companies or shares.

✅ATC Brokers enables you to trade commodities. However, the variety is restricted. The website allows users to trade precious metals such as gold and silver, diversifying their portfolios beyond currency.”

✅Moreover, Cryptocurrency trading at ATC Brokers is only available to professional account holders and does not include weekend trading, a notable departure from the usual 24/7 crypto exchanges. Popular cryptocurrencies for trade include Bitcoin, Bitcoin Cash, Ethereum, Ripple, and Litecoin.

Does ATC Brokers offer commodity trading?

Yes, trade various commodities, including precious metals like gold and silver, and energy commodities like oil.

What indices are available for trading with ATC Brokers?

ATC Brokers allows traders to trade on various CFD indices, including the Dow Jones and the S&P 500.

Deposit and Withdrawal

| 🔎 Payment Method | 🌎 Country | 💴 Currencies Accepted | ⏰ Processing Time |

| 💳 Credit/Debit Card | All | Multi-currency | Instant – several days |

| 📈 Bank Wire | All | Multi-currency | Instant – several days |

| 📉 Electronic Gateways | All | Multi-currency | Instant – several days |

Deposit Methods:

Bank Wire

✅Log in to your ATC Brokers trading account and go to the ‘Funding’ or ‘Deposit’ area.

✅Choose ‘Bank Wire’ as your deposit method.

✅Obtain the bank wire information supplied by ATC Brokers, which includes the bank name, account number, and SWIFT/BIC codes.

✅Make a bank wire transfer from your bank using the information supplied by ATC Brokers.

✅Keep a copy of your bank’s wire transfer receipt or confirmation as evidence of transfer.

Credit or Debit Card

✅Access your ATC Brokers trading account and visit the ‘Deposit’ area.

✅Select “Credit or Debit Card” as your desired deposit method.

✅Enter your card information, including the card number, expiry date, and CVV code.

✅Specify the amount you intend to deposit.

✅Confirm the transaction and wait for the money to be credited to your trading account.

e-wallets or Payment Gateways

✅Sign into your trading account and go to the ‘Deposit’ section.

✅Choose your favorite e-wallet or payment gateway (e.g., Skrill, Neteller) from the alternatives provided.

✅You will be taken to the payment service’s website or app, where you can safely log in.

✅Enter the amount you want to deposit and confirm the payment information.

Withdrawal Methods:

Bank Wire

✅Log onto your account and go to the ‘Withdrawal’ area.

✅Select ‘Bank Wire’ as your withdrawal method.

✅Fill out the form with your bank information, including the account number and SWIFT/BIC code.

✅Enter the withdrawal amount and submit your request.

✅Wait for money to be processed and received into your bank account, taking note of any costs and processing timeframes.

Credit or Debit Cards

✅Access your account and go to the ‘Withdrawal’ section.

✅Select ‘Credit or Debit Card’ for the withdrawal.

✅Check that the card previously used for deposits is eligible for withdrawals.

✅Finally, Enter the amount you want to withdraw and then confirm the request.

e-wallets or Payment Gateways

✅Log in to your ATC Brokers account and pick the ‘Withdrawal’ option.

✅Choose an e-wallet or payment gateway (such as Skrill or Neteller) from the list.

✅Enter the withdrawal amount and any other details requested.

✅Finally, Submit a withdrawal request and wait for the funds to be sent to your e-wallet.

How do I make a withdrawal from my ATC Brokers account?

Withdrawals from the ATC Brokers account will be accomplished via the client interface, subject to the withdrawal fee structure.

What is the processing time for withdrawals at ATC Brokers?

Withdrawal processing timeframes at ATC Brokers vary by method.

Pros and Cons

| ✅ Pros | ❌ Cons |

| ATC Brokers provides attractive spreads on a wide range of products | ATC Brokers has a high minimum deposit |

| ATC Brokers allows a range of payment options | The ATC Brokers website is not transparent, and there is a lack of vital information |

| Traders can expect multilingual customer support from ATC Brokers | Inactivity fees apply |

| ATC Brokers makes use of the famous MetaTrader 4 platform | ATC Brokers charges withdrawal fees |

Conclusion

In our experience, ATC Brokers provides competitive spreads and cheap fees on a large selection of products, the popular MT4 platform, and rapid execution times.

Despite the benefits of their platform, their website’s increased minimum deposit requirement and lack of transparency may be a hurdle for certain traders.

ATC Brokers provides customer assistance by email, phone, and live chat. For further information, visit their website’s ‘Contact Us’ section.

No, due to regulatory constraints, ATC Brokers may not accept customers from the United States. Before you start the account opening procedure, be sure you are eligible depending on your country of residency.

Withdrawal procedures at ATC Brokers might vary depending on the method utilized; contacting customer assistance for specific dates is essential.

Yes, ATC Brokers offers demo accounts. This enables prospective customers to test trading techniques with virtual funds in a risk-free environment before investing real money.

ATC Brokers’ minimum deposit is quite large (from $2,000), which may not be appropriate for all traders.

Yes, ATC Brokers provides cryptocurrency trading alongside conventional products such as Forex, commodities, and indices. It is critical to determine which particular cryptocurrencies they support.

Yes, ATC Brokers is registered and uses strict security measures, giving it a reliable option for traders.

ATC Brokers allows you to trade Forex, indices, commodities, and cryptocurrencies.

ATC Brokers provides variable spreads that fluctuate with market circumstances and charges fees on certain deals. For a complete cost schedule, please visit their website or contact support.

ATC Brokers is based in the United Kingdom and licensed by the Financial Conduct Authority (FCA).

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |